It was a slow and steady week of gains for the stock market this week. Bank earnings began and results were mostly ahead of expectations. This week, we begin earnings season in earnest with companies like SoFi (Monday), GM (Tuesday), Tesla (Wednesday), and Apple (Thursday).

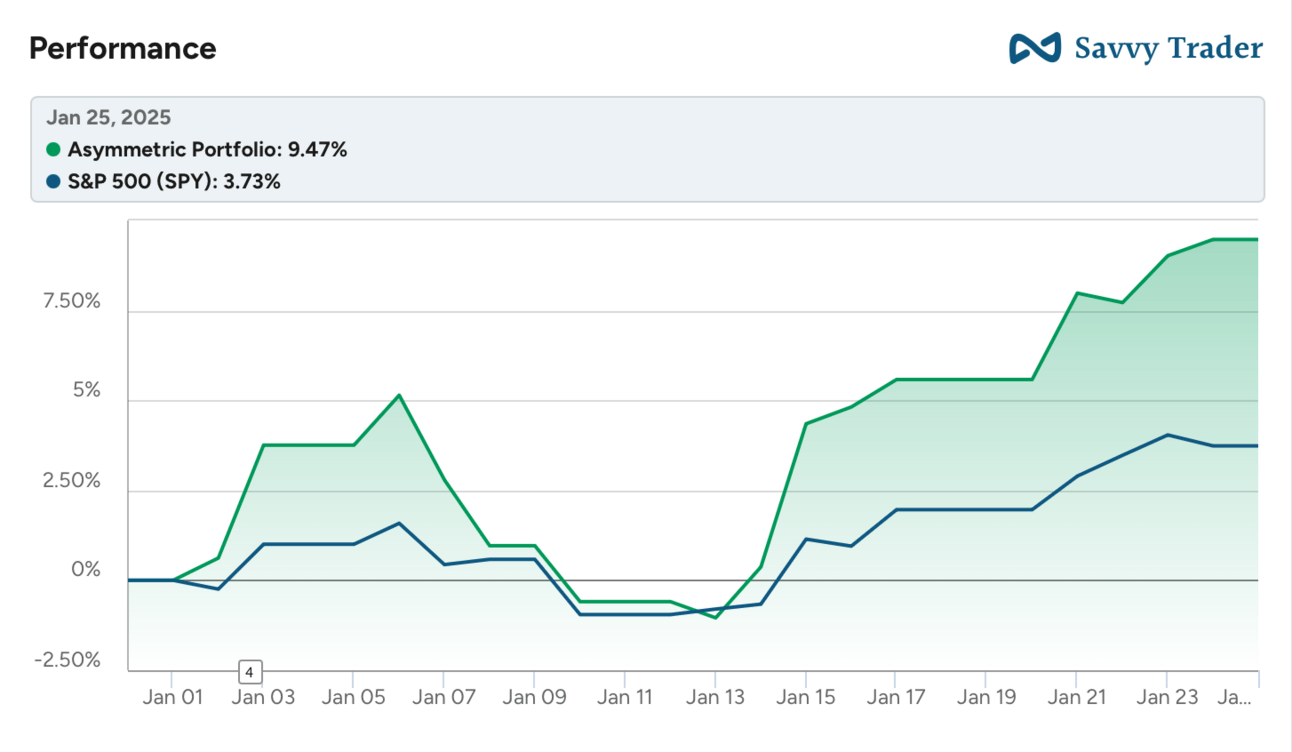

The Asymmetric Portfolio has had an incredible start to the year, up 9.5% so far. Like the market overall, it’s earnings season that will likely determine the direction the portfolio goes for the next few months.

What stocks am I adding to my market-beating portfolio? You can sign up for premium here to get 2x my content and gain access to the market-beating Asymmetric Portfolio. What are you waiting for?

In Case You Missed It

Here’s some of the content I put out this week.

Special Situation: I’m Shorting Tesla: Yes, I’m betting against one of the most popular stocks on the market. Why? Demand is falling, margins are dropping, subsidies account for over 100% of FCF, and FSD hasn’t lived up to expectations. Find out more in the longest deep-dive I’ve written.

