I hope you had a wonderful week!

Asymmetric Investing will be a bit quiet this week. I will publish an earnings update tomorrow, but that will be all until next weekend as I take some vacation time. With that, on to the week that was.

In case you missed it

Here’s some of the content I put out this week. Enjoy!

Disney Spotlight: The latest Asymmetric Universe stock is Disney. It’s a beaten-up company today, but I think there’s a massive opportunity to consolidate power in streaming.

Tesla’s Charging Deal: We learned through earnings calls exactly what other automakers are giving Tesla for using the North American Charging Standard and it’s not a lot.

Portnoy Takes Penn to the Cleaners: Penn Entertainment gave Dave Portnoy a $388 million check for Barstool Sports in February and gave his company back less than six months later.

Wynn Resorts Hitting on All Cylinders: From Las Vegas to Macau, there’s a lot to like about Wynn’s results.

Interest rates and the stock market

We are nearing the end of earnings season and the results have been…mixed.

The theme was stocks moving up big or down big after earnings, but there wasn’t a consistent theme across the market.

This week, the market fell pretty sharply and it wasn’t earnings that were the problem.

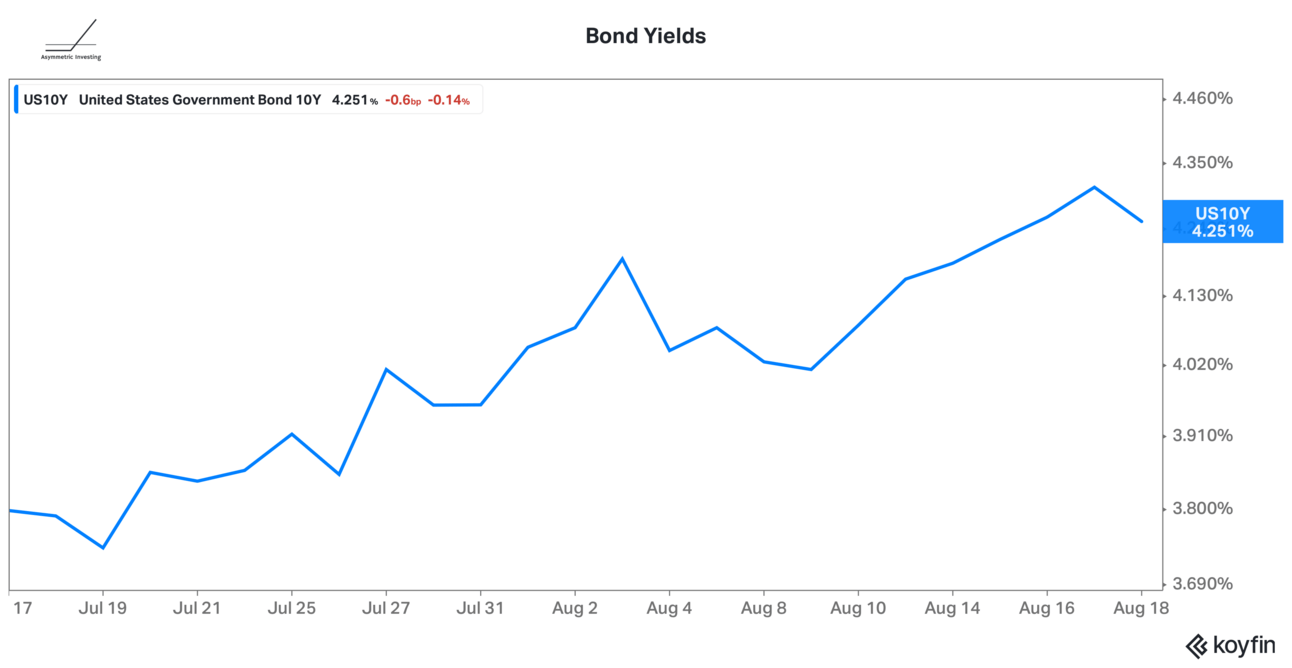

It was interest rates. Rates are rising and without the drumbeat of earnings, the day-to-day focus will likely go back to inflation and interest rates. Right now, the trends aren’t moving in the direction the market would like.

I’m not a macro investor and don’t try to time the market, but don’t be surprised if the market continues a downward trend as the economy comes under more pressure (higher rates and student loan payments resuming).

If the market does fall, I’m prepared to buy high-quality companies at lower prices.

Thank you for being an Asymmetric Investing subscriber. If you want all of my stock deep dives, stock updates, and access to Asymmetric Portfolio trades before I make them you can subscribe below. The premium subscription is what makes this newsletter possible so I appreciate the support.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.