A quick note to start:

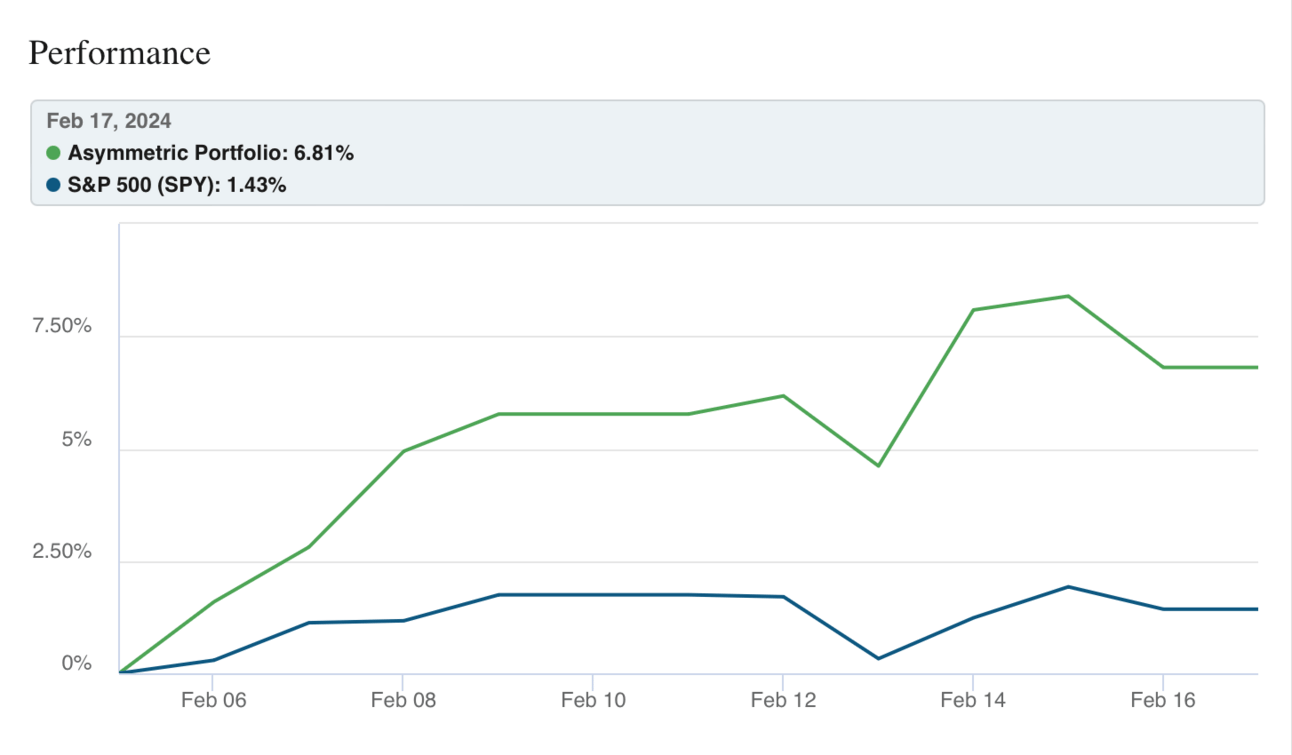

The Asymmetric Portfolio is now on SavvyTrader! This is the best portfolio tracking tool I’ve found and it’s what I’ll be using to show trades and portfolio performance for the Asymmetric Portfolio.

Premium subscribers will get notified of trades before they’re made and stock spotlights and earnings updates like this week’s Zillow and Coinbase breakdowns following great earnings reports!

Subscribe here to track the portfolio on SavvyTrader or better yet, get all of Asymmetric Investing’s market-beating analysis for under $0.30 per day.

Note: Performance is since Feb. 5, 2024 when the SavvyTrader portfolio was launched.

I hope you had a wonderful week!

