I hope you had a wonderful week!

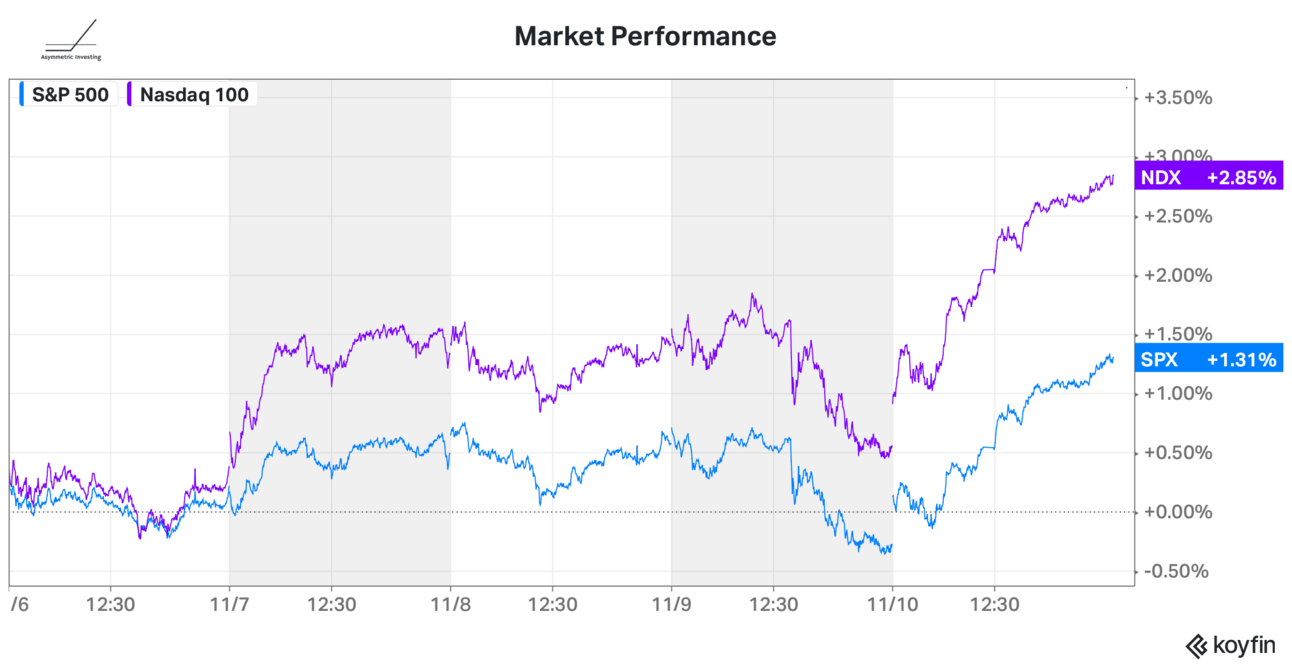

The stock market had another good week with most of the gains coming on Friday. Earnings were the biggest focus for investors this week at an individual stock level, but there weren’t many bellwethers this week, so even a solid report from Disney did little to move the market overall.

Over the next few weeks, it’s likely the day-to-day movements of the market will be driven by holiday shopping data, so be aware of that, starting with retailers like Home Depot and Target reporting this week. Remember to focus on long-term trends and not beating or missing analyst expectations.

Before we get to the week that was in investing, we have an advertising partner this week!👇

I’ve been living in the Quartr app this earnings season because it’s the easiest access to conference calls and company presentations. If you follow the market closely, this is a must-have.

In case you missed it

Here’s some of the content I put out this week. Enjoy!

The $47 Trillion Opportunity In Real Estate: A jury ruled against the National Association of Realtors and that could open up a business model disruption in real estate. I recently covered the company I think has the most upside.

Earnings Recap of Peloton, Dropbox, and Coinbase: There’s progress on the long-term strategy at each company, but Peloton and Coinbase, in particular, have a lot to prove.

Verizon Is a Great Buy: Worry about the debt is overblown. This has become a cash flow machine.

Virgin Galactic’s About Face: Space flights will stop in 2024 as Virgin Galactic puts 100% of its focus on the Delta spacecraft that’s due to launch commercial passengers in 2026.

Lessons From Earnings Season

I have some broad takeaways from the earnings season that I think a lot of investors and executives can learn from.

Sales and marketing costs aren’t all they’re cracked up to be. It’s been interesting to watch companies cut operating expenses like sales and marketing and watch their businesses continue to grow. Disney and Spotify were two that stuck out to me, cutting sales and marketing expenses but growing their services faster than they were earlier this year. Sometimes, growing companies get bloated in areas that don’t have a direct cost/benefit calculation. I joked in the Spotify update that CEO Daniel Ek is just now learning that sales and market spending need to generate…sales. Cutting to the bone sharpens focus and I’m seeing that more and more in operating expenses.

Losing money forever is unacceptable. The ZIRP era was known for companies like Uber who could burn money forever just to grow. It didn’t seem to matter if they could ever make a profit as long as money was cheap for investors. That has changed quickly in 2023 and we are seeing the ultimate fallout. Former darling WeWork filed for bankruptcy this week, Plug Power gave a “going concern” notice, and Virgin Galactic is finding it so hard to raise cash that it had to cut everything but the most critical product development to survive. Some big winners will come out of this era because good businesses are being thrown out by the market, but we now (finally) know that losing money forever isn’t a good strategy.

High multiples and disappointing results are lethal. High price-to-sales and price-to-earnings multiple means investors have high expectations for performance. When performance disappoints, the reaction is swift. We saw that at Enphase Energy and SolarEdge, which have been market favorites for years but see a few weak quarters ahead as the solar market adapts to higher interest rates. Their shares haven’t weathered that storm well. The less is that valuation matters (but it’s not everything).

Debt is risky. Debt isn’t all bad, but companies that don’t have a way to pay off that debt are in trouble. Just this week, we saw Warner Bros Discovery stock fall 12% after announcing decent earnings, but investors don’t see a way to grow in streaming, keep assets like the NBA, and pay down debt. Meanwhile, Disney’s stock was up after reporting more than 6 million streaming additions ahead of a big price increase. Debt is a delicate balancing act now more than ever.

I’m putting together a graphic showing important metrics like free cash flow, net cash, multiples, and growth trends for every stock in the Asymmetric Universe. Premium members can expect that in their inbox this week.

Thank you for being an Asymmetric Investing subscriber. If you want all of my stock deep dives, stock updates, and access to Asymmetric Portfolio trades before I make them you can subscribe below. The premium subscription is what makes this newsletter possible. I appreciate the support.

What do you want more of?

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.