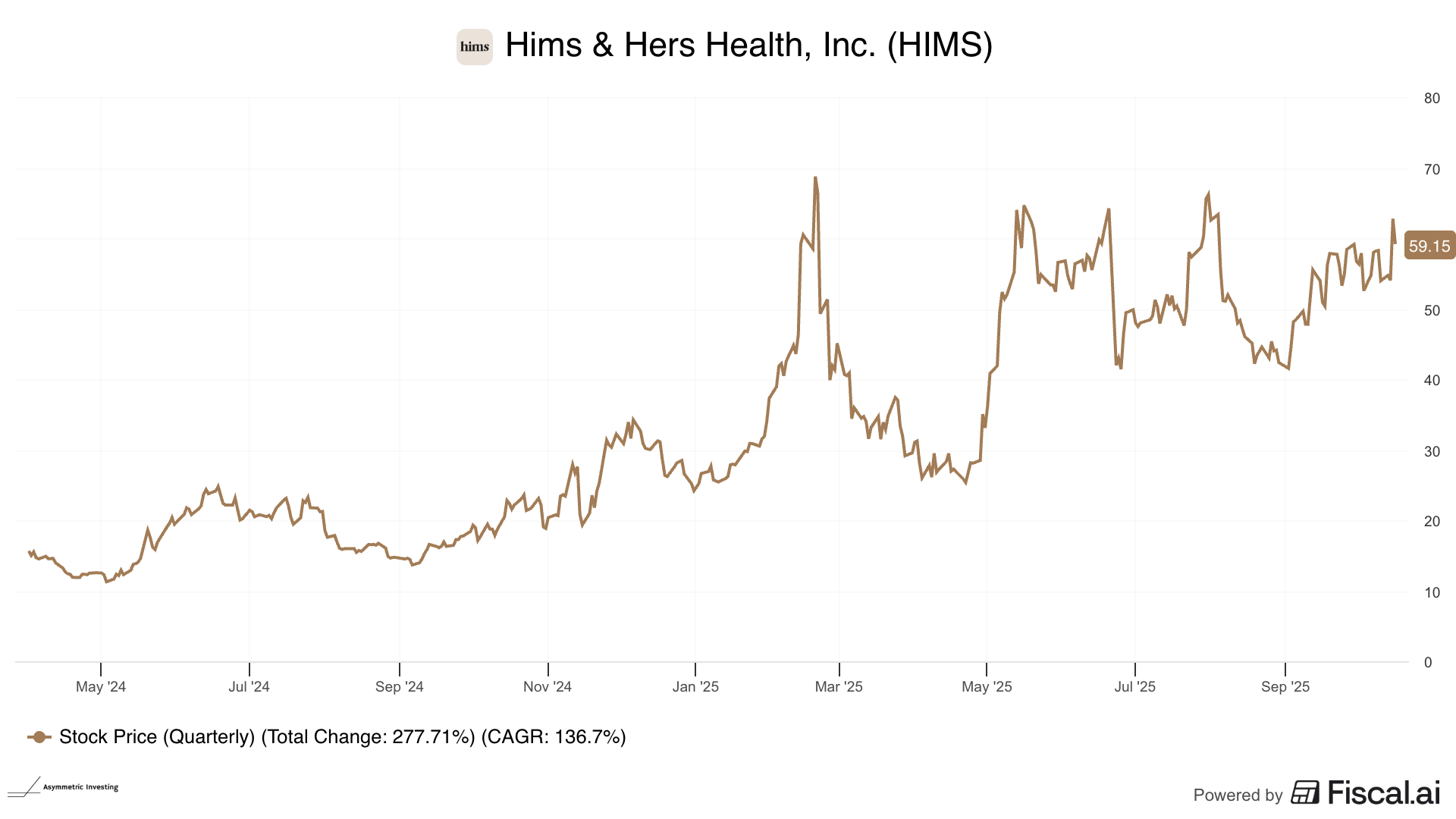

This article discusses Hims & Hers $HIMS ( ▼ 1.2% ) , which was covered in a spotlight article on May 24, 2024. At that point, the stock traded for $16.88 per share, and the company’s market cap was $3.4 billion. Shares are up 250% since then, but the opportunity is clearer today than ever.

