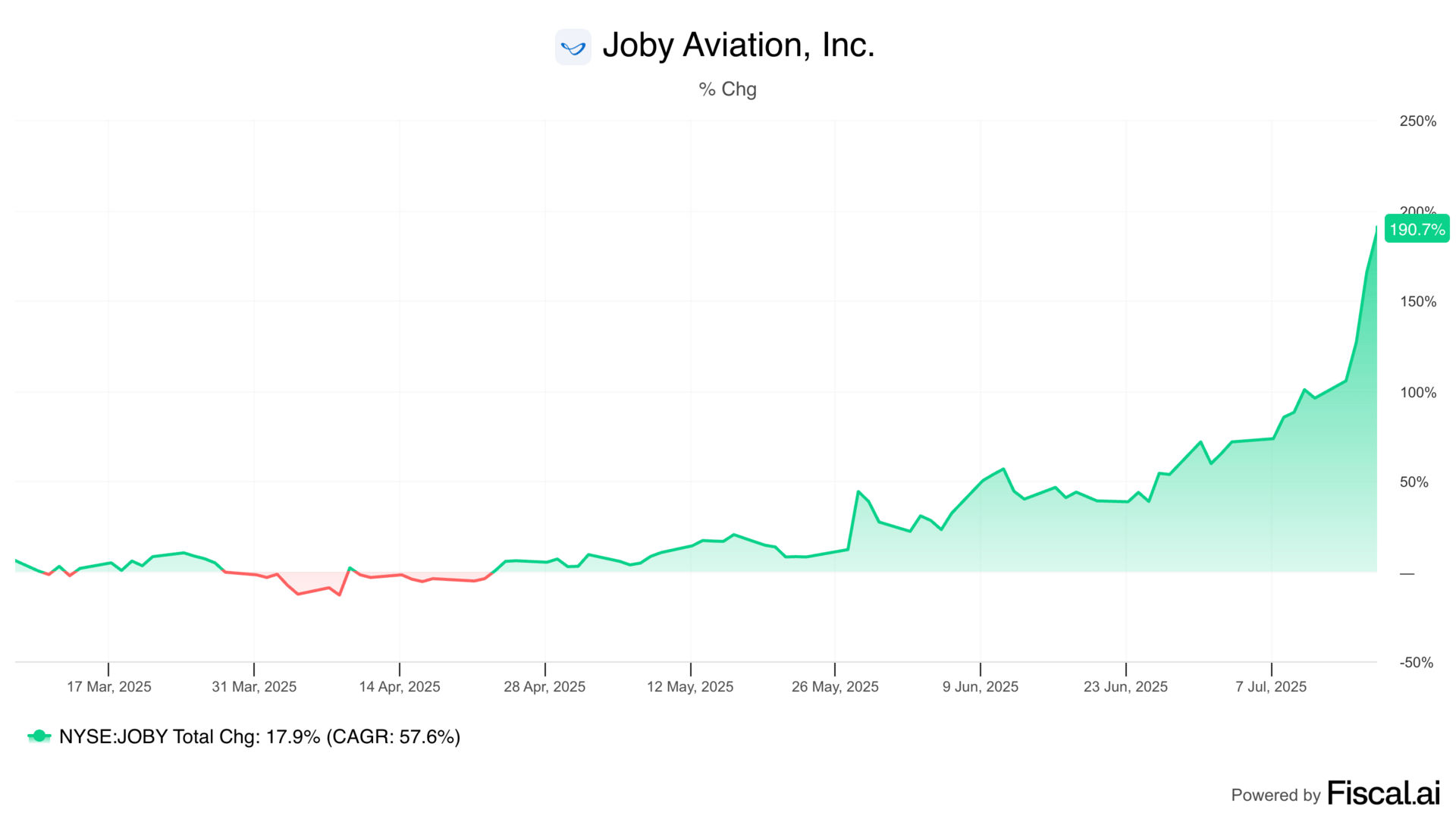

When the Joby Aviation $JOBY ( ▼ 3.52% ) spotlight was published on March 9, 2025, I didn’t think this would be a rocket ship. Like any Asymmetric Portfolio stock, there was a multi-decade thesis that certainly hasn’t played out in the last four months. However, the stock is up an incredible 190.7% since then, and I’m not going to complain about a stock I own going up.

Joby’s stock performance since the spotlight.

And this is what’s strange about the stock market. We don’t know when sentiment around a stock will change or when the market will see that the thesis we have on a stock is playing out. Joby hasn’t even launched commercial operations yet, but it’s moving in that direction, and the stock market thinks that alone is worth 191% more than it was a few months ago.

