Welcome to the final post of 2023! 🥂

Asymmetric Investing will be off December 25 - January 1, but expect big updates to start on January 2, 2023.

I hope you had a wonderful week!

In this space, I usually talk about the week that was on Wall Street, but today I want to look back a little further to the full year. You can see the S&P 500 and the Nasdaq 100 both had a great year, helped by a boost over the last two months.

I’ll get to where most of these gains came from below.

What's Ahead

Before we get to this week’s story, I want to share one of my favorite newsletters, Carbon Finance!👇

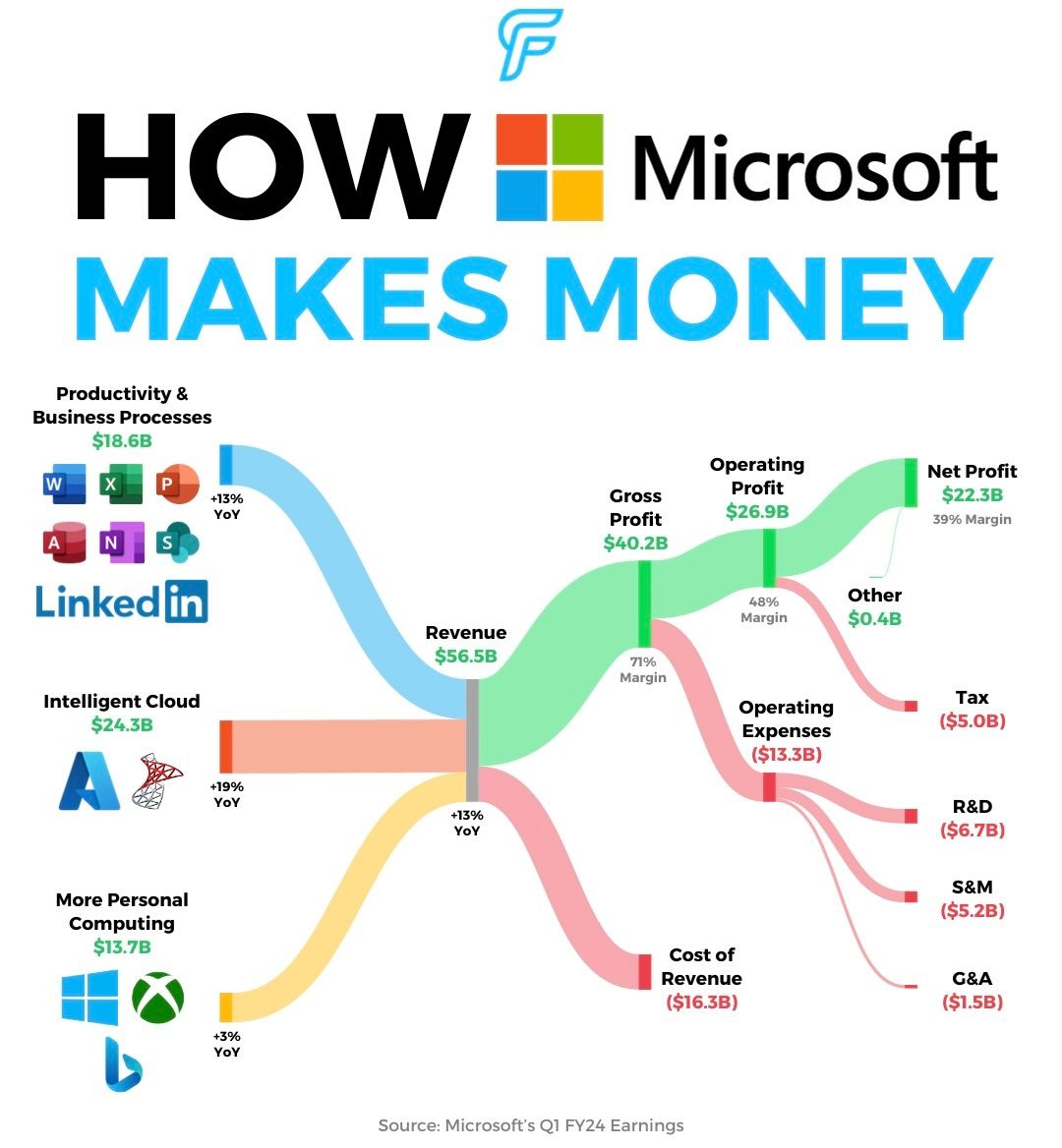

Don’t you love this infographic?

My good friend Carbon Finance sends out a weekly newsletter with simple, data-driven visuals that cover the most important headlines in investing.

The best part is it’s completely free and only takes 5 minutes to read.

In Case You Missed It

Here’s some of the content I put out this week. Enjoy!

Celsius Holding Spotlight: The latest spotlight article is out and it covers one of the fastest-growing companies on the market. It’s not a cheap stock, but Celsius is a monster in the beverage business.

Podcast Under Monetization: How can Spotify 10x revenue? The answer is in advertising and a 10x isn’t outlandish because Facebook increased revenue more than 10x by improving their ad business.

Coinbase’s $300 Trillion Opportunity: Coinbase is building products for the debt market and that’s an opportunity 10x bigger than equities, much less cryptocurrencies.

Bill Gates Has $34 Billion in Just 5 Stocks: Where does the Gates Foundation have its money? Here’s a look.

7 Stocks to Rule Them All

2023 isn’t over yet, so it’s not yet time to review the Asymmetric Portfolio’s performance quite yet.

But as I start to look at the index comparisons with a week to go, they’re a little difficult to wrap your head around. The Asymmetric Portfolio started on May 1, 2023, and since then the portfolio is up 9.76% compared to an 18.35% total return for the S&P 500. Yikes!

Compare it to the Nasdaq 100 (see above) and the comparison is even worse.

But are the S&P 500 or Nasadaq 100 the best comparisons?

Maybe not given what a weird year 2023 was.

2023 has been marked by a massive divergence between the Magnificent 7 and the Modest 493. If you aren’t familiar with the market’s latest buzz term, the Magnificent 7 are Apple, Alphabet, Amazon, Microsoft, Tesla, Meta Platforms, and NVIDIA.

You can see below that they’ve not only beaten the market overall in 2023, but these seven stocks have accounted for nearly all of the S&P 500’s gains.

The distortion is even more evident in the Nasaq 100, which adjusted its index weighting in July after the Magnificent 7 became 55% of the index weight.

There are several reasons for the outperformance of the Magnificent 7, but the biggest is plain as day: Multiple Expansion!

I’ll take my lumps in (likely) underperforming the S&P 500 and Nasdaq 100 in 2023 because the Asymmetric Portfolio wasn’t built on buying the biggest companies and hoping they get bigger.

As a constellation prize, it looks like I’ll outperform the S&P 493.

This overweighting to seven stocks will likely come out in the wash long-term and that’s why I’m not too worried about it. I’m comfortable buying smaller companies with 10x potential and riding the ebbs and flows of the market.

Looking forward to 2024, the comparison against the S&P 500 may work the opposite way if the Magnificent 7 sees multiple contractions, which will happen eventually.

This is just another wave (maybe a bubble) in the market. Ride it out and keep on swimming.

I’ll be here to do just that in the new year.

Thank you for being an Asymmetric Investing subscriber. If you want all of my stock deep dives, stock updates, and access to Asymmetric Portfolio trades before I make them you can subscribe below. The premium subscription is what makes this newsletter possible. I appreciate the support.

What do you want more of?

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.