The electric vehicle industry has been one of the biggest bright spots on the market over the past decade. Tesla $TSLA ( ▼ 1.4% ) is a $1 trillion company, Rivian $RIVN ( ▼ 3.94% ) is worth $16 billion, and even Lucid $LCID ( ▼ 5.48% ) is valued at $7 billion today. GM $GM ( ▼ 1.6% ) and Ford $F ( ▼ 0.63% ) are a paltry $51 billion and $46 billion, respectively.

But the “Big Beautiful Bill” is throwing a wrench in EV plans. And if history is any indication, the industry could go from boom to bust in a matter of months.

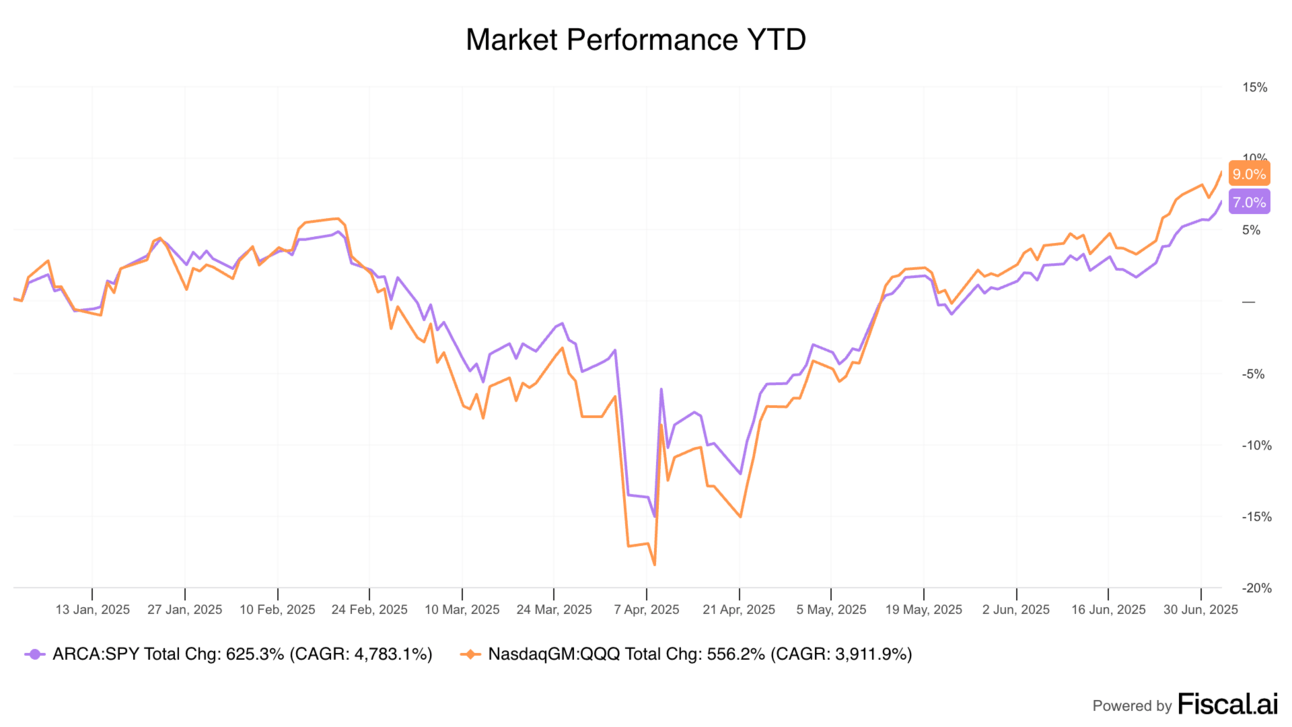

This week, the market wasn’t worried about the bill's impact, instead pushing to all-time highs. Expect a return to more “normal” trading after the holiday last week, which keeps volatility low as junior traders take over for their Hamptons-bound bosses.

The Asymmetric Portfolio continues to hold up well despite some volatility. But that’s the price we pay for superior returns. Earnings season starts in a couple of weeks, and that’s when the rubber really hits the road.

All of the charts you see here are easy to make with Fiscal.ai, the first place to go for all of my research. I can’t say enough how much easier it’s made my research, and you can start with 2 weeks free. 👇

In Case You Missed It

Here’s some of the content I put out this week.