The stock’s move is a mix of news, speculation, and opportunity for management, who can de-risk the business if they want to. Let’s get to the latest and what I’m doing now.

Progress and Votes of Confidence

There are some small signs of progress for Joby over the last few months. None of these is a “BUY NOW” sign hanging on the stock, but stack up enough good news and eventually the market notices.

Flight Progress

In April, Joby announced piloted flights with full vertical to horizontal transitions.

Joby purposefully set out to demonstrate remotely-piloted transition first, completing the first transition of a full-scale, prototype aircraft in 2017. The Company has since completed more than 40,000 miles of test flights across multiple aircraft, including hundreds of transitions from vertical take-off to cruise flight as well as more than a hundred flights with a pilot onboard in hover and low-speed flight.

Since completing a landmark first full transition flight with a pilot onboard on April 22, 2025, the Company has completed multiple transition flights with three different pilots at the controls, as Joby becomes the first company to routinely perform inhabited testing of an electric air taxi from hover to wingborne flight.

In May, Joby flew two aircraft at once. This may seem like a small milestone, but it’s another checkbox the company needs to complete before FAA approval and full launch.

We should see more flight testing milestones completed in the coming months as the company moves toward full FAA approval.

Toyota Investment

In May, Joby closed a $250 million investment from Toyota, the first such tranche with a second $250 million expected later this year. Toyota got a sweetheart deal at $5.03 per share and now owns 15.3% of the company.

The stake is big enough now that investors are viewing Toyota as something of a backstop if Joby needs more money, which I’ll get to in a moment.

Dubai Launch

Late in June, Joby announced it had delivered an aircraft to Dubai and had begun piloted flights to begin commercial market readiness work.

Dubai is the first place Joby will launch, likely ahead of full FAA approval, and getting months of testing in the hot, dry environment will be great learning for the Joby team.

Right now, Dubai plans to have four vertiports for Joby’s air taxi network, but I wouldn’t be surprised if that expands quickly if successful. Flights to other emirates could be in our future as well.

Scaling Up

This week, Joby announced an expansion of its Marina, CA, facility to 435,000 square feet and increased capacity to 24 aircraft per year.

This is on top of the Dayton, Ohio, facility that will eventually have a 500-aircraft capacity when it’s completed.

We don’t have timelines for each facility, beyond an expectation that Joby will build about one aircraft each month this year. But you’re seeing the groundwork being laid for scaling this to a significantly larger business.

Hydrogen Progress?

On Saturday, I covered Joby’s reported 9-hour hydrogen-powered flight. The near-term product for Joby is a battery-powered aircraft with limited range of max 150 miles, but the long-term potential is to put a hydrogen fuel cell in the aircraft and increase that range to several hundred miles.

Joby completed a 523-mile flight last year, powered by hydrogen, so we know this is on the roadmap, and when you combine longer range with autonomous flight, the potential for the business increases dramatically.

Striking While the Iron Is Hot

I mentioned in the spotlight and Joby Aviation and an Intro to Manifest Destiny Investing that I would be more bullish on Joby if the stock price went up. That may sound counterintuitive, but we know Joby will likely need to raise more capital, and a higher stock price both keep capital markets open and make each capital raise less dilutive.

In a best-case scenario, management can reduce execution risk and expand the potential addressable market by making the vision bigger with more capital.

Tesla did this to great effect, convincing investors the “Gigafactory” would be the growth driver, and then autonomy would be huge, and then robots and AI would be an even bigger market. Each came with capital requests that the market happily funded.

