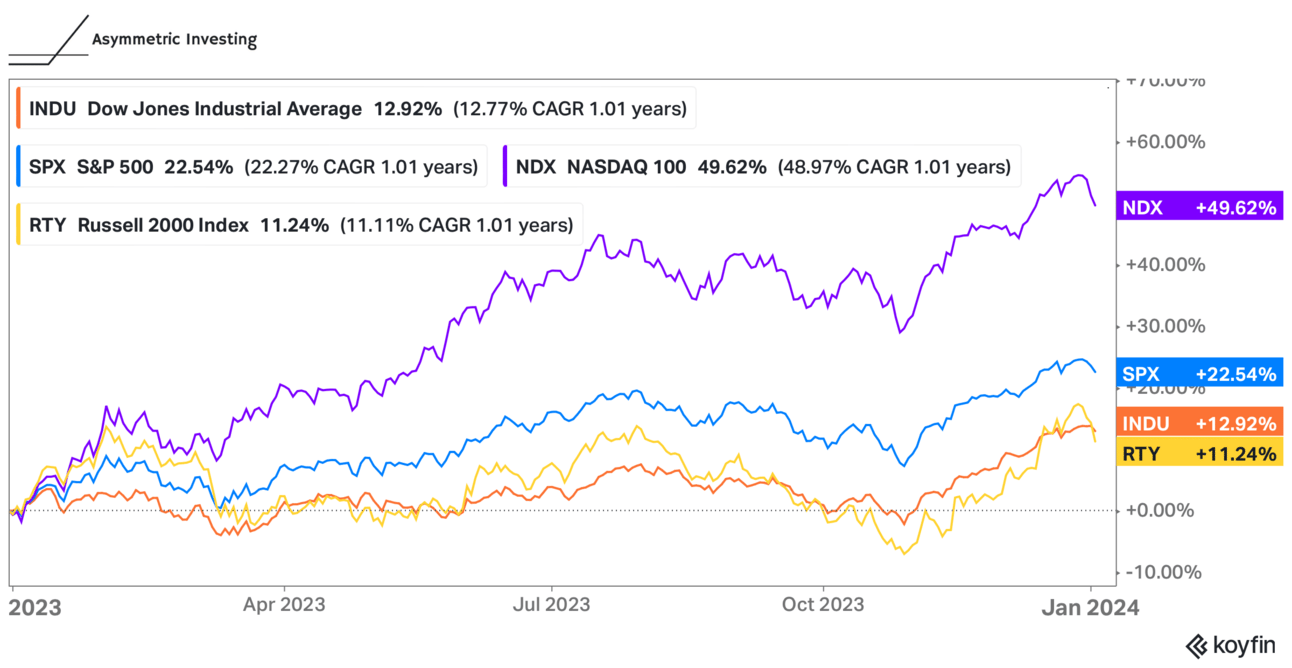

2023 was a great year for investors…as long as they invested in the “Magnificent 7” stocks.

Outside of those seven rocket ships, the market was pretty ho-hum.

The stock market is concerned about interest rates heading into 2024, but I think there are different trends investors should watch. There are underappreciated pockets of the market and values emerging for asymmetric investors.

Here are the trends to watch in 2024.

Artificial Intelligence & the New Metaverse?

Remember late in 2021 when the future of work and play was moving to the metaverse? It was such a hot trend that Facebook — one of the most successful companies of the last two decades — changed its name to Meta Platforms.

Artificial intelligence feels a little metaverse-like heading into 2024. Maybe I’m a curmudgeon in this view, but I’ve tried a lot of AI tools and never thought, “This is going to change everything.” And the magic of AI seems to wear off after about 5 minutes.

