In January 2005, I started my first full-time job as a Project Engineer at 3M’s largest manufacturing plant in Hutchinson, MN. If you’ve bought a roll of Blue Tape, Post-It Flags, or have a smartphone (a half dozen 3M films live in the screen you’re looking at now), you have probably interacted with something made in this plant.

20 years later, what’s embedded in my brain is how automated the plant was back then. Automated vehicles were driving around pallets, there was a football-sized automated warehouse with 100 feet of racks for product, and a 6-foot-wide piece of paper would turn into thousands of rolls of tape in boxes without anyone touching them.

Automation has been here for a lot longer than many people realize. Humanoid robots today look cooler, but they’re less efficient and more costly than the specialized robots on every manufacturing floor in the world today. And it’s this efficiency of today’s manufacturing robots that always has me questioning the efficacy of humanoid robots for many use cases companies talk about in manufacturing.

However, off the manufacturing floor is another story.

Today’s robots are moving out of the factory. Tesla’s Optimus is probably the best known of these robots, but there’s Figure 02, Atlas from Boston Dynamics, and so many more. And this week Google — of all companies — introduced a robotics model that could make AI robots even more accessible. But how do we make money?

Asymmetric Investing has a freemium business model. Sign up for premium here to skip ads and get double the content, including all portfolio additions.

The Supply Chain Crisis Is Escalating — But This Tech Startup Keeps Winning

Global supply chain chaos is intensifying. Major retailers warn of holiday shortages, and tech giants are slashing forecasts as parts dry up.

But while others scramble, one smart home innovator is thriving.

Their strategic move to manufacturing outside China has kept production running smoothly — driving 200% year-over-year growth, even as the industry stalls.

This foresight is no accident. The same leadership team that saw the supply chain storm coming has already expanded into over 120 BestBuy locations, with talks underway to add Walmart and Home Depot.

At just $1.90 per share, this resilient tech startup offers rare stability in uncertain times. As investors flee vulnerable companies, this window is closing fast.

Past performance is not indicative of future results. Email may contain forward-looking statements. See US Offering for details. Informational purposes only.

AI Robotics’ Insane Pace of Innovation

A few years ago, humanoid robots were a sideshow. They could balance on their own, and while some performed some simple tasks there wasn’t much visibility to real-world use cases.

Today, the pace of innovation — driven by AI — is astounding.

On February 20, 2025, Figure showed a humanoid robot putting groceries away.

March 12, 2025, Alphabet’s Gemini Robotics showed robots moving groceries into bowls and folding origami.

Unitree G1 can do Kung Fu.

Agility Robotics is making warehouse workers.

You can get lost in robotics videos on YouTube.

None of this was possible a year ago.

Robotics is advancing as fast as AI and that’s incredibly exciting for the number of possible use cases being brought to life.

But is it investable?

