This week, I did something I don’t normally do. I put on three short positions within what I call the Special Situations Portfolio.

These positions were added because I feel the market is vastly overvalued in certain sectors and there’s significant downside risk to both the stocks I took a short position in and many of the stocks in the Asymmetric Portfolio. But here’s the key.

I didn’t sell stocks in the Asymmetric Portfolio.

I didn’t put on stop losses.

Instead, I bought long-dated puts that won’t expire for nearly 2.5 years.

Limited loss. High upside.

I’ll get to why this was my choice below.

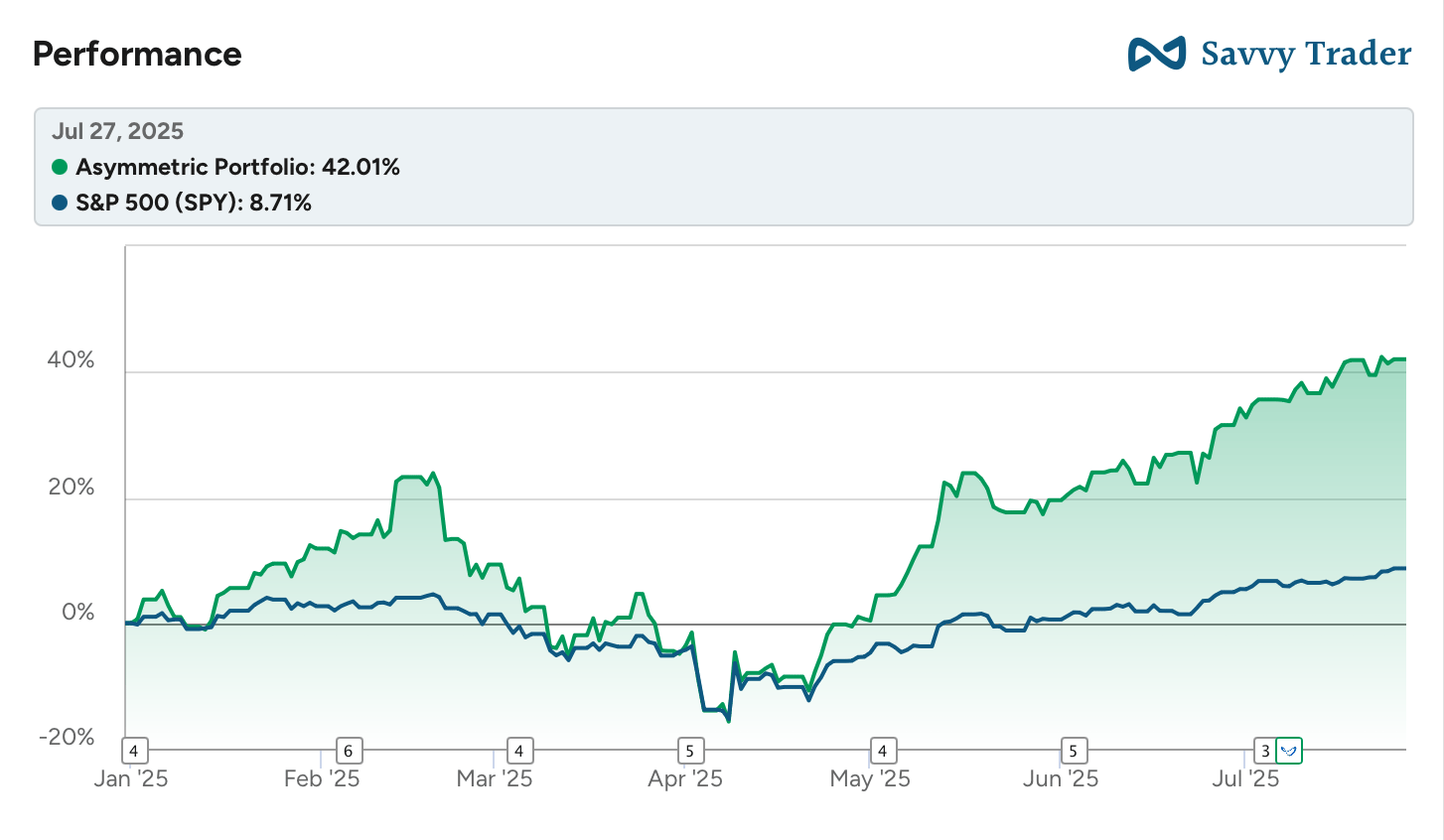

The Asymmetric Portfolio had an up-and-down week and ended little changed from a week ago. I expect that to change this week when some of the biggest holdings in the portfolio report earnings.

In Case You Missed It

Here’s some of the content I put out this week.

