The beauty of internet businesses is the marginal cost to serve the next customer is effectively zero. For example, Netflix can add millions of new subscribers in a quarter without costs rising or being limited by capacity (like a manufacturer like Tesla might be). This results in almost uncapped profit potential.

The problem with internet businesses is customers don’t necessarily stick around for long. Not only is competition only a click away, but it’s easier than ever to cancel the subscriptions that make subscription and software as a service (SaaS) businesses so attractive and profitable.

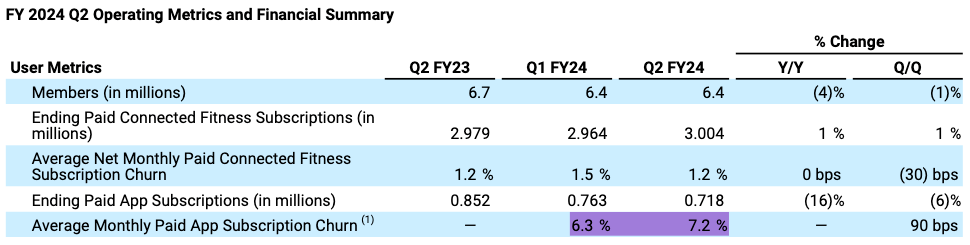

Peloton is running into this challenge right now as it attempts to be more of a fitness content business than a hardware business.

LTV to CAC

There’s a concept in finance known as LTV to CAC. Companies try to calculate the long-term value (LTV) of a subscriber or customer and then compare that value to the cost of acquiring customers (CAC). As long as LTV/CAC is over 1, a company can grow profitably.

There are many inputs to LTV, but the big ones are how much a customer is paying per month and how quickly they churn from the business. In a subscription or SaaS business, the key metrics are:

Subscription price

Churn - monthly rate of cancellation

The impact of price changes is clear, so I’ll focus on churn. A business like Netflix has about a 2% churn rate and that’s very good for a subscription business. Peloton’s app churn rate was 7.2% last quarter. Yikes!

Churn: The LTV Killer

Churn is arguably the most important factor in a subscription business — even more important than price. If churn is low, growth can be almost infinite with a low marginal cost structure. High churn will kill a business.

Let’s build an example that will show Peloton’s challenge.

Subscription with a $25/month price

LTV is calculated as average 2-year revenue * 70% gross margin

Customer Acquisition Cost is $200

Below is a chart of the blended average monthly subscription rate paid by a customer over two years at varying churn rates. At the end of Year 2, a 2% churn rate has the average customer paying $15.71, and an 8% churn rate averages just $3.67.

2% Churn

$480 Total Revenue

$336 LTV

$136 2-year profit

4% Churn

$390 Total Revenue

$273 LTV

$73 2-year profit

8% Churn

$270 Total Revenue

$189 LTV

$11 2-year loss

The 2% churn business will be profitable at the end of two years. Now, management has options. They could increase the CAC they’re willing to pay to grow the business, raise prices to increase LTV, or just run the business profitably as is.

Move to the far right and the answers get harder. Remember, these projections will be made after a few months of churn data is available, but management won’t know the true LTV of a cohort of customers until the end of Year 2. By then, a business is bleeding cash.

Peloton’s Treadmill

Returning to Peloton, the company’s LTV/CAC appears to be about 1, or breakeven, which makes it tough for the company to get to free cash flow positive. Peloton is on a customer acquisition treadmill.

Based on fiscal Q2 2024 results, the company has a high churn rate among app subscribers (this is where we want to see growth).

And there doesn’t appear to be any real momentum generating net subscriber additions.

Free cash flow is getting close to breakeven, but without subscriber growth driven by an LTV/CAC ratio well above 1, the company is going nowhere.

CEO Barry McCarthy acknowledged the problem on the earnings call and said growth hadn’t been the biggest priority until recently.

We've been busy saving ourselves the last 2 years. And now we're positioned to invest in innovation

CFO Liz Coddington acknowledged that LTV to CAC is above 1, but it doesn’t sound like it’s impressive.

When we look at our media spending, we are trying to make sure that our media spending is efficient and drives an efficient LTV to CAC, definitely over one. Ideally, we want to be in the 2x to 3x range. We were not there for Q2, but we were above 1, and our goal is to move towards more increasing media efficiency.

Is Peloton an Uninvestable Treadmill Stock?

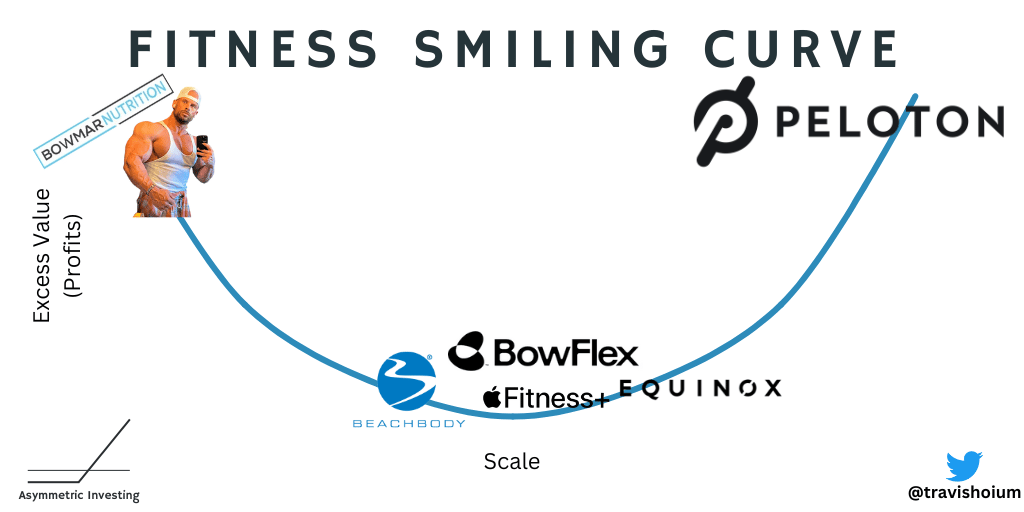

Peloton is still in the Asymmetric Portfolio because I think it’s clear the company is the winner in streaming fitness content at scale. You can see that visualized in the image below and public results show that Beachbody and BowFlex are in an even worse financial position than Peloton. And let’s be honest, when was the last time you heard about Apple Fitness+?

But it’s also possible winning in the streaming fitness market won’t be enough to matter for the stock. The market simply may not be big enough to matter.

Right now, Peloton appears to be on a customer acquisition treadmill and management’s guidance of two quarters of flat subscriber numbers ahead doesn’t instill confidence that will change.

I’m not selling Peloton yet, but I’m not buying more and this is a huge reason why. It’s possible Peloton simply fades to oblivion in the portfolio.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.