Before we get started, I wanted to outline what to expect at Asymmetric Investing over the next few days.

Thursday: Time in the market > timing the market + Hims & Hers earnings and market reaction.

Friday: Portillo’s comeback? + Is Virgin Galactic a rocket stock or is it done for?

Saturday: March 2025 stock buys will be released.

Sunday: Is the consumer all right?

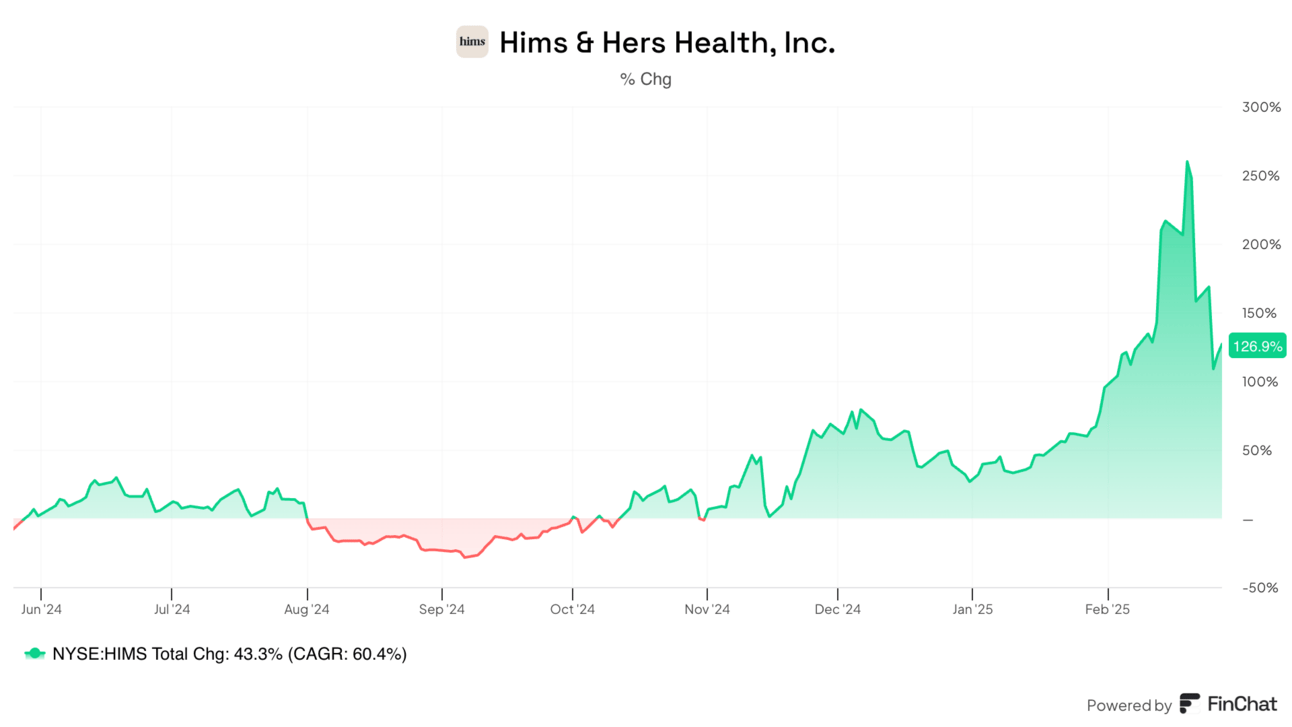

I thought of this quote this week when we saw Hims & Hers stock—which was the largest position in the Asymmetric Portfolio on Monday—crash 22.3% on Tuesday after the Q4 2024 earnings report.

Yes, the stock was down and investors who had a negative position were right that day. But the stock is also up 231.3% in the past year.

Are the bears judging the company on the same time horizon I am?

Are we debating the same things?

Or are they playing a short-term game while I’m thinking about the next decade?

