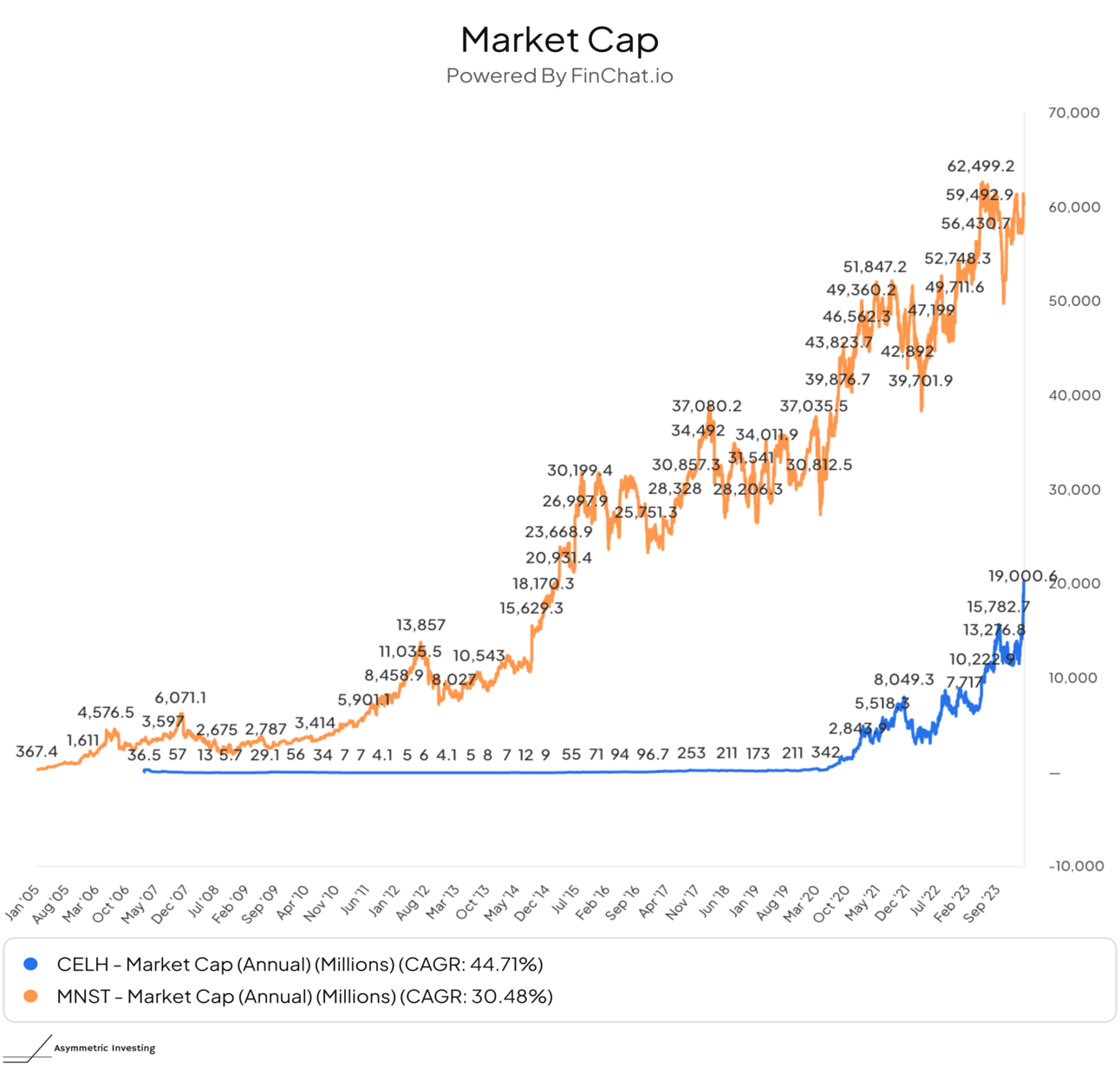

When I wrote the Celsius Spotlight article on December 20, 2023, I didn’t expect Celsius to become one of the top-performing stocks in the Asymmetric Portfolio. But since then, shares are up 82%, and looking a year out the stock is up an incredible 202%.

Objectively, this is one of the most expensive stocks on the market. It has a price-to-sales ratio of 15.5x, a price-to-earnings ratio of 114x, and even a forward price-to-free cash flow is a whopping 118x.

I love a cheap stock. But growth at the rate Celsius is growing is worth paying up for. And this is a stock worth the premium.

This AI Startup Investment is Winning

Otherweb is the fastest-growing AI platform on the internet. They have developed technology that transforms a $565 billion market.

Investors are taking notice, and here’s why:

1) They raised $1.9M+ from 2,000+ investors, including founders with $100M+ exits, VCs, angels, executives from Google and Amazon, and more.

2) They grew to over 8 million users in just 15 months.