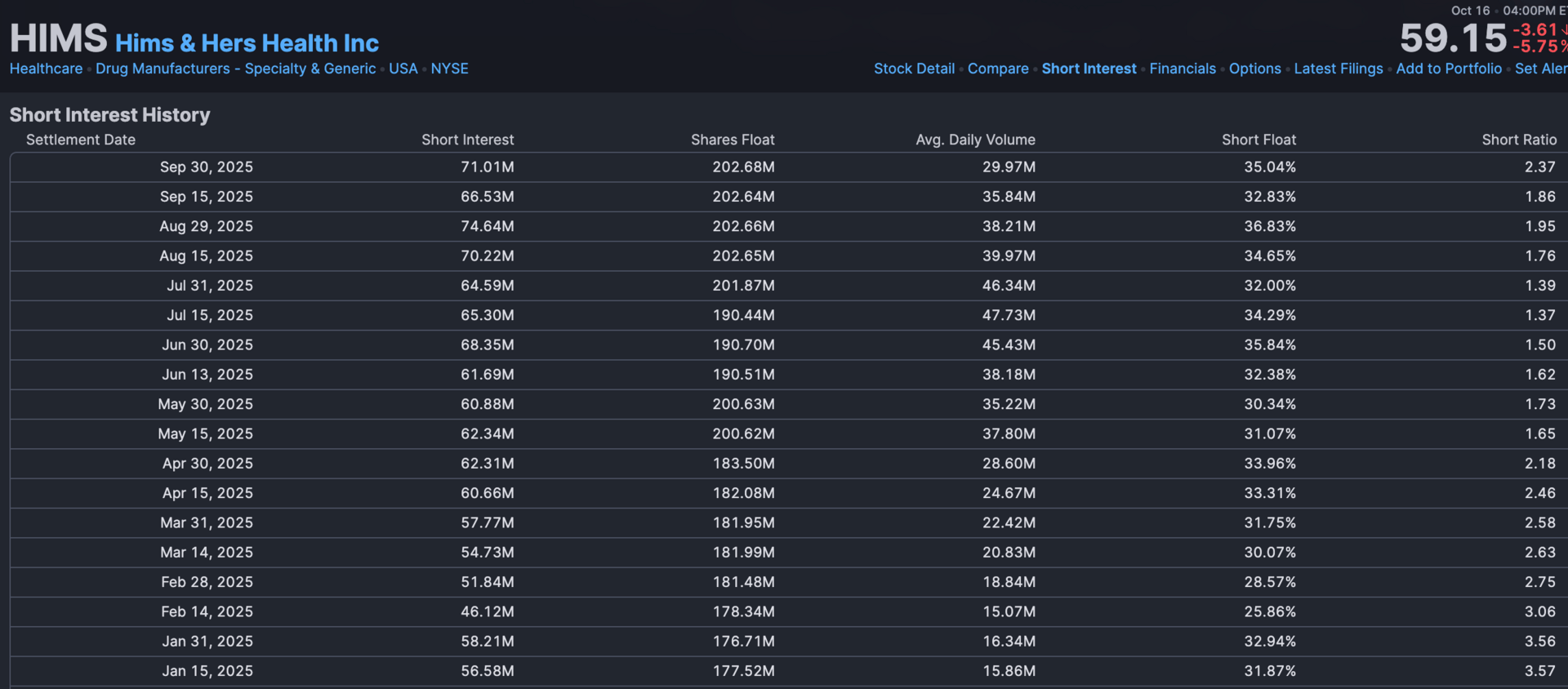

One of the reasons Hims & Hers is in the spotlight again is a debate about the future of the company. Some investors are skeptical, and that’s why this is a high short-interest stock. But this is also a high-growth company in a potentially massive industry.

Add it up and you get a company with revenue growth, margin expansion, and multiple expansion at its back. I love the positioning of Hims & Hers and continue to think the potential is 10x — or more — over the next 10 years.

