The stock market took a bit of a nosedive this week after inflation data came in hotter than expected and tensions began to rise in the Middle East.

Over the past year, inflation has been the #1 concern for the market because it’s the main piece of data the Federal Reserve uses to determine whether interest rates should go up or down. In theory, lower rates mean higher stock prices.

In reality, interest rates drive the stock market short-term and earnings drive the stock market long-term. And on the earnings front, the current inflation may not be bad news, which I’ll get to below.

Not surprisingly, the Asymmetric Portfolio pulled back as well but is still beating the market handily since I moved tracking to SavvyTrader in February. As earnings season begins, I expect to see more divergence from the high correlation with the market over the last few weeks.

Asymmetric Investing has a freemium model. If you want to skip ads and get double the content, including all portfolio additions, sign up for premium here.

Discover an AI Networking Solution That Guarantees Results

The speed of innovation with AI exceeds prior rates of change by 3x or more. IT leaders today need enterprise networks that bridge the gap between goals and resources needed.

Nile redefines enterprise networks, with AI-powered automation for campus and branch IT infrastructures–all backed by performance guarantees. Join the broadcast April 16th for new insights and demos from analysts, IT experts, & Nile leaders to get a first look at how Nile is revolutionizing enterprise networking.

In Case You Missed It

Here’s some of the content I put out this week. Enjoy!

Membership Economics and the Costco Effect: Costco broke the retail mold by using memberships as the profit center and breaking even on stores. This could become a trend as companies like Robinhood and Target try to copy parts of the model.

Autonomous Driving and Asymmetric Opportunities: Autonomous driving is back in the news after Cruise said it would return to roads and Tesla announced a robotaxi event in August. I run through the opportunities for investors here.

Google’s AI Story: Google I/O was this week and it was all about AI. What intrigued me is how Google Cloud could become the AWS of the AI world.

Rivian Hits an All-Time Low: Falling EV prices and demand is hurting Rivian and the stock is now at an all-time low. The problem is that cash is running out and the path to profitability is nearly non-existent.

Inflation and Why I’m Not Worried

Every few weeks, the market gets an inflation shock that sends stocks into a tailspin. Is inflation out of control? Is it structural? Will rates remain higher for longer than we thought?

The simple answer may be YES!

And that might be OK.

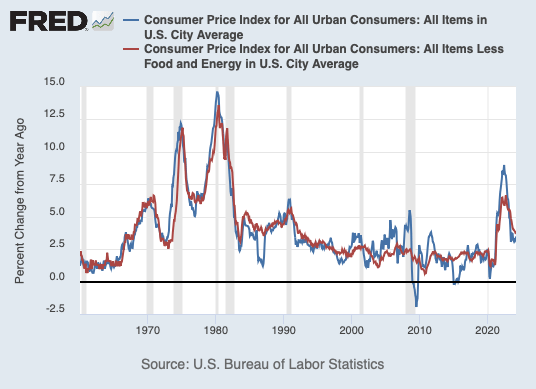

Since the mid-1980s, two of the biggest reasons inflation has been held under control were the deflationary effect of offshoring and technology.

For example, the Apple II was introduced in 1977 for $1,298, or $6,530 in today’s dollars. Today, you can get an Apple laptop that’s more than 10,000x faster for $999.

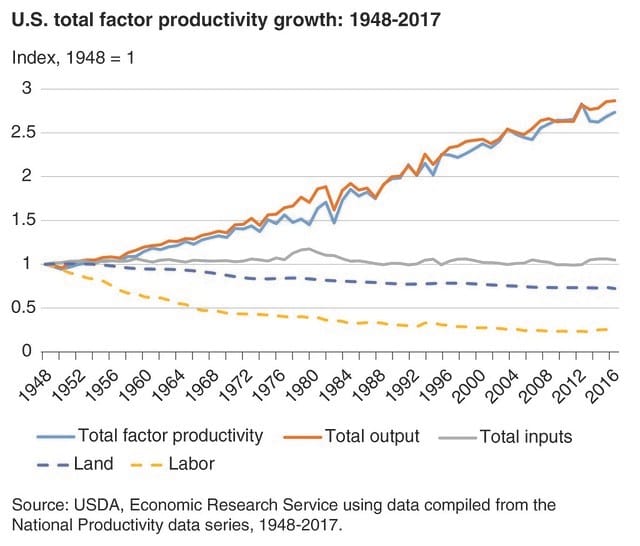

Food prices have been held in check because fewer workers are producing more food than ever before, driven by technological improvements in seeds and farming practices.

