I hope you had a wonderful week!

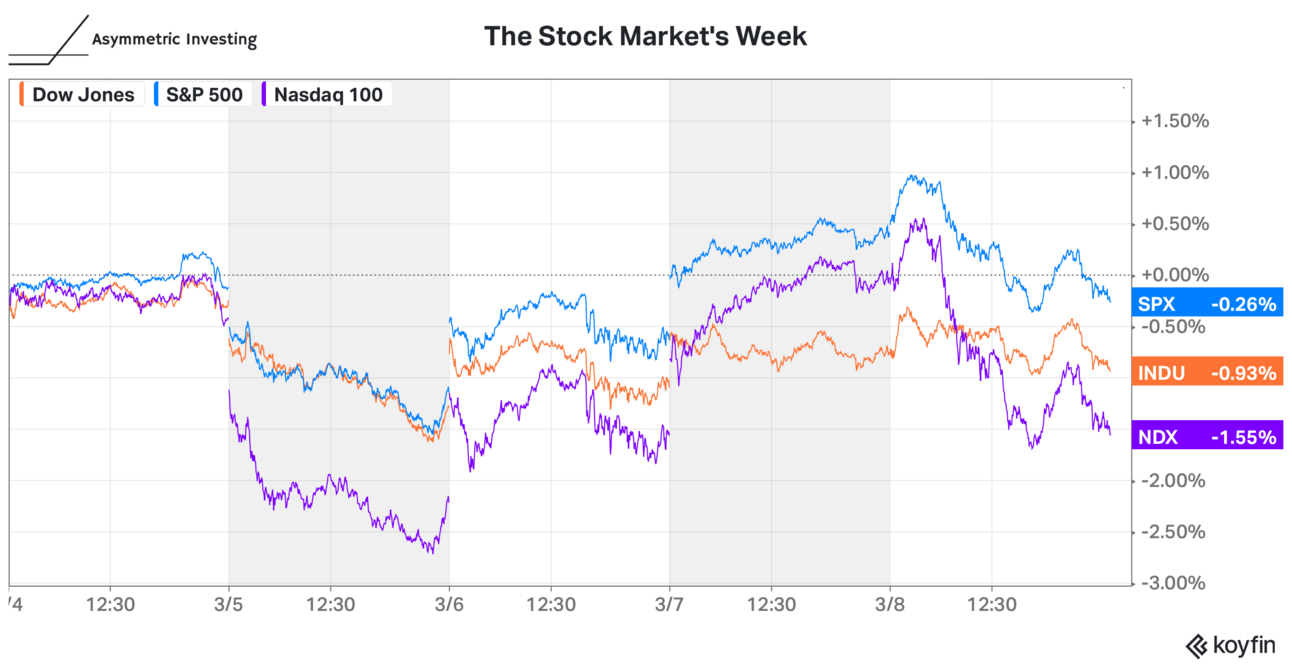

The stock market had a bit of a down week as strong economic data made investors worry interest rates are going to stay higher for longer than expected in 2024. For the year, the S&P 500 is up 7.4% and the Nasdaq 100 is up 7.1%, which is a hot start for just over two months of trading.

