I hope you had a wonderful week!

Earnings season is coming to a slow close and it’s been a mixed bag. Overall, the stock market seems to be taking a bit more cautious approach and that can be seen by stocks being punished for even the smallest earnings miss. As for Asymmetric Universe stocks, premium subscribers got more detail on the beats, misses, and market reactions to all of the earnings reports.

This week at Asymmetric Investing, I plan to publish a long overdue spotlight and update on earnings. I will be traveling for the next two weeks, so articles may be a bit more sparse than usual. With that, on to the week that was.

In case you missed it

Here’s some of the content I put out this week. Enjoy!

Earnings Update: I covered earnings from five of the Asymmetric Universe of stocks. Long-term, operations are looking good, but short-term the market wasn’t happy. This short-term volatility is why I focus on how a company is performing over a long period of time and its strategic position, not earnings beats and misses each quarter.

Who Pays the NBA’s $75 Price?: NBA contracts are going through the roof, partly on the thesis a big raise is coming in the next media rights deal. The problem: Who is going to pay? I tried to answer that question and laid out some options, but there are no easy answers here.

Why Enphase and SolarEdge Have Hit a Wall: Solar stocks have been dropping this year and weak Q3 guidance didn’t help matters. In this video, I discuss how tailwinds have become headwinds for component suppliers.

5 Artificial Intelligence Stocks to Buy Now: Keep it simple with AI. Buy the big companies that can make AI products. This is more than likely a sustaining technology, so the big will get bigger.

Proterra and WeWork: When Good Ideas Go Bad

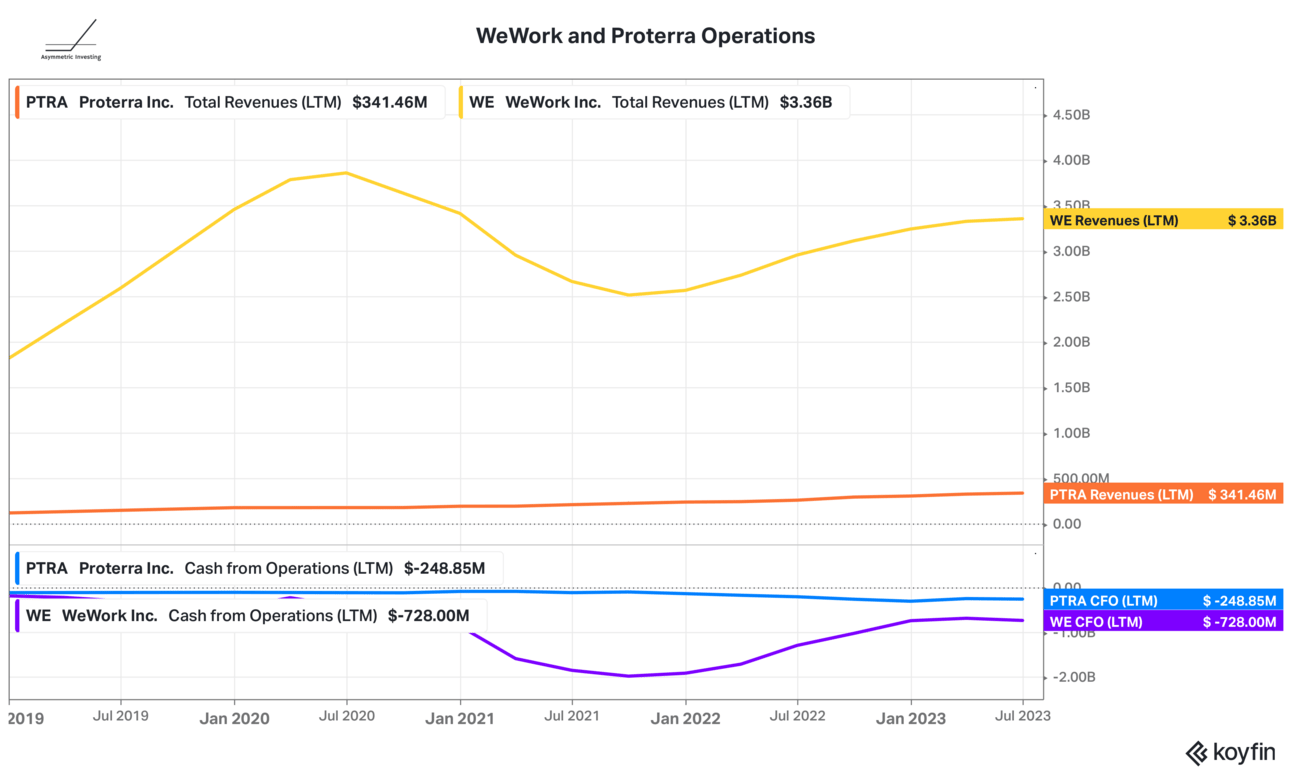

That sound you’re hearing is the air slowly coming out of the market’s various bubbles. This week, electric vehicle company Proterra filed for bankruptcy and WeWork included a “going concern” warning that questioned if it can continue operations without restructuring, ie bankruptcy.