AI’s Napster Moment: A Chinese AI lab may have destroyed the value many AI startups have spent billions building.

SoFi Earnings: The Big Question: Is SoFi a bank or a tech company?

Livestream: I’m going live once a week and this is a replay of my discussion with Jose Najarro about the latest in chips, Netflix, and AI.

The Ticking Time Bomb on Big Tech’s Balance Sheet

This week, I explored the world of data center investment and depreciation. It’s not an exciting world, but it may be a place to find risk where most investors are seeing opportunity.

As I’ve highlighted before, the economics of AI aren’t the same as technology companies are used to. Normally, a tech company invests a bunch of money in developing a product where the output is a high-margin product or service they can sell for years.

AI has proven to be much more capital intensive with higher marginal costs than past tech cycles. And the margin may not be as good as it appears.

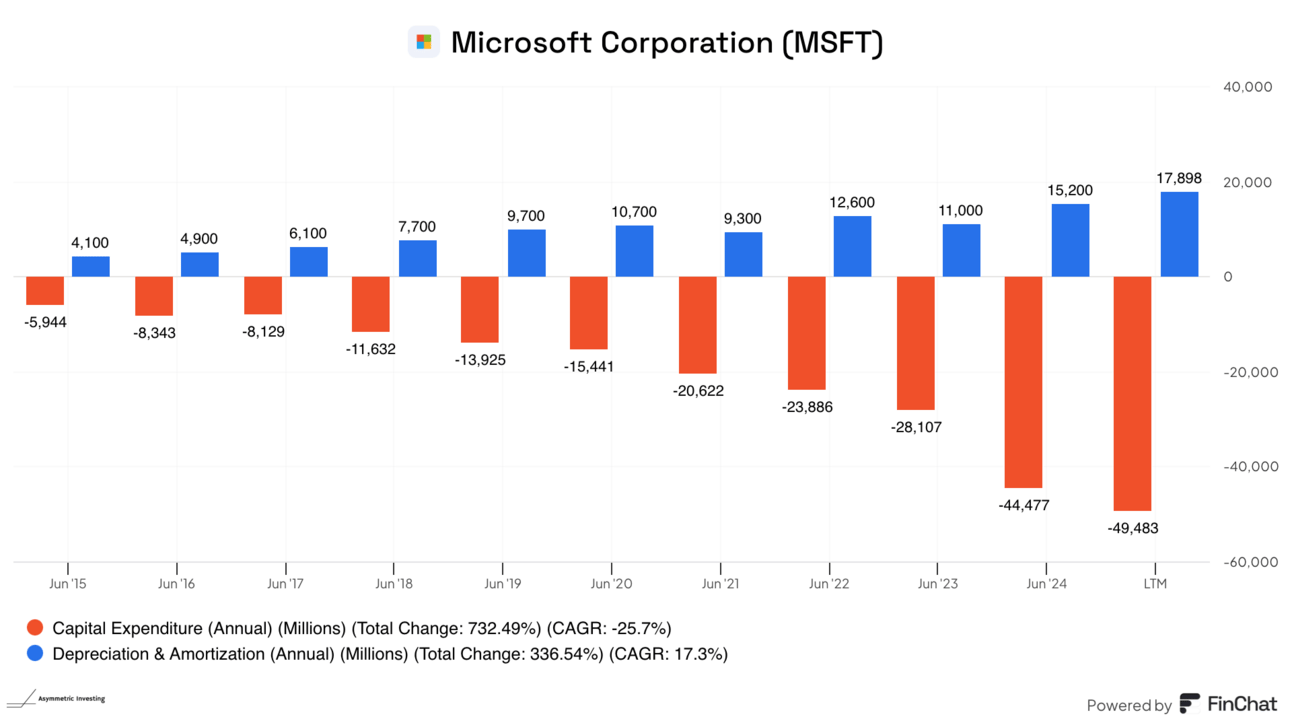

One of the biggest costs that go into building out data centers is the NVIDIA chips these companies are purchasing. They account for ~1/2 of the data center’s cost and for a company like Microsoft the overall capex investment has gone exponential with $80 billion expected to be spent this year. But you can see below, what’s spent on capex (red) and the cost that goes on the income statement (blue) are mismatched because of the depreciation cycle for buildings, construction build-out, and chips. Each company is different, but chips are normally depreciated over 5-6 years.