Yes, the bears were right about the fact that GLP-1s are coming off shortage and Hims & Hers won’t be selling them beyond Q1 2025, at least not in their current form. And that brings uncertainty into the company’s revenue growth and earnings.

But let’s take a long-term perspective. Hims & Hers grew revenue 43% to $1.2 billion in 2024 excluding GLP-1s. In 2025, the company expects to grow revenue between 56% and 63%. Excluding GLP-1s, guidance is for 108% growth in the final three quarters of 2025!

That doesn’t seem like a terrible company to me.

Investors are often cheering or booing based on their time frame. It’s been a bad few days for Hims & Hers, but zoom out on the stock chart to when the Hims & Hers spotlight was written and you see a very different story from the GLP-1 focused trading of this week.

If you’re looking at Hims & Hers as a trade, the Q4 2024 report may have been a reason to sell the stock.

But I am looking at it as a long-term investment, and the number of companies growing revenue by 43% per year, trading for 6x sales, and expanding operating margins is short.

But is the stock going to $50 or $30 next? That’s what traders want to know. And Wall Street analysts need to have an opinion because they need to guess what next quarter will look like and how the stock will react.

Hedge funds and institutional investors want to know what’s going to happen next week or at most this year because that’s how their fees are calculated.

I can be honest and tell you I have no idea if Hims & Hers stock hits $30 or $50 next and I don’t care. I take a long-term view and analyze whether or not Hims & Hers is building a platform that could change how we interact with healthcare.

I think this can be a company with $10 billion revenue company by the end of the decade with 20% operating margins. That’s a 10x opportunity that I’m not going to miss by trying to predict the next 10% move.

Thinking long-term is our biggest advantage over Wall Street and I think this year with Hims & Hers is a prime example of why.

Asymmetric Investing has a freemium business model. Sign up for premium here to skip ads and get double the content, including all portfolio additions.

Smarter Investing Starts with Smarter News

The Daily Upside helps 1M+ investors cut through the noise with expert insights. Get clear, concise, actually useful financial news. Smarter investing starts in your inbox—subscribe free.

