I have been wondering out loud if the consumer is all right for months on this newsletter. This week, that concern came front and center as some data (which I’ll get to below) indicated that consumers are pulling back and a recession may hit the U.S. sooner than you might think.

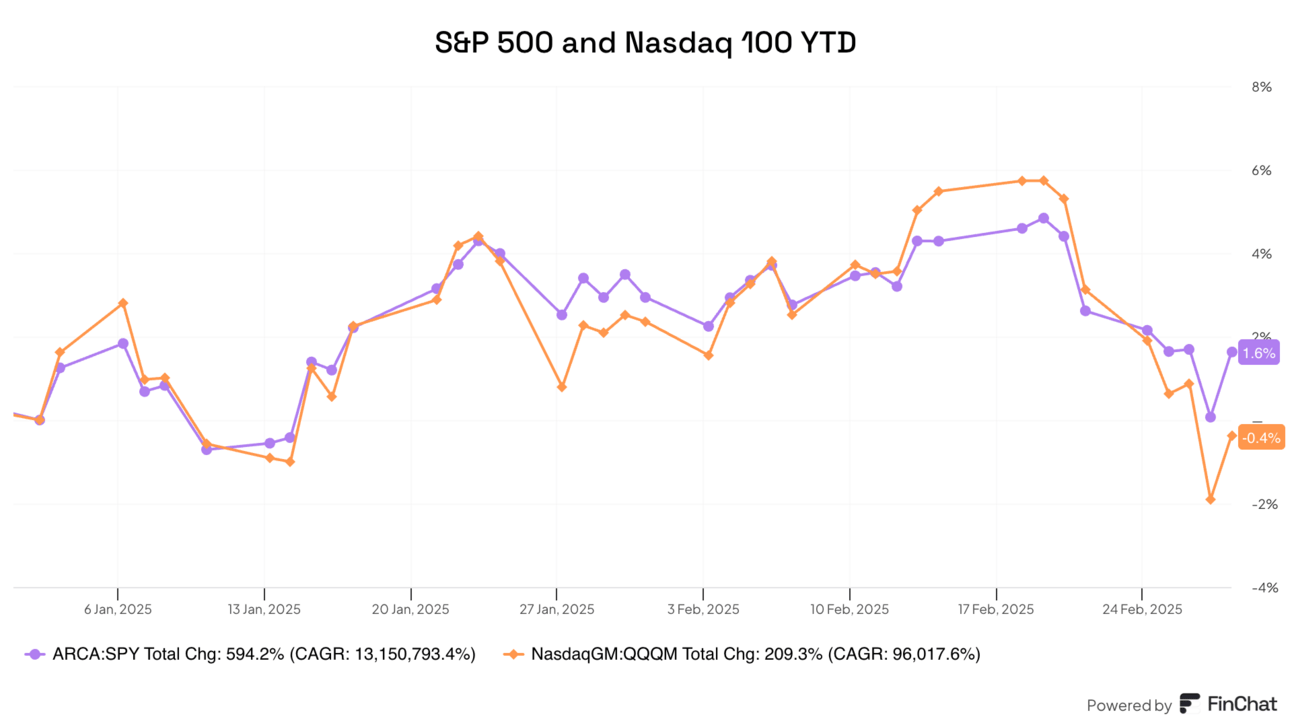

The Nasdaq 100 has even gone negative for the year in response to the negative news.

