Late on Tuesday, NVIDIA $NVDA ( ▼ 0.04% ) announced it would take a $5.5 billion charge in the current quarter related to H20 chips it was no longer able to sell to China. NVIDIA has been under chip export restrictions for years, but the Trump Administration is closing off the sale of a legacy chip that still accounts for a significant chunk of sales for the company.

This may not seem like a big deal on its face. It’s a one-off chip control, and the U.S. wants to keep China at bay in AI.

But the implications for NVIDIA are profound, and they could foreshadow what happens with tech broadly over the next decade.

China has blocked tech giants like Meta Platforms and Google’s main products from the country for over a decade, reducing their total addressable market and shifting value to its domestic tech companies like Alibaba, Tencent, and Baidu. This move may shift hardware value as well, reducing the upside for NVIDIA’s chips and potentially bringing in new threats to the business.

Big Tech’s Reliance on China

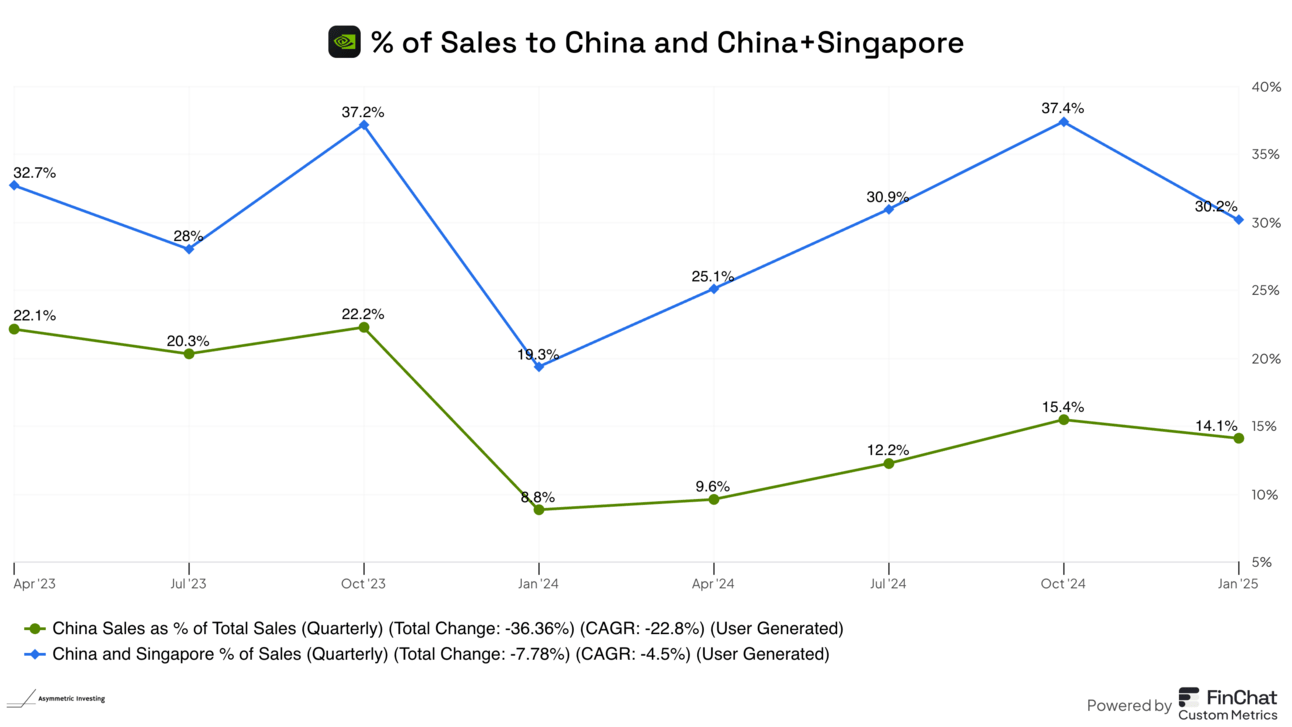

The China risk varies by company, but NVIDIA may be more reliant on China than you think. Technically, only 14.1% of sales were to China, but it’s widely known that Singapore is buying more chips than it can physically install, so those chips are likely going to (you guessed it) China. China + Singapore is a whopping 30% of sales.

