The stock market struggled early in the week as the impact of tariffs became apparent and (ultimately) delayed. I wrote about the dynamic last Sunday if you’re interested.

Earnings were surprisingly muted with primarily earnings beats with unimpressive guidance.

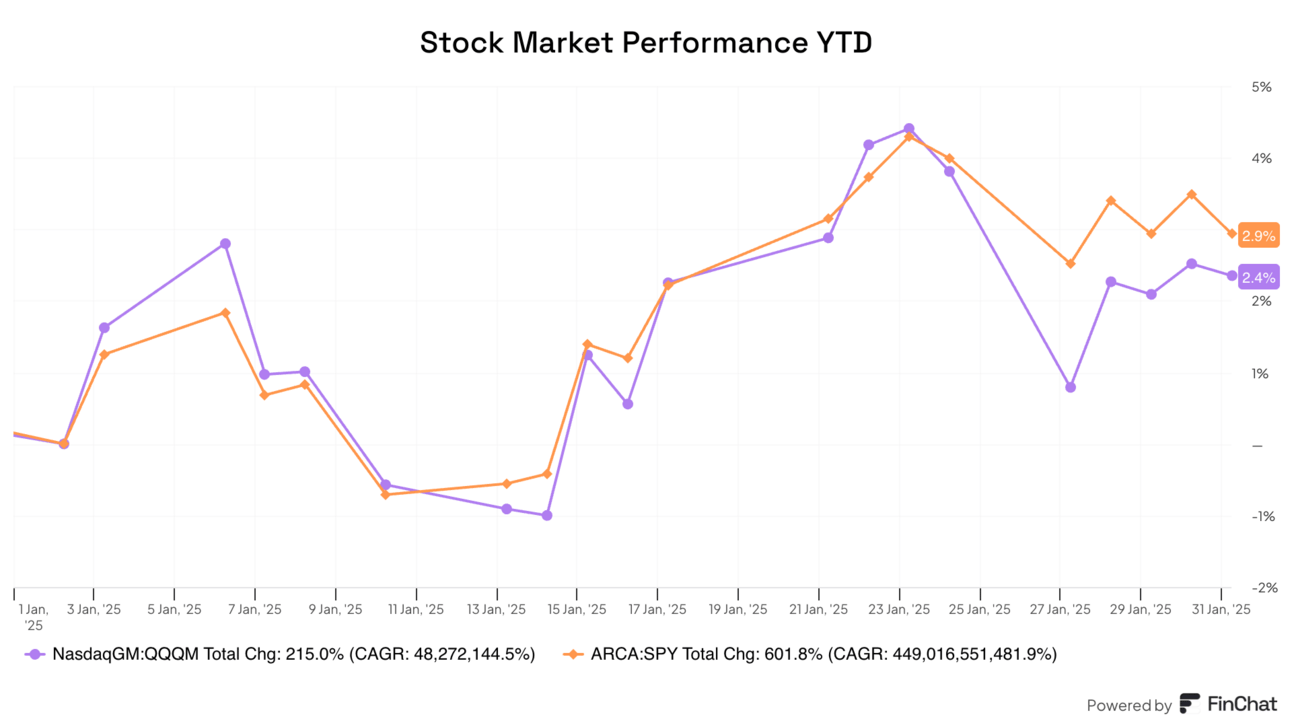

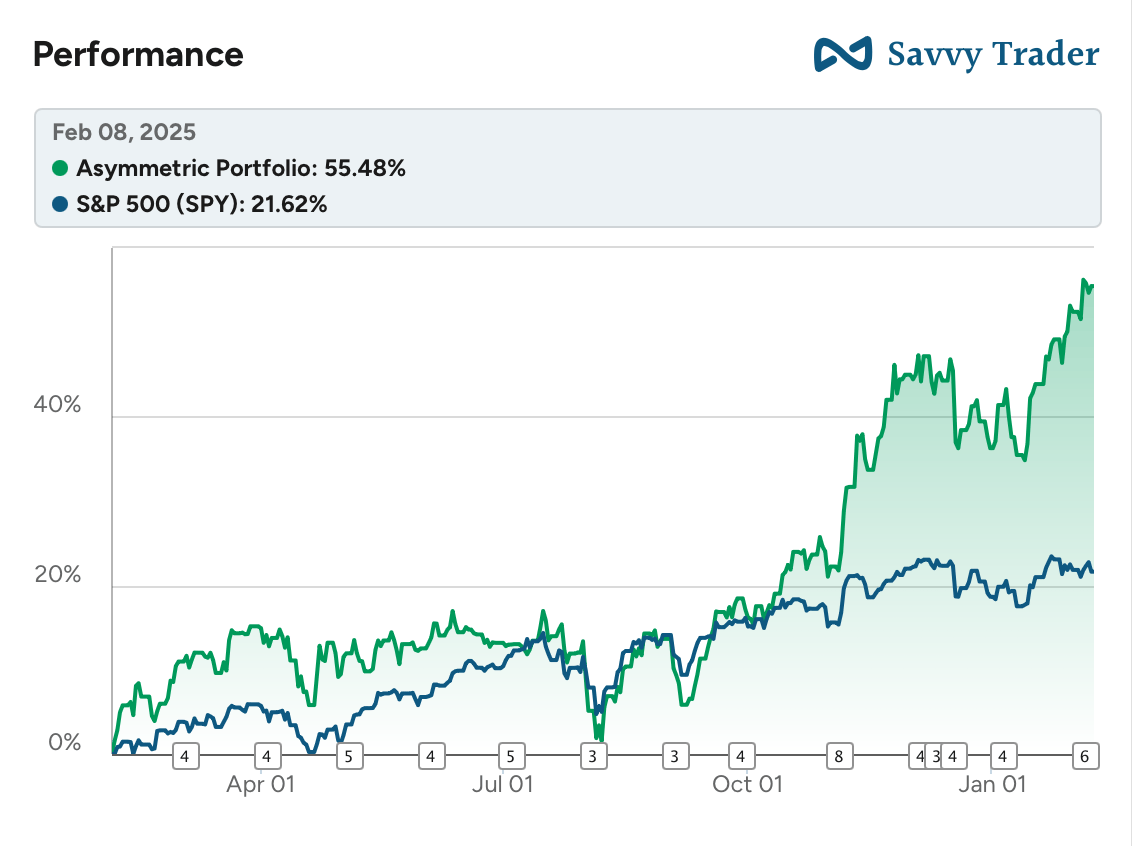

The Asymmetric Portfolio continues to perform well, rising 14.1% this year compared to 2.5% for the S&P 500. Zoom out further and the portfolio is up 55.5% in just over a year. I don’t expect the performance to be this good forever, but the process is working.

What stocks am I adding to my market-beating portfolio each month? You can sign up for premium here to find out, get 2x the Asymmetric Investing content, and gain access to the market-beating Asymmetric Portfolio. What are you waiting for?

Oh, and there are no ads for premium subscribers.

Is it time to expand your portfolio?

AI discovery for cities to call home

Massive market of 30M U.S. relocations per year

Founders with 6 exits & $100M+ ARR experience

Read the Offering information carefully before investing. It contains details of the issuer’s business, risks, charges, expenses, and other information, which should be considered before investing. Obtain a Form C and Offering Memorandum at https://wefunder.com/lookyloo

In Case You Missed It

Here’s some of the content I put out this week.

What I’m Buying in February 2025: I sold one stock (it’s being acquired) and bought five stocks this week.

Spotify Now “Owns Your Ears”: How did Spotify become the highest returning stock in the portfolio? I answered by digging into what the thesis was in 2023 and how it’s played out since.

What’s $75 Billion Among Friends?: Why is Alphabet growing capex faster than competitors?

Does Bill Ackman Read Asymmetric Investing: Bill Ackman started buying Uber stock mere days after I published the Uber spotlight article. Coincidence?

Disney’s Foundation and Calm Before the Storm

Disney reported earnings this week and this will be one of the most interesting companies to watch over the next two years. The market still doesn’t appreciate Disney in many respects, but the launch of ESPN over the top this fall could change the game.