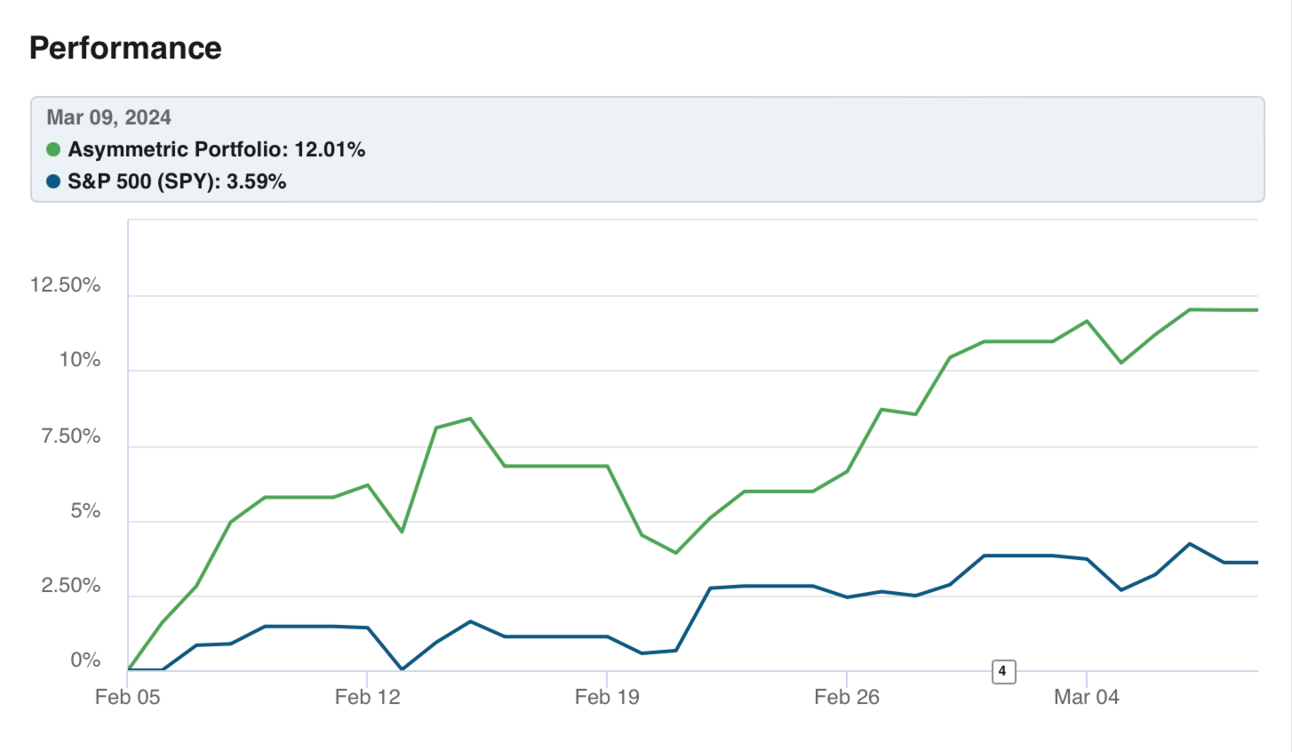

The Asymmetric Portfolio continues to have a great start to the year, helped by strong earnings reports from Celsius and Crox. Outside of weak guidance from Dropbox, Q4 2023 earnings were outstanding for the Asymmetric Universe with many stocks jumping double-digits after results were announced.

As a reminder, premium subscribers get deep dives on every stock in the portfolio along with trades before they’re made. If you want access to this market-beating research, you can upgrade here.

We explain the latest business, finance, and tech news with visuals and data.📊

All in one free newsletter that takes < 5 minutes to read. 🗞

Save time and become more informed today.👇

In Case You Missed It

Here’s some of the content I put out this week. Enjoy!

Brand New Spotlight Article: This high-growth stock has been beaten up by the market despite performing flawlessly over the past year. It doesn’t hurt that the CEO is one of the most impressive leaders I’ve come across. Click here to find out the latest stock to enter the Asymmetric Universe.

Celsius Isn't the Next Monster -- It's the Next Coca-Cola: Celsius is often compared to Monster, which is still 3x the company’s size. But maybe the better comparison is Coca-Cola, which is 10x bigger.

Owlet’s Turnaround Continues: The smallest company in the Asymmetric Portfolio reported earnings and a 75% growth rate and margins that nearly doubled showing an impressive turnaround that should pick up momentum in 2024.

Disney’s Misunderstood Potential: Disney’s parks and experiences are now the core of the business, but don’t sleep on the streaming business being even bigger than Netflix long-term.

A New Phase of FOMO

be fearful when others are greedy and to be greedy only when others are fearful

There’s an inverse relationship between how comfortable we feel as investors and the buying opportunities available on the market.

A great sign that we’re getting to a peak in the market is investors confidently proclaiming that the hottest stock on the market still has incredible growth potential despite being historically insanely expensive.

It’s never really “different this time”.