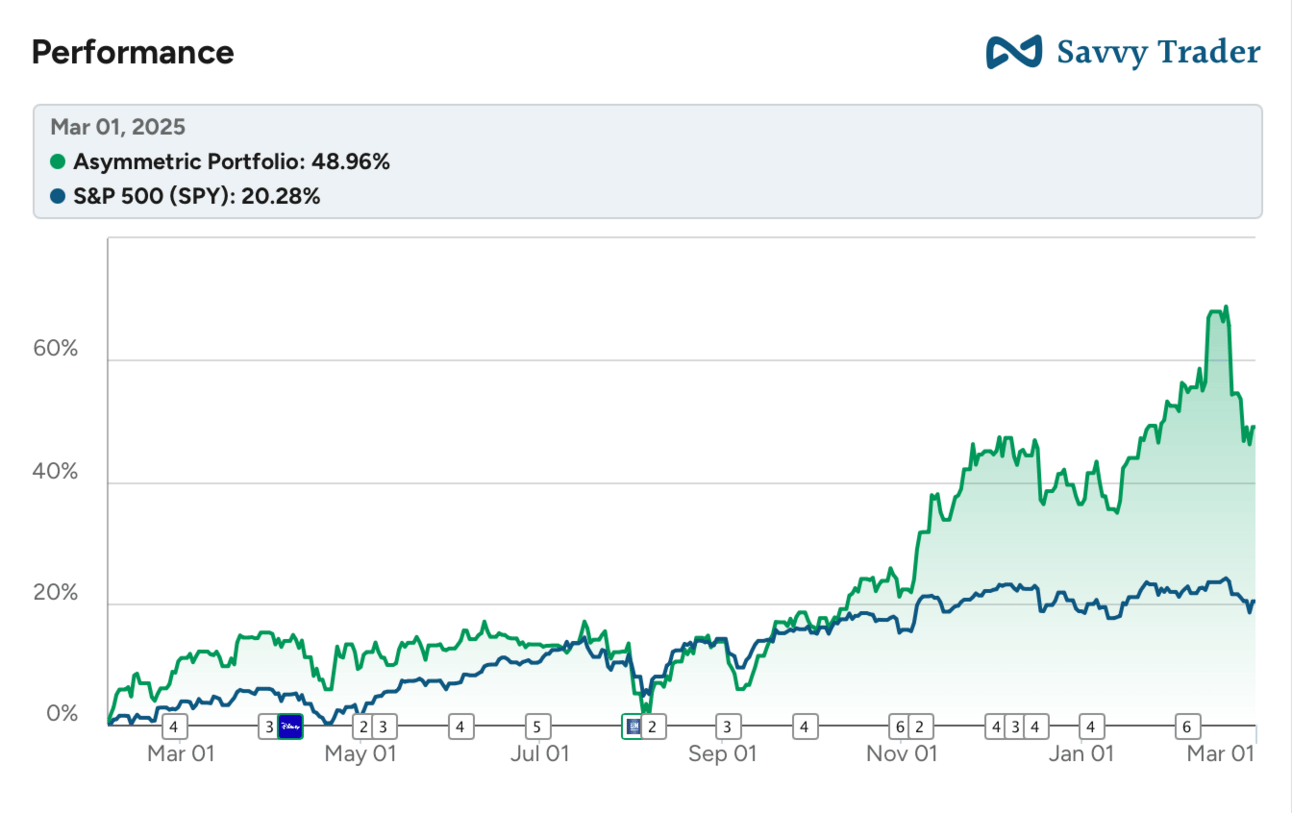

The Asymmetric Portfolio has managed a 9.3% gain for the year, but has been extremely volatile. Zoom out and the portfolio is still outperforming the market by a nice margin. I’m not changing anything about the frameworks used in the Asymmetric Investing if the market goes south because volatility is both a price we pay to outperform the market and an opportunity to buy great businesses for cheap.

The “Special Situation Short” of Tesla is up 64% in a little over a month. I started that position partly as a hedge of the overall market and partly because of Tesla’s unique risks, but I didn’t imagine the sentiment around Tesla would turn this quickly.

What stocks am I adding to my market-beating portfolio each month? You can sign up for premium here to find out, get 2x the Asymmetric Investing content, and gain access to the market-beating Asymmetric Portfolio. What are you waiting for?

How do I make all of the charts in Asymmetric Investing? Simple. With Finchat. You can get started with FinChat Pro free for 2 weeks below. After that, you’ll get 15% off for being an Asymmetric Investing subscriber. I can’t say enough how much easier it’s made my research. Check it out 👇

In Case You Missed It

Here’s some of the content I put out this week.

Our Biggest Advantage Over Wall Street: Thinking about a business long-term is our greatest advantage and that’s evident with Hims & Hers.

Portillo’s and Virgin Galactic Update: My thoughts on earnings and their future.

What I’m Buying in March 2025: The buys for the month are out and will be executed early next week.

5 Frameworks I Use to Beat the Market: These simple rules will help any investor beat the market.

Is the U.S. Headed for a Recession?

Coming into 2025, it was hard to find any sort of bearishness in market sentiment.

Whether it was regulations or crypto or interest rates or simply politics, business owners and investors found every reason they could to be bullish.

We’re now two months into the year and the consumer has a different view of the world. And remember, it’s consumers that matter in the economy, not talking heads on TV.