The Hims & Hers Long-Term Story

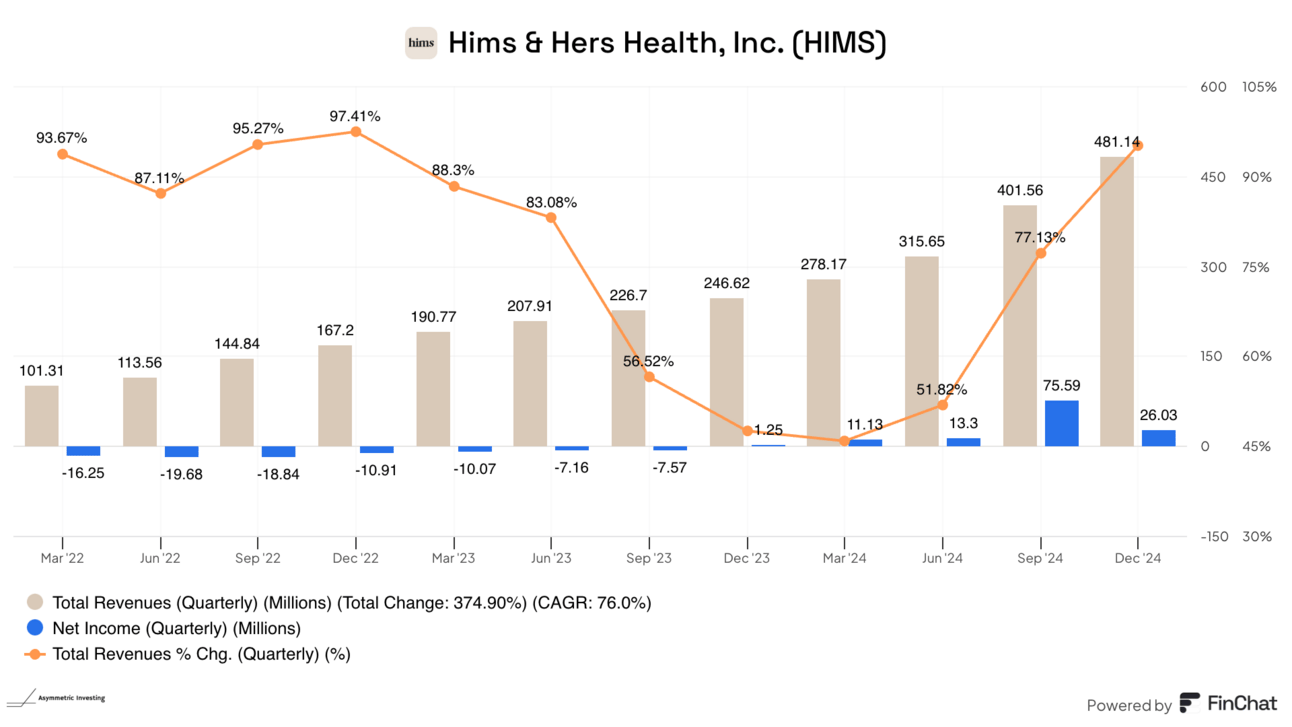

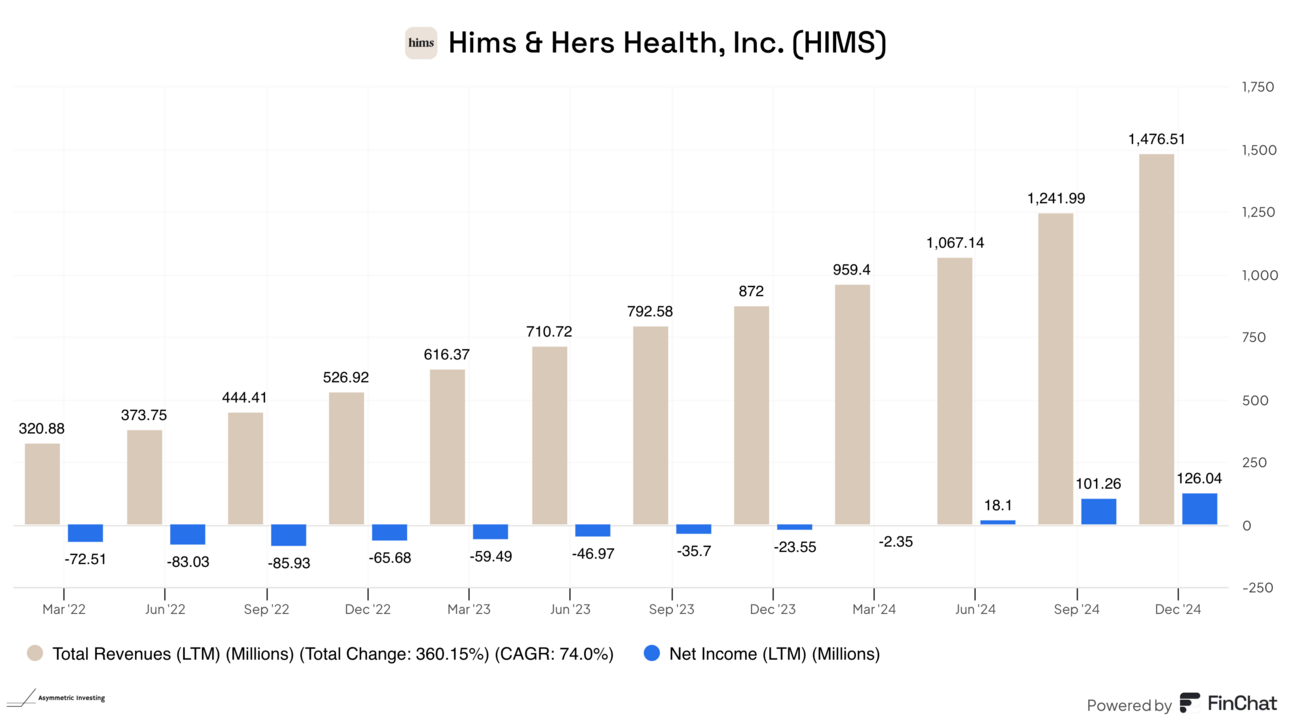

I want to start with having an honest and long-term focused discussion about Hims & Hers revenue trajectory. Below is the quarterly revenue, net income, and growth rate.