Get all of Asymmetric Investing, including my stock buys each month, with a premium membership.

Growth & New Products

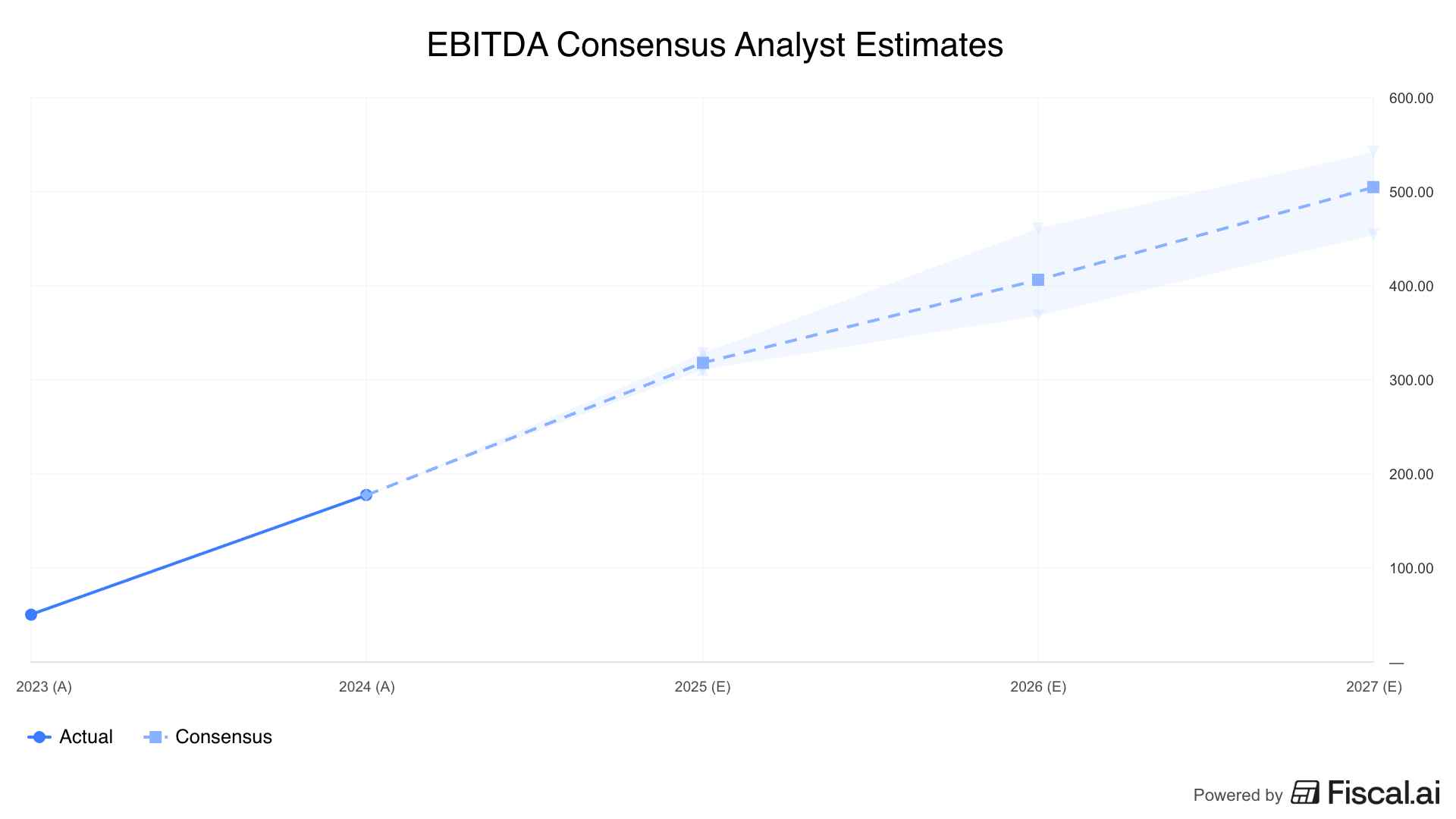

I don’t build financial models in large part because I don’t think they are particularly useful when the long-term vision is clearer than a spreadsheet could tell us. This will make sense when I show analyst estimates, which are based on said spreadsheets.