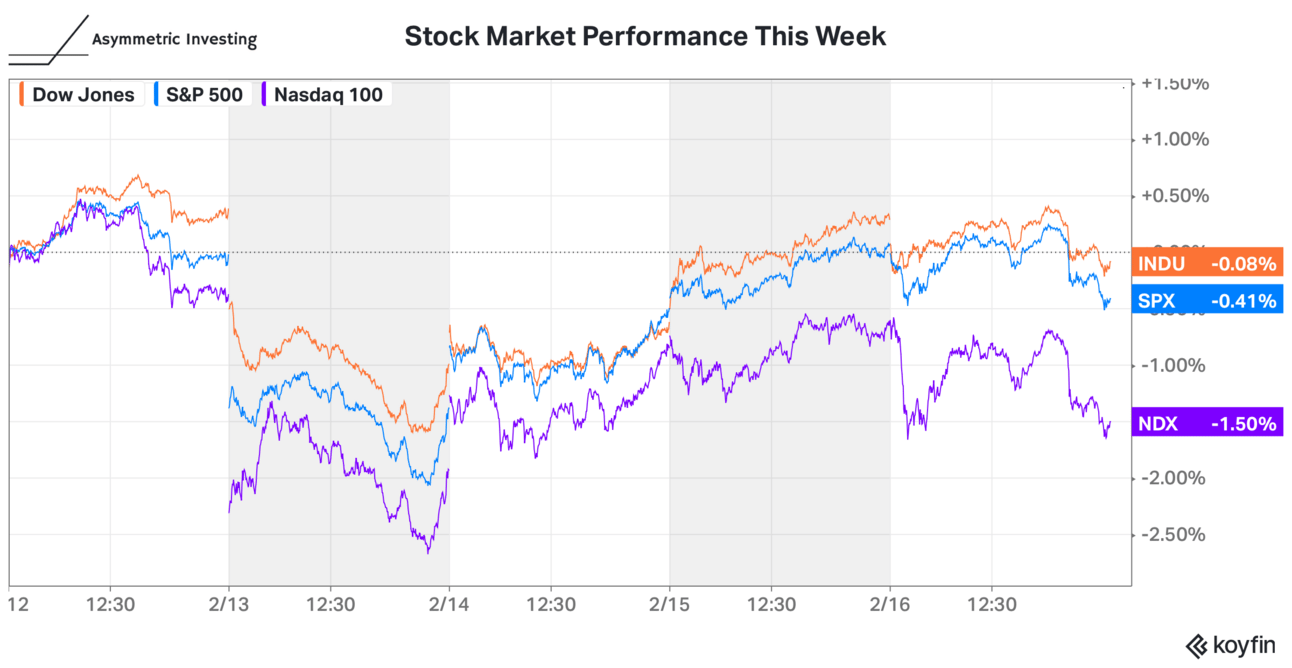

The market’s hot streak took a pause last week as more earnings reports came out. Not every report was bullish as the week prior and investors seem to be realizing that cost cuts have driven profit growth while revenue growth has stalled for many companies. We will see if that trend continues next week.

In Case You Missed It

Here’s some of the content I put out this week. Enjoy!

Fine, I’ll Do It Myself: How GM and MGM Resorts are using buybacks as a weapon.

Zillow and the Housing Super App: The grand vision for Zillow is that it become the go-to app for all things housing and the company is showing progress in executing on that vision. (premium)

Coinbase Keeps On Winning: Shares of Coinbase were up 28% this week and a great earnings report showed the company keeps on winning in the crypto market. (premium)

My #1 Stock Right Now: Earnings showed this stock has momentum that could last a decade.

Airbnb’s Brian Chesky (Sort Of) Sets Out the Bigger Vision

Airbnb CEO Brian Chesky has been teasing developments “beyond the core” for a while now. In the July 2023 spotlight article, I included this quote:

And finally, we're expanding beyond our core. We have some big ideas for where to take Airbnb next. We're building the foundation for new products and services that we plan to launch in 2024 and beyond.

Six months later, we still don’t know what “expanding beyond our core” means, but we’re getting some good clues.

In the Q4 2023 conference call, an analyst asked Chesky to expand on a prepared teaser that something “beyond the core” was coming in late 2024. Chesky responded (key points are highlighted):

So yes, let me start with AI. So I think, to talk about AI, it would be good to zoom out, just lay out the landscape. One way to think about AI is, let's use a real-world metaphor. I mentioned we're building a city. And in that city, we have infrastructure, like roads and bridges. And then on top of those roads and bridges, we have applications like cars.