I’m Shorting Hype: I disclosed the rationale and short positions I put on this week.

Google Flexes Its AI Muscles: The market still thinks Alphabet is going to be disrupted by AI, and we’re seeing the exact opposite from their results.

Why Disney Should Go All-In on the NFL: Rumors are swirling that ESPN could acquire the NFL Network and RedZone, which could be game-over for other streaming sports players.

The Frameworks Behind Asymmetric Investing

If you haven’t read the Asymmetric Investing Frameworks article, that’s a great place to start when looking to understand how I buy and sell stocks. But given my recent purchase of put options, I want to put some context behind that decision.

Here’s how I think about buying, selling, and puts.

Buying Stocks

How I buy stocks in the Asymmetric Portfolio is simple. I buy on a monthly cadence and have built in buying more aggressively if the market falls. Historically, this is the best way to make money long-term, and it keeps me from trying to time the market. This year, I added a mechanism to increase purchases if the market falls. I systematized being greedy when others are fearful. Here’s how I buy:

Buy once per month (on or about the 1st of the month)

2x investment if the market (S&P 500) is down 20%

3x investment if the market is down 30%

4x investment if the market is down 40%

5x investment if the market is down 50%

Notice that I don’t deviate from the time of the monthly buys. Sometimes this means I’m buying at a peak, sometimes I hit a bottom, but over time I’m going to dollar cost average and be putting money into the market regularly, which is what matters most.

Keep. It. Simple.

Selling Stocks

One of my frameworks is to over-index on not selling.

Why?

You never know when a company is going to break out of a funk, and your thesis is going to play out spectacularly well. And the most painful mistakes are selling your winners too early.

One mistake I made was selling Chipotle. I bought shares in 2007 and sold them in 2008 when I had a nice gain of over 100%. Needless to say, selling was a mistake! I had done the work. I owned the stock. I had conviction. I was right… My mistake was selling.