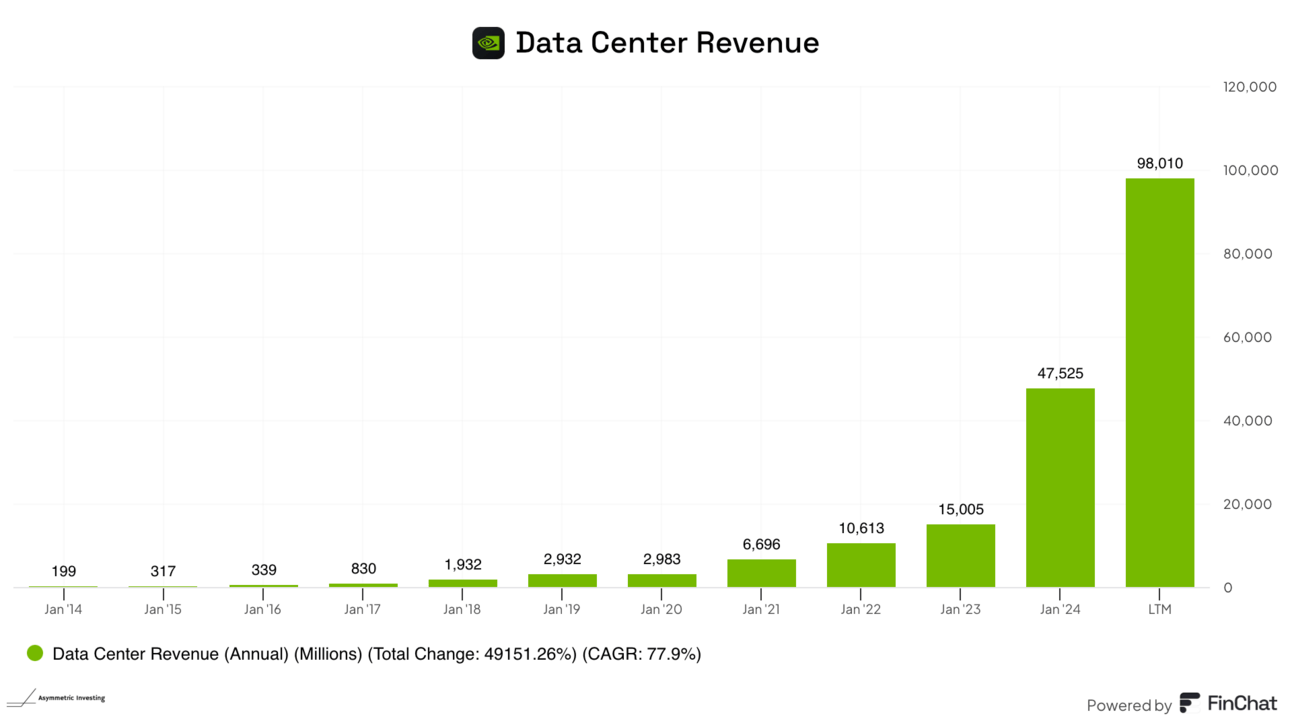

To put the scale of the investment in chips into perspective, this is NVIDIA’s data center revenue. We’re talking big money here.

The depreciation of chips is important because if you get the depreciation timeline wrong you eventually have to write off the worthless chips. Most companies are depreciating chips on a five or six-year schedule, which may be off by years.

Ben Thompson and Nat Friedman discussed this in passing when talking about the potential debt funding for Stargate.

