Nike didn’t invent the idea of athlete endorsements, but it was the first company to build a global brand out of it. In 1984, Nike signed Michael Jordan to a shoe deal that turned a scrappy shoe company into a juggernaut.

This shoe started it all.👇

Michael Jordan brought the eyeballs. Nike brought the product. Neither would be who they were without the other and the formula worked for decades.

Tiger Woods followed in Jordan’s footsteps and has been the second most important Nike athlete for more than 20 years. He was surrounded by a “moat” of athletes from Lebron James to Serena Williams to Ken Griffey Jr., who were all paid handsomely to endorse Nike over other athletic brands.

But Tiger’s deal with Nike ended on Monday and we’ve seen fewer mega-endorsement deals and for good reason. Like it or not, celebrities don’t need big endorsements anymore.

Note: I will use “celebrity” as a catch-all for athletes, entertainers, influencers, etc. I’m focused on people with an audience they can build a business around.

Celebrity Becomes Big Business

The way to monetize celebrity today isn’t with a big endorsement deal. It’s in business.

He didn’t start the trends, but I want to credit 50 Cent (yes, the rapper) for popularizing celebrities as business partners. As part of a deal with Vitamin Water in 2004, he received stock options that netted him a reported $100 million when Coca-Cola bought the brand in 2007.

$33 million per year isn’t bad work, if you can get it. And it puts Tiger Woods’ $20 million per year Nike check to shame.

I’m not a businessman. I’m a business, man.

The move for celebrities now is the turn their fame and audience into a business.

Why take a one-time check to build someone else’s business when you can build a business with 10x the upside?

Jessica Alba’s Honest brand went public in 2021 and was worth over $2 billion for some time.

Gwyneth Paltrow’s Goop is worth an estimated $250 million.

Puff Daddy has reached billionaire status with his Ciroc and DeLeon liquor brands.

Kylie Jenner of Kardashian fame didn’t sponsor a makeup brand, she started Kylie Cosmetics in 2025 and is now worth an estimated $700 million.

Mr. Beast turned YouTube fame into Feastibles and Mr. Beast Burger.

The Rock, George Clooney, and Ryan Reynolds have used similar strategies to build multi-billion dollar companies.

In every case, the celebrity is selling a commodity product (outsourced manufacturing) and using their megaphone to reach a massive audience.

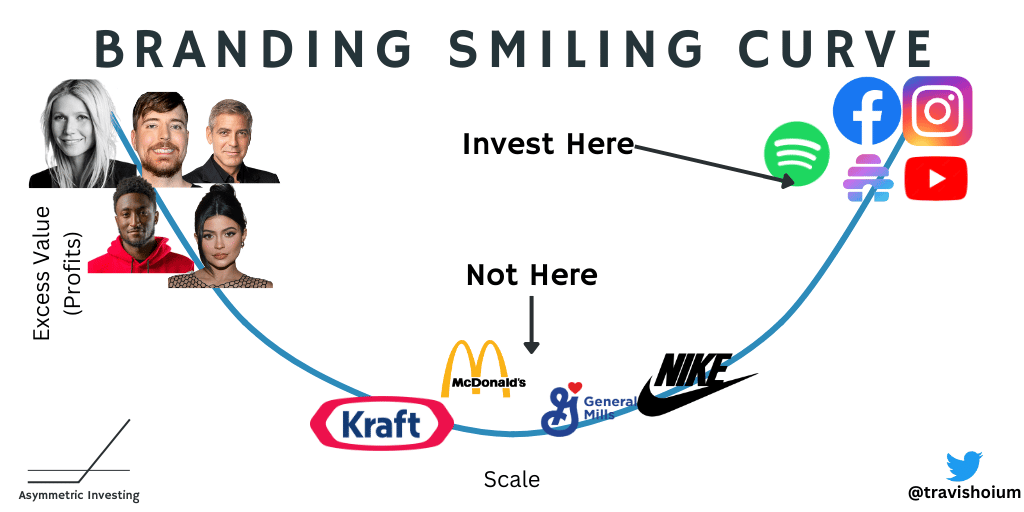

This leverage is another example of the breakdown of supply power that defined powerful brands for decades. It used to be that big manufacturing combined with big retail and big media to sell a monolith of products to consumers. Kraft, Heinz, GM, General Mills, Post, Nike, Budweiser, and 3M were seen as great brands, but the truth is their power was on the supply side of the market. Being the biggest supplier to a retailer or media entity meant they could use leverage (financial or otherwise) to keep smaller brands out.