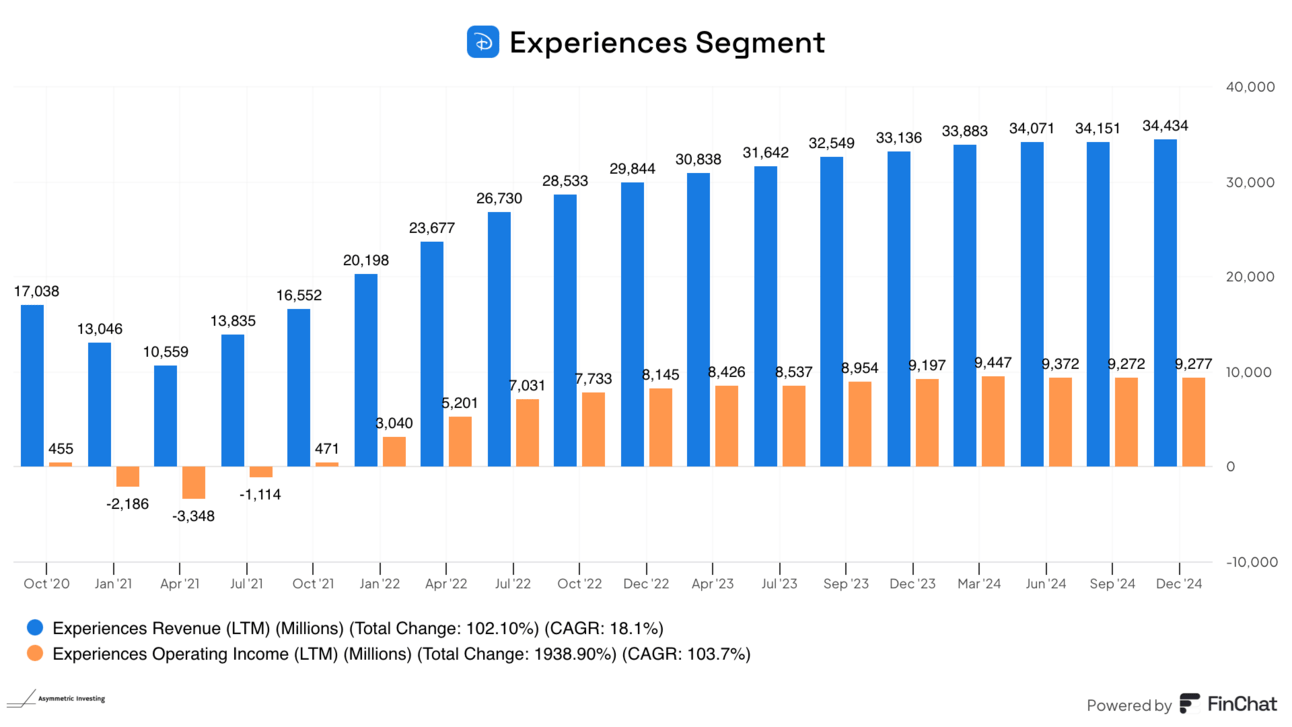

For starters, Disney has an experiences business that’s an incredible foundation to start from. With $60 billion going into experiences over the next decade to build new cruise ships and expand parks, this is a slow and steady growth business.