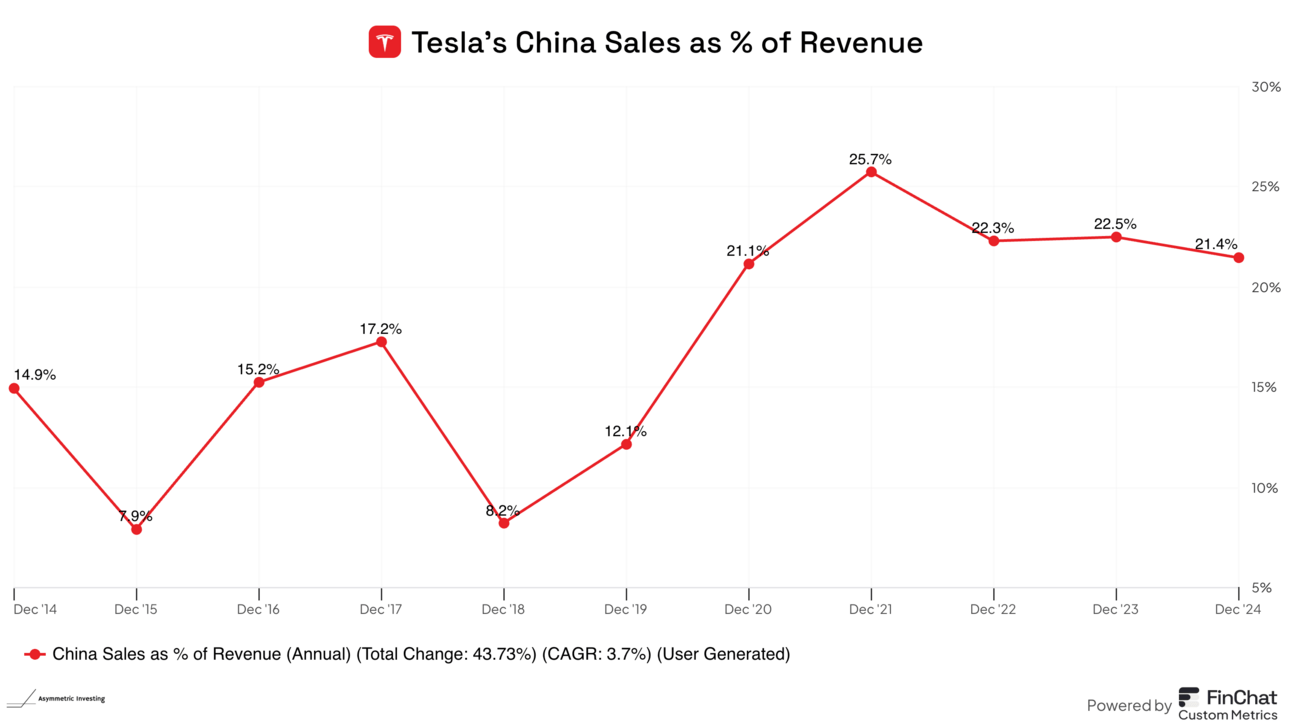

Of the Mag 7, Tesla’s only growth market globally was China last year, and the company generated 21% of revenue there. But it also has a major manufacturing facility in China, and that supply needs to go to Europe and other parts of the world. If you wonder why Elon Musk is lobbying against tariffs, this is why.