You can see that growth kicked up in the second half of 2024, helped by GLP-1s. How much did they help?

We launched an oral-based weight loss offering in the fourth quarter of 2023, which saw great success as it scaled to a revenue run rate of over $100 million in just over 7 months. Our GLP-1 offering, which launched in the second quarter of 2024, has experienced similar success, delivering north of $225 million of incremental revenue in 2024.

An analyst asked if the impact was $75 million in Q3 and $150 million in Q4 and I think that seems like a reasonable guesstimate — although management dodged the question.

You can back out those numbers or change them if you’d like, but if we did assume $150 million in GLP-1 revenue in Q4, revenue growth would have been 34.3%. Slower than previous growth, but not bad.

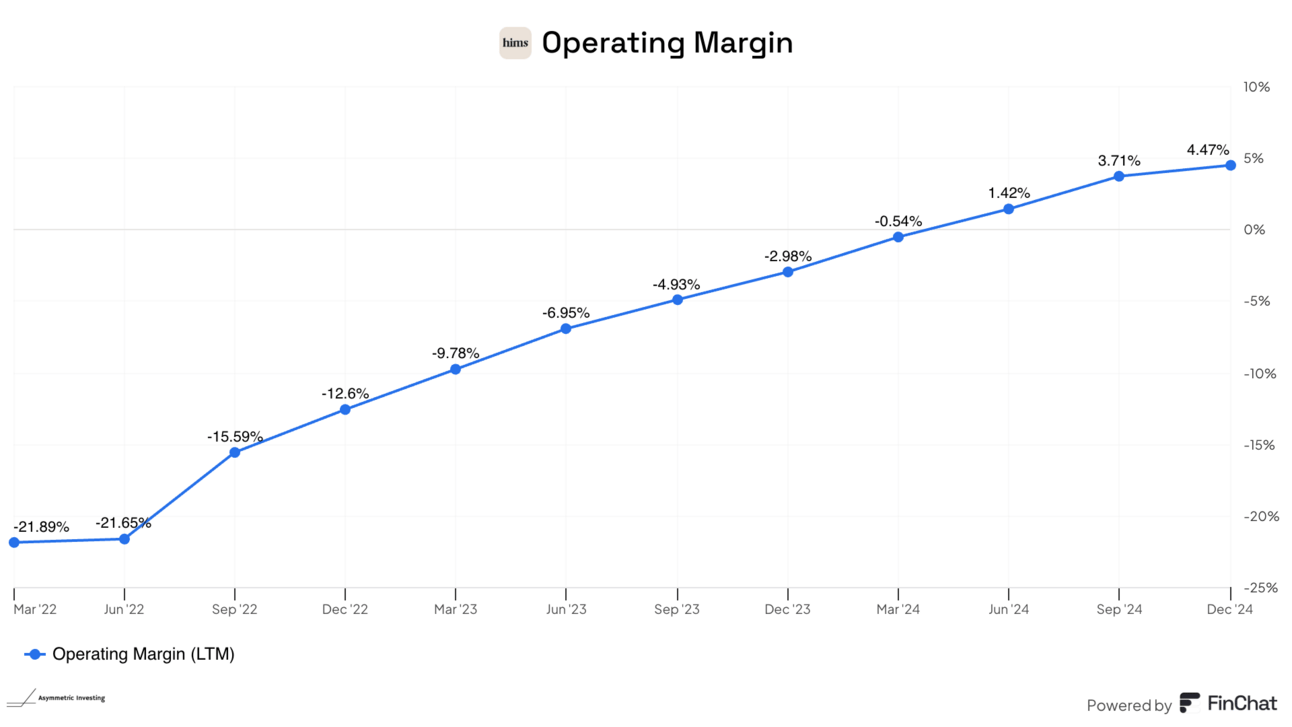

The Margin Story

Operating margins also continue to improve, which is a sign that marketing spend is paying off the longer customers are on the platform. One of the reasons I ended up buying the stock last year was that it became apparent Hims & Hers wasn’t on a customer acquisition treadmill and long-term value would likely exceed customer acquisition costs (LTV > CAC).

This comment and the following chart show the improvement should continue.

Higher retention as a result of an increasing shift toward personalization as well as acquisition of customers organically and through lower cost channels continues to provide confidence in our ability to achieve between 1 to 3 points of leverage on our marketing spend per annum.

If Hims & Hers gets to a 20% operating margin as the business scales, it’s not out of question Hims & Hers could have $10 billion in revenue and $2 billion in operating income early next decade.

Not bad for a company with a $9.3 billion market cap.

Hims & Hers the Platform

What I thought was most telling about the conference call was how clear CEO Andrew Dudum and CFO Yemi Okupe were about the future of the company. This is a platform company changing how we interact with healthcare, not just a product company.

In 2024, we launched tools such as BMI calculators and trackers to help members monitor water intake, nutrition, movement and sleep, all focused on helping our subscribers build a healthier lifestyle. In this next generation of health care, we see a world where AI can substantially elevate the subscriber experience by providing resources with greater sophistication such as AI coaches, therapists, nutritionalists and trainers available for 24/7 on-demand support to help our customers make meaningful lifestyle changes in pursuit of their health and wellness goals, trusted and empathetic AI-powered care coordinators to help customers navigate their health care journey, and greater transparency and visibility into the reasoning that drives each treatment and service recommendation on our platform in a manner not constrained by the availability of provider time on the platform.