Mid-Year Asymmetric Portfolio Review: I went through how every stock in the portfolio has performed this year, and my quick thoughts.

What I’m Buying in July: My monthly buys are in.

Robinhood’s Meteoric Rise & Valuation Risk: I LOVE Robinhood, but we have to talk about how expensive the stock is.

The Cheapest Stock in the Asymmetric Portfolio: This stock is so cheap that management keeps buying back shares in droves.

More Than EV Tax Credit Cuts in BBB

The secret in electric vehicles is that subsidies have driven most of the industry’s historic (and limited) profitability. I’m not saying this is bad. Subsidies are often needed to get an industry off the ground, to the point where companies can stand on their own.

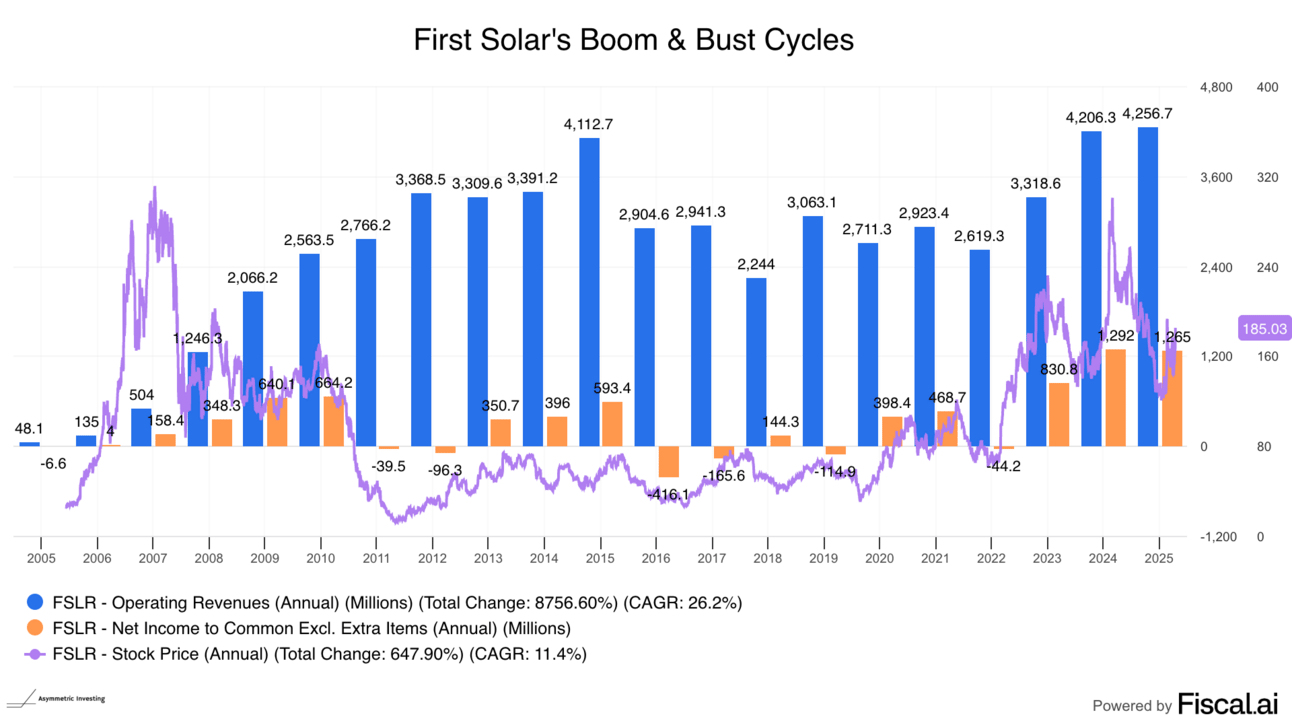

But when subsidies are pulled, it can be a shock to the system.

For example, I started covering First Solar in 2009 as an analyst at a hedge fund in grad school, and the company was growing revenue by ~100% per year and had 50% gross margins. What an incredible business…until German and Italian subsidies dried up, and then Chinese competition hit, and then interest rates went up. The point is, boom and bust cycles are normal in manufacturing and in industrial/energy products.

