I hope you had a wonderful week!

Last week was peak volume for earnings season and reactions were all over the map. A lot of stocks that dropped 90%+ from the 2021 peak to the 2022 trough bounced hard on “better than expected but still not great” earnings reports. And some great companies that missed slightly on the top or bottom line were punished. I’ll get to some general thoughts on what I’m seeing below.

This coming week at Asymmetric Investing, I will be covering earnings for five stocks on Monday and publish a new spotlight.

In case you missed it

Here’s some of the content I put out this week. Enjoy!

Asymmetric Portfolio Allocation: I bought five stocks for the Asymmetric Portfolio last week. Premium members get this update on the first trading day of every month before trades are made.

Facebook and the Impenetrable Moat: Why is Facebook an amazing stock? How did I miss it? And why do I still own Snap? I answer these questions and more.

4 Stocks to Avoid At All Costs: Businesses that have no ability to make a profit shouldn’t be long-term investments.

5 Incredible Dividend Stocks to Buy Now: These are great businesses that aren’t getting a lot of love from the market right now. Ohh well, I’ll take a dividend yield over 7%.

The Pandemic And Delayed Consequences

I’ve spent a lot of time wondering what we still haven’t seen as a consequence of the pandemic/stimulus/supply shortages that began in 2020. In some parts of the economy, there was a peak a trough and now everything is back to normal. In other parts, it seems like the pandemic hasn’t ended yet.

I’m reminded of the housing crisis that really began in 2006 but didn’t make its way to the stock market until 2008. It’s not always easy to see what the second or third-order effects of an event will be and predicting the timing of those events is nearly impossible. It can be years before we will all be saying, “Of course, [insert bubble/crisis] was obvious.”

What I see right now is the speed of normalization being different across industries.

2022 Digital/Tech Recession: Tech, SaaS, streaming, cloud, crypto, and other digital companies faced a slowdown starting in early 2022 and quickly adjusted. Most companies are done cutting and we’re now back to thinking about growth.

2023 Financial Recession: The impact of stimulus on inflation began in late 2021, but the Fed didn’t react in a significant way until Spring 2022, and we didn’t see an impact on banking until Spring 2023 when SVB collapsed. Now, lending is down, layoffs have started, and fear in the financial sector is higher than we’ve seen in a decade.

2024? Physical Recession: Thus far, manufacturing, energy, autos, homebuilders, and other physical goods companies have been doing pretty well. But the delayed consequences of the pandemic-era low interest rates and supply shortages are starting to pop up.

What’s unusual here is the long lag between supply and demand indicators over the last three years. The supply of many products was so short that it’s hard to disentangle what’s leftover demand from 2021 and what’s natural growth. In many cases, we don’t know…yet.

