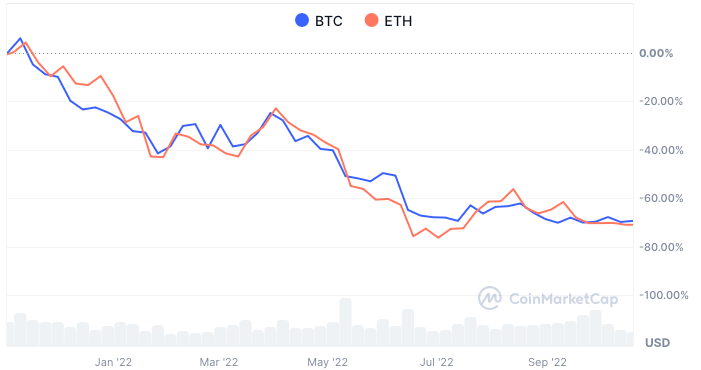

In late 2021, Bitcoin and Ethereum were trading at all-time highs, and investors didn’t have a care in the world. Valuations were crazy by any objective metric, and inflation had begun, but no one seemed to care in 2021.

Cryptocurrencies were the poster of this moment, hitting highs in November 2021. A year later, values had dropped by 75% as the market transitioned from greed to fear.

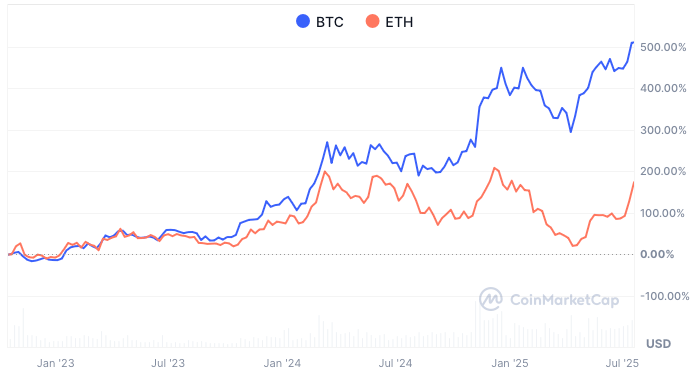

The vibe of the market feels similar today as it was in 2021. No-revenue companies are soaring, valuations of the most talked-about stocks are sky high, and people are posting their leveraged trading wins of millions of dollars online. Bitcoin is also at all-time highs again, and Ethereum is getting close, which is always a good indicator of where greed is.

