Earnings season is in full swing and most of the Asymmetric Portfolio of stocks have reported. In this post, I’m going to review Peloton, Dropbox, and Coinbase’s results.

Let’s get to it!

Peloton’s Quarter of Change

A lot has changed at Peloton since I wrote the first spotlight article. The company announced a “fitness solution for any place, any time, and any equipment“ strategy and launched a partnership with Lululemon. It’s too early to see any fruit from the changes in calendar third quarter (fiscal Q1 2024) results and any potential upside will take years to play out. So, we need to read the tea leaves in earnings and management’s comments.

Peloton is taking steps to solidify itself in the top right of the smiling curve. In the quarter:

Peloton partnered with Mirror, turning a competitor into a partner and customer acquisition source.

Bowflex and Beachbody are now penny stocks priced for likely bankruptcy in the future.

Equinox is private, but reports are that it’s in financial distress.

Strategically, it looks like Peloton is winning the top right corner of the smiling curve. That’s exactly what we want to see. Now, it’s time to turn that strategic strength into financial strength.

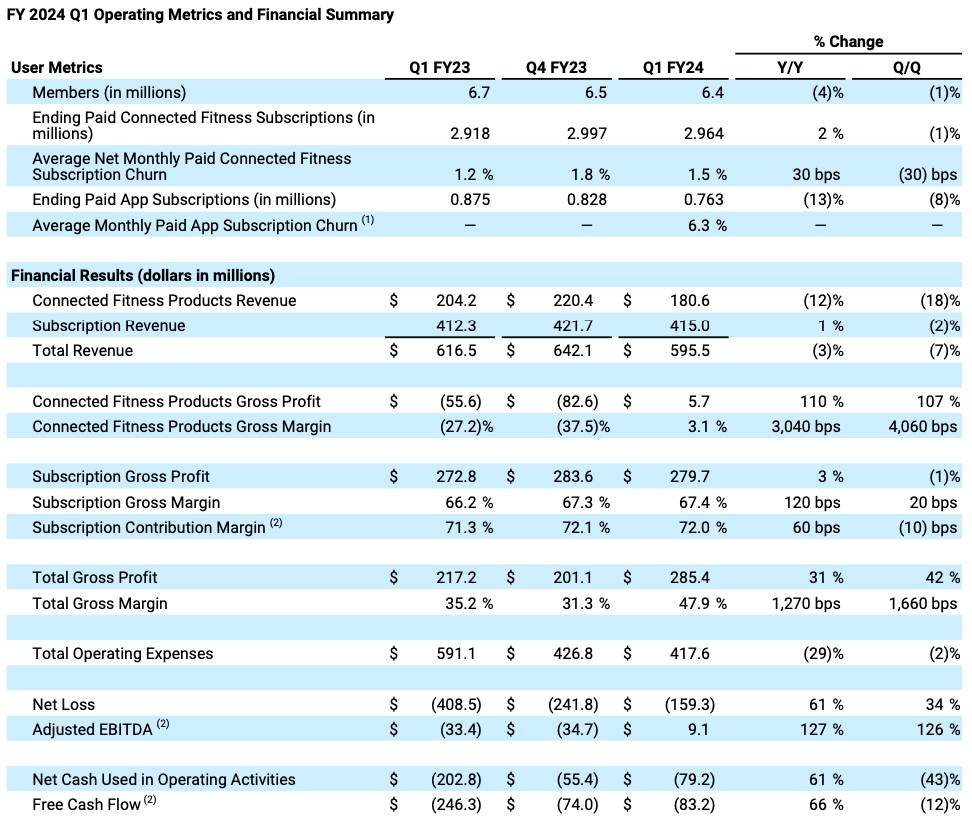

Q1 2024 financial highlights:

Revenue was down 3% from a year ago to $595.5 million, driven by a 12% drop in hardware sales.

Net loss was $159.3 million, a 61% improvement from a year ago and 23% improvement sequentially.

Free cash flow was negative $83.2 million, a sharp improvement from negative $246.3 million a year ago.

App subscribers fell 13% Y/Y and 8% Q/Q. This was due to the sunsetting of the old plans and the introduction of new plans, but this will be the number to watch over time.