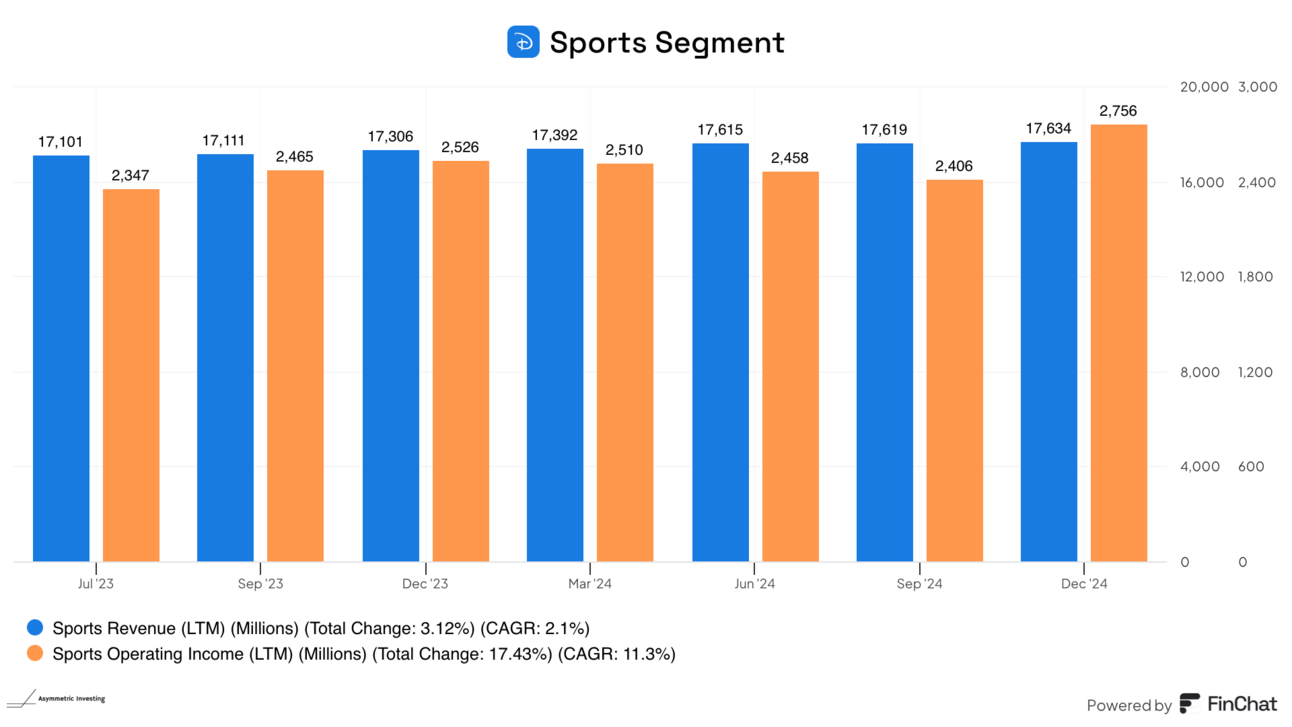

Sports (ESPN) is suffering from the same cord-cutting that most of linear TV sees, but it’s the one channel that’s still a draw, carrying NFL, college football, NBA, and more. And it’s still a money-making machine. I’ll get to the importance of sports in a moment.

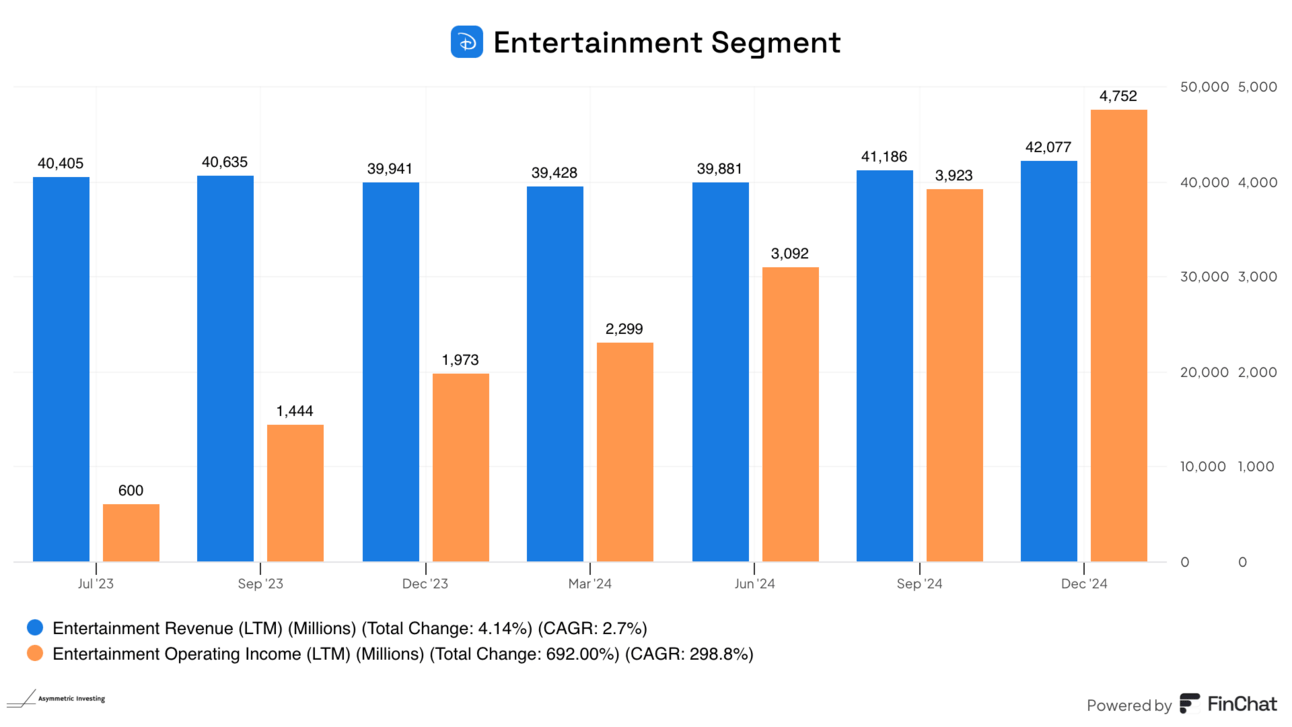

Where Bob Iger has turned the business around is entertainment, which includes film and streaming. You can see that it’s not a big growth business on the top line, but it’s suddenly very profitable.

Add it up and Disney is solidifying a solid foundation. But the 10x potential in the stock comes from streaming.