What we see with Hims & Hers is a company that grew tremendously with GLP-1s in the past year, but has seen growth slow over the past quarter.

On the surface, this seems bad, but keep in mind that the low point of growth is 45.8%!

What’s the “normal” growth rate right now? Is it 10%? Or 30%? Or 50%?

Answer that, and I could tell you what the future of Hims & Hers stock likely looks like.

To give away the plot, analysts are expecting less than 20% growth over the next two years, and even Hims & Hers is only guiding for 23% revenue growth through 2030.

I think both are underestimating the business’s potential.

The reason comes down to growth that’s fueled by new products.

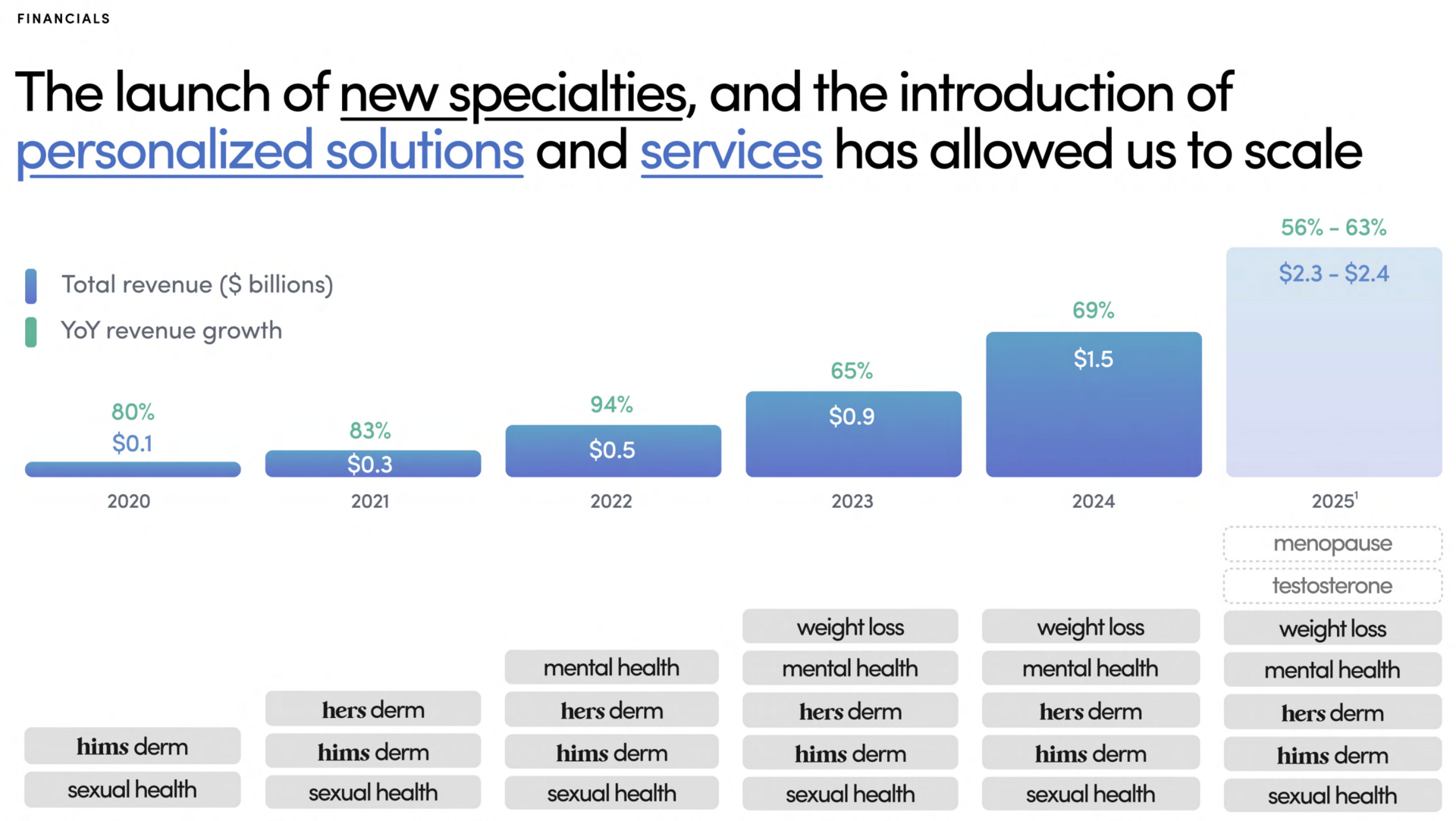

Until late in 2023, Hims & Hers had only three specialties — mental health, dermatology, and sexual health. After the recent launch of testosterone for the Hims app and menopause and perimenopause for the Hers app, the company is up to six specialties, and revenue has compounded more quickly as the number of specialties grows.

The more specialties, the wider the scope of the business.

This attracts more subscribers and entices subscribers to spend more on the platform.

Ultimately, more specialties drive more growth and higher margins.

Eventually, even suppliers (think GLP-1 makers) have to come to Hims & Hers to help build out their product offering or get left in the dust.

Supply Before Demand

The reason these new specialties are important is that supply is a leading indicator of demand right now.

Hims & Hers didn’t have growth from GLP-1s until they…offered GLP-1s.

It sounds simple, but it’s true.

I think the power of Hims & Hers is the company’s ownership of demand. But at this early stage in the growth cycle, the company needs to bring new products to market that build up demand.

The launch of testosterone and menopause products are a big deal and will drive growth for years.

And what’s the opportunity when longevity becomes part of the offering?

Margins and the Customer Acquisition Treadmill

When I wrote the spotlight, I worried that Hims & Hers was on a customer acquisition treadmill.

If the cost to acquire a customer is higher than the ultimate value that customer generates for a business, growth is a money-losing proposition.