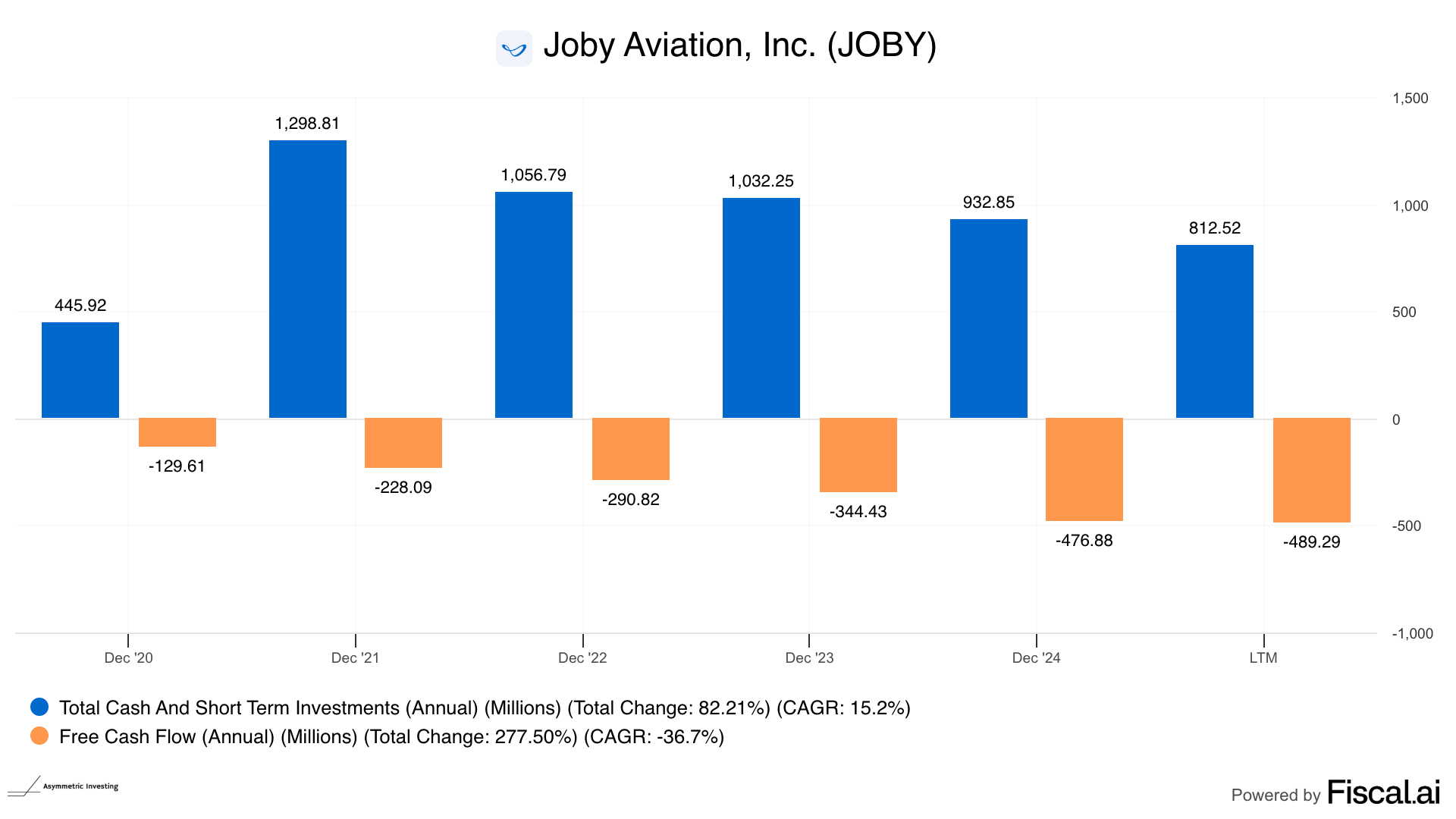

Joby Aviation has a decent balance sheet with over $1 billion in cash (after a $250 million investment from Toyota in May), but that’s only enough to fund about two years of operations at the current burn rate.

How does Joby’s risk profile and addressable market change if the company raised another $1 billion tomorrow? I think it would be positive for both.

And a raise that big would be less than 10% dilutive at the current stock price.

I think now is the time to de-risk the business and go after the higher market, stronger, more defensible business model (#3 below) of owning and operating an air taxi service. Here’s how Paul Sciarra explained the company’s options:

As we look ahead, we see 3 distinct paths to generating revenue, each of which provides a different strategic opportunity for the business.

First, we have a direct sales model for defense applications and for businesses who want to own and run their own aircraft. This path enables us to optimize for near-term cash, including prepayments that may precede certification.

Second, we have markets where we do not plan to be involved in operating the air taxi service directly, and instead, we may work with partners to deliver that service. We see this model applying primarily outside of the U.S., for example, in Japan, where we've partnered already with ANA and Toyota. Efforts like this may involve joint ventures or include sales or leases to a foreign subsidiary. Working with these partners allows us to leverage local expertise and relationships, and it presents opportunities for growth while limiting our capital commitments and derisking our go-to-market.

Third, we have our direct-to-consumer path, where we own and operate the air taxi service ourselves. This option is more capital intensive, but we believe it has the potential to deliver higher margins over time and a stronger, more defensible market position. And here, we are working with strategic partners to generate demand, and build out necessary takeoff and landing locations in key markets, working with industry leaders such as Delta, Uber and Virgin.

In 2021, when the market was hot, high-risk companies should have raised enough cash to survive for years. But many didn’t. Joby has the opportunity to strike now, de-risking the business, potentially pushing forward capacity expansion, and enabling a more capital-intensive business model with the higher ROI available. I would love to see management get aggressive while they can.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor, or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.