Ben Thompson: So, you have a data center, which is I think a 30-year depreciation, and then the GPUs are I think accounted for in a five-year depreciation, but actually are unusable after about 36 months. So, you already have a problem there in terms of your accounting for the GPUs go and by definition, taking debt out on a 36-month sort of item is probably not ideal, that is rapidly diminishing in value. But if say we had a power build out, well, guess what? We can be using electricity forever.

Nat Friedman: That’s right.

That’s right…

So casual.

$100 billion of chips being installed each year, growing at a 100%+ rate, are being accounted for wrong.

This is a big deal.

The Time Bomb and Its Impact

This mismatch between capex spend and delayed depreciation costs — with the potential for write-downs if the depreciation schedule is wrong — is common among tech companies. And if there’s an adjustment in the value of GPUs a year or two years from now, we’re talking about potentially tens of billions of dollars of impact per company.

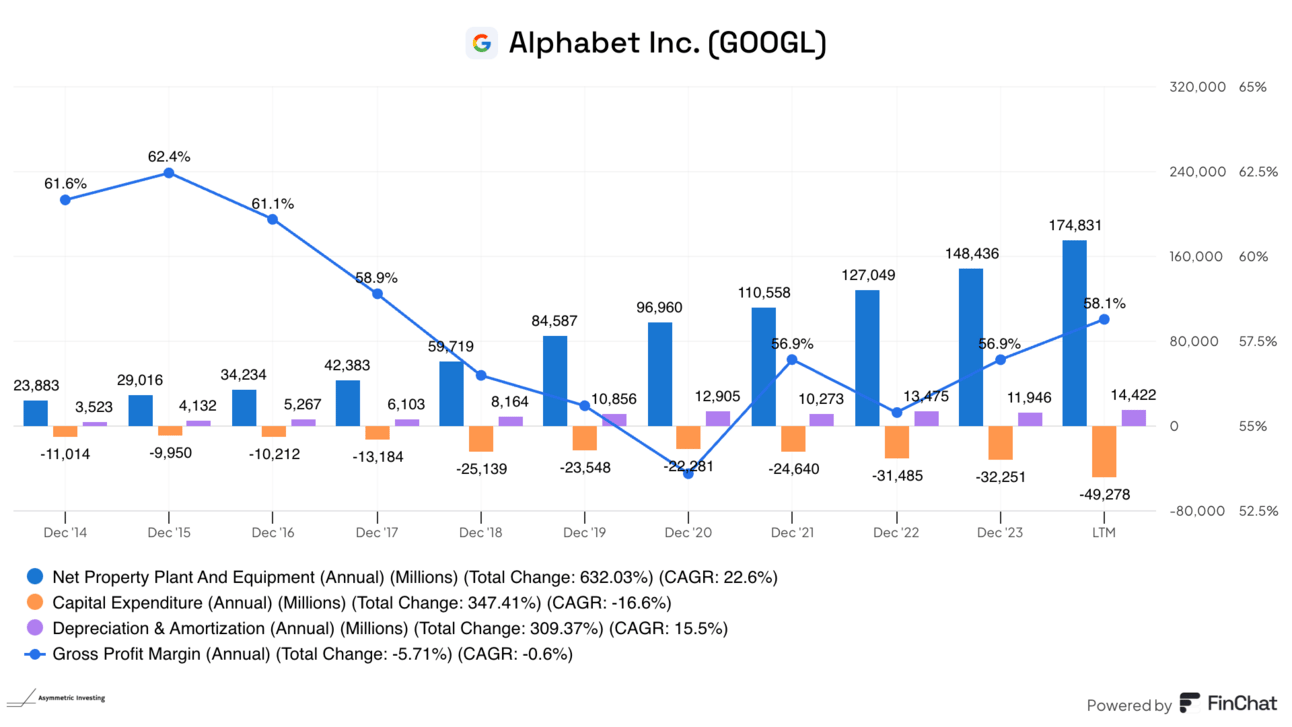

Alphabet has grown its capex nearly 5x in the past decade to build out its cloud. If GPUs are being depreciated on too long a schedule, the improvement in margins may be overstated.