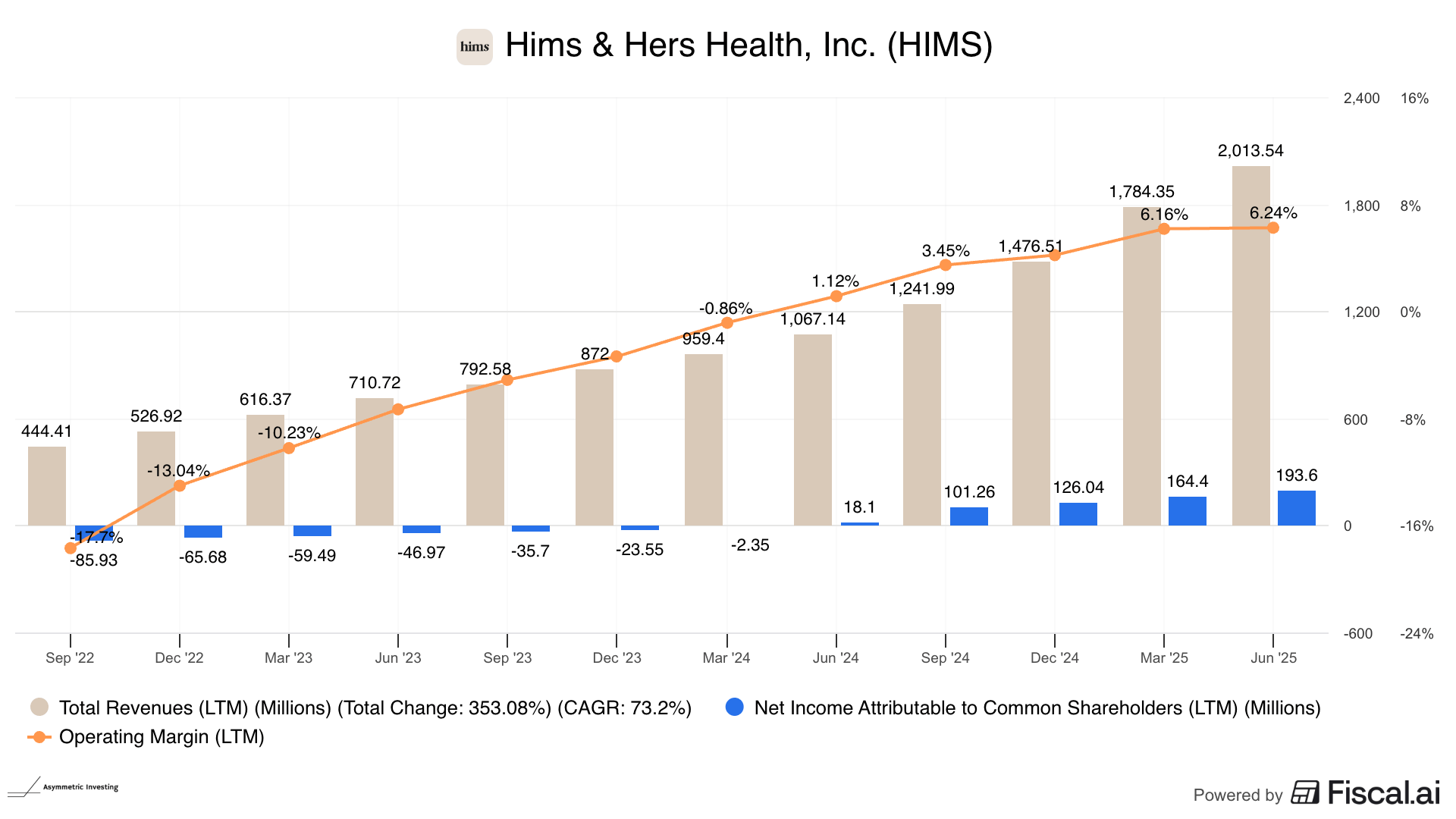

The best indicator that Hims & Hers wasn’t in fact on a customer acquisition treadmill was the fact that margins continue to rise.

I want to bring up that concern because I think we can put it to bed. Hims & Hers is generating more than enough margin to offset customer acquisition costs and grow profitably long-term.

Lowered Expectations

So, it seems that Hims & Hers is doing well with some GLP-1 volatility in the results. But can the company grow at a robust rate in the future?