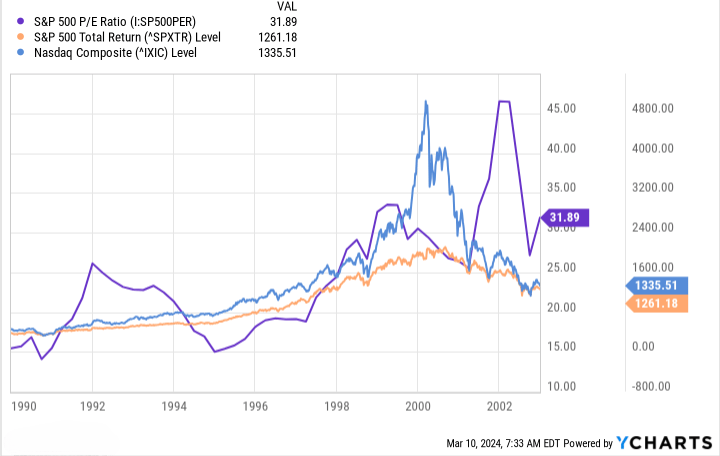

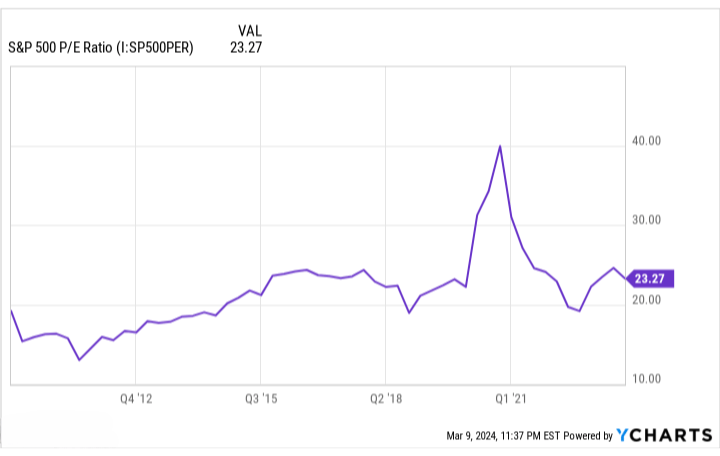

We saw this in the 1990s with internet stocks, peaking before the market crashed in 2000. The S&P 500 had a P/E ratio in the low-30s at its bubble peak (I couldn’t get reliable data for the Nasdaq Composite) and tech stocks got to insane valuations as FOMO set in.

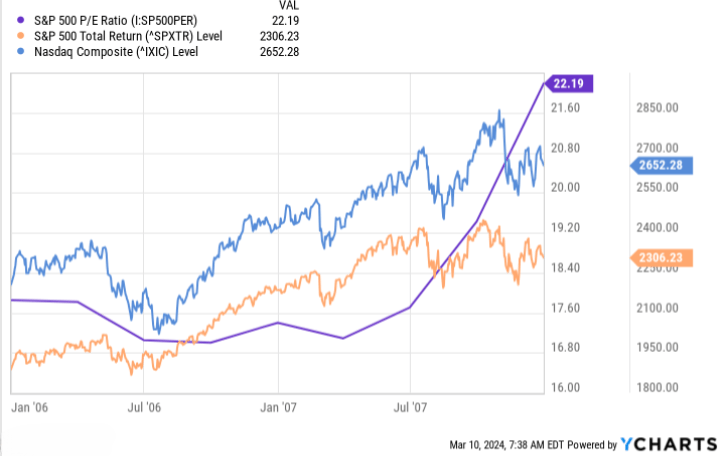

The S&P 500 traded for a 22.2 P/E ratio to start in 2008 before the market collapsed.