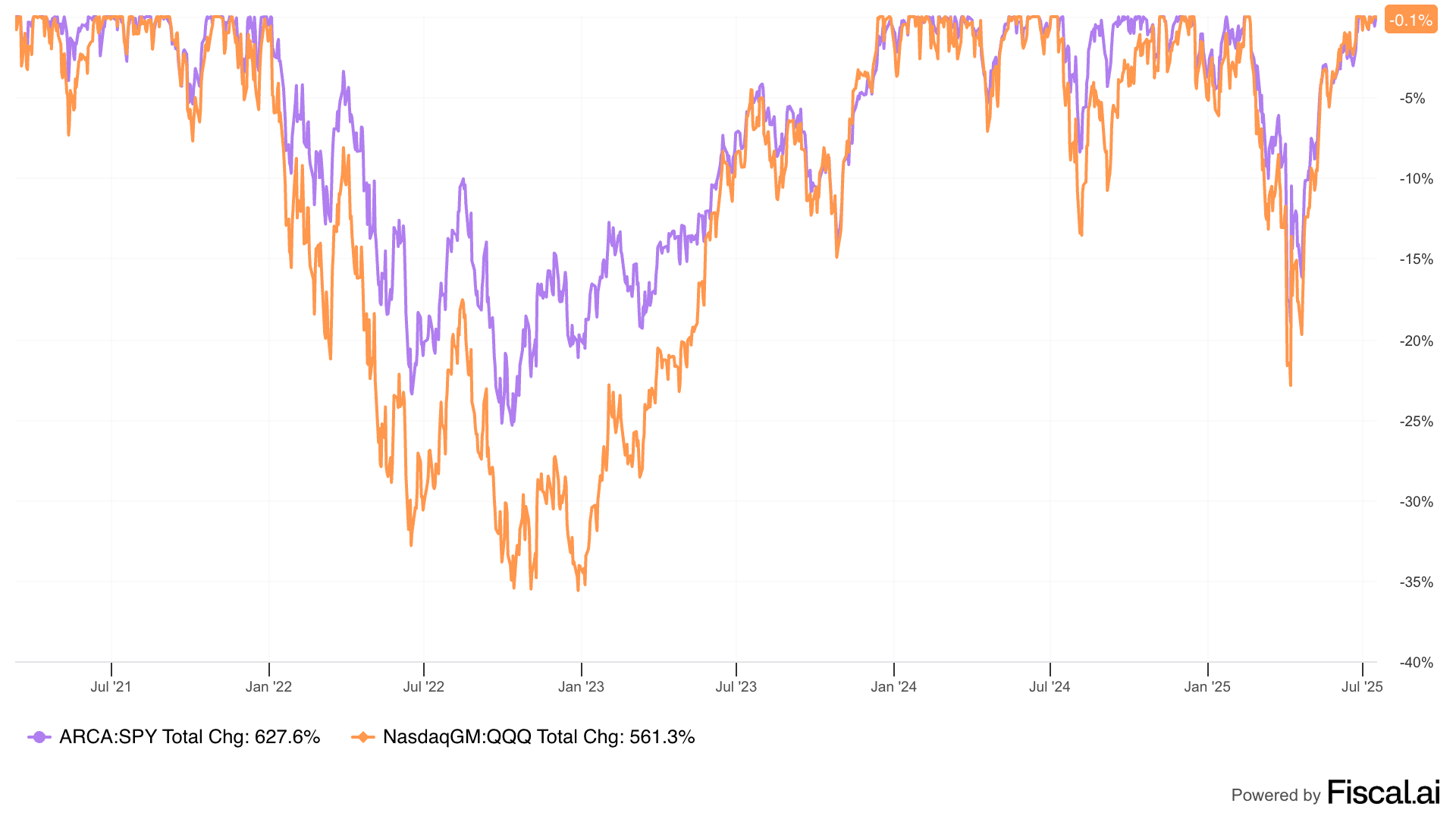

I’m using crypto as an example, but the entire market went through a major drawdown in 2022, coming off the sugar high of the Gamestop and SPAC era. The Nasdaq 100 fell 34.6% from peak to trough, and many stocks fell 80% or more.

SYP (S&P 500) and QQQ (Nasdaq 100) drawdowns.

Today feels a lot like late in 2021. We can see a storm coming. In 2021, that storm was inflation and a post-pandemic “normal”. Today it’s inflation, tariffs, rising credit card and auto defaults, and a weakening labor market. I was taught to be fearful when others are greedy, and everyone seems to be REALLY greedy right now.