So Airbnb is not an infrastructure company. Infrastructure would be a large language model or, obviously, GPUs. So we're not going to be investing in infrastructure. So we're not going to be building a large language model. We'll be relying on, obviously, OpenAI. Google makes -- or create a model, Meta creates models. So those are really infrastructure. They're really developing infrastructure.

But where we can excel is on the application layer. And I believe that we can build one of the leading and most innovative AI interfaces ever created. And maybe one way to make this real is if you were to open, say, ChatGPT or Google, though the models are very powerful, the interface is really not an AI interface. It's the same interface as the 2000s, in a sense, the 2010s. It's a typical classical web interface. So we feel like the models, in a sense, are probably underutilized.

Here's another way of saying it. Take your phone and look at all the icons on your phone. Most of those apps have not fundamentally changed since the advent of Generative AI. So what I think AI represents is the ultimate platform shift. We had the internet. We had mobile. Airbnb really rose during the rise of mobile. And the thing about a platform shift, as you know, there is also a shift in power. There's a shift of behavior. And so I think this is a 0-0 ball game, where Airbnb, we have a platform that was built for 1 vertical short-term space. And I think with AI -- Generative AI and developing a leading AI interface to provide an experience that's so much more personalized than anything you've ever seen before.

Imagine an app that you feel like it knows you, it's like the ultimate Concierge, an interface that is adaptive and evolving and changing in real-time, unlike no interface you've ever seen before. That would allow us to go from a single vertical company to a cross-vertical company. Because one of the things that we've noticed is the largest tech companies aren't a single vertical. And we studied Amazon in the late '90s, early 2000s, when they went from books to everything, or Apple when they launched the App Store. And these really large technology companies are horizontal platforms. And I think with AI and the work we're doing around AI interfaces, I think that's what you should expect of us. We're not going to talk specifically on this call about the specific products and services we're going to be offering, but you will see some very big announcements later this year. And as you know, we did an acquisition of GamePlanner AI. It was from the creator of Siri. And that was just accelerating the efforts we are already endeavoring on.

There’s a lot there, but I want to focus on two things. First, Airbnb sees AI as a platform shift and wants to be the application that can adapt to be designed for AI-first usage. Second, Airbnb sees an opportunity to move from a single vertical (housing rentals) to multiple verticals (air travel?, experiences?, etc).

Any company could see this shift coming, but not every leader could steer a large, profitable business like Airbnb into this uncertain AI-first future. Here’s where Chesky himself is key to the investment thesis:

Chesky is a founder and can make big strategic shifts other leaders couldn’t. Founders simply have the vision and entrepreneurial capital that non-founders don’t. There are historical examples:

It took Steve Jobs coming back to shift Apple to mobile.

Mark Zuckerberg was key to shifting Facebook to the news feed, acquiring Instagram, and more recently “getting fit”.

Rich Barton was the leader behind Zillow getting into iBuying, out of iBuying, and now building the Housing Super App.

Chesky is an industrial designer by training. He’s not a programmer. I think this makes him uniquely qualified to lead the design of an AI-first user interface.

Think about Steve Jobs’ influence on Apple’s products as an example of a non-programmer’s importance to the product.

Now think about who Airbnb is competing with to make this shift. There are hotel brands like Hilton or Marriott, who aren’t equipped in any way to be AI companies. Then there’s Booking.com or Expedia Group, which operate as travel discovery tools, but aren’t founder-led or design-oriented. We could see a startup win the market, but Airbnb already has the network effect built and customer habits in place.

If AI is going to be disruptive in travel. If AI concierges become a real thing, I am betting on Airbnb and Brian Chesky to figure it out.

Sometimes investing is as simple as that. Do you trust this leader to figure out the path forward better than the competition?

Chesky built Airbnb from a crazy idea to a $100 billion company and he has been through challenges before (2020).

The Airbnb investment thesis can include cash flow analysis and a discussion of moats, but at the end of the day, we’re betting on Brian Chesky’s leadership. And I — for one — think investors are in good hands.

You can get all Asymmetric Investing content, including deep dives, stock trades before they’re made, and ongoing coverage of Asymmetric Universe stocks like Airbnb with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.