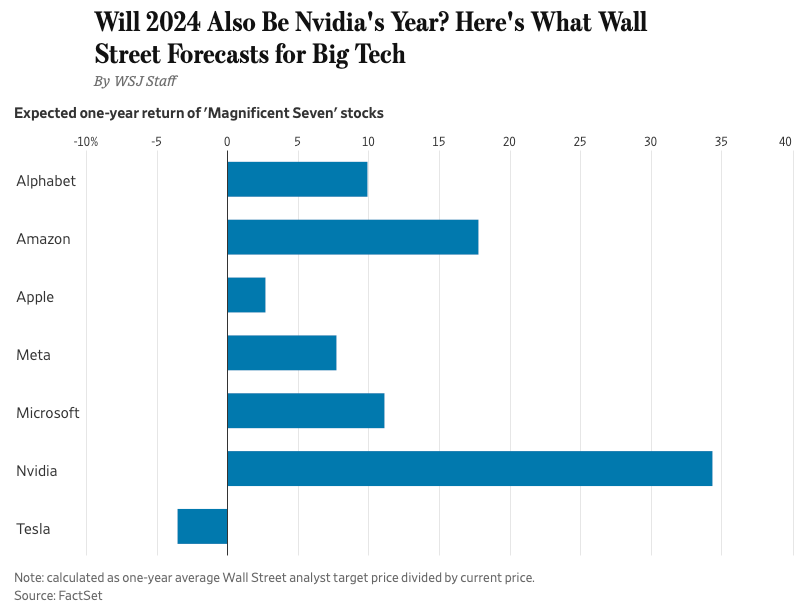

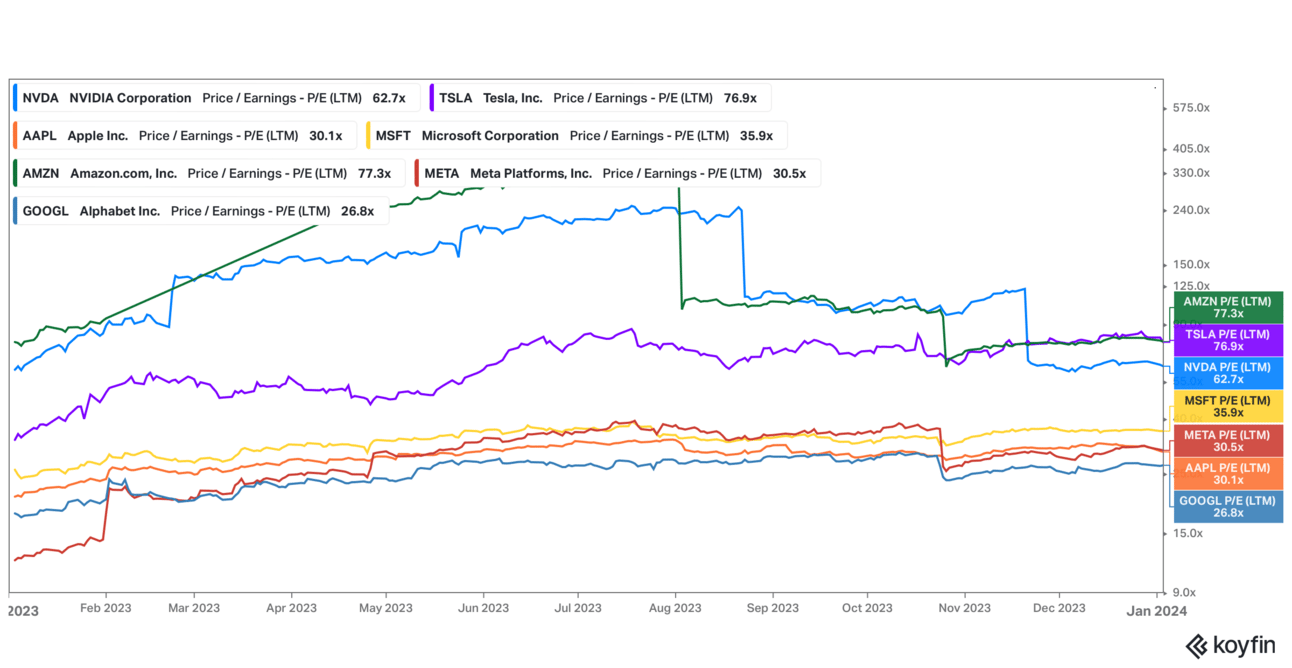

Yet, AI seemed to drive the Magnificent 7 to new heights as the market realized this was a sustaining innovation, not a disruption to big tech that was going to be the biggest beneficiary. Multiple expansion (not improving business) drove their stocks higher with the average P/E ratio of the Magnificent 7 rising from 35.9 at the end of 2022 to 50.1 at the end of 2023 (FYI, NVIDIA’s P/E was down in 2023, so that’s not what drove this increase).

