Note: I will be taking most of the next week off so publishing will be light.

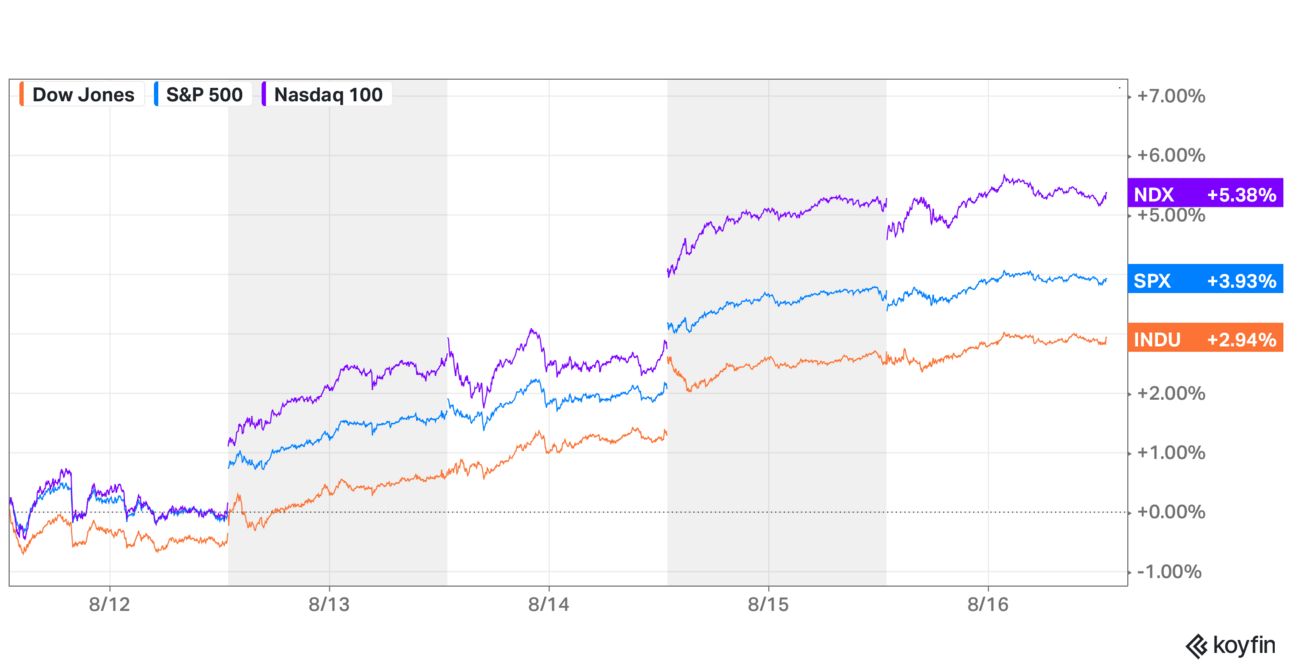

The stock market went crazy this week on the theory that lower inflation and a weakening economy will cause the Federal Reserve to lower interest rates.

The rate point is probably right. Pressure is mounting and what’s the Fed to do?

But why are stocks rallying if a recession might be coming? Why do investors think people will buy more Teslas or do more home remodels if rates are a few basis points lower?

That’s what I’m going to explore below.

Despite strong earnings, the Asymmetric Portfolio continued to have a rough earnings season. There’s not much exposure to the AI trade that went crazy this week, so it's no surprise this wasn’t the best week. In time, I think good earnings will win over more speculative assets.

Asymmetric Investing is a freemium business model, which means the free version is made possible by ads like this one. Sign up for premium here to get 2x the content, access the Asymmetric Portfolio, and avoid ads.

Learn from investing legends.

Warren Buffett reads for 8 hours a day. What if you only have 5 minutes a day? Then, read Value Investor Daily. We scour the portfolios of top value investors and bring you all their best ideas.

In Case You Missed It

Here’s some of the content I put out this week. Enjoy!

Unloved and Overlooked: When a stock is out of favor, that’s the time to buy. But it’s also the hardest time to buy a stock.

Prescriptions and Subscriptions: This is the smallest Asymmetric Portfolio stock at a $43 million market cap, but it has big dreams and the business is heading in the right direction.

The On Thesis: Compounding growth in shoes, apparel, and international sales is core to the near term On Holding thesis, but innovation could drive the company for decades.

The Truth About Interest Rates

Here’s an uncomfortable truth that Wall Street doesn’t want to hear.

Fed rate cuts don’t matter all that much to the economy.

Most consumers don’t have a clue what the Fed Funds rate is. They don’t pay attention to earnings beats and misses.

Consumers spend money when they have money in their pockets. Not because interest rates are low.

In short: Stock market traders are worried about rates. Consumers aren’t.

This was an interesting comment from a podcast called The Compound: “The risk of a policy error has increased substantially in the last six weeks…For consumers there’s somewhat of a lag. I think psychologically for consumers, that’s the biggest piece here.”

This is exactly backward. Consumers don’t care about the Fed cutting rates, stock traders do.

Traders will buy stocks if interest rates fall. They will sell if rates rise.

