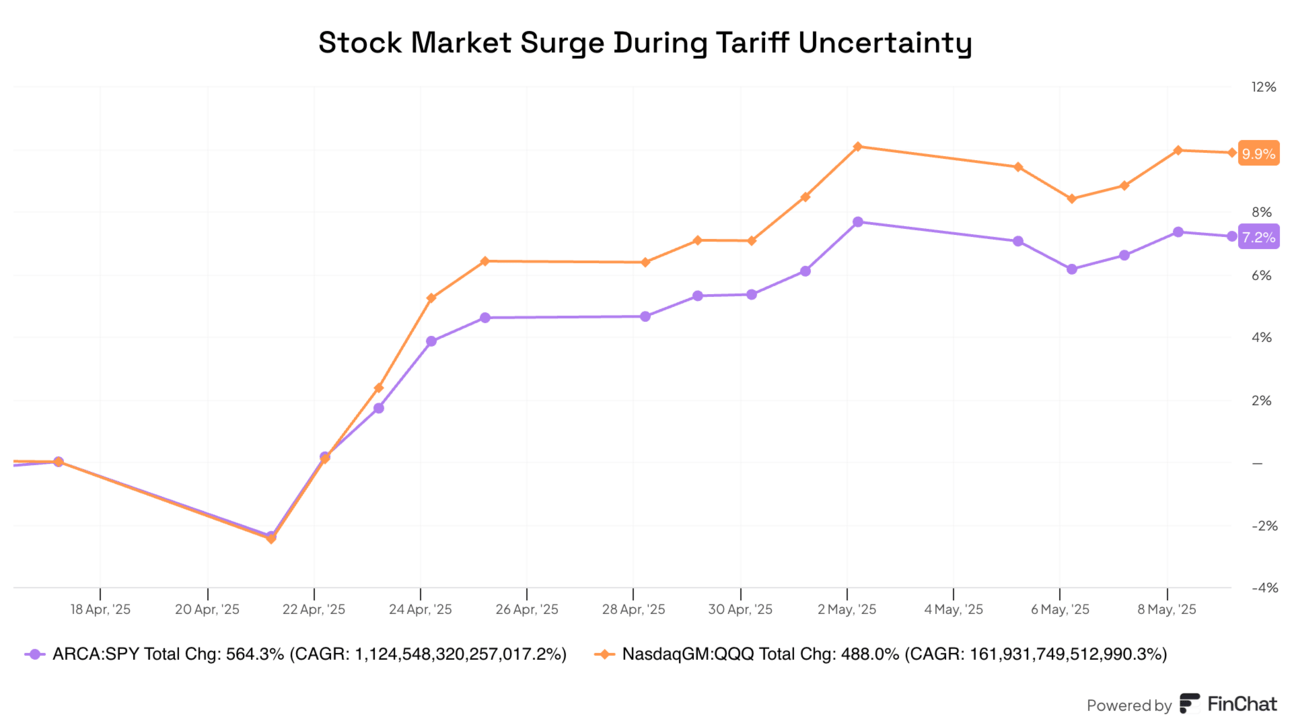

I’m finishing this article late on Sunday, after the news broke that the U.S. is going to announce some kind of trade deal/framework/handshake tomorrow morning. It’s already shaping up to be a wild day of trading tomorrow with some big moves higher, based on overnight trading.

What’s been so interesting watching the market the last few weeks is how little concern there was about the very real chance stores will start being short on some items in just a few weeks. Tariffs have brought unprecedented uncertainty to U.S. businesses, and the higher costs and risks of more tariffs are sure to raise prices on everything from groceries to commercial construction.

But the market hasn’t seemed to care.

Why?

I’ll try to answer that below.

