Earnings season begins in earnest this week with companies like 3M, Tesla, Alphabet, and Verizon all reporting. This may be the most anticipated earnings season in years because it’s the first time we will hear about the impact tariffs will have on business. I’ll share what I’m watching below.

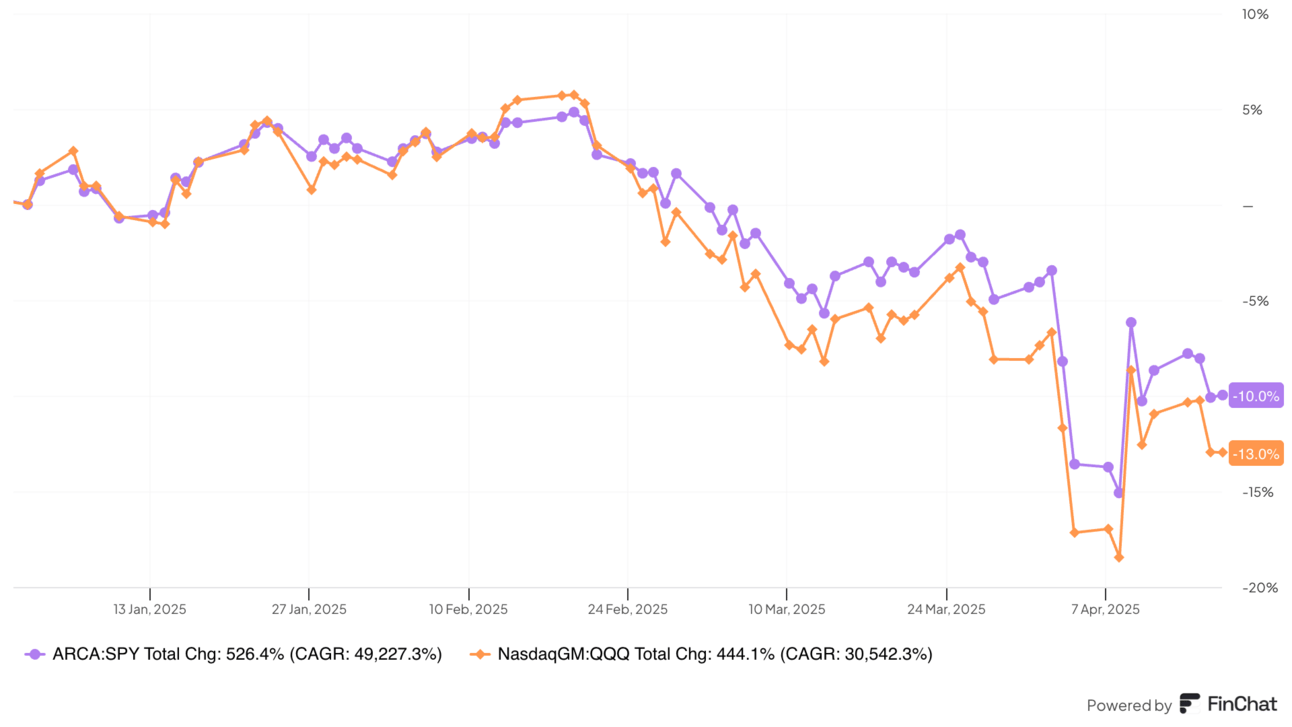

As for the market overall, we’re in what you would call a “correction” or a drawdown of over 10%. But the S&P 500’s 14.1% drawdown and Nasdaq 100’s 17.1% drawdown aren’t quite “bear market” territory, which is defined as a decline of over 20%. Earnings season may give us an indication of whether the next step is higher or lower.

Through it all, the Asymmetric Portfolio has held up reasonably well. You can see that it’s still beating the market this year, despite falling sharply from February highs. This performance does not include the 260% gain from the special situation short position closed earlier this month.

What stocks am I adding to my market-beating portfolio each month? You can sign up for premium here to find out, get 2x the Asymmetric Investing content, and gain access to the market-beating Asymmetric Portfolio. What are you waiting for?

How do I make all of the charts in Asymmetric Investing? Simple. With Finchat. You can get started with FinChat Pro for free for 2 weeks below. After that, you’ll get 15% off for being an Asymmetric Investing subscriber. I can’t say enough how much easier it’s made my research. Check it out. 👇

In Case You Missed It

Here’s some of the content I put out this week.

NVIDIA’s China Problem: The Trump Administration hit NVIDIA with a $5.5 billion bomb that may have much broader impacts for the company and the tech industry broadly.

Lyft Goes to Europe: Lyft acquired a European taxi company, and I think it’s all about autonomy.

5 Stocks to Buy In a Market Crash: I’m interested in these stocks…at the right price.

Earnings Season BINGO

As we scrutinize this quarter’s earnings season, here are the themes I’m watching/listening for and what you’re going to see in my coverage.

Earnings (duh)

First things first, I’ll be looking at what companies report. This may seem obvious, but remember, there are questions about whether the U.S. was already in a recession in the first quarter.

The details will differ by company, but I’m looking for revenue growth rates and margins most closely. If pricing power started to slip, it could be a canary in the coal mine.

Tariff Impacts

What’s going on with tariffs? Does anyone know?

Can we put puzzle pieces together?

Who gives a direct dollar impact?

Who is raising prices and by how much?

Maybe most importantly, who has the pricing power to pass tariff costs on and who is going to see margins shrink?

When I look at companies like On Holding, Crocs, and Mobileye, I’ll be looking for the direct impact of tariffs.

Guidance

This quarter won’t be just about guidance changing up or down. It’ll be about the details around guidance. Do companies:

Reduce guidance

Withdraw guidance

Add caveats like “if tariffs” to guidance

I’m expecting analysts to probe companies about their expectations for the year and management teams dancing a tight rope on conference calls.

Layoffs, CapEx Delays, and Other Cost Cuts

Are companies scared?

Are they cutting operating expenses or delaying capex?

Who is thinking about layoffs?

Recessions get started when everyone gets a little nervous at the same time and all companies rationally cut back spending, which reduces employment, which reduces revenue, and a downward spiral ensues.

Adjacent Impacts

If you want to know how well consumers are doing, sometimes the best place to look is with advertising companies like Google and Facebook.

Are auto companies cutting back? Mobileye will know first.

Are Canadians and Europeans cutting back travel to the U.S.? MGM and Airbnb can tell us.

There are going to be a lot of adjacent and second-order impacts of tariffs and sentiment changes, and that may be the most important discussion to look for. As always, I’ll be covering all of the Asymmetric Portfolio for premium subscribers starting on Thursday.

You can get all Asymmetric Investing content, including deep dives, stock trades, and ongoing coverage of Asymmetric Universe stocks with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your research before acquiring stocks.