The internet changed that. Anyone can start a brand and a website. Celebrities can do both and reach millions of people with a single post on social media. Slowly, big companies that manufacture and distribute products have become commodities in the value chain.

When the power of the middleman breaks down, the power resides in the celebrity who has a direct connection with their audience.

Before we go further, I want to share one of my favorite newsletters, Carbon Finance!👇

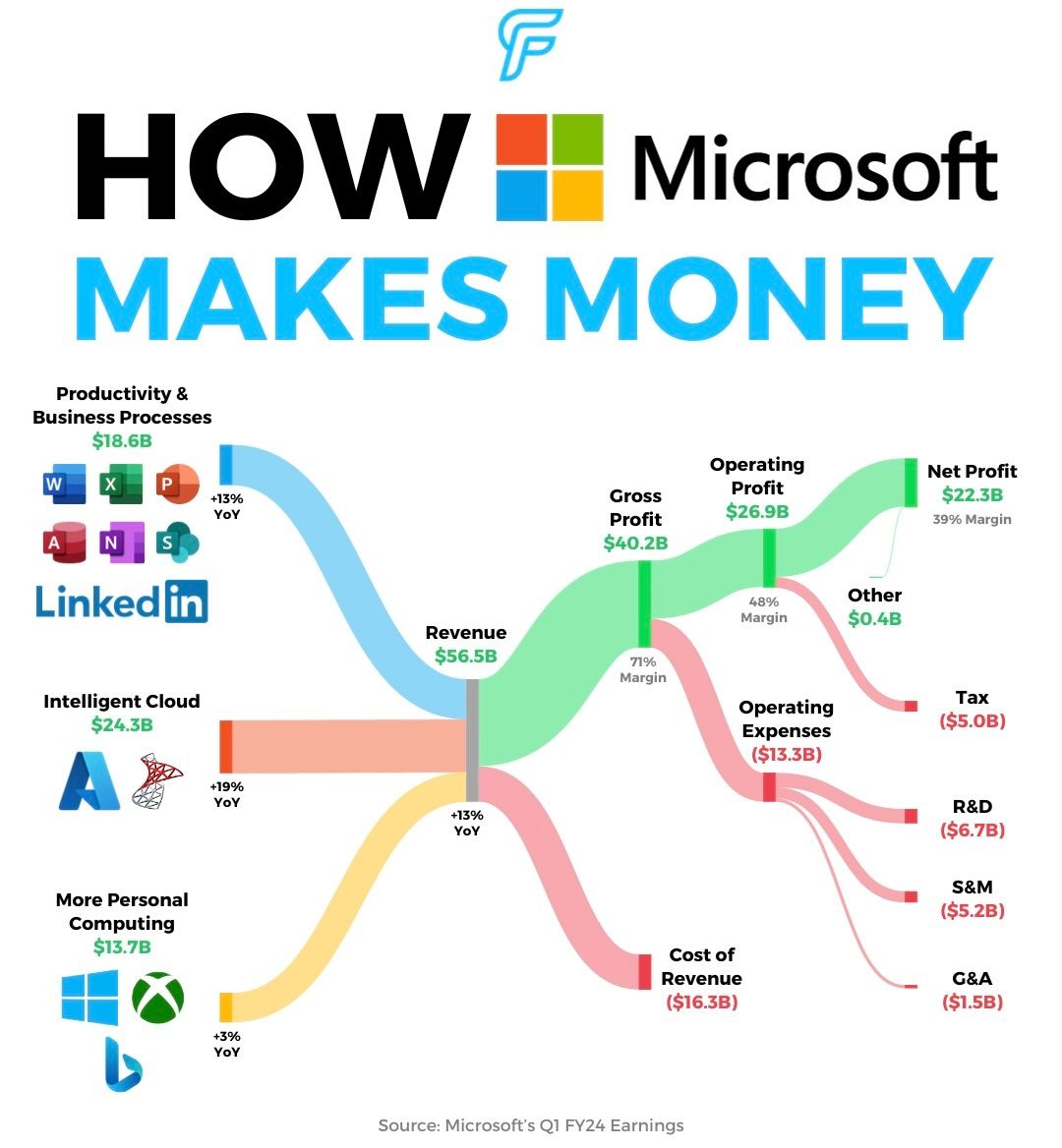

Don’t you love this infographic?