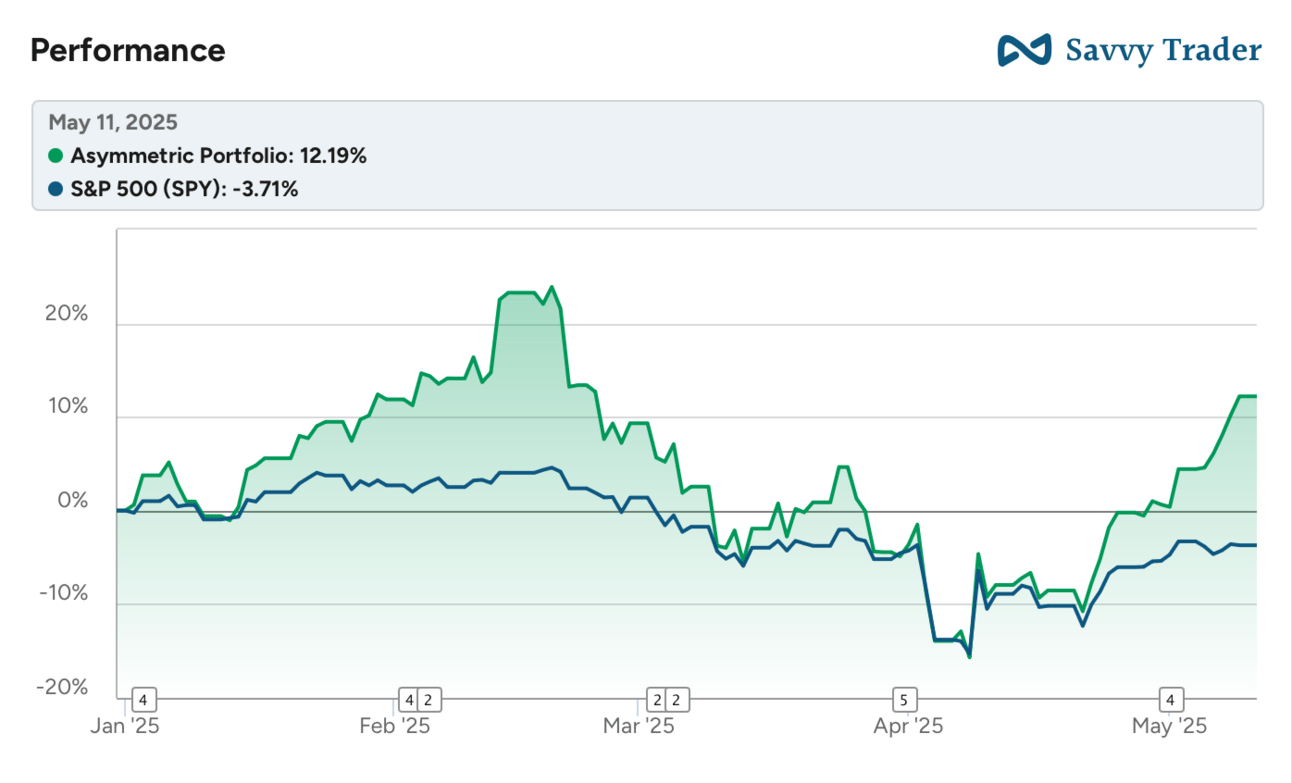

Last week, the Asymmetric Portfolio swung into positive territory for the year, and this week it surged to double-digit gains. Strong earnings reports from Hims & Hers, Crocs, Lyft, and Owlet helped the portfolio trounce the market, and (right now) it looks like the outperformance will continue tomorrow.

All of the charts you see here are easy to make, research like finding transcripts and insider buys is easier than ever, and you can even ask an AI about earnings transcripts. I can’t say enough how much easier it’s made my research, and you can start with 2 weeks free. 👇

In Case You Missed It

Here’s some of the content I put out this week.

The History of “Dying” Tech Businesses: The market thinks Google search is dead, but tech businesses don’t typically go to zero. The more likely scenario is search flatlining as AI becomes more commonplace.

Celebrating Big Investing Wins: There were some big moves from Asymmetric Portfolio stocks last week and I took time to celebrate some of the biggest gainers recently. Don’t forget to enjoy the wins along the way!

Hims & Hers Raises $1 Billion: Hims & Hers now has a warchest to go after the growing opportunity in healthcare.

Wall Street’s Long-Short-Term View

One of the strange dynamics on Wall Street is the conflict between the short-term nature of trading and the long-term nature of investing.

The short-term mindset is easy to see.

If a company misses analysts’ guess at earnings a stock will drop, even if management is demonstrating their long-term strategy is working.

A new competitor entering the market can cause a stock to drop, even if the threat isn’t hurting their business. (see Hims & Hers stock when Amazon announced a telemedicine product)

This short-term mindset is visible on a daily basis and it’s what gives us an advantage as Asymmetric Investors. We can take advantage of short-term blips and buy long-term potential the market is missing.

But then we see times like this month where the market rises as people post charts like this, predicting empty shelves by Memorial Day. There’s turmoil and pain coming, which should impact markets negatively, right?

But it hasn’t.

That may be because the market’s focus isn’t on next week, it’s on next year.

We say it all the time, but the market is a forward looking mechanism.

Sometimes what the market is looking at is stupid, like whether or not analysts are raising earnings estimates or what interest rates are doing, but stock values are the present value of the expected future free cash flows. That’s the theory anyway…

So, why aren’t stocks down because of tariffs?

Someone on Twitter gave a theory that resonated with me (I can’t find the source but want to acknowledge this isn’t an original idea).

There are two likely scenarios long-term for the U.S. economy and markets.

Scenario 1: The bond market (maybe the stock market) freaks out, raising interest rates for the U.S. government, forcing President Trump to back down on tariffs. Long-term, that’s bullish for stocks.

Scenario 2: Tariffs remain high, but the U.S. economy is so resilient we trudge along and employment remains strong, wages go up, and there’s an economic boom driven by tariffs. Long-term, that’s bullish for stocks.

Despite all of President Trump’s irrationality when it comes to trade, any rational person would say that he’s not going to be so stubborn he’s going to drive the economy into a deep recession, or depression, just to make a point.

Eventually, he would give in, China would give in, or businesses would find a way to survive.

Q2 2025 may be bad for a lot of companies, but stocks are based on expectations for 2026 and 2027. By then, tariffs will be in the rear view mirror and the two scenarios above point to bullishness for investors.

It may not seem logical stocks are going up. Unless you think through the potential scenarios of this tariff gambit and then it’s entirely logical to be bullish long-term.

May 11, 2025: The Capitulation

And that leads us to tonight. The White House put out the following press release indicating, “substantial progress between the United States and China in the very important trade talks“ and the market has breathed a sigh of relief.

The worst-case scenario seems to be off the table and now we can focus on earnings again.

Did I mention how amazing earnings were for most companies in the Asymmetric Portfolio? If it weren’t for the tariff uncertainty, the numbers would tell you the market should be going higher.

Until the next short-term blip to capture the market’s attention.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor, or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your research before acquiring stocks.