To say the last week has been unusual on the stock market is an understatement. There was an election and investors seemed to buy every speculative asset under the sun under the thesis that “yada, yada, yada, 🚀.”

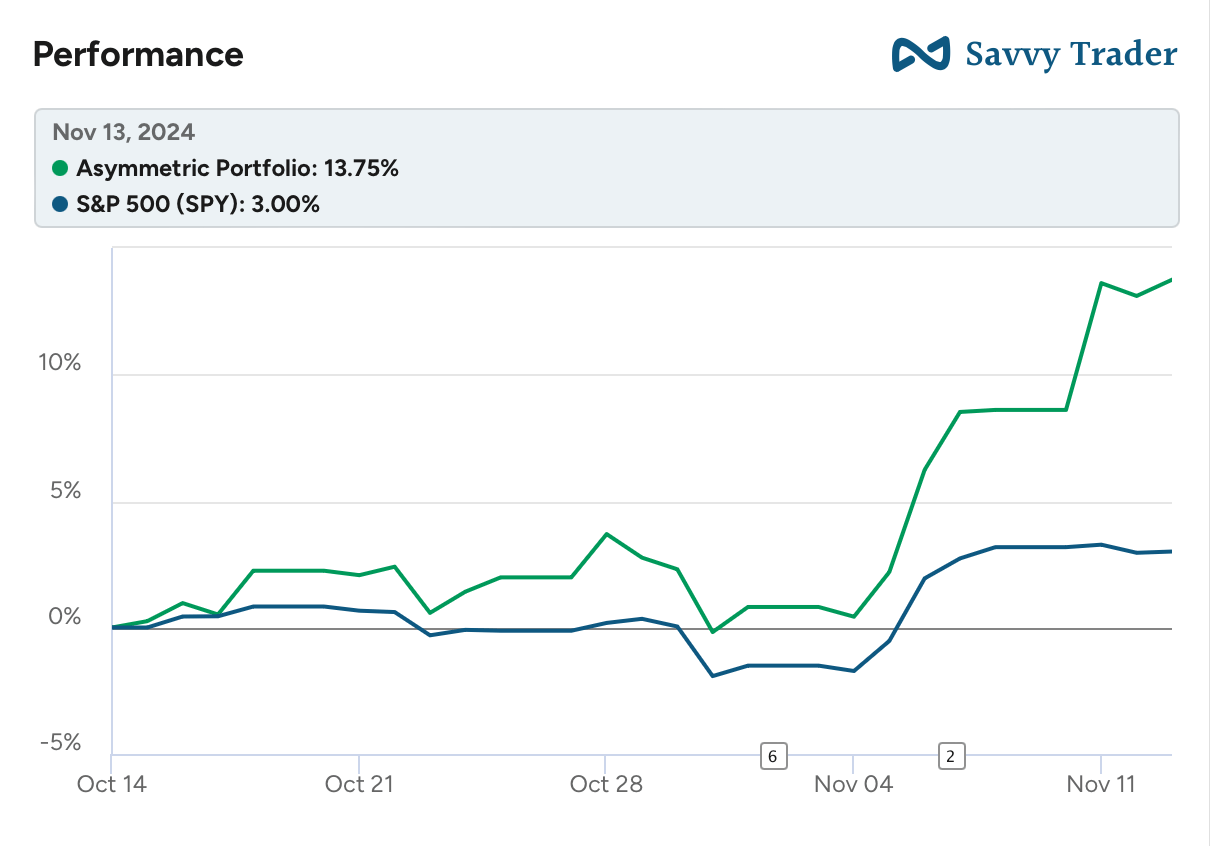

This bullishness has helped the Asymmetric Portfolio, which is outperforming the S&P 500 by a whopping 10.75% in the past month. That’s an outlier month, but what what should I do about it?

While I’m skeptical of a lot of the newfound bullishness in the market, I’m not suddenly a bear. I may be more skeptical of paying 60% more for a certain stock or want to wait and see how a policy plays out, but the general theme of “buy and don’t sell” still holds in the Asymmetric Portfolio. So, I’m not selling anything.

I reminded myself multiple times this week: This is why I have frameworks.

Know Thyself

Any investor needs to know their strengths and weaknesses and find ways to augment the former and limit the latter.

One of my “superpowers” as an investor is the ability to be aggressive when the market is down. I’m naturally disposed to being greedy when others are fearful.

But the reverse isn’t true.

When the market is greedy, I’m uncomfortable. I don’t see value in companies I like. I don’t see future tailwinds from multiple expansions. I see risk more clearly and it can outweigh potential reward.

This disposition isn’t bad, but it’s taken me 29 years of investing to understand it.

