Disruption is an easy topic to discuss but very difficult to understand.

There’s nuance and debate about what’s disruption and what’s just innovation or evolution in an industry. The framework I like to think about is this:

Is the incumbent capable of responding?

Let me give a few examples.

The Internet fundamentally disrupted the newspaper business because a physical newspaper had geographic limitations. The internet had no geographic limitations and had zero distribution cost. Newspapers were incapable of responding to bloggers and social media companies.

Netflix disrupted linear TV because it could provide abundance (watch anything, anytime) while linear stations were built around scarcity (24 hours/day/channel). The linear business model is incapable of a seamless transition to streaming. Although, like newspapers, everyone will try.

Microsoft was so PC centric that it missed smartphones because it was structurally incapable of building a good smartphone. This was despite seeing the smartphone coming years before the iPhone was released.

EVs are billed as another disruption, but are they?

EVs may be the future of transportation, but EV and ICE vehicles both have 4 wheels, seats, a chassis, headlights, and airbags and look very similar to each other. This looks more like an evolution than a disruption.

And the older auto stocks remind me of cigarette stocks in the late 1990s. Overlooked and unloved.

And that’s a good thing!

Asymmetric Investing has a freemium business model. Sign up for premium here to skip ads and get double the content, including all portfolio additions.

Better PR with minimal effort: Let AI write your articles

Generate high-quality articles in seconds - SEO-optimized, plagiarism & fact-checked

Be featured for free by journalists looking for credible sources

Get your articles indexed and ranked directly in Google News

Distribute your content to top magazines with a single click

Forget ChatGPT: Manage, publish and track your PR efforts in one place

Get great PR fast:

Making Money In a Dying Business

In 1998, the cigarette industry agreed to pay $206 million over the next 25 years to settle government lawsuits related to tobacco-related healthcare costs.

The industry also agreed to add warning labels and curtail marketing. The writing was on the wall. The cigarette industry was dead.

