Note to Subscribers: After 50 weeks of posting on Asymmetric Investing, I will take the next week off to enjoy Spring Break with my family.

I will be back on March 28, 2024, with the next update.

I hope you had a wonderful week!

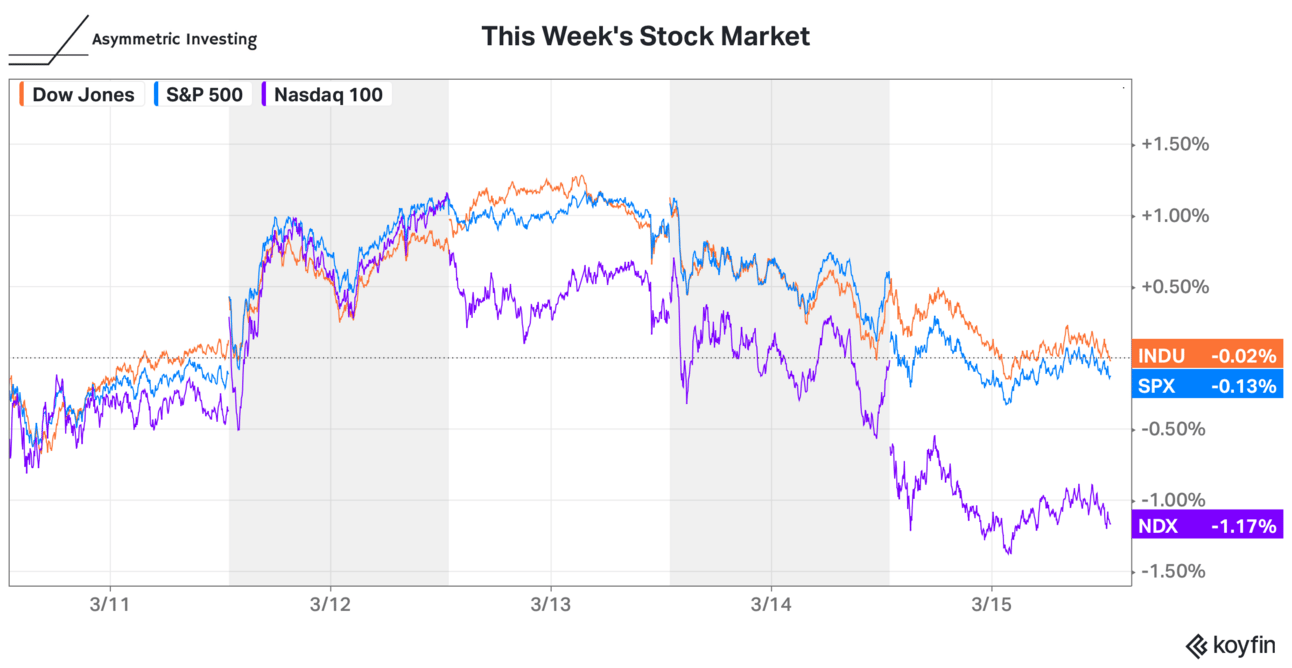

After months of big Nasdaq companies driving the market higher, the opposite happened this week. The Nasdaq 100 was down 1.2% while more industrial and diverse indexes were flat. For at least a few days, high-valued stocks gave back gains and it may be a sign of what’s to come if earnings don’t live up to lofty expectations in tech.

Are you ready to take your investing game to the next level?

We empower investors like you with a daily newsletter which includes the insights needed to stay informed and make profitable decisions in the stock market.

Join Millions Who Trust The Early Bird

Discover daily recommendations

Unlock hidden opportunities

Make informed investment decisions

By receiving our #1 stock tip delivered straight to your inbox every day at 6:59 am—completely FREE.

Seize the Opportunity:

Join the ranks of millions of investors who trust The Early Bird. Sign up now to receive today's #1 Trade of the Day and unlock a world of exclusive benefits.