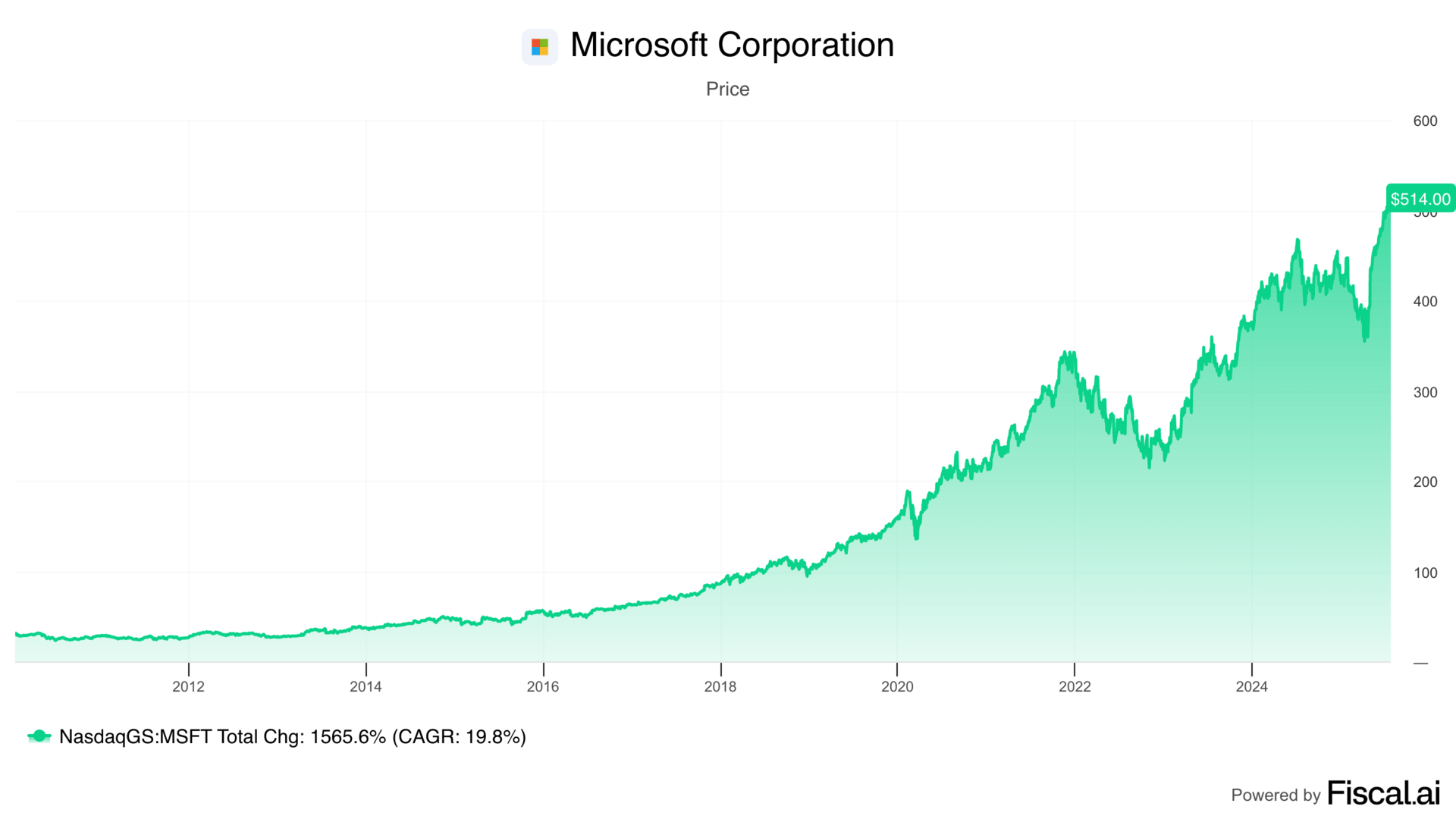

In the 2010s, I started managing some of my grandparents’ money, and I was conservative, buying low P/E multiple stocks like Apple and Microsoft. If you don’t remember, both companies were unloved in the 2014 to 2016 range and had P/E multiples in the low teens.

After taking about a 2x profit on Microsoft, I exited the stock only to watch it nearly 10x over the next 8 years. I had done the work. I owned the stock. I was right… My mistake was selling.

My grandpa used to say, “You don’t have a profit until you sell.”

Technically, he was right.

But selling is also why these investments only became 2x returns instead of 10x+ returns.

To generate 10x returns, we need to let stocks compound their gains. That means holding and not selling.

So, when do I sell?

If the thesis behind a company fundamentally changes or there’s a major change in an industry, I will consider selling. For example, I sold all of my Apple stock last year because shares were trading for 35x earnings, and the company was shrinking and hadn’t had a compelling new product in nearly a decade. Owning Apple at 13x earnings when it was growing is very different than owning Apple at 35x earnings when it’s shrinking.

In the Asymmetric Portfolio, I sold shares of GM, Dropbox, and Sony because I learned my original thesis was proven incorrect.

That’s when I sell. But here’s the key.

If a business is doing well, I will never sell in the Asymmetric Portfolio based on valuation alone. That’s a great way to lose out on even greater returns over time.

Note: In the Asymmetric Portfolio, I’m not worried about over-allocating to a single stock because I’m adding funds each month. A stock, like Spotify, may become a big position, but it will never get too big because it will eventually be diluted by other buys. In a portfolio where money isn’t being added, I may rethink that strategy if a position gets to ~15-20% of the portfolio.

Buying LEAP Put Options

The trade I put on this week was to buy long-dated puts on three stocks.

Puts give me the option to sell a stock at a set price on a date in the future, in this case, December 17, 2027.

These are also known as LEAPS.

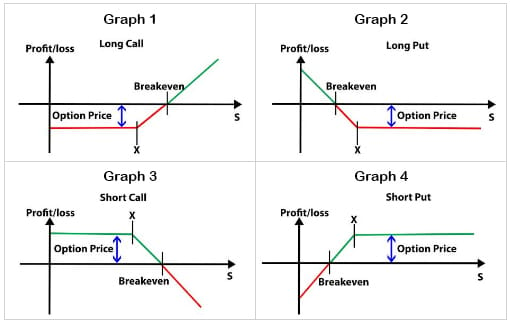

The payout for this option is shown in Graph 2 below. All I can ever lose in the position is what I paid for the options, and the upside is only capped by the stock going to zero.

Notice: Graph 1 is the payout of buying a call option, which is the image I use for the Asymmetric Investing logo. I don’t own calls, but the image illustrates that the only downside of buying stocks is losing your initial capital, while the upside potentially is theoretically unlimited.

LEAP Puts have a few advantages:

Losses are limited to the price paid for the put option

There’s a long time (2.5 years) to let this thesis play out

I have chosen “out of the money” puts, which give more asymmetric upside than closer to the money puts

I can sell the option before the expiration date

The value of the option can rise if market volatility (VIX) goes up

LEAP Puts also have some disadvantages:

The value of the option falls over time, all else equal

This is the time value of the option (Theta)

“Out of the money” puts are high risk because they can quickly drop in value if a stock rises

Options are an expensive trade because they’re less liquid than a stock

Unlike a stock, you need to get the timing of the trade right because the option expires

I think LEAP put options are an appropriate tool for the way I invest in the Asymmetric Portfolio because they provide limited loss and high upside potential. But they’re not for everyone.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor, or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your research before acquiring stocks.