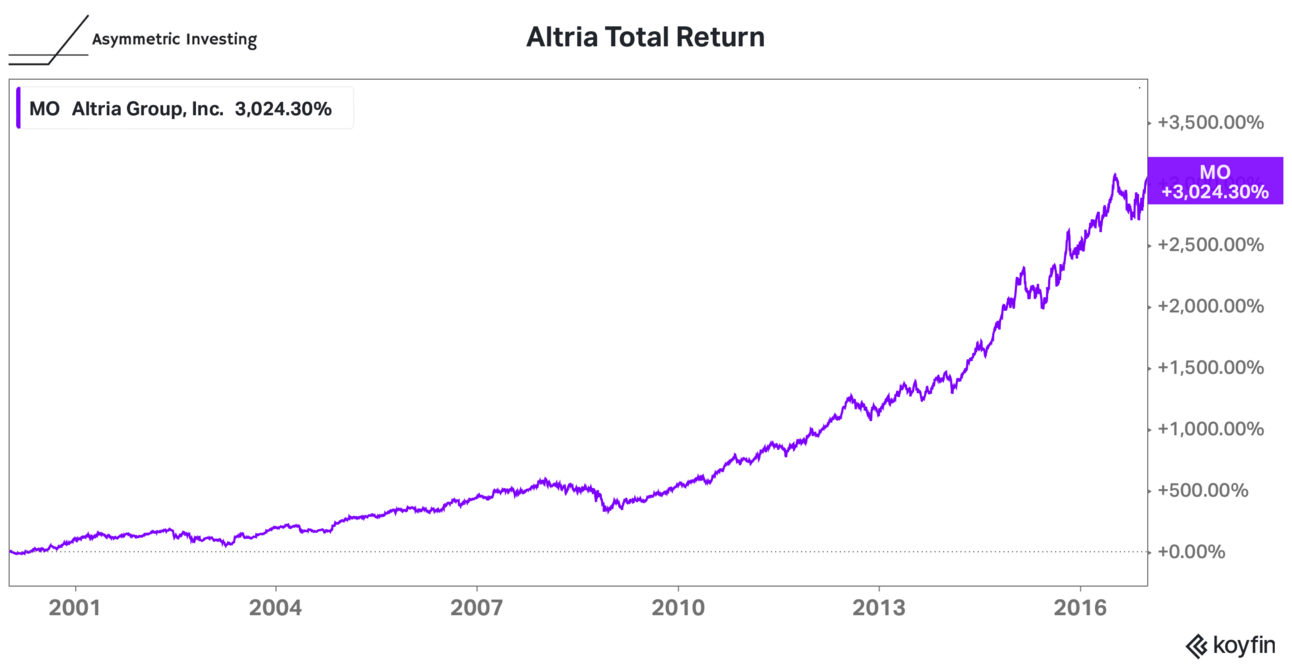

And then a funny thing happened. Altria — formerly Philip Morris, maker of Marlboro — was one of the best-performing stocks over the next two decades.

What happened?

Smoking demand dropped but the business was still generating cash because existing users kept their habit for years/decades.

The company bought back stock at an extremely low price/earnings multiple.

Eventually, the P/E multiple expanded, but only after the share count dropped.

The move away from smoking wasn’t paradigm shift for society, it was a generational shift that is still ongoing.

I think this is an instructive example for the auto industry today.

EVs and the Dying ICE Business

Even Detroit’s most seasoned executives think EVs are the future. Just like cigarette execs knew in 1999 the future was bleak.

The question is around timing and who wins in an EV future.

EV’s Adoption Rate

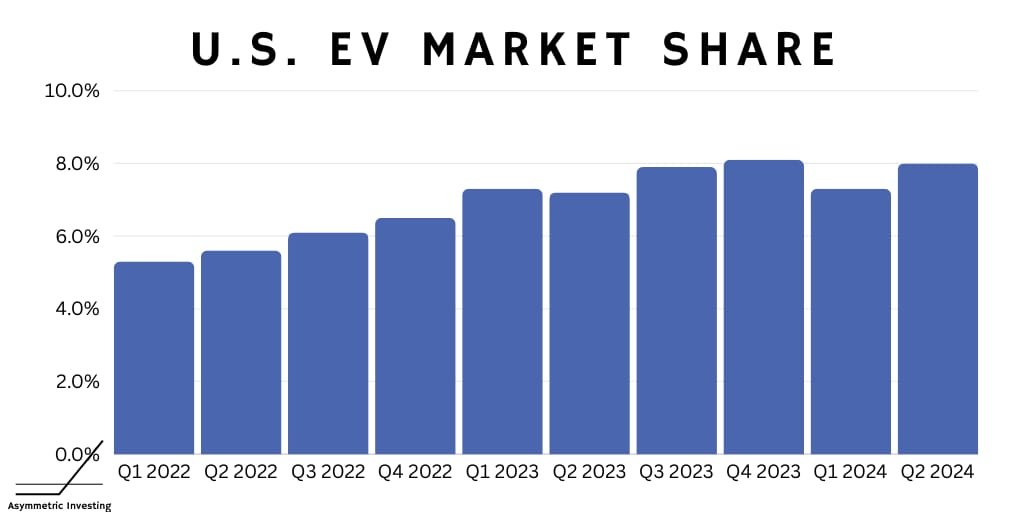

On the timing front, I think it’s become clear that EV growth has slowed. According to Kelly Blue Book, in 2021, 3.2% of U.S. vehicle sales were EVs, which rose to 5.8% in 2022, and 7.6% in 2023. Since then, market share has stalled out.