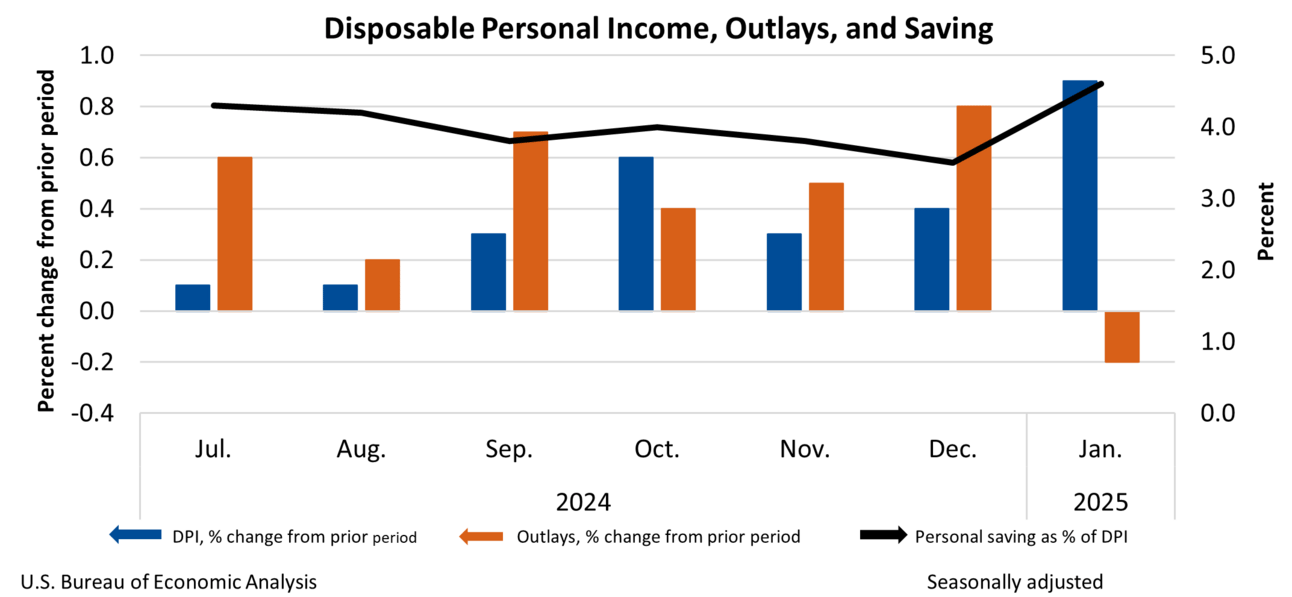

A report out this week from the Department of Commerce showed spending declined in January despite higher wages. Is this a blip in the data? Saving after over-spending for Christmas? Or fear about a world with tariffs (which we’ve seen in other survey data)? We don’t know yet what the longer term trends hold, but this is worth watching.