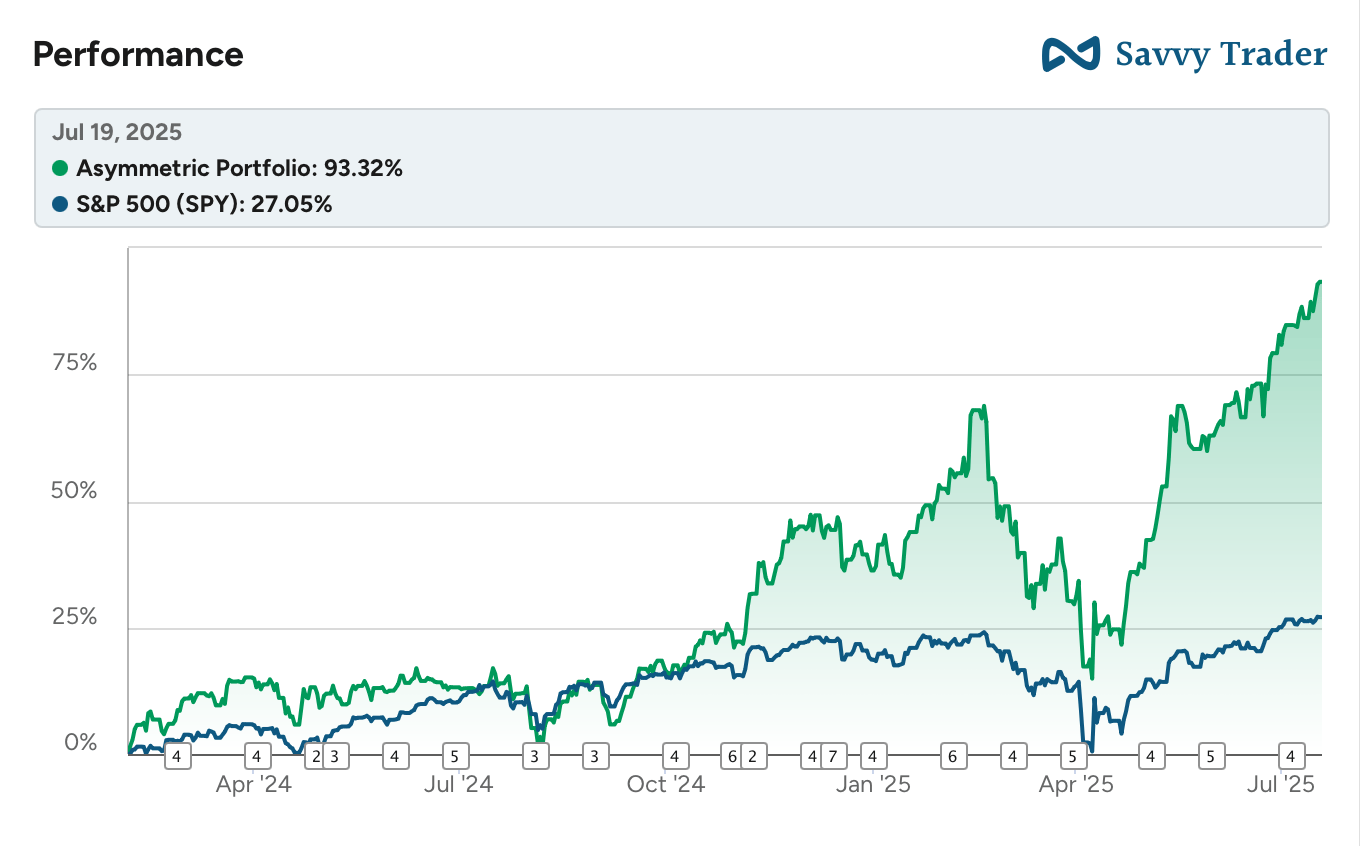

Of course, I’ve benefited from that greed. The Asymmetric Portfolio has been on such a tear that many stock valuations have me scratching my head. Almost every day, the portfolio hits new highs on nothing more than speculative buying. No earnings. No positive tariff news. Just YOLO!!

I won’t sell stocks based on valuation, but it’s gotten to the point that I’ll (likely) be putting on a hedge position early this week, which I will disclose to premium subscribers as always before the trade is made. But more on why I’m becoming more fearful in a moment.

The charts you see here are easy to make with Fiscal.ai, the first place to go for all of my research. I can’t say enough how much easier it’s made my research, and you can start with 2 weeks free. 👇

In Case You Missed It

Here’s some of the content I put out this week.

Joby Aviation’s 190.7% Jump: Why Joby has become the hottest stock in the Asymmetric Portfolio.

Uber and Commoditizing Autonomous Driving: Autonomy won’t be a winner-take-all market if Uber has anything to do with it.

Earnings Preview: I went over what I expect from Alphabet and Mobileye.

If It Looks Like a Bubble…

I don’t want to be crippled by valuations, but I do want to be aware of where valuations are for the market, because if companies don’t live up to expectations, we could see a big drawdown again. And that’s where the current valuations and economic backdrop deserve some scrutiny.

What I’m seeing is assets priced for perfection. And we aren’t likely to get perfection in results.