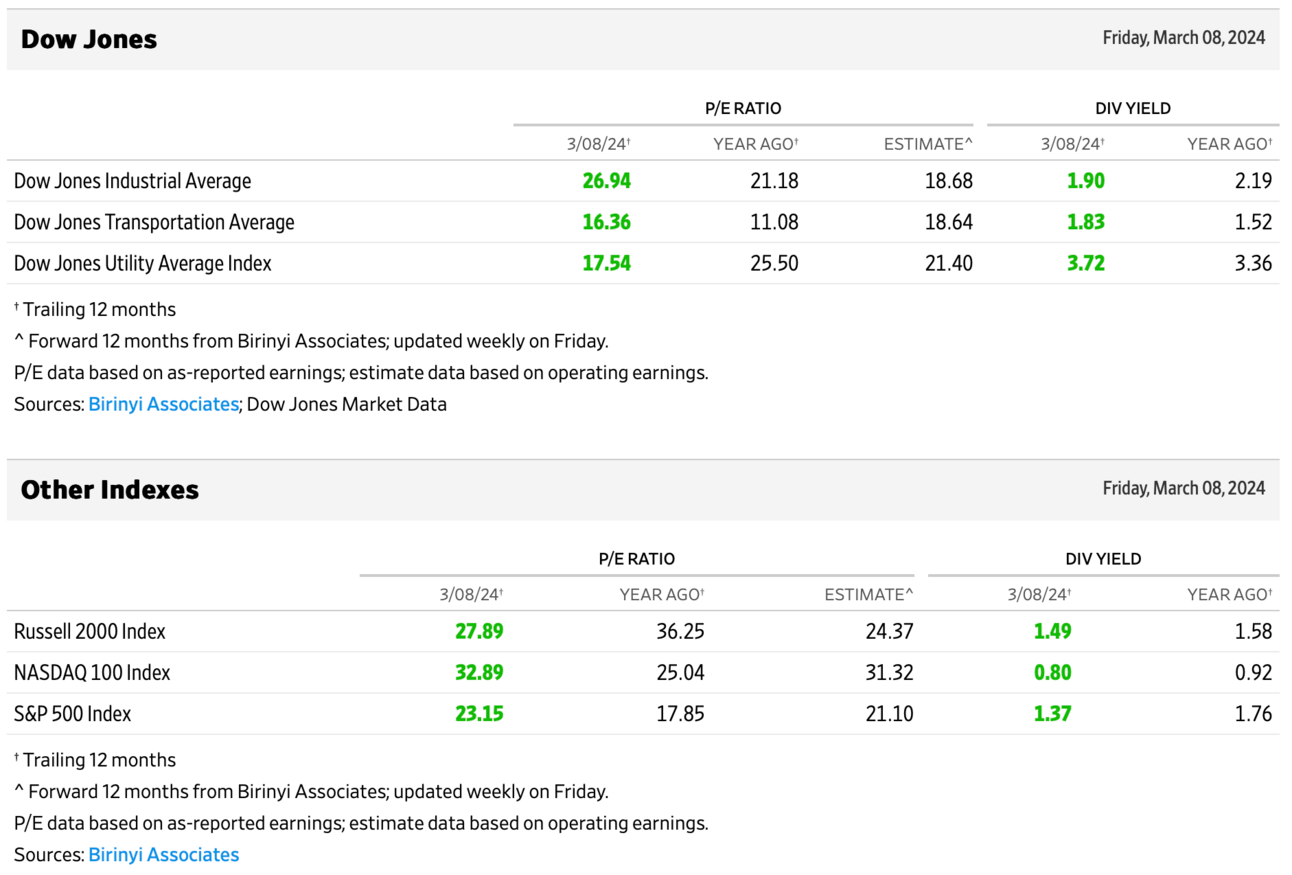

Today, the S&P 500 is reaching a P/E multiple that should start raising alarm bells and the Nasdaq 100 looks even more expensive.

According to the Wall Street Journal, the Nasdaq 100 trades for nearly 33 times earnings. The market hasn’t gotten the memo that interest rates are staying higher for longer than expected just a few months ago and consumers are slowing down their spending.

The Magnificent 7, which drove the market in 2023, is also trading for historically high multiples. Only Alphabet and Apple trade for a P/E ratio under 30x and they’re not cheap at 26.6x and 23.4x respectively.

What we’ve broadly seen in earnings over the past month is that earnings growth was driven by cost cuts at many companies. That’s great, but it isn’t a repeatable earnings driver.

On the downside, companies that reported even the smallest miss of guidance or estimates were punished with slides of 20% or more at times.

AI is growing, we know that, but look at retailers like Target and Home Depot and you see sales falling as consumers trade down and put off large purchases.

We may not be in a recession, but I think it’s hard to argue this is a time when investors should be greedy.

Should you be fearful? Or buy more? Here’s what I’m doing. 👇

What I’m Doing About My FOMO

I have no idea if the market will go up or down over the next week, month, or year. But I do see signs we’re getting to uncomfortable valuation metrics and I’m making some adjustments to what I’m buying as a result.

I’m filling the Asymmetric Universe (or the pool of stocks I can allocate capital to in the Asymmetric Portfolio) with high-quality companies in anticipation of a pullback in the market.

I may not buy these stocks now, but when a buying opportunity emerges, I want to be ready with my best ideas fully researched and conviction already built so the downturn doesn’t cloud my judgment.

I’m allocating new funds to companies that have strong balance sheets, positive cash flow, and trade for reasonable valuations. This doesn’t eliminate risk in a downturn, but it reduces the magnitude of losses from multiple compressions if a bubble pops and ensures companies are coming from a point of strength rather than a point of weakness.

10 of the 19 stocks in the Asymmetric Universe have a net cash position (ie. no debt).

12 of 19 stocks have positive free cash flow, including 10 of the top 11 positions in size.

7 of 19 positions have a P/E ratio lower than the market.

Remember, this is a high-growth portfolio, so many companies are trading earnings for growth.

I’m still buying.

We have no idea how long the market can go up or what will cause a decline. So, I’m still buying the same amount each month.

This allows me to dollar cost average into great companies and not have to try to time the market. A similar strategy would have worked out well in any of the market downturns of the last century.

I’m not worried about missing the “next big thing”.

AI is hot. I don’t own any AI stocks (unless you call Alphabet an AI stock).

Crypto is up. I’m not buying crypto right now…but I’m riding the wave with Coinbase shares acquired in mid-2023.

I will ride trends, but won’t chase them.

I’m not selling.

I’ve made the argument the market may be overvalued, but that doesn’t mean I’m selling. That’s because I don’t know where the top is and I only own companies I want to own for a decade or more. I’ve missed out on more gains by selling great companies than any other investing mistake.

I think the right move is to be conservative in what I’m buying, but over-index to not selling anything.

These are guardrails that help me keep a long-term focus. I’m not going to time tops or bottoms, but I’m not going to ignore them either.

If great deals don’t exist in areas I would like to invest in, I won’t chase them.

As the market gets greedy, I’m starting to take a more cautious approach and understand what I want to own when the narrative changes. Eventually, fear will set in and I’ll be ready to pounce when it does.

You can get all Asymmetric Investing content, including deep dives, stock trades before they’re made, and ongoing coverage of Asymmetric Universe stocks like Airbnb with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.