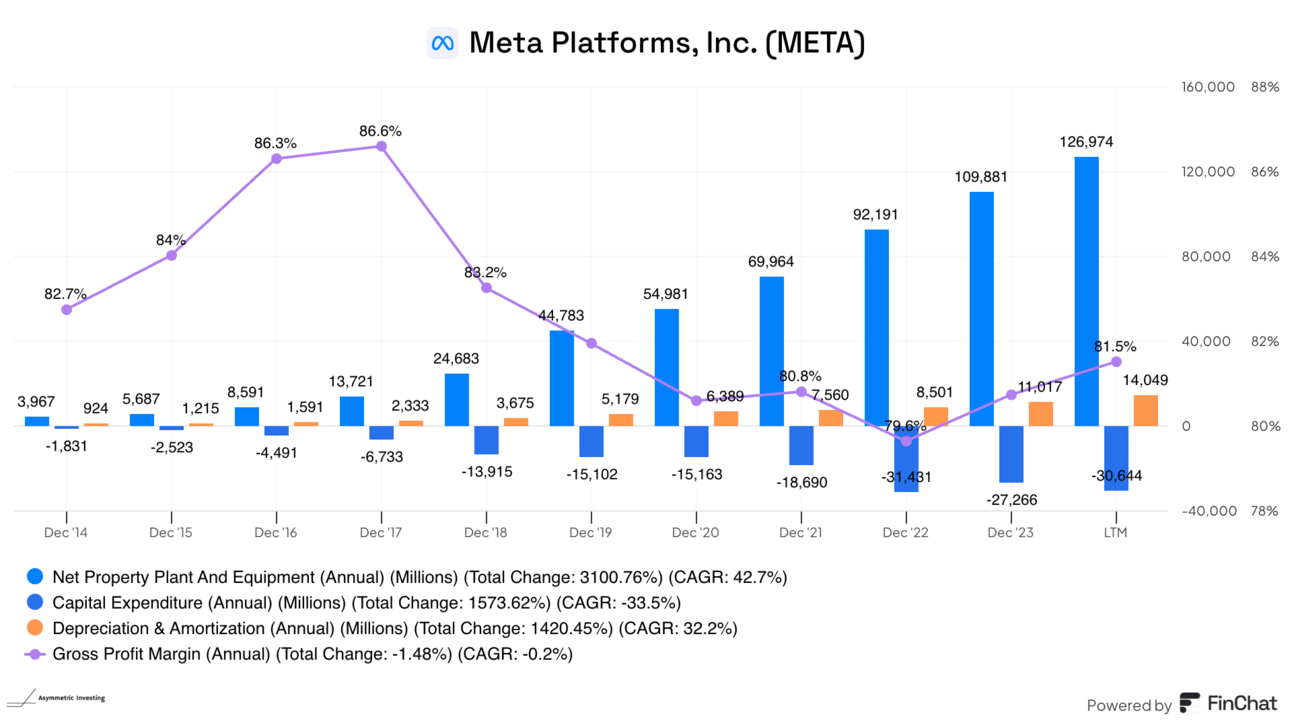

The same goes for Meta, although the growth in capex has been much more stark. A decade ago Meta built very little infrastructure and today that’s a $30 billion/yr cost.

And Microsoft — in my opinion — is the elephant in the room. Look at those margins, and look at how the sentiment around the company’s position and growth has changed since ChatGPT was launched. And no other company has more GPUs on the balance sheet, waiting to be written down.

To be clear, we don’t know if this is a problem yet. But it could be. And the scale of the issue is what’s new.

If GPUs are being depreciated for five or six years but they’re only usable for two, the hyperscalers have potentially tens of billions of dollars in write-downs coming. And it may change how they’re thinking about building out AI infrastructure and the return they need on their investment.

Another thing to think about in AI.

You can get all Asymmetric Investing content, including deep dives, stock trades, and ongoing coverage of Asymmetric Universe stocks with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your own research before acquiring stocks.