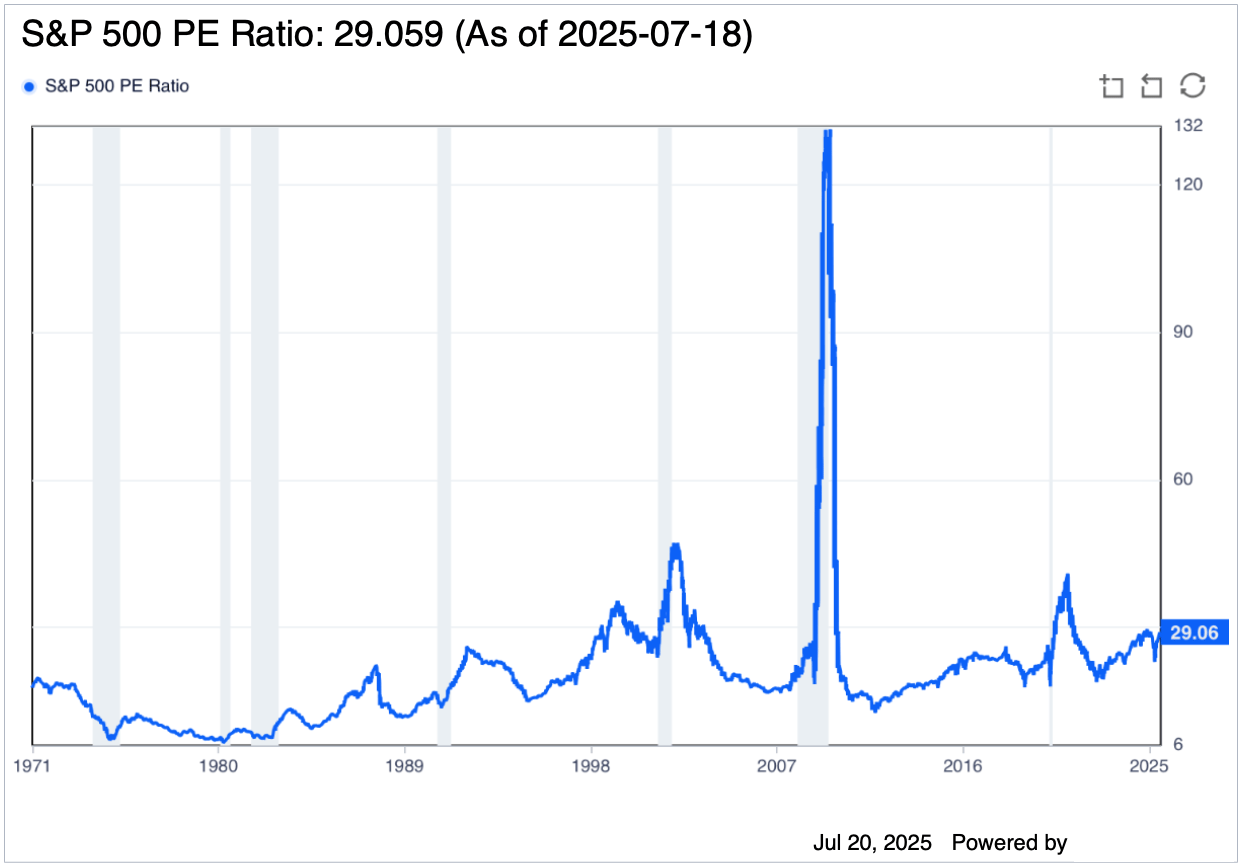

Valuations Matter

You can see below that the S&P 500 is trading near multiples not seen in non-recessionary periods since 1998. And that was in the middle of the dot-com bubble.