To combat these flaws, I built frameworks to limit my mistakes.

And I’m putting those frameworks to work this week.

Asymmetric Investing has a freemium business model. Sign up for premium here to skip ads and get double the content, including all portfolio additions.

200% Revenue Growth: Be Part of Their Global Expansion

This is a paid advertisement for Med-X’s Regulation CF Offering. Please read the offering circular at https://invest.medx-rx.com/

Fast-growing product expanding globally – invest now

200% revenue growth in five years

Entering 41 international markets, major partnerships

Why I’m Fearful When Others Are Greedy

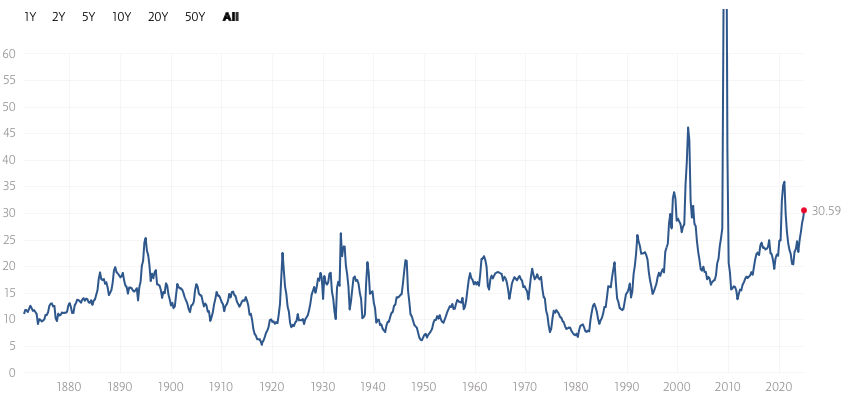

Before I get to what I’m doing, let’s look at why I’m not particularly excited about this market overall. The P/E ratio of the S&P 500 is higher than at any point outside of the 2000 dot com crash, the financial crisis, or COVID.