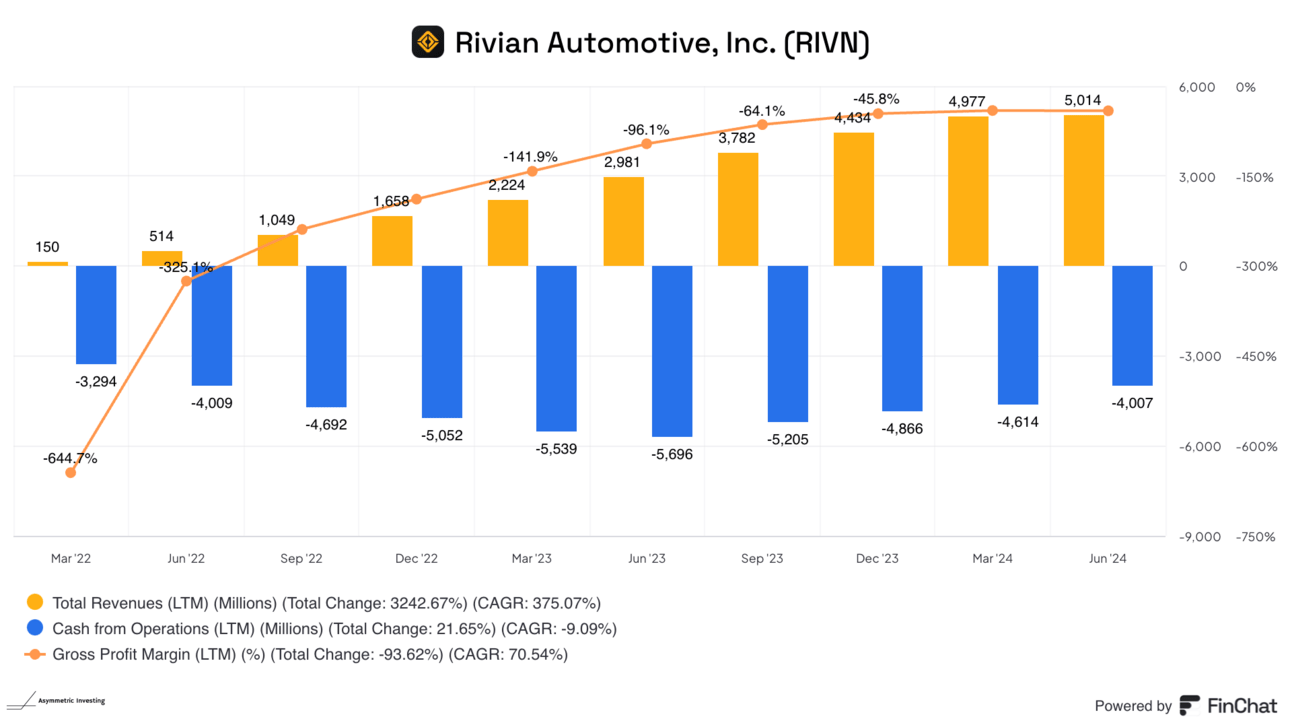

At the same time, EV companies like Tesla, Lucid, and Rivian have been expanding capacity rapidly.

EV Economics

What happens when capacity goes up and demand is flat for a high capital cost product?

Companies start competing on price. That destroys margins and cash flows.

Companies like Rivian will make the problem worse as they increase capacity in 2025 and open a new plant in 2026.

If the EV adoption rate continues to ramp slowly and losses continue, investors will eventually throw their hands up and quit treating these stocks like tech stocks — which they’re not.