3) They are riding a $15.7 trillion wave of AI innovation.

The Celsius Growth Machine

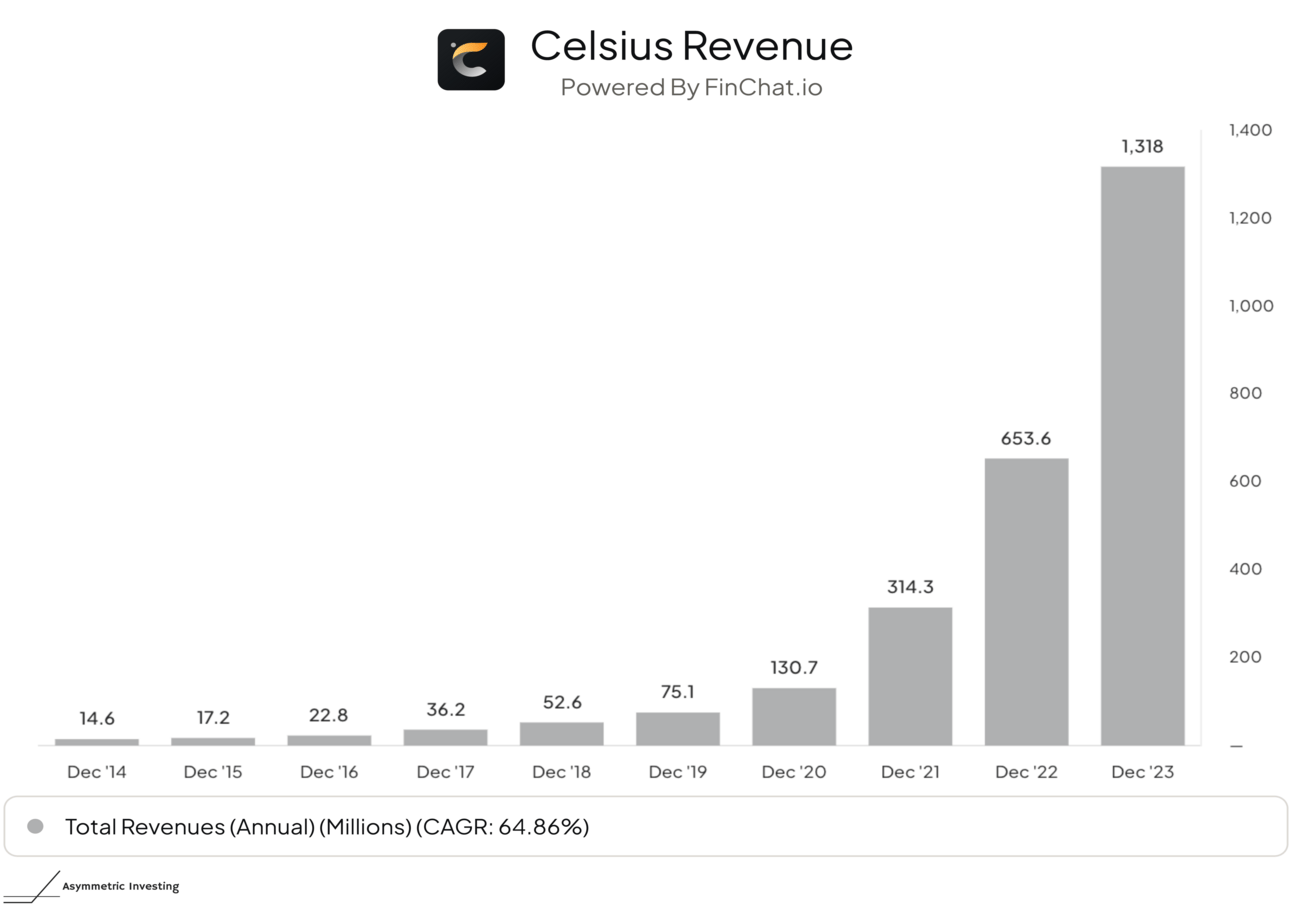

I love a company that breaks an analyst’s financial model, which is often limited by how far out you can predict outsized growth. And Celsius does exactly that. Not only is revenue up almost 100x in 9 years, but the compound annual growth rate (CAGR) has been 105% over the last four years.