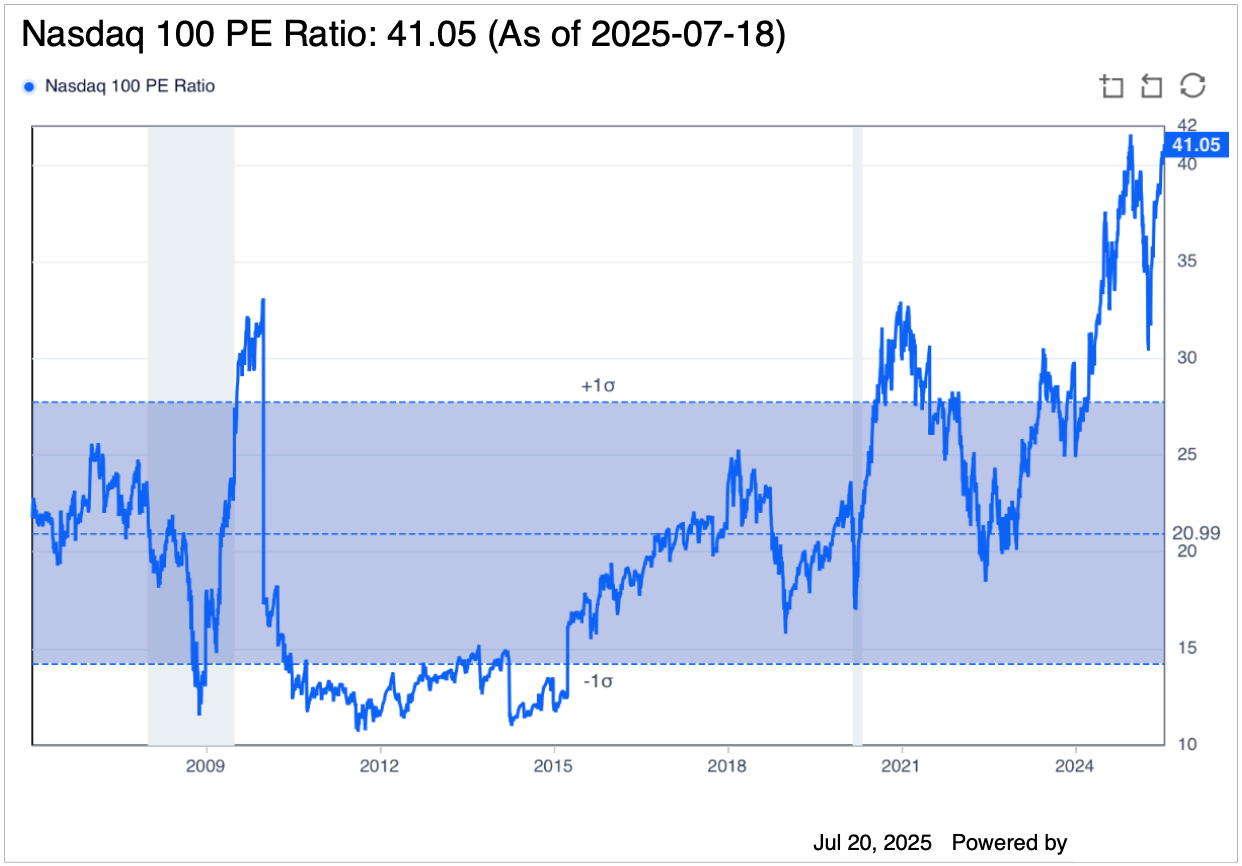

The Nasdaq 100 has even surpassed the peak P/E multiples of the great financial crisis and COVID.

Yahoo! Finance even wondered this week if the current market is a bigger bubble than the dot-com bubble.

The current market isn’t in a bubble everywhere, but it’s easy to see a bubble in certain segments of artificial intelligence, quantum computing, and other emerging technologies. And if there’s even a little disappointment, the bubble can burst.

Job Openings

Have you noticed more people having a hard time finding jobs after getting laid off or taking a buyout from a company looking to cut headcount? Spend a few minutes on LinkedIn and you may see it.

My anecdotal view is that lots of people are having a hard time finding jobs, despite a low unemployment rate. The job openings data doesn’t set off alarm bells, but the trends are going lower. The large dashed line is nonfarm hires, and you can see that’s already below 2019. Is that labor market weakness? Maybe…

Even the unemployment data is confusing, with the unemployment rate for ages 20-24 rising (especially among men), but the rate for ages 25 to 34 falling.

Are entry-level jobs drying up? If so, why aren’t higher-cost jobs?