Disney’s Next Big Launch

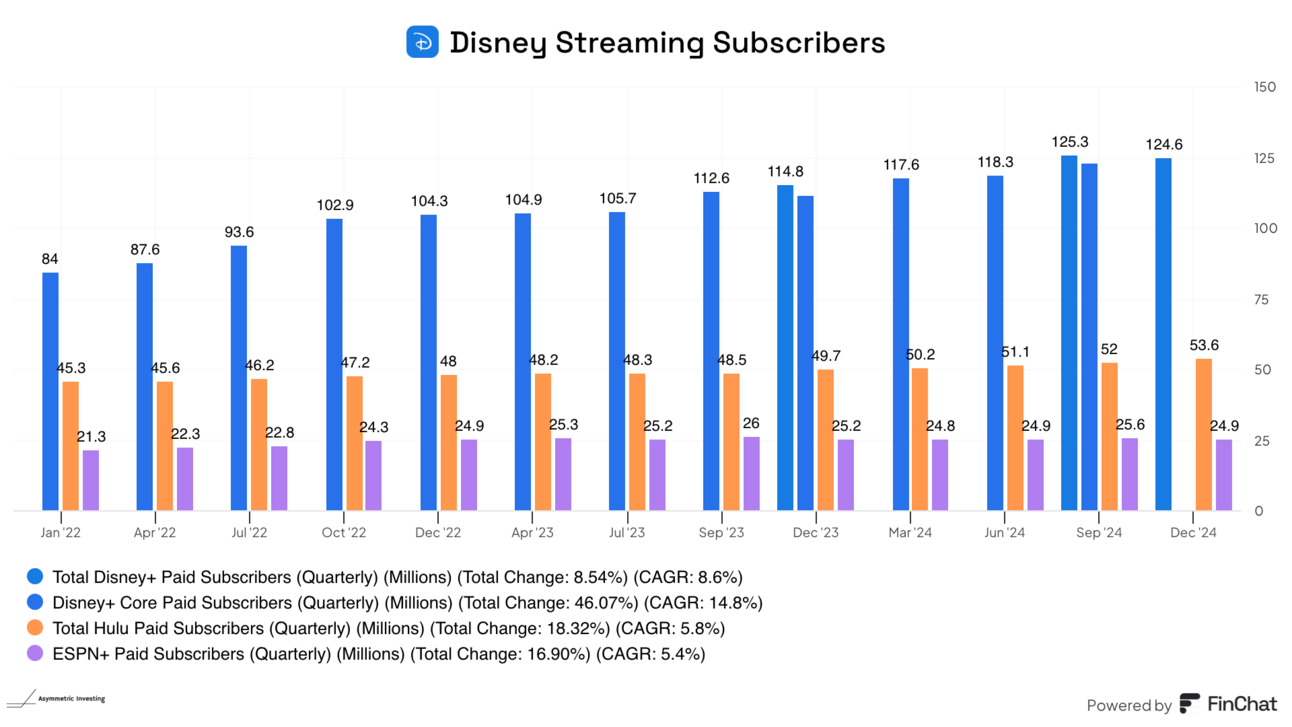

Disney boasts the second-largest streaming subscriber base and the best advertising business with Hulu. Note: The Disney+ figures below overlap because Disney changed reporting after selling its India business.

What’s lagging on this chart is ESPN. And ESPN should begin holding its weight this fall when it goes over the top.

What happens when ESPN goes over the top?

Disney will be going direct to consumers, replacing a ~$10 carriage fee with the fee charged to consumers.

Advertising revenue per viewer should increase because ads can be targeted more effectively.

The addressable market will increase because Disney can take ESPN to houses without cable and doesn’t have geographic limitations.

You can see above that sports is a big business, but it could be much bigger with ESPN over the top. Let’s give some example numbers as a baseline:

Disney could reach 100 million subscribers with ESPN over the top.

I think revenue per subscriber could be $30/month or more. ($20 for a subscription and $10 in ad revenue)

Those two assumptions give you a $36 billion revenue business, double the size of the sports segment today. And margins could be significantly higher because content costs wouldn’t scale with revenue, they would remain relatively flat.

Instead of playing on a level distribution playing field with competitors, Disney’s sports business would also live more by the smiling curve.

For example, if Disney sports is a $36 billion business and Max is a $5 billion business (50 million subscribers paying $10/month), who wins the next big sports rights deal, like MMA? Disney.

And that attracts more subscribers and allows for higher prices. And on and on.

Netflix is the only other game in town and it views sports as an ancillary piece of its business to pull in customers with one-time events or prevent churn. But you don’t subscribe to Netflix because you’re a sports fan.

Disney has an opportunity to be the biggest distributor of sports in the world. A decade from now, sports alone could be a $100 billion business.

Don’t sleep on the change the company is going through over the next 6 months and just how much this is the calm before a very important storm for Disney.

You can get all Asymmetric Investing content, including deep dives, stock trades, and ongoing coverage of Asymmetric Universe stocks with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your own research before acquiring stocks.