Your success in the market is just one click away!

In Case You Missed It

Here’s some of the content I put out this week. Enjoy!

Exclusive Interview with Matterport CEO RJ Pittman: Premium members got the first Asymmetric Investing interview this week and it’s with a company that easily has 10x potential.

Spotify and the Musician’s Minimum Wage: A minimum wage bill has been proposed in the U.S. Congress and it could make streaming music unviable.

On Holding and What Wall Street Got Wrong: On had a wild week because the market didn’t understand the impact currencies have on the business.

What Happened to Tesla Stock? Shares of Tesla are down 60% from their peak and the sentiment around the company has deteriorated. So, what exactly has gone wrong?

Disruption in Housing

It was a big week in the housing industry. The National Association of Realtors (NAR) “announced an agreement that would end litigation of claims brought on behalf of home sellers related to broker commissions“ and it could change how the real estate industry operates in the U.S.

This isn’t just any litigation. In November 2023, NAR was found to have colluded to keep fees high in the real estate broker market, which governs transactions in the $52 trillion U.S. housing market. On Friday, they proposed a solution and settlement that, if approved by the court, could change residential real estate forever.

To understand what’s happening, let’s look at the way the industry works today. In the image below, you can see the sellers on the left and buyers on the right who ultimately want to connect in a real estate transaction. But they aren’t easily able to connect because agents and the multiple listing service (MLS) where homes are listed are sitting in the middle.

The MLS is the local platform for listing and discovering homes, so it’s the connective tissue for the market today. It’s also where rules are laid out for the way agents can act, the fees they can charge, and what fees are disclosed.

That’s why it’s at the center of the collusion case and this proposed solution.

Today, the standard fee to sell a home is about 6% and buyer’s agents receive about half of that fee. Incentives for both agents are aligned.

The seller’s agent has an incentive to agree to the fee split to keep the fee high and the status quo alive with vitally important local MLS access acting as the carrot and the stick. The buyer’s agent has an incentive to steer clients to homes with a 6% fee and a commission split because…money.

What happened on Friday was a break between the seller’s agent and buyer’s agent fees on the MLS.

NAR has agreed to put in place a new MLS rule prohibiting offers of broker compensation on the MLS. This would mean that offers of broker compensation could not be communicated via the MLS, but they could continue to be an option consumers can pursue off-MLS through negotiation and consultation with real estate professionals.

This means the buyer’s fee and the seller’s fee would be individually negotiated and be more transparent to all parties. If you’re a buyer searching Zillow yourself to find homes, does a buyer’s agent deserve a $15,000 commission on your home?

Maybe, but that payment will now be paid explicitly, which will likely lead to lower fees in the industry and more “self-serve” on the part of buyers.

Aggregation In Housing

I think this will ultimately lead to an aggregator — a site that gathers together materials from a variety of sources — in the housing industry, which could be a trillion-dollar opportunity. Unlike legacy businesses, an aggregator generates power from controlling the point of demand, not the source of supply.

If a single company is the go-to place to list a home, find a home, shop for a mortgage, discover movers, and even rent it would be an incredibly valuable service even if the standard transaction fee on the site is 1%, not 6%.

The natural company to build that aggregator is Zillow.

Zillow already has the most popular house-hunting app in the U.S. and its rental business is growing quickly. But Zillow couldn’t truly disrupt the housing industry as long the MLS held all the local power over listings, something Zillow needs access to. Now, that power has broken and that could lead to the self-listing of homes and more buyers without agents searching on Zillow.

Given the slow pace of change in housing, it may take decades for Zillow to build a truly disruptive aggregator and replace the local MLS structure. But history tells us someone will build an aggregator and be the digital marketplace. Zillow is my bet and this could be the most asymmetric stock I’ve covered in Asymmetric Investing.

You can get all Asymmetric Investing content, including deep dives, stock trades before they’re made, and ongoing coverage of Asymmetric Universe stocks like Airbnb with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.