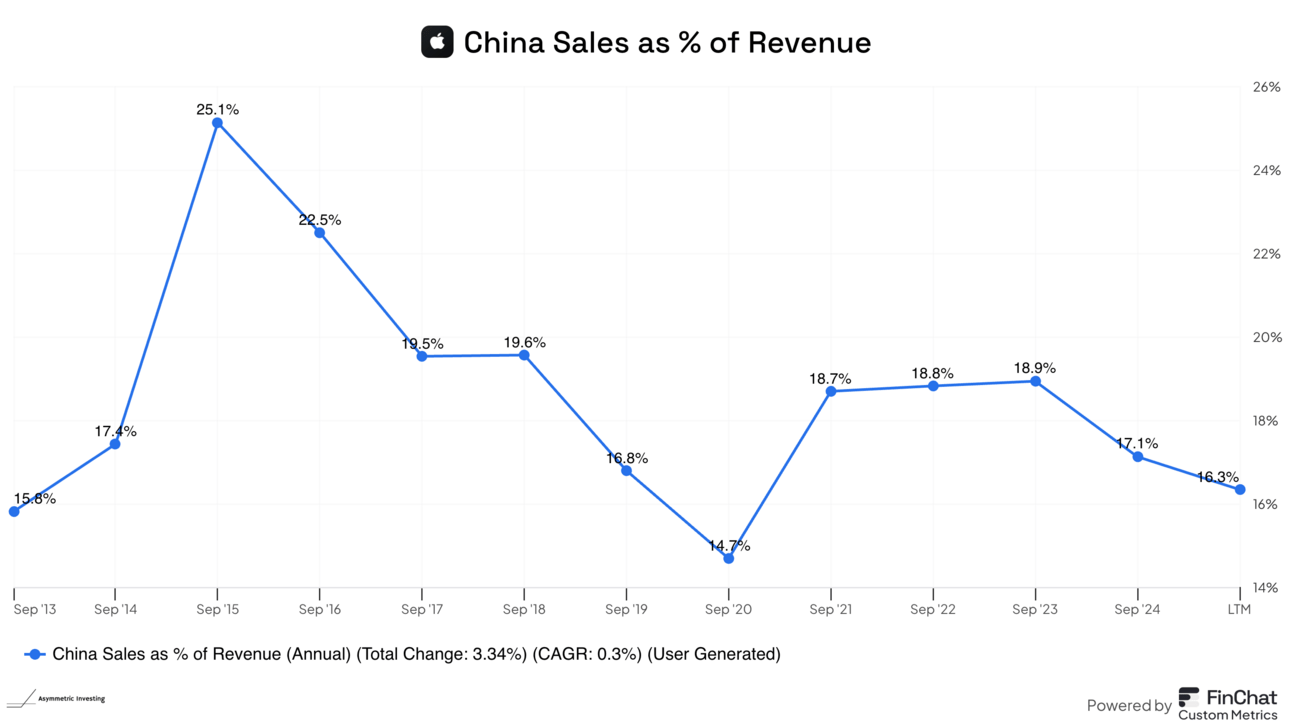

Like Tesla, Apple’s reliance on China isn’t just about sales, it’s about supply. The company’s supply chain is intertwined with Chinese suppliers, and a vast majority of Apple’s products go through China at some point.

Amazon’s supply chain is deeply intertwined with China, although the company doesn’t have a big direct presence there.

Meta’s reliance on China is zero, so there’s no real direct China risk there.