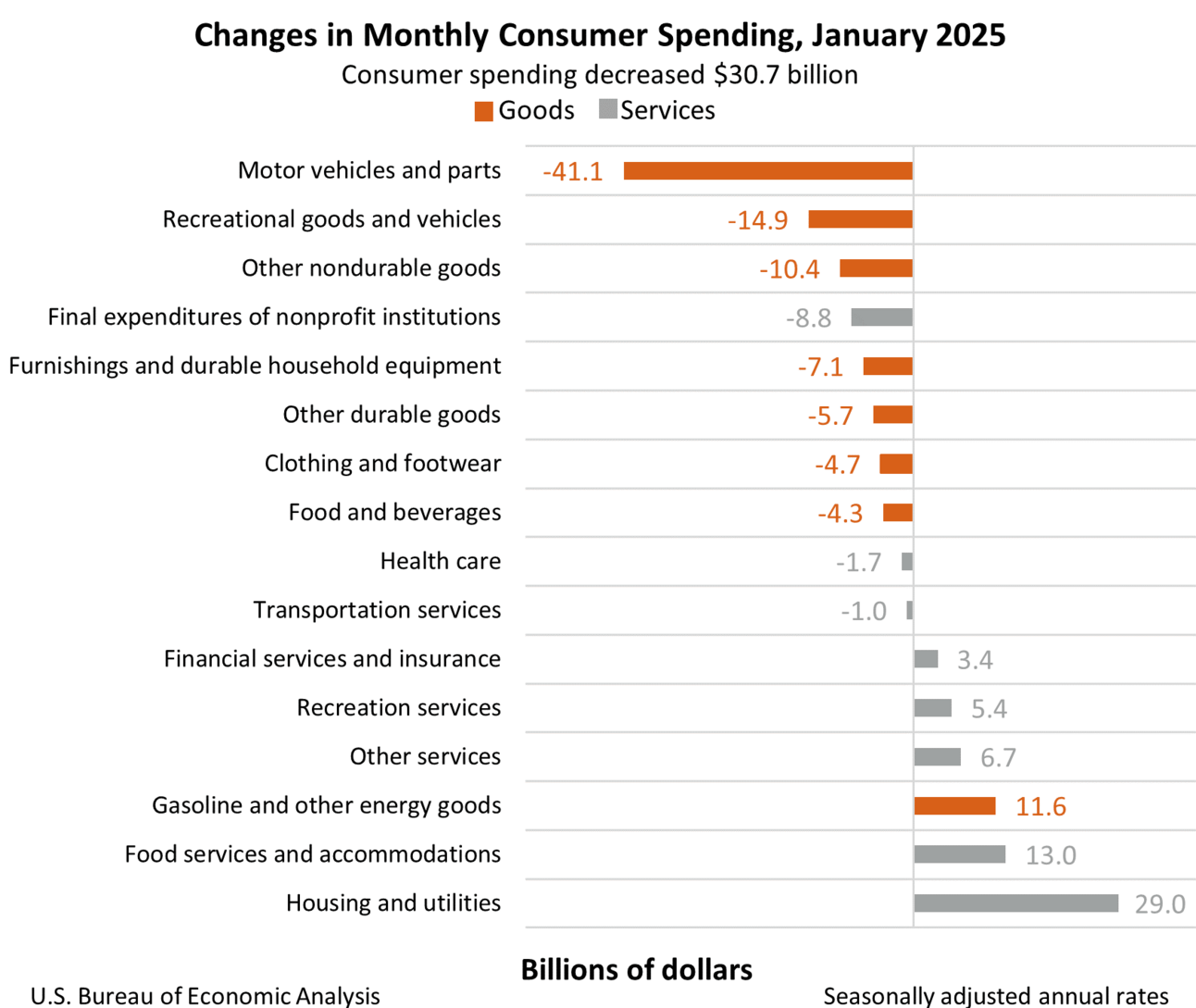

Within that high level number was more detailed data on where spending is down. Big purchases like vehicles and furniture are down while housing and utilities are up big.

I think this is an interesting trend when we’re potentially heading for tariffs on imports from Mexico, Canada, and China as early as Tuesday.

Tariffs aren’t necessarily bad for the U.S. market long-term because it could shift more manufacturing and jobs back to the U.S., but the short-term impact will be higher prices for a lot of goods we buy every day and potentially less volume for most companies. Ironically, vehicles will likely see the most acute impact, so buying one now may be a prudent financial move rather than waiting…

All of this data is feeding into a recession watch measure called the Atlanta Fed’s GDPNow real GDP estimate. You can see below that estimates were for modest GDP growth in Q1 2025 until just this week. Now, the estimate is for negative growth. 2 quarters of negative growth (a shrinking economy) = a recession.

I don’t bring this up to strike fear in investors. I’ll buy stocks this week just like I do at the beginning of each month.

However, I do think the apparent change in consumer behavior early in 2025 is notable. If it continues, a recession may be more likely than previously thought. A prudent move may be to not buy highly priced stocks that are priced for perfection because this doesn’t look like a perfect economy.

Recessions don’t start because everyone predicts one.

Recessions are like dominoes.

Consumers spend a little less on cars.

So, automakers reduce orders for steel and cut shifts back.

So, those consumers slow spending on new shoes and clothing.

Government layoffs cause less demand for cars and discretionary goods.

So, some building slows, which hits 15% of the economy.

And eventually something we didn’t expect to break…breaks.

A recession is definitely possible in 2025. And it may be more likely than not at this point.

When there’s as much change in the economy and consumer sentiment as we see today, something is bound to break. And that may unveil risks we don’t realize exist today.

You can get all Asymmetric Investing content, including deep dives, stock trades, and ongoing coverage of Asymmetric Universe stocks with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your own research before acquiring stocks.