ICE Outperforms EVs

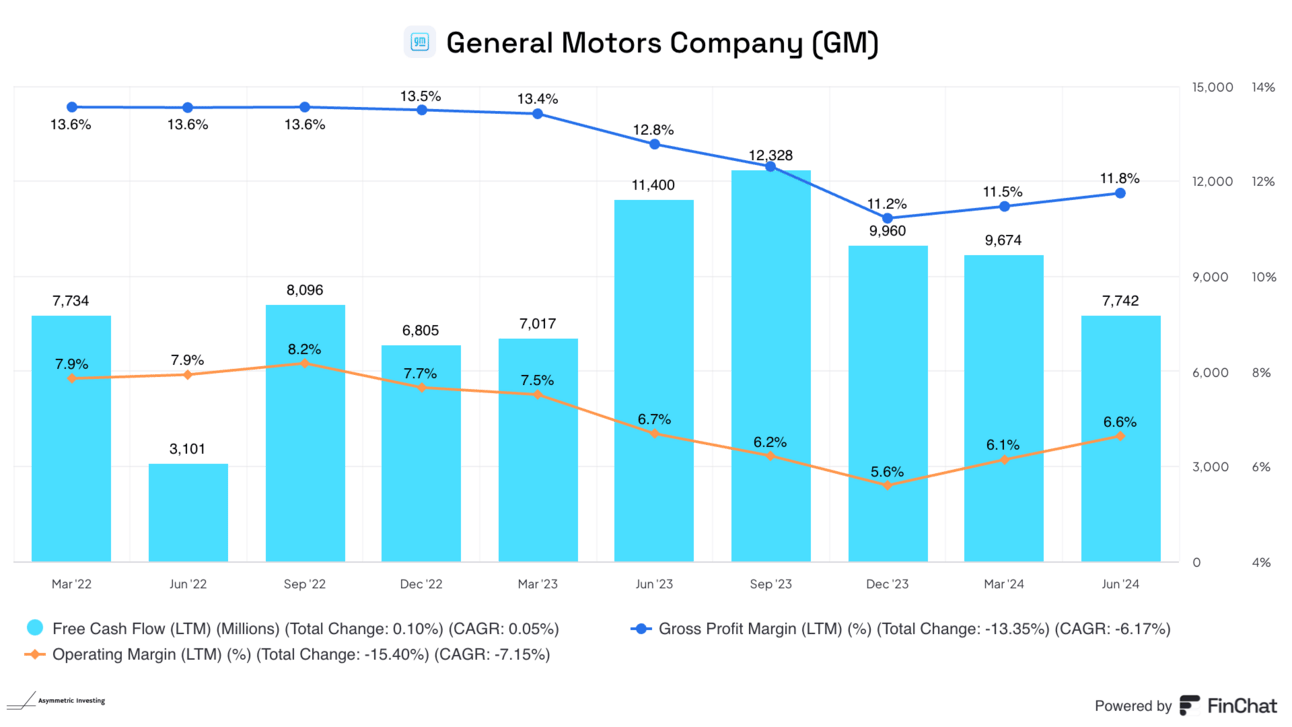

Why haven’t legacy ICE manufacturers met the same margin-crushing fate as EV companies?

They’re not facing the same competitive pressure. In a lot of ways, the competition in ICE trucks and SUVs is lower as everyone invests in EVs.

As a result, GM has kept prices stable this year and that’s helping margins even as the company invests billions in EV capacity that it’ll roll out over the next decade.

GM has said it isn’t in a rush to make an all-in EV transition because it’s making money selling ICE vehicles and that’s where the demand is for the foreseeable future.

I think when you see EV demand as softening, at the end of the day, we've got an ICE portfolio that's going to probably throw a lot of cash longer than what some people who might have [thought there would be] more of an aggressive EV adoption. But if EVs pivot, then ICE may come down but it's -- at the same time our EV profitability is going up.

ICE vehicles may be a dying business, but this is a generational shift that will take decades to play out.

No rush in trying to win in an oversupplied, low margin market.

Disruption and EVs

If EVs were indeed a disruption to the auto industry, there would be no way for the industry to respond.

Like newspapers, linear TV, and PCs, auto companies wouldn’t know how to respont.

But I don’t think EVs are a disruption.

EVs are a generational evolution of the auto industry.

If that’s true, it’ll take decades for the transition to take place and legacy auto companies will have an advantage because they have the manufacturing capacity, distribution infrastructure, and brand awareness to make and sell EVs profitably.

I think it’s becoming clearer by the day, that’s how we should view the auto industry as investors. And that’s why I own GM at a 5x P/E multiple instead of Tesla at a 60x P/E multiple.

GM reminds me a lot of Altria in 1999. It’s a dying business AND a great investment.

The REAL Auto Disruption

EVs may not be disruptive to Detroit, but autonomy is.

And that’s a story for another day…

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.