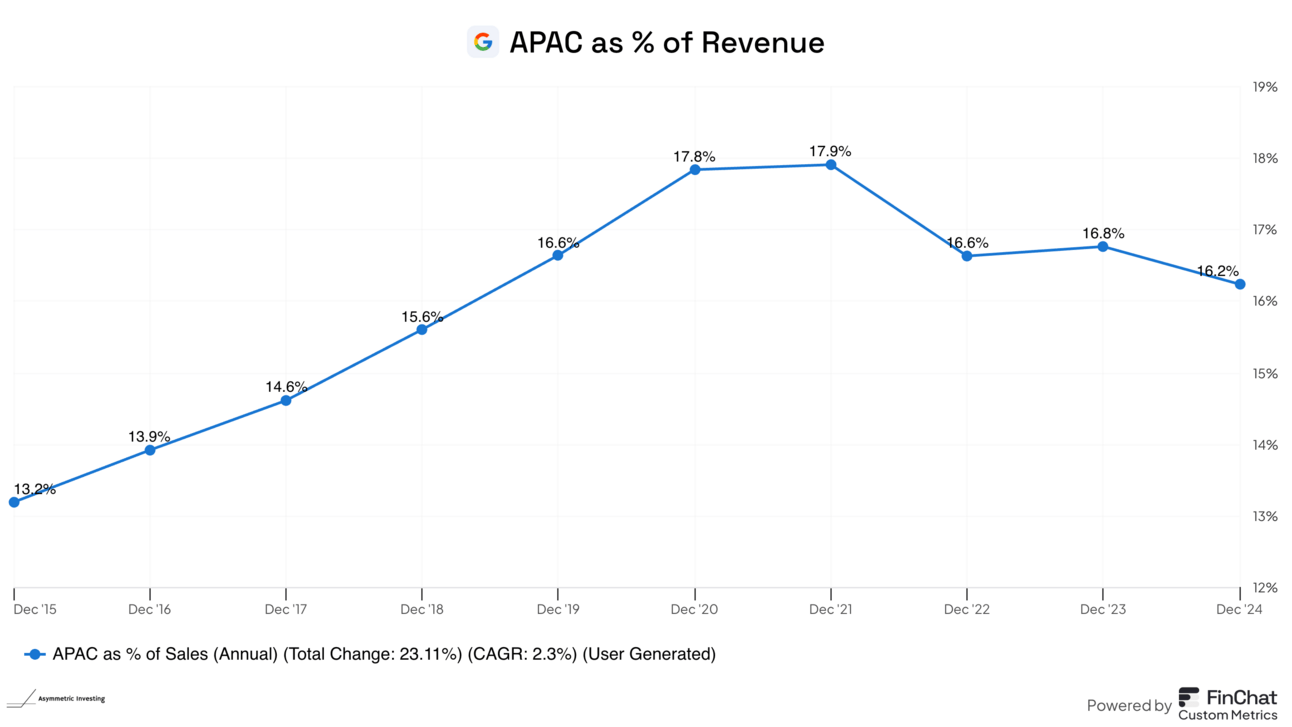

The two remaining stocks in the Mag 7 — Alphabet and Microsoft — don’t directly report China revenue, but bucket the country in with the rest of Asia Pacific. It’s likely that the revenue for both in China is negligible.

I ran through the entire Mag 7 because I want to put the China risk into perspective. For NVIDIA, the risk is high, and the same holds true to varying degrees for all of these stocks.

Asymmetric Investing has a freemium business model. Sign up for premium here to skip ads and get double the content, including all portfolio additions.

Learn AI in 5 minutes a day

This is the easiest way for a busy person wanting to learn AI in as little time as possible:

Sign up for The Rundown AI newsletter

They send you 5-minute email updates on the latest AI news and how to use it

You learn how to become 2x more productive by leveraging AI

Why the China Topic Is a Big Deal

China is a big deal for tech because of the nature of technology itself. Tech companies develop something once — like a chip or search engine — and make money selling it over and over and over again at very low marginal costs.