As it turns out, revenue growth didn’t make up for operational losses and eventually the market didn’t want to continue funding businesses that didn’t have a clear path to profitability.

Chart by Koyfin. Get 10% off a Koyfin subscription here.

WeWork has been a trainwreck for years and I’m frankly surprised it lasted this long. The arbitrage between renting commercial space from a landlord and renting it out to individual clients was a good idea, but scaling it as far as WeWork did was an incredible risk that ultimately failed.

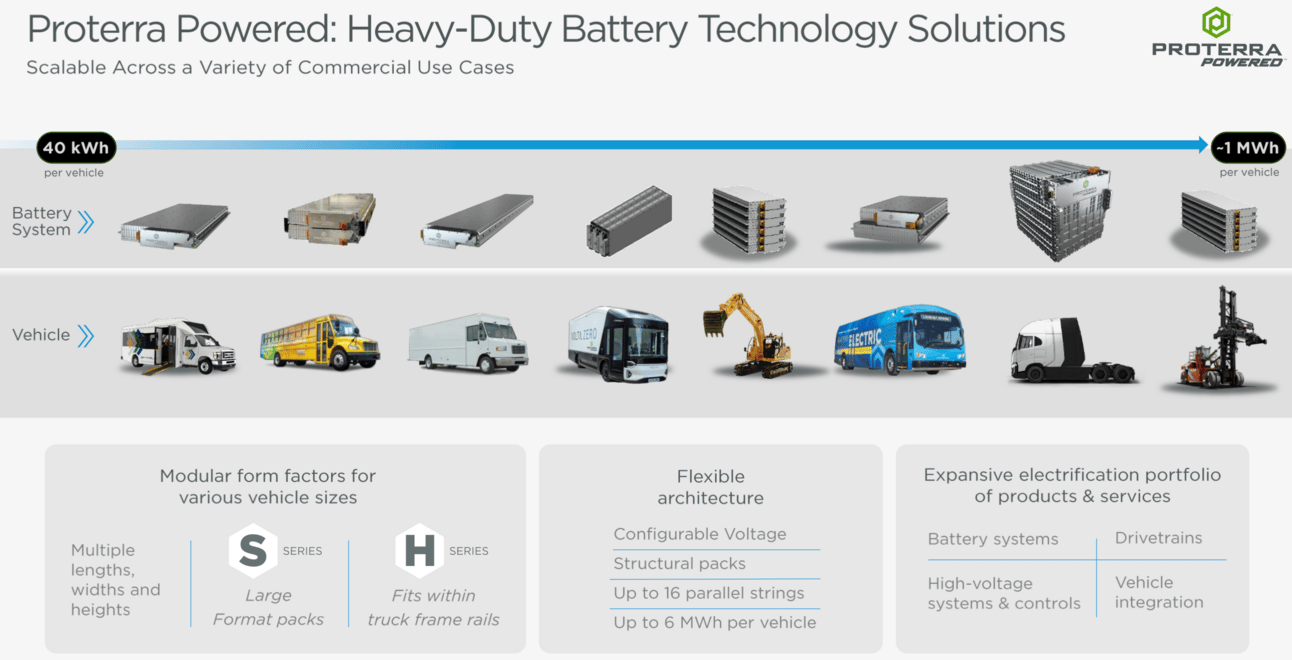

Proterra’s bankruptcy is a little more disappointing. The company started as an electric bus company, selling over 1,300 buses to transportation agencies in the U.S. and Canada. But the bus business either didn’t scale fast enough or wasn’t big enough to support Proterra’s ambitions and the company eventually became an industrial electric battery system supplier.

As appealing as an electric backhoe may be, end markets didn’t mature as quickly as Proterra needed to survive.

While our best-in-class EV and battery technologies have set an industry standard, we have faced various market and macroeconomic headwinds, that have impacted our ability to efficiently scale all of our opportunities simultaneously.

Electric power is the future of transportation, construction, heating, and many other parts of the economy. But adoption may not happen as quickly as some investors hope. And when growth ambitions and market realities collide, reality wins.

I hope Proterra’s business can live on after bankruptcy. It’s a mission worth fulfilling, even if it didn’t work out for investors.

Have a great week, everyone!

Thank you for being an Asymmetric Investing subscriber. If you want all of my stock deep dives, stock updates, and access to Asymmetric Portfolio trades before I make them you can subscribe below. The premium subscription is what makes this newsletter possible so I appreciate the support.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.