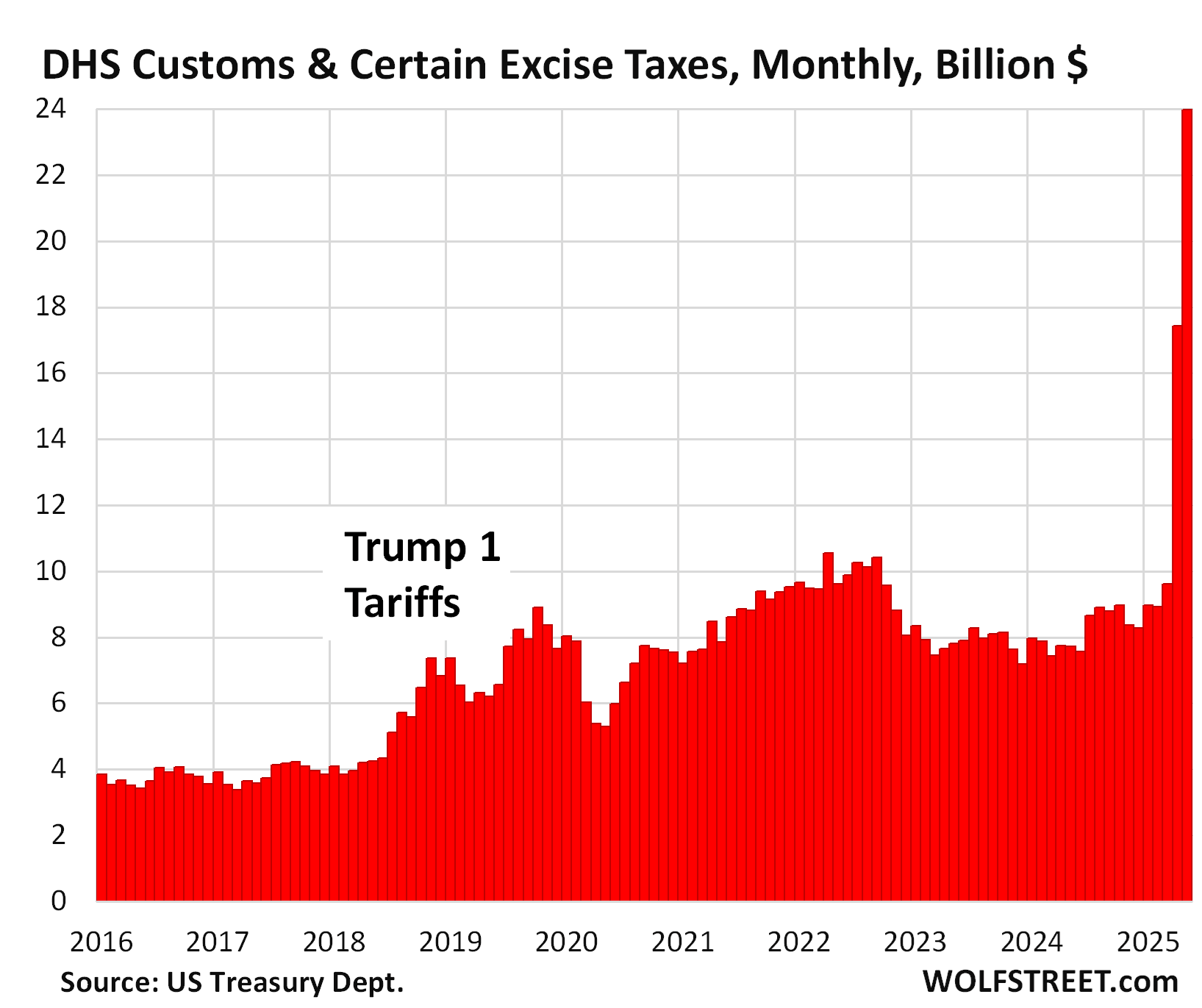

Tariffs Are Coming

We haven’t really seen the impact of tariffs on the economy, but we will. It doesn’t seem like there will be much change from the tariff rates announced on April 2, 2025 (which caused a market crash) and what will be implemented now or soon. And President Trump is likely emboldened because the market has shot to a record high, brushing off tariff concerns.

But tariffs are coming and will cost consumers and businesses about $200 billion annually. That’s only about 1% of GDP in the U.S., so it may not break consumers. But it will break some small businesses.

What we can’t deny is that there’s a lag between tariffs being announced and any negative (or positive) consequences. The products imported in March are likely on store shelves now, and tariffs weren’t considered in their pricing. But by September or October, we will have pricing adjustments based on tariffs, and the impact could be jarring for some products.

I think most investors think the tariff impact is behind us, but in reality, it hasn’t even started.

Stressed Consumers

Most of the big banks reported earnings last week, and they aren’t seeing major signs that consumers are in trouble. But I went back and looked at Jamie Dimon’s comments in March of 2007, and he didn’t see a financial crisis beginning less than a year later.