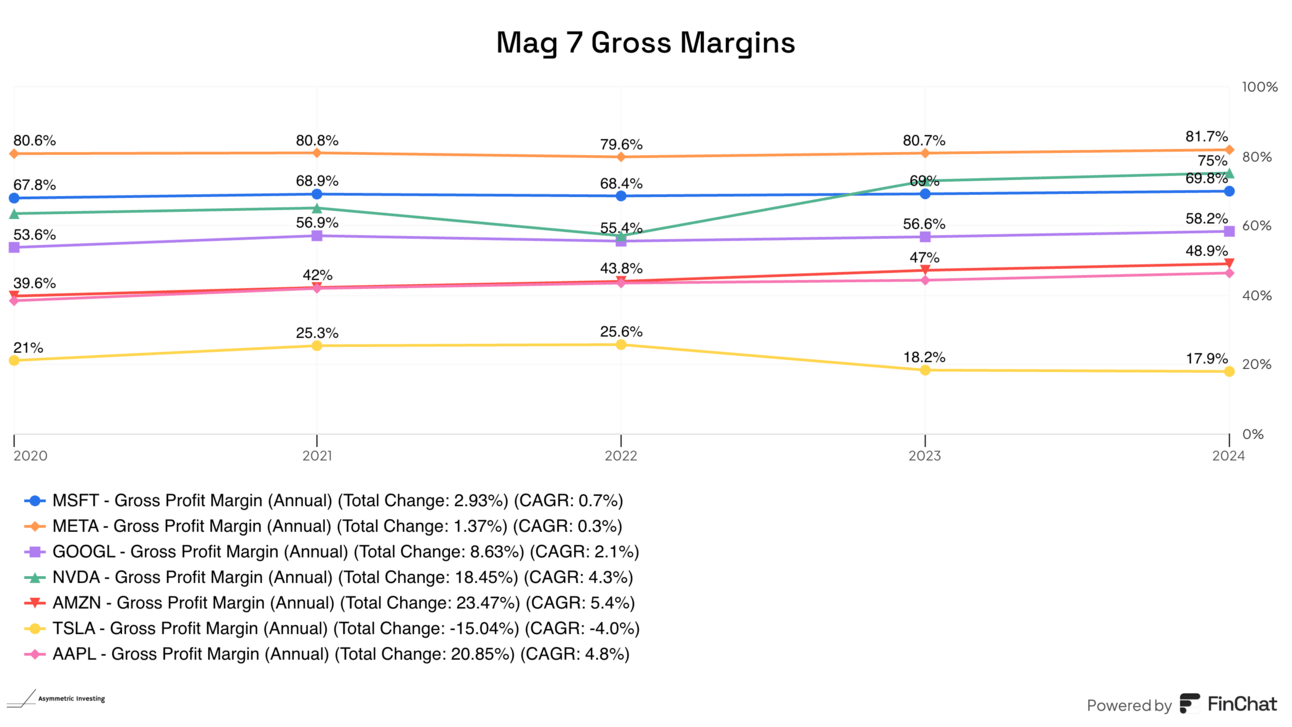

You can see below that Tesla has the lowest margins, which makes sense because it’s an automaker, and companies like Meta, NVIDIA, and Microsoft have the highest margins.

This business model is predicated on there being a large addressable market to serve.

This is operational leverage at a global scale.

What happens when the scale goes from global to…less than global? That is the question.

NVIDIA’s Moat and China

Having a smaller addressable market and potentially lower sales is a simple first-order effect. But second-order effects are a bigger deal.

Within China, companies will be forced to use competing chips from Huawei and other domestic companies. This will increase competition for NVIDIA outside of China as well.

This is a playbook China has used before. U.S. auto companies had to partner with domestic Chinese companies to get into the market, teaching the Chinese to make cars. Now, the U.S. has to put heavy tariffs on Chinese EV imports, or we would be flooded with cheap Chinese cars that may be better than what we can buy today. The same goes for PCs and dozens of other industries.

The more meaningful strategic impact may be on NVIDIA’s software moat. NVIDIA is the chip of choice in software because of the CUDA/software infrastructure the company has built to run on its chips. If you’re an AI developer, CUDA is the lock-in, not the chips.

But every chip competitor and NVIDIA customer would LOVE to see NVIDIA’s software moat weakened. Now, China will have the chip competition, and they may build a software ecosystem to compete with NVIDIA.

This won’t be done because it’s the easy solution. An alternative would be built because it’s necessary.

If China does develop an alternative software ecosystem, what would it do with it?

Here’s where the “Deepseek moment” is instructive. I think China would open-source that software to destroy as much value as it can. Commoditize your compliments!

Meta would love to use open-source software and weaken NVIDIA’s moat because it’s spending billions on NVIDIA chips that sell for an 80% margin. So would Alphabet and Microsoft, and Amazon.

These are NVIDIA’s customers, and they would be happy to commoditize a supplier.

For NVIDIA, competition from China is nothing but bad news.

⬆ Competition

⬇ CUDA Moat

⬇ Total Addressable Market

What’s worth considering in this trade war is the impact restrictions will have on iconic American companies and seemingly safe stocks.

I focused on NVIDIA here, but the analogy extends to Apple and Tesla as well.

Meta and Alphabet may be more insulated because they’re already blocked in China.

But the trade war and protectionism will hurt big tech’s earnings potential and operating leverage.

Worse yet, there could be wide-ranging strategic impacts.

NVIDIA was simply the first one to take it on the chin.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor, or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.