My good friend Carbon Finance sends out a weekly newsletter with simple, data-driven visuals that cover the most important headlines in investing.

The best part is it’s completely free and only takes 5 minutes to read.

Attention and Trust

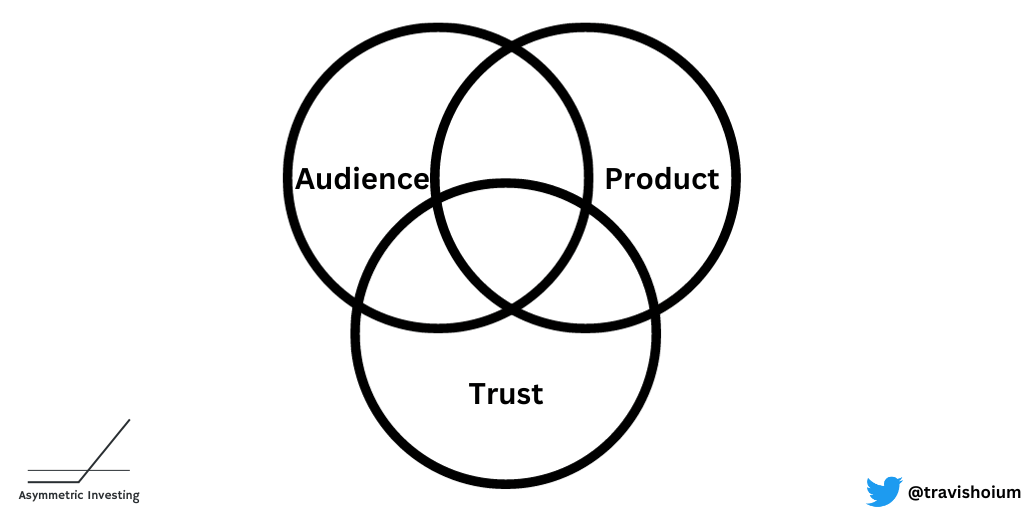

Building a celebrity brand isn’t for everyone and this is where I think Tiger Woods may have trouble in the new paradigm. Building a brand on the back of commodified suppliers only works if you have an audience that trusts you.

Woods doesn’t have a big social media following (relatively speaking). He doesn’t do interviews. He’s not known as a great product designer.

Marques Brownlee would be a better person to launch a new product (which he did himself here).

Who is Marquees Brownlee? Just a YouTuber with 18.1 million subscribers and 4 BILLION views. I would argue, he brings a bigger audience and more trust to a product than Tiger Woods.

The Platforms That Make It All Possible

Many traditional brands will come under threat as more celebrities build brands and leverage their audiences. But they can’t do it alone. A megaphone requires an audience for anyone to hear it. That’s where social media and creation platforms like Spotify, Instagram, YouTube, and Beehiiv (where I’m writing now) come in.

The platforms that connect celebrities/creators with an audience will maintain their value and get stronger over time.

It’s the brands in the middle that are in trouble. They’re not built to compete with competitors who bring millions of customers to the table. Their supply power is breaking down and it’s no surprise that margins and profitability are falling as a result.

Tiger Woods Is the Last In an Era

We don’t know what Nike’s negotiation with Tiger Woods was like, but I think it’s clear neither saw the same value in the other as they did a decade ago.

If Tiger wants to, he can start a golf ball company and sell millions of golf balls. Or maybe he wants to sell shoes. Or maybe workout equipment.

And Nike isn’t getting the value they once did from someone who doesn’t have a captive audience worth millions of dollars per year.

Like it or not, the product world will get more celebrity business owners before the trend changes. That’s great for platforms and aggregators, but it’s terrible for the big brands that used to be endorsed by their new competitors.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.