I think it’s clear the future user experience for Hims & Hers is going to be the company with a medical question/problem and the platform providing a holistic solution from lifestyle change suggestions to professional services to pharmaceuticals.

Is Hims & Hers going to go as far as giving me recipes to eat healthier and workouts I can do based on the equipment I have at home or my gym membership?

Why not? The company already sells meal replacement shakes and bars.

The vision is to be a platform with all of the tools to democratize health and wellness 24/7. Let’s listen to what management is saying they’re doing.

One of the things that I think about a lot as an entrepreneur is what are things that the ultra-rich have access to, and then how can we broaden that and give that to everybody. So things that people have are on-demand therapists, right? They've got nutritionalists. They have fitness coaches. They have meditation coaches. These are people that are in your life, helping you to live a healthier lifestyle. I think we are capable of building incredible AI versions of all of those coaches, which really change the paradigm for how easy it is to change the lifestyle dynamics in your house and ultimately expand that to tens of millions of more people down the line.

This is a longer quote, but I think it was telling about Dudum’s view of the future of Hims & Hers.

We will continue to position ourselves to be a leader in addressing the chronic obesity epidemic across America. There may not be a more impactful use case for precision medicine than America's obesity epidemic, which impacts 100 million individuals across the country and results in 0.5 million preventable deaths per annum. North of 200,000 individuals joined the Hims & Hers platform in the span of a year to meet their weight loss needs, is evidence of the benefits that consumers see in our approach to personalized medicine. As we shared last year, we believe our approach can enable material improvements in clinical adherence and compelling customer satisfaction, and we're seeing gains in the realization of this goal. In order to truly address the epidemic, patients need comprehensive care that extends beyond medicine to making lifestyle changes from nutrition to exercise to mental health, and we are dedicated to this approach. Precision medicine is about using the right tool for the right patient at the right time. We believe this approach to personalized medicine will ultimately drive better clinical outcomes by enabling providers to personalize the dose, form factor and other clinical delivery aspects of existing clinically validated medications.