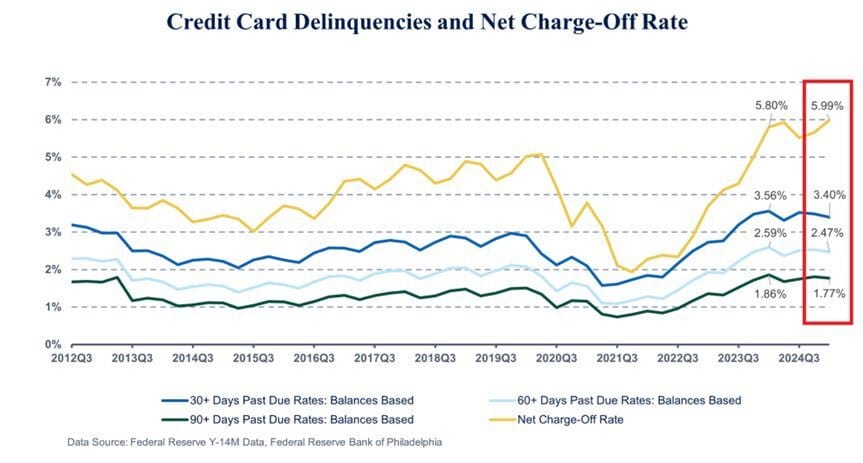

What we’re seeing is that credit card delinquencies are rising.

Auto loan delinquencies are at a 14-year high.

Housing could be a huge problem, but the data is even more confusing. I’m seeing homes sit on the market longer than I’ve seen since at least 2019, and almost every home cuts its asking price at least once.

Derek Thompson recently pointed out that some markets are in collapse while others are just fine.

Are economic conditions OK? Probably.

Would I be shocked to see us go into a recession in the next 12 months? No.

Rate Cuts, What Rate Cuts?

Another thing traders seem stuck on is the Federal Reserve cutting rates this year. The market is currently pricing in two rate cuts, which is seen as bullish for the market.

But why?

Inflation will likely be an issue in the second half of the year, and lower rates would make that worse.

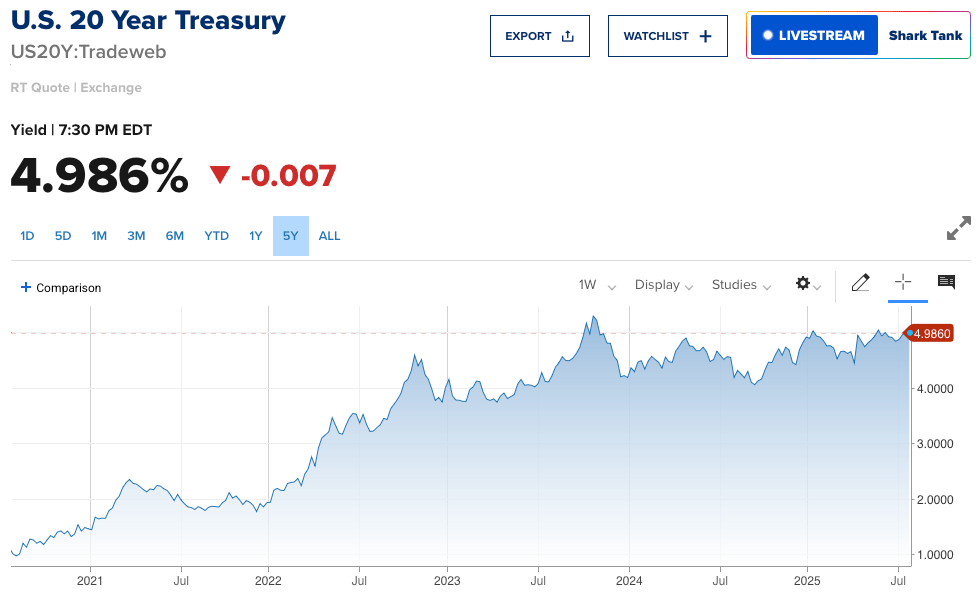

20 and 30-year treasuries aren’t giving us any indication that bond markets are expecting rates to stay low for long.

I think waiting for rate cuts will end badly, and investors should price in rates staying about where they are for the foreseeable future.

Add all of this up, and I’m worried about the market being priced for perfection. And I don’t want to be caught flat-footed if the market drops.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor, or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your research before acquiring stocks.