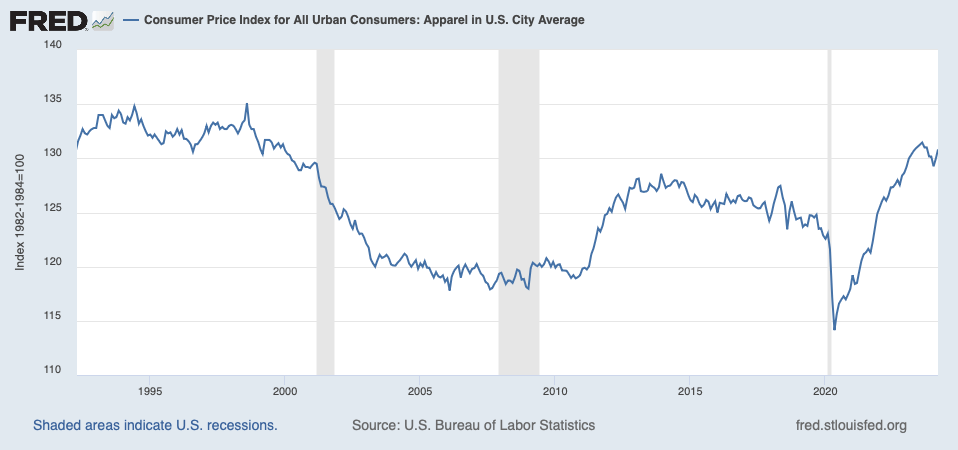

This one is incredible. The Consumer Price Index for apparel is lower today than it was in 1992. Why? Offshoring!

We could go through example after example of telecommunications, TVs, cars, and much more being cheaper today than they were 40 years ago, adjusted for inflation. In nearly every case, the cost reduction came from either technology or a global labor arbitrage.

As we stand in 2024, both deflationary tailwinds may be starting to reverse and become structural inflation.

Unwinding Deflation

The reality of today’s economic and political environment is a lot of the offshoring that drove cost efficiencies and increased consumption in the U.S. over the last half-century is being rethought.

The pandemic showed how fragile a global supply chain can be and tensions with China, Russia, and the Middle East have caused everyone to reconsider where products are made. In my coverage universe:

TSMC moving some chip production to the U.S. — driven by Apple’s pressure

Yes, tech products will get more expensive as a result.

First Solar is increasing U.S. manufacturing

Yes, solar energy will be more expensive as a result.

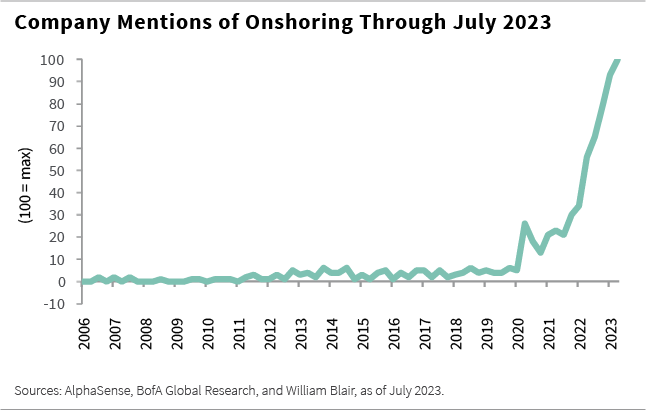

These aren’t isolated incidents. William Blair released this chart of mentions of onshoring in conference calls.

Another data point is the percentage of cost of goods sold coming from China, which is now in decline after three decades of increases.

Making goods in the U.S. to serve U.S. customers will be more expensive than using lower-cost labor around the world. But it will also provide more U.S. jobs and make companies more resilient against shocks to the market.

Why isn’t this terrible for the stock market?

In this scenario, higher inflation is correlated with more jobs and higher wages in the U.S.

More jobs and higher wages mean workers have more to spend on cars, homes, food, apparel, etc.

Inflation looks like it’s here to stay and the drivers are different than they were in the 1970s. This time around, inflation may be the result of unwinding some of the deflationary effects of the past half-century, and for many parts of the country that’s a good thing and could help earnings growth long-term.

The market seems to be realizing that and I think we’ll see relatively strong earnings despite the inflationary headwinds.

What are you waiting for?

You can get all Asymmetric Investing content, including deep dives, stock trades before they’re made, and ongoing coverage of Asymmetric Universe stocks with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.