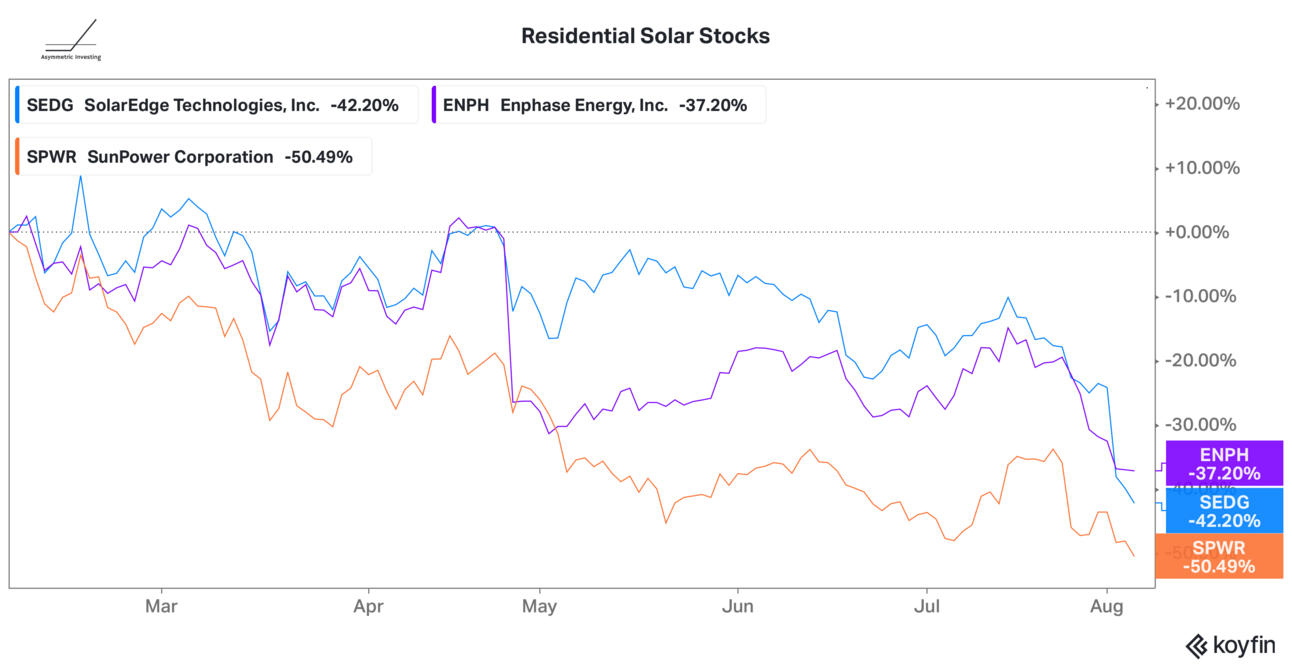

I flag this because earnings reports from Enphase and SolarEdge (residential solar equipment suppliers) indicated that end-market demand for residential solar is dropping because of higher interest rates. This took the market, installers, and these companies by surprise. All companies said inventory grew rapidly in Q2 2023, leading to very weak guidance for the second half of the year as installers adjust.

Chart by Koyfin. Get 10% off a Koyfin subscription here.

This follows a slowdown in some areas of the housing market, which has shown up in falling sales at Home Depot and Lowe’s and a decline in existing home volume.

Are we seeing natural demand for physical products slow because of higher interest rates, inflation, and the “return to normal”? Or are we just returning to the normal trendline? Here’s what to watch for and why I’m more worried about the physical world than the digital or financial world:

Auto sales (3% of the economy): So far, so good in the auto business. GM and Ford reported phenomenal numbers and it seems that legacy automakers are keeping supply low enough to maintain high prices and margins. But EVs are a different story. Higher interest rates and dwindling demand relative to growing supply have already caused price cuts at Tesla, Ford with the F-150 Lightning and Mach-E, Hyundai, Kia, and about a dozen Chinese automakers. Is the supply shortage going to become a supply glut in the next 12 months? And what will the impact on companies and the economy be?

Manufacturing (12% of the economy): Manufacturing activity is driven by consumer spending and those in the know don’t seem to think conditions are good. The July Manufacturing PMI reading of 46.4% was the eighth consecutive month under the 50% mark that delineates expansion or contraction.

Homes (16% of the economy): We know home sales volume has dropped. But home values haven’t dropped and it seems that while remodels are getting smaller (according to Home Depot) they’re still taking place. If values fall, mortgage rates continue to rise, and buyers or remodelers simply put off their purchase we could see a slow decline in housing.

Raising interest rates typically slows the economy and the Fed raised rates at a record pace over the last 18 months. It’s hard to see how there’s not a big impact on the economy. But where and when will that impact show up? Maybe we’re starting to get the answer.

Chart by Koyfin. Get 10% off a Koyfin subscription here.

This is the second straight week I’ve posted a fairly bearish view on the market, despite a decent earnings season. But I think it’s important to point out general trends I am seeing that can tell us where there’s operational weakness on the horizon. Keep an eye on EVs, auto loan performance, home improvement companies, and manufacturing sentiment over the next few quarters because they may paint a different picture of the economy than the market sees right now.

Have a great week, everyone!

Thank you for being an Asymmetric Investing subscriber. If you want all of my stock deep dives, access to the market-beating Asymmetric Portfolio trades before I make them, and all premium updates you can subscribe below. The premium subscription is what makes this newsletter possible so I appreciate the support.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.