The solar industry went from boom to bust in a matter of years, but EVs have taken over a decade. And we’re now in a different environment than anyone investing in electric vehicles has ever experienced.

What’s $7,500 Among Friends?

After the “Big Beautiful Bill”, the $7,500 EV tax credit and $4,000 credit for buying a used EV are gone. And there will be a cliff between September 30, 2025 and October 1, 2025 as those changes take effect.

I want to be clear about what will happen next.

EV companies will have to reduce their prices by ~$7,500 to compete.

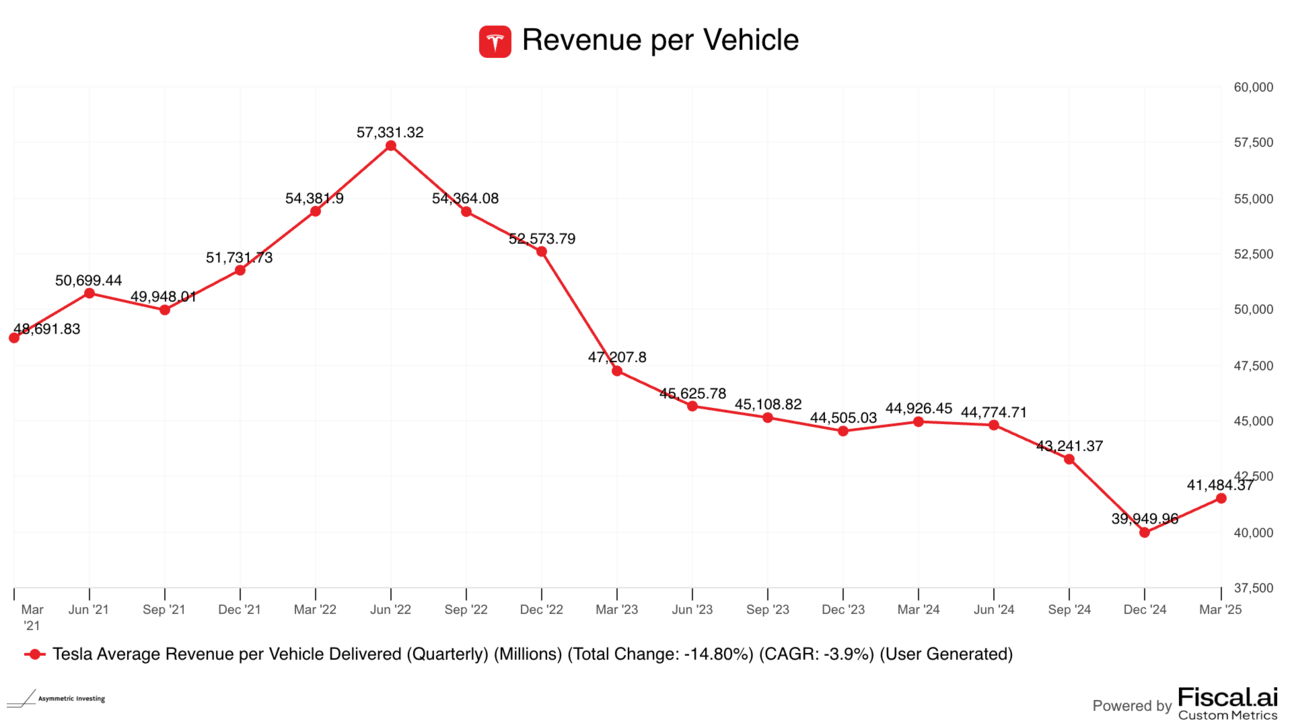

We know this because when automakers started moving past the chip shortage in late 2022, it started a multi-year drop in Tesla’s vehicle prices. In other words, industry supply rose, and Tesla had to respond by reducing prices.

No surprise, gross margins dropped along with prices.