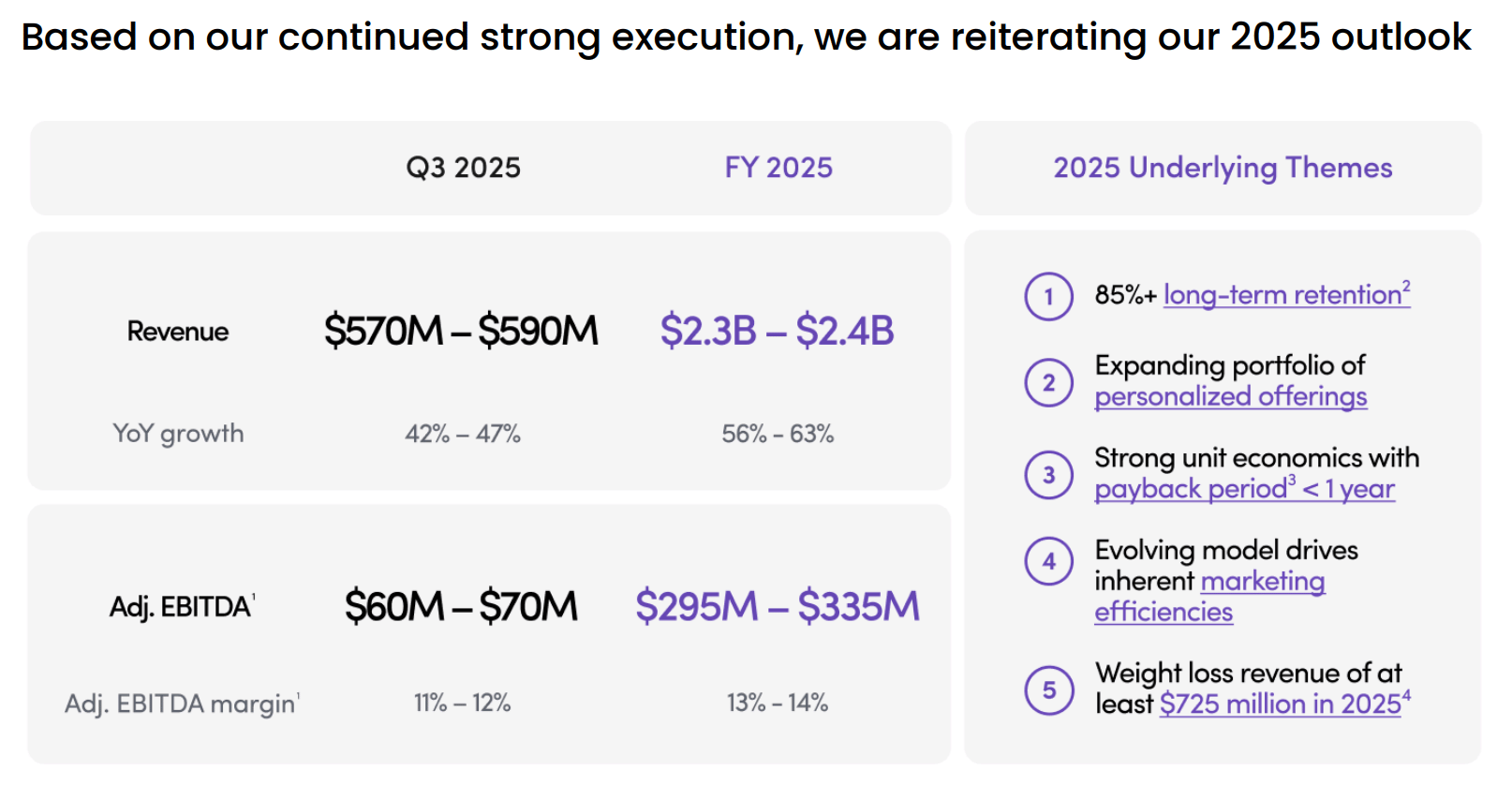

Management has given guidance of $2.3 billion to $2.4 billion in revenue for this year. That’s a 56% to 63% growth rate, but shows deceleration from a 90% growth rate in the first half of the year. The worry is that growth is decelerating.

Analysts are on par with guidance for 2025, but notice that they only expect 19% growth in 2026 and 18% growth in 2027.