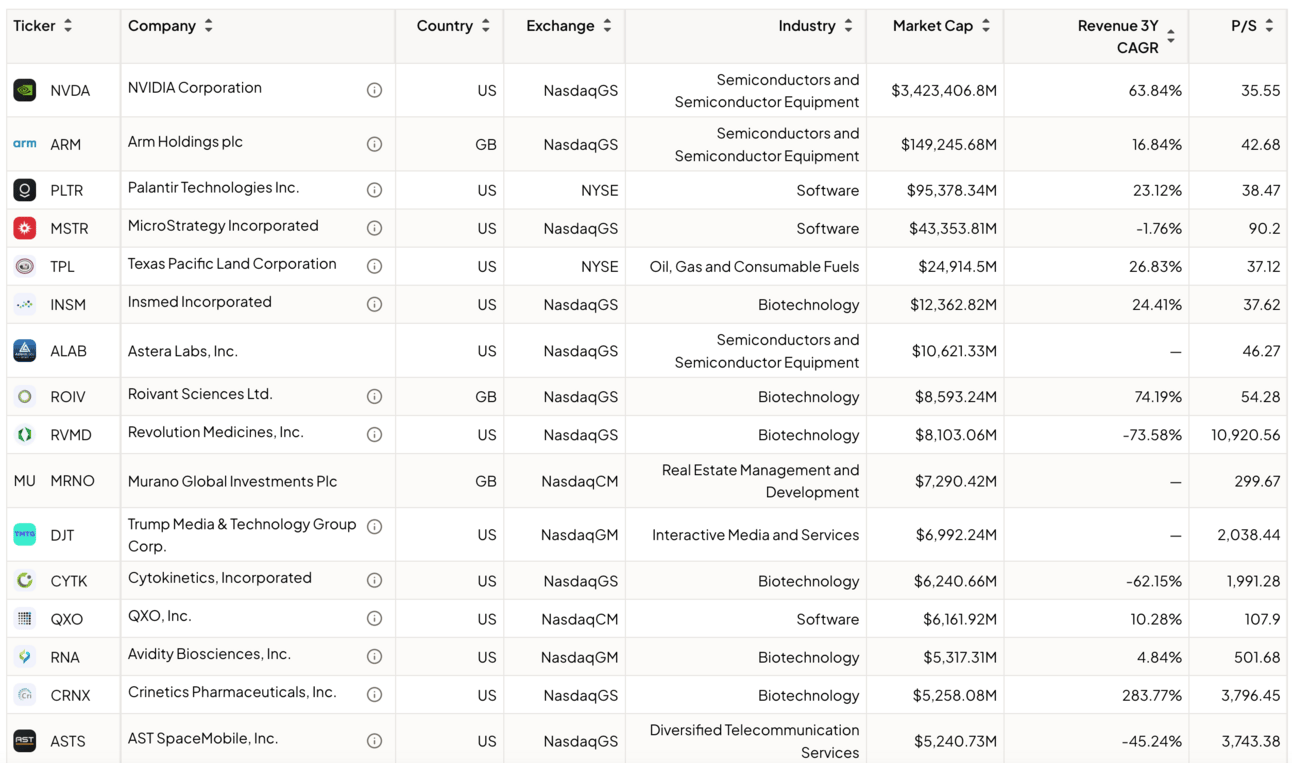

There are currently 16 stocks with a market cap of over $5 billion and a price-to-sales multiple over 30, including the most valuable company in the world.

And a dog coin that happens to have the same ticker as the proposed Department of Government Efficiency (DOGE) has increased in value by $30 billion since the election because…memes.

Logically, none of this makes sense.

Then I put how I invest, what I own, and the Asymmetric Universe of stocks I cover into perspective.

Perspective, Perspective, Perspective

One of the reasons I get uncomfortable in a rising market is stock gains are generally driven by multiple expansions (rising stock price and no change in the underlying business), not a business improvement.

Business growth and margin expansion are measurable and predictable. Multiples are not!

What I’m reminding myself this week is simple: Multiple expansion is one of the four reasons stocks go up and they’re a feature, not a bug, of Asymmetric Investing.

I like to ask this question:

Based on the current valuation, are multiples likely to be a tailwind or a headwind?

This week we were riding tailwinds. Valuation multiple tailwinds are part of an asymmetric thesis!

And those tailwinds aren’t anywhere near bubble territory for even the hottest Asymmetric Universe stocks.

On a portfolio-weighted basis, here are the valuation stats of the Asymmetric Portfolio:

Price to Sales (forward): 3.65

Forward P/E: 34.0

3-Year Revenue CAGR: 24.1%

So, the portfolio is trading for a slightly higher P/E multiple than the market average and is growing about 2.5x faster (S&P 500 revenue growth is about 10%).

With some perspective, maybe the stocks in the Asymmetric Portfolio aren’t overvalued after all.

What I’m Doing

Bringing this back to frameworks, I have 2 frameworks I’m leaning into this week.

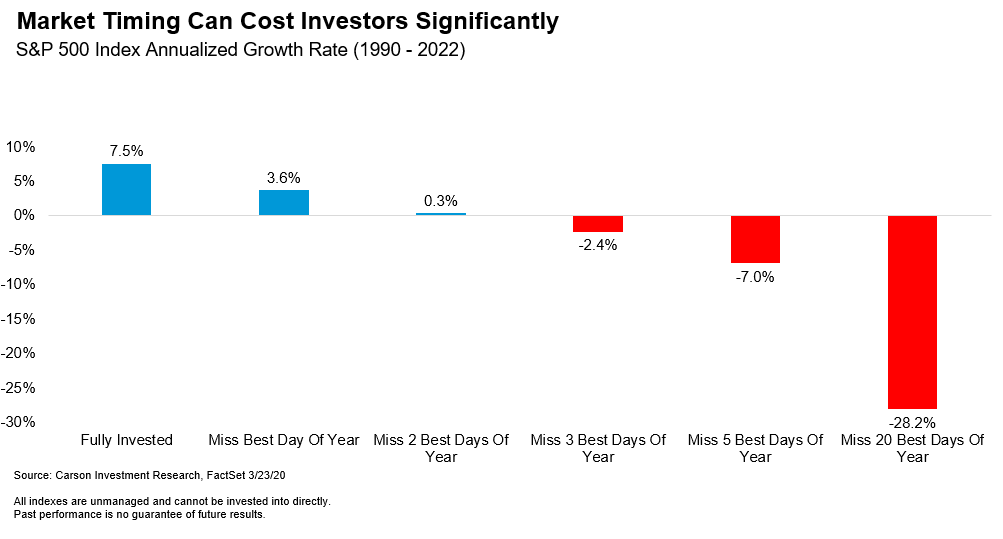

Stay fully invested

Don’t sell

As this study from FactSet shows, missing just the top few days of returns can be costly to long-term returns. I’m not going to start timing the market now.

Why am I not selling winners or stocks that have popped? See the above returns AND that’s not how asymmetric returns are generated.

I need to frame this one:

I’ll be back tomorrow with some earnings takes after these massive moves. There are two double-digit moves higher on earnings today, so there will be lots to discuss.

Hopefully, this email helps you understand my mindset in this market. I’m cautious, but reminding myself of the frameworks that work for asymmetric investing. Trust the process.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.