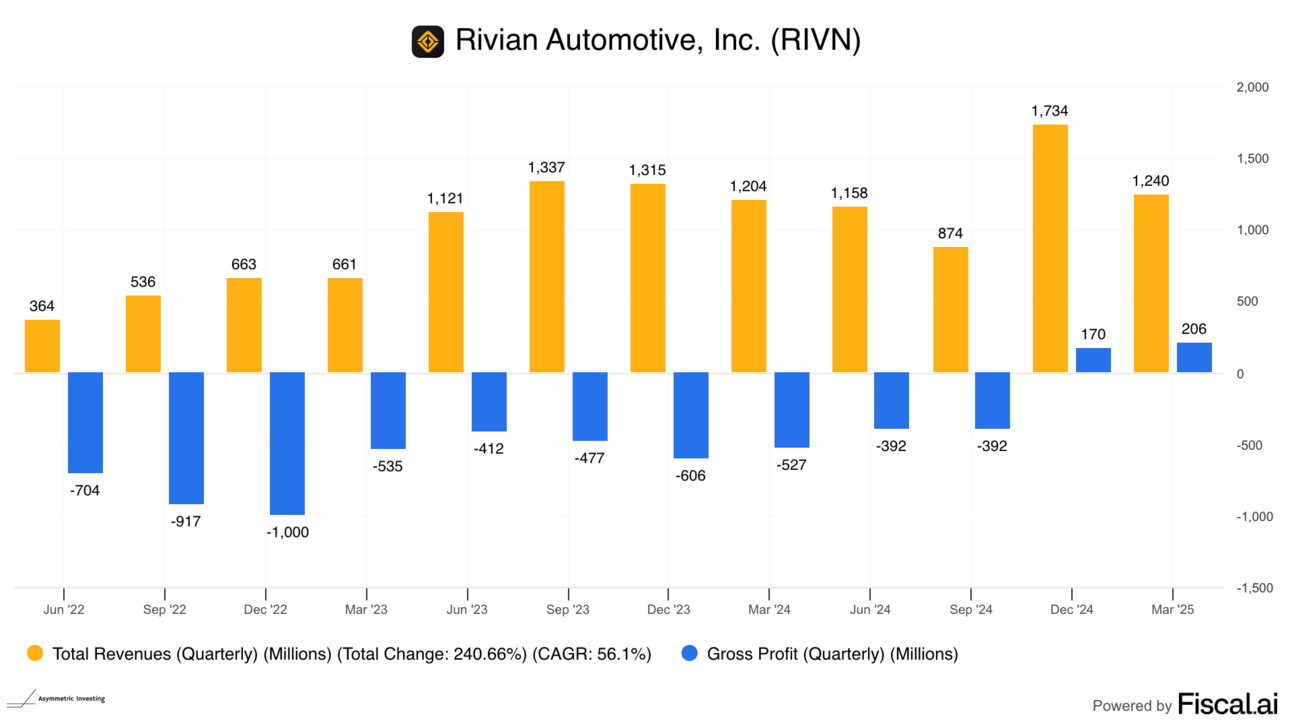

Not every EV company is the same when it comes to the tax credit. Rivian’s vehicles are so expensive that few qualify for the credit, but as it moves mass market with the R2 and R3, the $7,500 tax credit would have helped with demand and margins.

There’s no way to spin this as a win for the industry. Everyone’s margins will go down, and that’s not all that will hurt the bottom line.

Battery Subsidies and New Rules

I’m going to be a bit vague here because I don’t want to get details wrong and the subsidies for each company are opaque…but:

The “Big Beautiful Bill” at the very least modifies some of the provisions in battery subsidies that began in the Inflation Reduction Act, which provided billions in subsidies for producing materials, cells, and battery packs in the U.S.

There are now higher domestic content requirements.

Prohibited foreign entities like China have been listed, which may be impossible to overcome.

Companies like Tesla have benefited from having some manufacturing in the U.S., and estimates have put those tax subsidies at multiple billion dollars on top of the $7,500 tax credit. If those battery subsidies dry up, it’ll impact energy storage (where batteries came from China) and EV margins.

There’s no way to spin this as a margin positive event. Profits will be hurt by the bill.

Regulatory Credits → Zero?