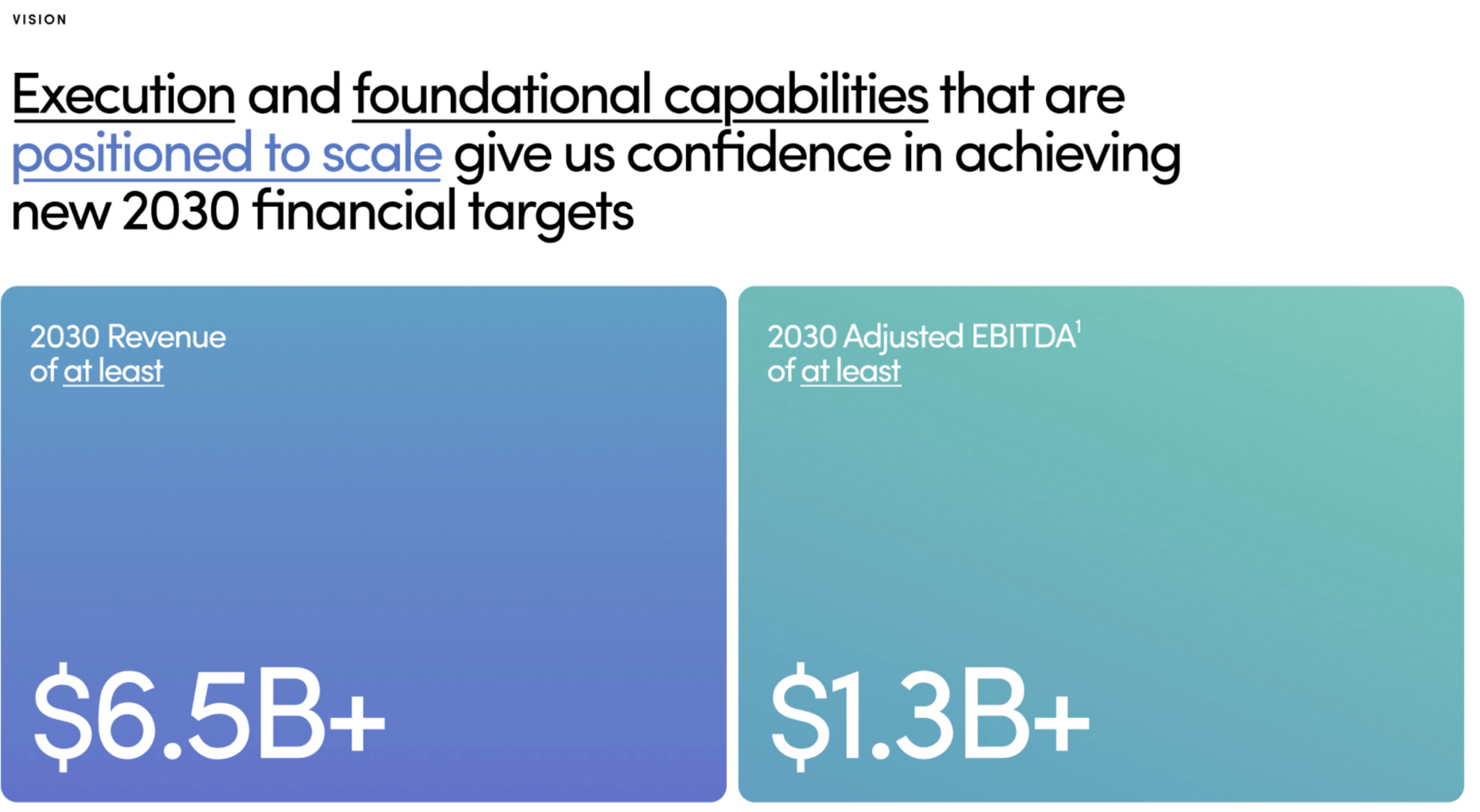

And yet, management has said the company will grow at a 23% rate from the midpoint of 2025 guidance through 2030.

I will note that prior long-term guidance was hit a year early, so a 23% compound annual growth rate through 2030 may be low.

How does the market react if testosterone and/or menopause products are a hit?

On top of that, analysts don’t expect much margin expansion in the next few years either.

It’s all set up to be a huge few years for Hims & Hers if they can grow the way I think they can, because analysts aren’t caught up to what’s going on with the company.

Hims & Hers Has 100x Upside

I don’t invoke the 100x potential for Hims & Hers stock lightly.

Few companies will achieve those returns even over 20 or 30 years. But the potential for Hims & Hers is very real.

Remember, this is a company with a 77% compound annual growth rate over the past five years, so growth is a tailwind.

Margins over that time have gone from -18% to positive 6.2% and rising, so margins are a tailwind.

But multiple expansion is underappreciated as well. Palantir is growing revenue at 39% and is trading for 124x sales, while Cloudflare is growing at 27% and is trading for 40x sales.

Hims & Hers is growing faster than both and traded for 6.6x sales! Why shouldn’t it trade for 60x sales?

Adding to the potential fuel, 35% of shares of Hims & Hers are sold short.

The potential for a short squeeze is very real.

Stocks only go up for 4 reasons:

Revenue growth

Margin expansion

Multiple expansion

Buybacks

Hims & Hers has 1-3 as a tailwind in a huge way.

I think Hims & Hers is heading in the right direction on all fronts. It’s expanding the product lineup, becoming attractive to more customers, expanding margins, and there’s an opportunity for investors to benefit from low expectations and multiple expansion.

That’s why this is one of the top stocks in the Asymmetric Portfolio and is likely to stay there for a long time.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.