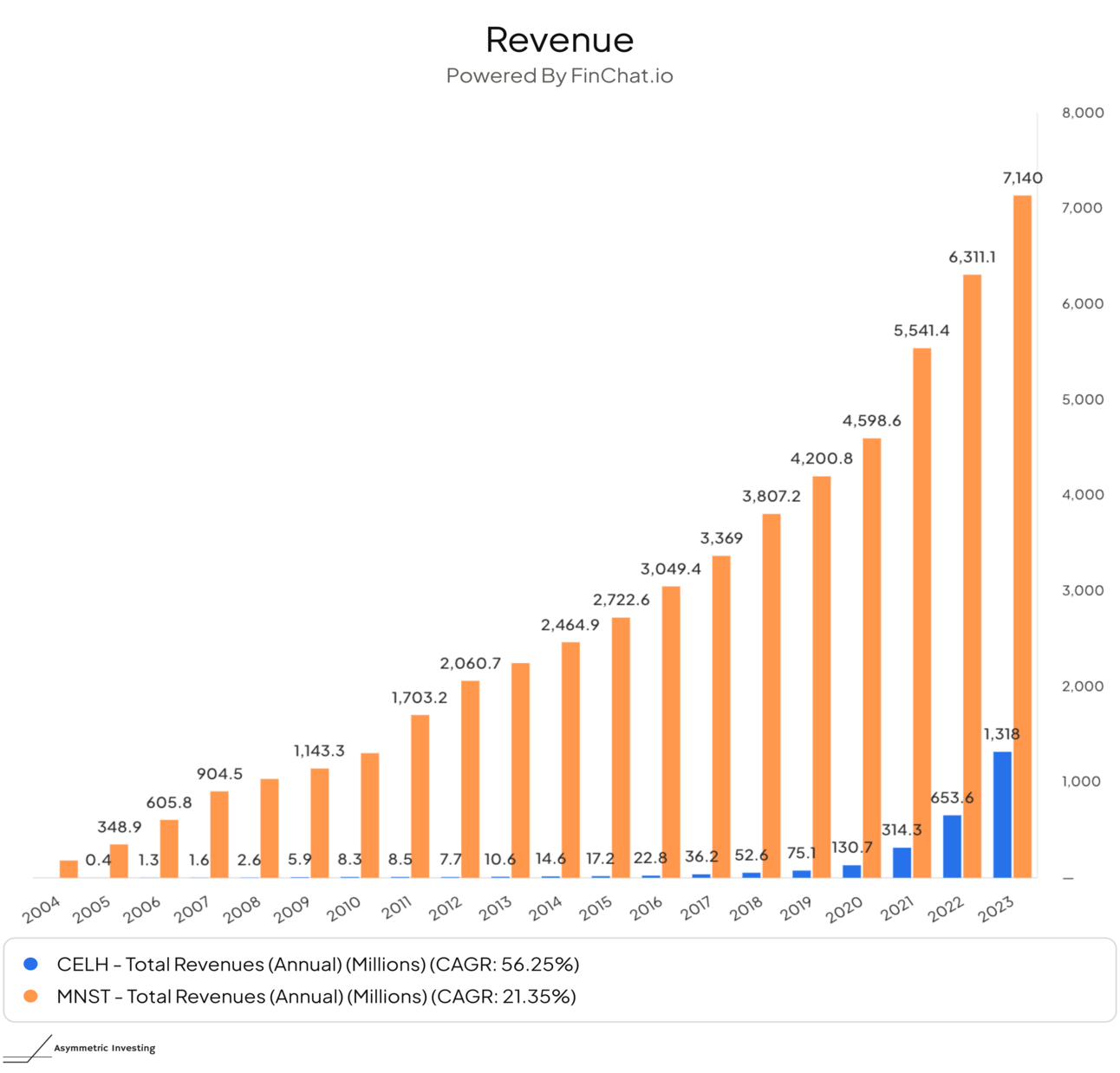

Despite the rate of growth, Monster (the closest competitor) generated more than 5x as much revenue as Celsius last year.

There’s clearly a lot of growth potential.

Celsius just made its way to national chains in the past year thanks to Pepsi handling distribution.

It’s moving into restaurants and convenience stores right now.

Shelf placement is getting better because retailers LOVE products that sell quickly.

And international is an almost untapped market.

Using Monster as the comparison, Celsius is expensive but if the upside is bigger than Monster there’s still 3x upside over the next 5-10 years.

Is Celsius the Next Monster OR the Next Coca-Cola?

But is Monster the right comparison?

Monster is a very niche product with a very specific consumer.

Celsius seems to be more widely adopted and has more appeal to women and older beverage drinkers.

To me, it’s the new soda. A casual drink to have any time of the day.

Maybe the better comparison is Coca-Cola?

If that’s the case, the upside for Celsius isn’t 3x from here, it’s more than 10x in value and about 35x growth in revenue.

Growth Needs Perspective

Just looking at growth rates is often deceptive for investors. Instead, we need to look at growth in the context of the potential market.

With that perspective, Celsius is worth paying a premium for because it has 5x growth potential to be equivalent to Monster and 35x growth if it becomes as popular as Coca-Cola.

We can debate all day how much of a premium we should pay and there’s no doubt this is an expensive stock.

But this kind of growth potential I want to own and add to long-term. That’s exactly what I plan to do.

If you want to read the full spotlight article along with all previous picks and the stock I’m covering in March, sign up for a premium subscription here.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.