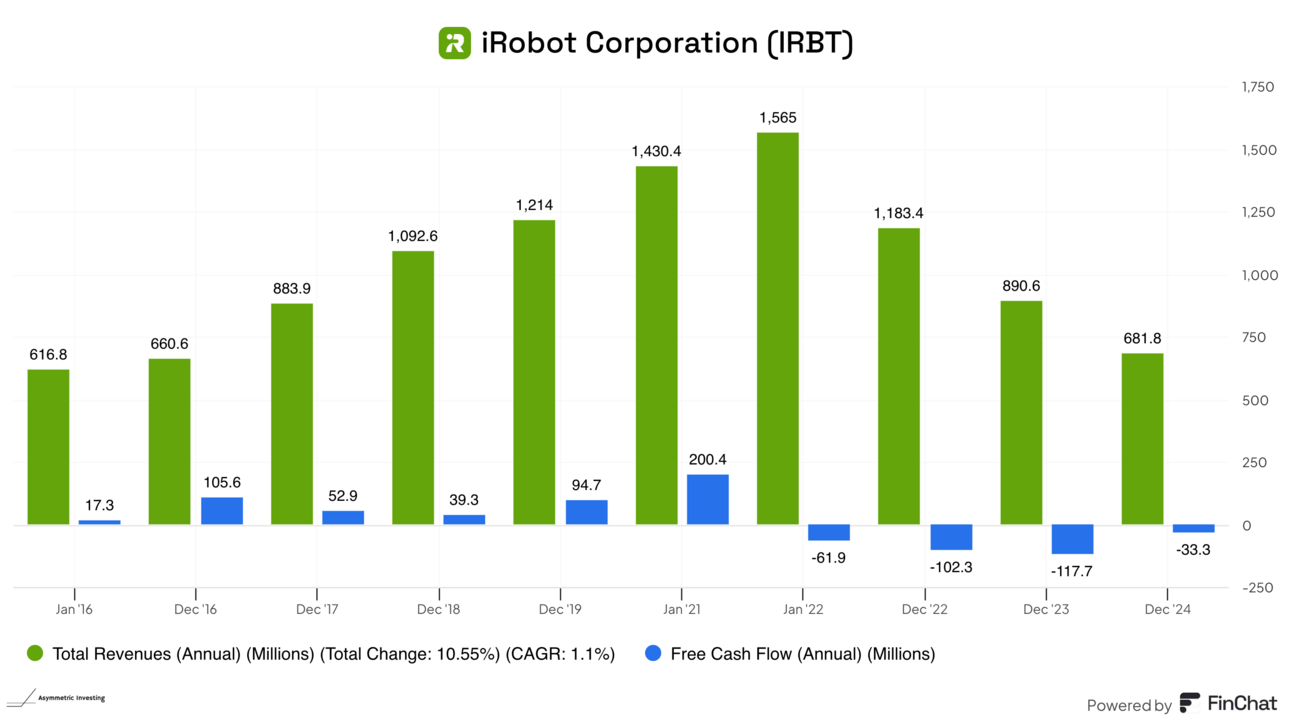

Roomba maker iRobot is a cautionary tale. The company has a market cap of just over $100 million and has warned it may go bankrupt.

But there’s something here with humanoid robots.

How much would you pay for a robot that can put your groceries away and pick up the house or mow the lawn?!? As someone with 3 kids, those tasks are worth a lot.

My thoughts are evolving on the space, so these views may change, but I find it difficult to see where there’s value in humanoid robots from an investment perspective.

What differentiates one robot from another?

Will any of these companies make money?

Or will AI robotics be the next money incinerator after AI model building?

The Generalization of Robotics

In What If Artificial Intelligence Destroys Everything and Artificial Intelligence and the Scorched Earth Theory, I explained why it seemed clear even a year ago that AI models would commoditize themselves. Models weren’t differentiated from one another, there’s no durable cost advantage or network effect or 2-sided market or aggregation, market dynamics we often see from highly profitable businesses.

I thought AI models would ultimately be a commodity, which was a contrarian opinion when I started saying it.

The commoditization of LLM models has played out faster than expected with LLM developers tripping over themselves to introduce cheaper and more effective models.

And no one is making money!

The problem is generalizability.

When a single piece of software — in this case an LLM — can do dozens of tasks well, users can see the use case for many things. But a competing LLM can do the same tasks at a similar ability and the developer lowers the price or makes it more accessible on their platform, undercutting the first LLM. As LLMs keep getting more capable, they commoditize more of their ability area and yet no LLM seems to have a real, durable competitive advantage over any competing LLM.

It’s like the biggest perfect market competition where the profit of everyone involved is competed to zero.

And still, LLM providers are lowering costs and improving capabilities, destroying the investment competitors made just a few months ago.

Just yesterday, Google announced the Gemma 3 model that can run on a single H100 GPU.

More capability.

Cheaper.

Yet it’s unclear how anyone — outside of NVIDIA and even that will eventually come into question — makes a sustainable profit in AI.

AI, Robotics, and a Search For Differentiation

This commoditization of LLMs is important to understand because it shows just how quickly an impressive new technology can become very low value for investors very quickly. Outside of NVIDIA, who is making money on AI LLMs today? Maybe cloud providers, but there’s a lot of accounting shenanigans that may be a $100 billion ticking time bomb.

What I see with the demos from Figure and Boston Dynamics and Unitree is incredible advancements in AI. Someday, I could see having a robot in the house to take the mental and physical load off mundane household tasks.

But that day is likely years off.

And by then, a dozen companies will make a robot that can put away the groceries or fold the laundry.

What differentiates one robot from the next?

Is there a 2-sided market of suppliers and customers? No!

Is there a network effect where having one robot increases the value of the next robot in the office or neighborhood? No.

Is there an aggregation of supply and a single point of distribution to demand? No.

I see robots outside the factory floor following the same commoditization we have seen in LLMs. By the time the average person is aware they can buy a robot for the home, there will be a dozen options and they’ll be low margin pieces of hardware.

Hardware and Commoditization

Commoditization isn’t new in hardware. We often think of the iPhone as an example of hardware and software combining to make a highly profitable product. But that’s an outlier because of the premium Apple was able to extract from the operating system and the network effect Apple had with developers flooding to the platform.

It’s more likely robotics follows the path of Dell or Gateway in the 1990s with a commodity manufacturer assembling robots with varying levels of capabilities.

This is why Google’s demo was so interesting to me.

Google isn’t a hardware company.

They’ll never (I shouldn’t say never) make a robot themselves.

But they could be a robot AI…or operating system.

Google could monetize robots by connecting them to the data Google has and connections with advertisers, shopping sites and so much more. But it’s a software layer in a hardware business and software scales.

That said, maybe the software of robots looks more like LLM software than iOS and it’s just a commodity.

If that’s the case, the software and hardware of robotics will commoditize over the next decade as the number of robots increases exponentially. There may be opportunities for motor manufacturers or sensor companies, but the next trillion dollar business probably won’t be an AI robotics company.

At this rate, there may not be much money to be made by investing in AI robotics, but someday I may be able to throw my dirty clothes on the floor at night and find them washed, folded, and in the drawer in the morning.

Put it that way and the future does sound amazing!

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.