Two things can be true at once.

Artificial intelligence will play a large role in work and technology in the future.

Very few individual companies will see a significant financial benefit from artificial intelligence.

It certainly looks like artificial intelligence is being commodified before most people even know how to use it. Given the different business models in tech, someone is likely to “scorch the earth” and simply give away the AI product any other company spent millions/billions to build.

OpenAI is seen as a leader in AI models and has a deep partnership with Microsoft, so Meta open-sourced their models.

Midjourney had success with image AI, so ChatGPT, Google, and others started giving away image generation AI.

NVIDIA is making a fortune on AI chips, so of course Intel, AMD, Microsoft, Google, Amazon, and every startup under the sun is making a custom AI chip.

5 years from now, it’s unlikely you will know who made the foundational model or AI chip you use to find the closest ice cream store.

What will matter is where you ask AI the question…just like it is on the internet today. Where’s the value added in doing the same thing in a slightly different way?

At the very least, in 2024 I won’t pay a premium for artificial intelligence hype that may not materialize. If there’s a use case that’s a trillion-dollar market, you have my attention. But I have yet to find it yet.

I’m going against the grain, but AI in 2024 looks a lot like the metaverse in 2022.

Gif by abcnetwork on Giphy

Horizontal is the New Vertical

The last 15 years in technology were about building scale in vertical product segments or platforms. For example, Apple’s strength isn’t just in making the iPhone, it’s in combining the iPhone with custom chips, the App Store, cloud storage, and more into one ecosystem. You see similar dynamics at Microsoft, Amazon, Meta, and Alphabet.

However, the benefits of being on one platform or another are fading as smartphones improve more slowly and regulators demand more interoperability. And big-tech is diluting itself by adding more half-hearted services (Apple TV, Apple Music, Apple Fitness+, Amazon Prime Video, Threads, etc).

That will allow more companies to focus their energy on a niche, creating a horizontal business that works on all devices.

Netflix was an early horizontal leader in streaming, so that’s the model to follow. It’s no coincidence Netflix had a button on nearly every TV purchased over the past 15 years. It wanted to be everywhere for everyone.

Companies like Spotify, Peloton, Dropbox, and Zillow are examples of companies with horizontal businesses in very big and valuable markets. I think we’ll see them both grow and improve financially as their offerings prove differentiated in the market. Not to mention, they’re getting leaner as the “free money” era ends.

Industries tend to oscillate between vertical and horizontal structures over time. This is a normal cycle and I’m leaning into it with a lot of Asymmetric Investing stocks.

As the age of vertical integration comes to an end, focused horizontal services companies will gain market share in 2024 and generate better returns than big tech.

Cash is King

Hidden in the rising stock market was a drastic underperformance for crappy businesses with bad balance sheets. Unlike 2020 and 2021, hype was no longer enough to drive stocks higher, a real business was needed.

In 2024, cash will be king for companies that want to grow aggressively. Cash gives companies the flexibility to invest in the core business, acquire competitors, or simply ride out a downturn that decimates an industry.

Coinbase — the top-performing stock in the Asymmetric Portfolio — was a great example of that in 2023. Cash on the balance sheet allowed management to outlast FTX and Binance, buy back debt for cheap, and fund growth initiatives.

In 2024, investors should focus on:

Buying companies with great balance sheets

A net cash balance is preferred

FCF positive is a near must-have

Sell crappy companies

It’s getting harder to raise money for money-losing companies

Look for management teams being opportunistic with cash

Ex. GM buying back ~20% of outstanding shares in December

Not only can cash be used as a weapon in business, it generates more cash by doing nothing. And with interest rates over 5% for short-term debt, there’s an opportunity to make money just by having a good balance sheet.

Or if you’re Airbnb, you can make ~$500 million per year by simply holding ~$10 billion of customers’ deposits for them. Not a bad gig if you can get it.

Expect the Unexpected

Remember this headline in October 2023?

To start 2024, no one is expecting a recession anytime soon.

I don’t know if a recession is coming, where rates will go, or if the market will go up or down this year.

Be prepared to adapt when the unexpected arrives. Because the one thing we can count on is 2024 looking very different from 2023, despite Wall Street’s best attempt to make it look exactly the same.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.