I’m going to give some context to segment results below, but I want to highlight this from the conference call. People engaging with Peloton content is ultimately how the company adds value for consumers and engagement seems to be strong.

Finally, I’d like to give you an update on content and user engagement. Y/Y, we saw an increase in average monthly subscription engagement (as measured by time spent on the platform) in the quarter of 6%. Two engagement trends were apparent during the quarter. Members are engaging with longer classes, and, on average, they are taking more class types than they did a year ago.

For our part, we’ve continued to invest in expanding our programming initiatives across Running, Strength, Rowing, Yoga, and Stretching. And to ensure we are driving even greater engagement, we just announced that Peloton Members with NBA League Pass will be able to stream games live directly on their console alongside their favorite TV shows, movies, and more.

The addition of more types of content should make Peloton’s content more valuable and stickier for customers. We are starting to see that and the hope is more app users will increase the trend.

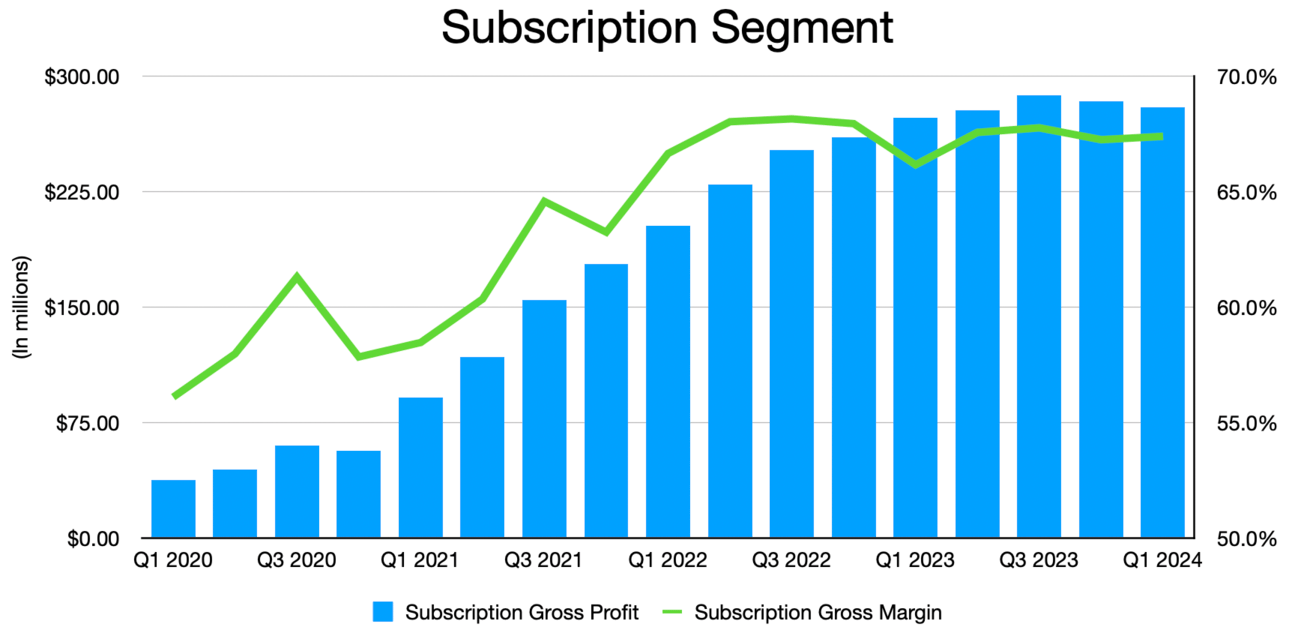

Financially, the hardware and subscription trends are both moving in the right direction.

Hardware sales were Peloton’s downfall after the pandemic, but there was a very small gross profit last quarter. Breakeven would be ideal in a razor/razor blade model for Peloton.

Subscriptions are where the money is and gross profit is down slightly the last two quarters but is holding up well. If the new subscription strategy is successful we will see this segment grow over time.

The thesis for Peloton is still intact and I like the solidified position in the smiling curve. But it’s a tough climb and it will take more time to see if the app-first strategy is going to work.