Consumers aren’t going to buy more toilet paper or go out to eat more if interest rates fall a few basis points.

The Truth About Interest Rates

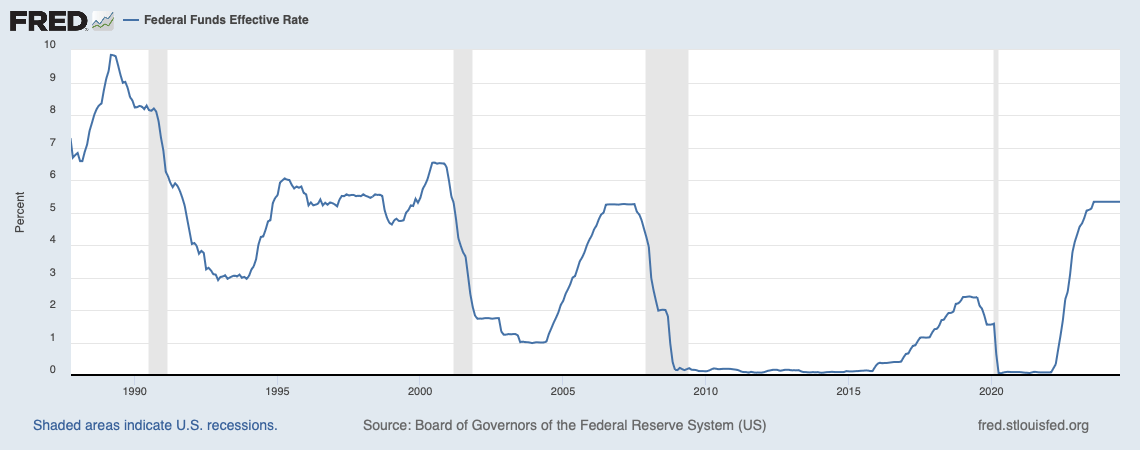

Sure, there are items interest rates impact. Car loans are easier to get if rates are lower. So are mortgages.

But we’re playing at the margins right now.

Unless rates go to zero again — which I don’t think they will OR SHOULD — the economy needs to work through its natural cycle with rates relatively similar to where they are today.

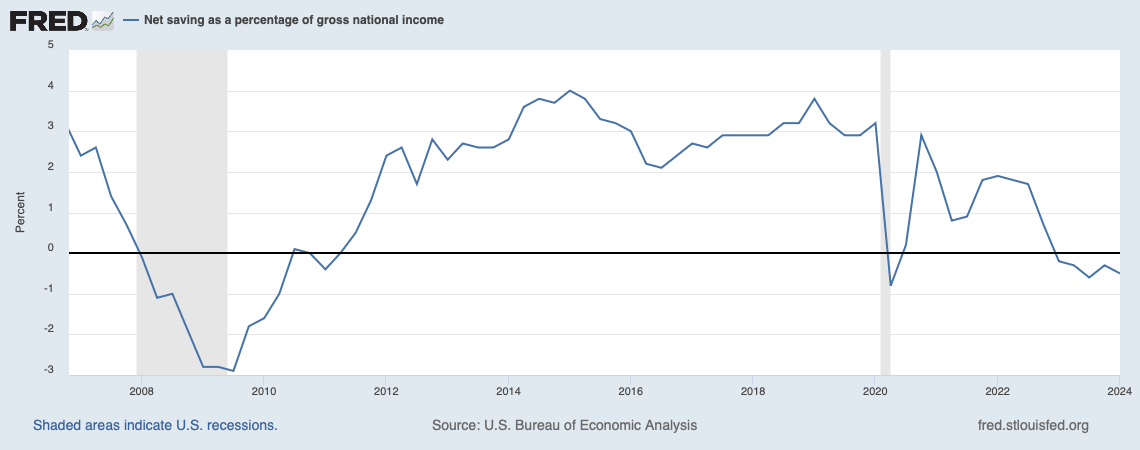

Pandemic levels of spending weren’t normal. We shouldn’t keep that bubble inflated, we should let it deflate, which it’s doing right now.

If a consumer can’t afford a car at current rates, maybe they simply can’t afford the car? That’s not a purchase we need to stimulate further.

The same goes for housing. A 2.75% mortgage — which I have — isn’t normal or healthy. It inflates values and locks people into houses rather than promoting a more normal market.

Getting back to “normal” will take time. It will be uncomfortable. But we need to do it.

And keep in mind that consumer spending during the pandemic wasn’t normal. People had money to spend from stimulus checks and the savings from not going out to eat. Now, they’ve eaten up all of that extra cash and the next savings rate is negative. But we want consumers to spend more on credit cards and go into debt to keep the current expansion going…until it goes bust later?

I write all of this to remind you that the day to day moves of the market are hysteria.

The market is not the economy.

The people who freak out about the Federal Reserve cutting a month or two late or 25 basis points too far are trading, not buying and holding stocks for decades. Over the course of decades, the moves of the Fed this month will be lost to time.

You can get all Asymmetric Investing content, including deep dives, stock trades, and ongoing coverage of Asymmetric Universe stocks with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.