In our work, we are committed to integrity and transparency. We are not bypassing the regulatory process nor are we creating new drugs. The regulatory framework for compounding and the FDA have long recognized the need for compounders to be able to compound medication to meet patient needs that utilize ingredients of but that are not essential copies of existing drugs. We focus on providing access to better care in this framework through personalization, period. We believe that Americans deserve transparency about the system and their options, and we will continue to passionately push back against any attempts to confuse or scare consumers about whether compounding can be done legally and safely. We won't claim improved efficacy until the data substantiates it. We will continue to show our quality and safety process across every step of the customer journey. We take a logical approach that lets patients and providers draw their own conclusions because we believe that patients, not pharmaceutical profits, should drive our health care system. We are aware that change can be scary for industry incumbents. Big pharma's reaction to our call to fix today's stuck in sick health care system has been to band together and question the need for affordable compounded solutions and incite fear in regular Americans through broad-stroke statements about the safety of all compounded medications.

As always, we will continue to monitor and comply with regulatory requirements related to the GLP-1 shortages. And we will continue to primarily focus within our weight loss category on bringing care to individuals that stand to benefit from our oral-based offerings, liraglutide, later this year, and clinically necessary personalized dosages of semaglutide. The investments we've made on our platform will help ensure that we can effectively help the millions of potential Americans that can benefit from our holistic approach to weight loss treatment. Additionally, these investments position us to be a leader in providing access to high-quality treatment to millions of more Americans as more brand name GLP-1 medications go generic in the coming years. As a founder-led company, we have one rare advantage that most companies do not, extreme patience. While most might get lost in the noise of today's realities, the future is where we are focused, a future where high-quality personalized care is available to everyone on demand at affordable prices from the comfort of their home. This vision is coming to reality, and it's shaking the incumbent system. We believe that in the coming years, that future will be obvious and available to all. We look forward to updating you on our progress across these priorities over the course of 2025.

I couldn’t have laid out the long-term thesis better myself.

So, why is the stock down this week?

The Hims & Hers Short-Term Story

What short-term investors (and those with a short interest that reached 32% of the shares outstanding) were focused on in the quarterly report was GLP-1s.

I would see things like, “most of Hims & Hers growth is coming from GLP-1s.”

Yes, that’s true.

In the fourth quarter of 2024, the company’s 95% growth consisted of about 60% growth contribution from GLP-1s and 35% contribution from non-GLP-1s.

But look at that second number. 35% growth from non-GLP-1s is incredible!

And let’s not forget that Hims & Hers will be able to convert some of those customers to other weight loss products, can provide holistic solutions to others, and will bring generic GLP-1s to market later this year to serve others. And there’s more generic GLP-1s coming later in the decade.

Investors don’t like decelerating growth and revenue growth will slow from 95% in Q4 2024 to 52% in the final 3 quarters of 2025, based on the midpoint of 2025 guidance. I use the final three quarters because management said the GLP-1 semaglutide won’t be sold for commercially available doses after this quarter.

This figure excludes contributions from commercially available dosages of semaglutide, which will not be offered on the platform after the first quarter. There may be the potential to offer commercially available dosages of compounded semaglutide throughout the year. However, we see our steady-state weight loss offering being primarily composed of our evolving oral-based solutions as well as liraglutide later this year.

52% is lower than 95% and that’s “bearish” for some investors.

I think 52% growth is amazing and remember that’s compared to reported Q2-Q4 2024 revenue, not adjusted for non-GLP-1 revenue. If we pull out the $325 million of semaglutide sales in this period, revenue is expected to grow 108% in the final three quarters of 2025!

If Hims & Hers can do that for a decade, this will be one of the top performing stocks on the market.

Take the long-term view and focus on this chart going up and to the right over time. That’s what matters most.

Everything else is noise.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.