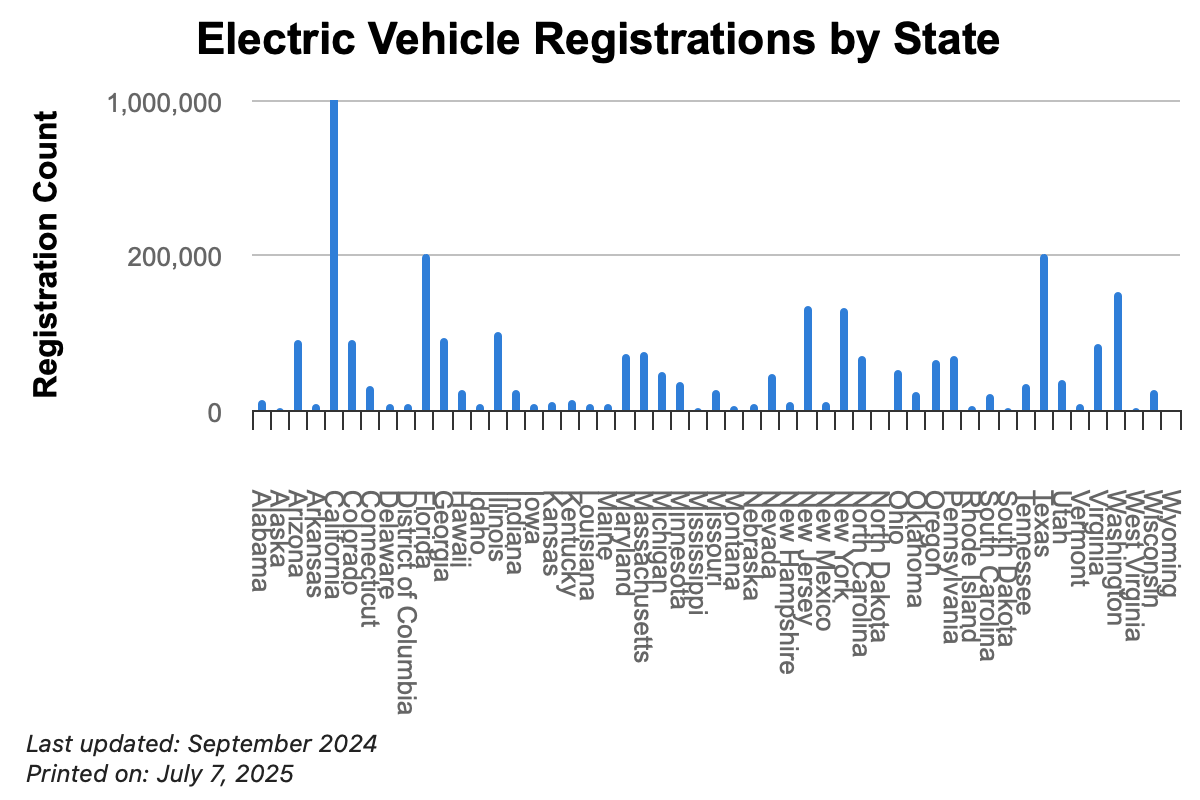

In May, Congress passed a bill that “effectively blocks” California’s EV mandate. This is a big deal because California accounts for about 1/3 of all EV sales in the U.S.

Eliminating California’s ability to make its own rules may both reduce demand for EVs and eliminate the value of zero-emission vehicle credits that have been a windfall for EV companies.

The impact of regulatory credits can’t be overstated. Tesla would have lost money last quarter if it weren’t for regulatory credits.

Over at Rivian, the company reported $299 million in regulatory credit revenue in Q4 2024 and another $157 million in Q1 2025. For 2024, the credits amounted to $6,301 per vehicle delivered!

It’s difficult to gauge exactly how many credits are going for and where they’re coming from, but I think it’s safe to say both Rivian and Tesla have benefited greatly from California’s mandates.

And that source of cash may be drying up.

Pesky Supply and Demand Strikes Again

The problem for EV companies is…they’re manufacturers. They have the capacity to produce supply, and they need to keep that capacity utilized to keep costs low.

If supply from competitors increases and/or demand falls, they’re screwed.

So, all of the factors I highlighted above will likely be negative for demand, but it doesn’t factor in supply. GM’s EV sales were up 134% in the first half of 2025, and the company now has a 16% market share. That’s both competition and less demand for ZEV credits.

In China and Europe, the situation looks even worse because Chinese manufacturers are taking share.

The future looks bleak for EV companies, and the Big Beautiful Bill may be to blame for their ultimate downfall.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor, or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your research before acquiring stocks.