This article is an update on Hims & Hers, which was covered in a spotlight on May 24, 2024, here. Shares are up 40.6% since then, and I think shares are still undervalued.

A company growing at 77% rarely expects its growth rate to ACCELERATE in the future. But that’s where we are with Hims & Hers.

And still, the stock looks relatively undervalued by traditional financial metrics.

This continues to be one of my highest conviction stocks, and it’s now the 8th largest holding in the Asymmetric Portfolio and climbing. If you aren’t familiar with Hims & Hers and haven’t seen how quickly the company is growing, it’s time to pay attention.

Asymmetric Investing has a freemium business model. Sign up for premium here to skip ads and get double the content, including all portfolio additions.

Cash is king 👑

Not long ago, investors were chasing rocketship startups in hopes of a huge payday.

Boy how times have changed.

Those overvalued, buzzy startups just aren't as attractive anymore. You know what's cool? Undervalued companies that earn real profit.

WebStreet finds these companies, acquires them, improves them, and sells them. (And lets you invest)

They buy overlooked businesses already earning money

They improve operations, so they make even more money

They bundle everything into a single, powerful fund that you can invest in.

It's like micro private equity on autopilot.

Unlike a lot of startups, WebStreet is doing great.

77% Growth and Accelerating

The healthcare industry in the U.S. is a mess, and Hims & Hers has the opportunity to disrupt the status quo by going directly to consumers. It’s not just a place to get pills; it’s a healthcare platform that gets better by getting to know you. In time, Hims & Hers will be able to treat more people with better service than a doctor’s visit and standing in line at the pharmacy today.

From the Hims & Hers Spotlight:

The average doctor visit is 18.9 minutes, and it’s impossible to express your thoughts, concerns, and history to provide an optimal health plan in that amount of time. What if there was a better way?

Hims & Hers is building that better way with a health platform that gets to know you. The process starts with an intake questionnaire and moves to a virtual visit with a doctor before beginning your ongoing journey. You may start by looking for hair loss treatment or ED medication and come away with a personalized medication that treats you more effectively than anticipated.

As Hims & Hers learns more about its customers and more data is put in the system, we can see a path to Hims & Hers knowing far more about your medical needs than a doctor does today.

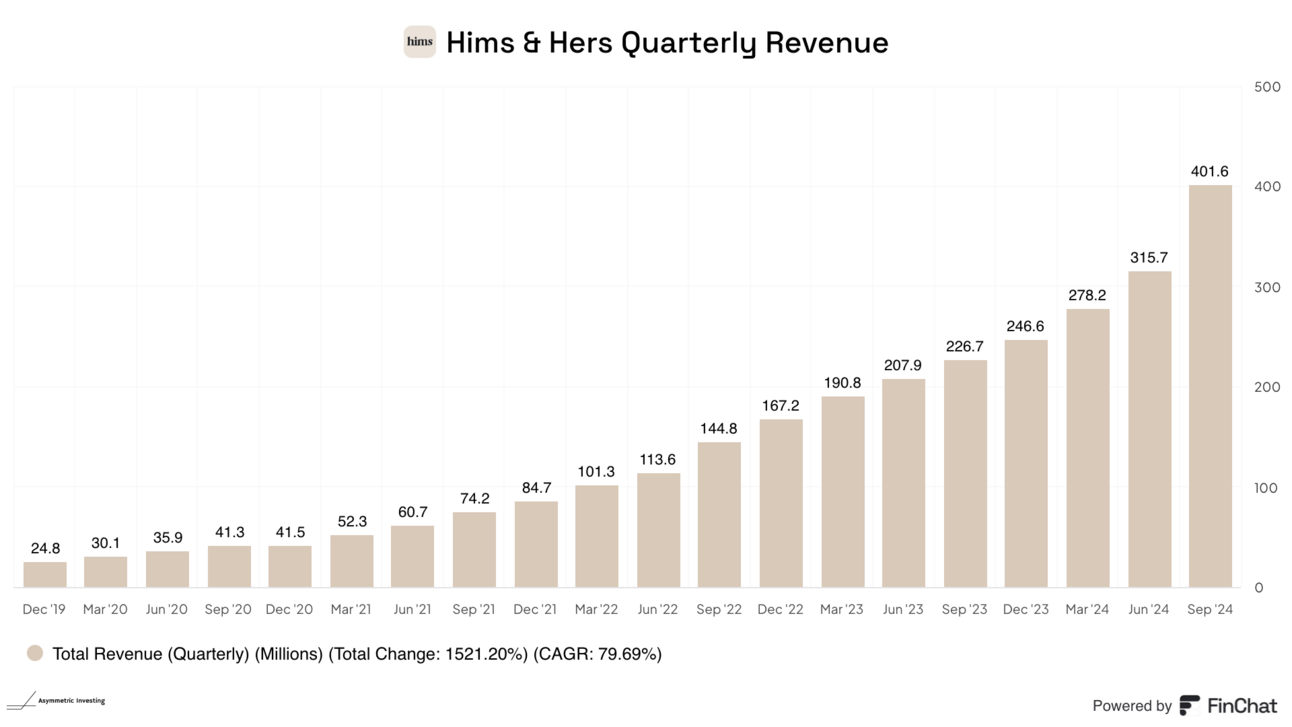

What’s crazy is how quickly this platform is growing. In the third quarter of 2024, revenue grew an incredible 77% to $401.6 million, up from 52% growth a quarter earlier. And that’s just the beginning.

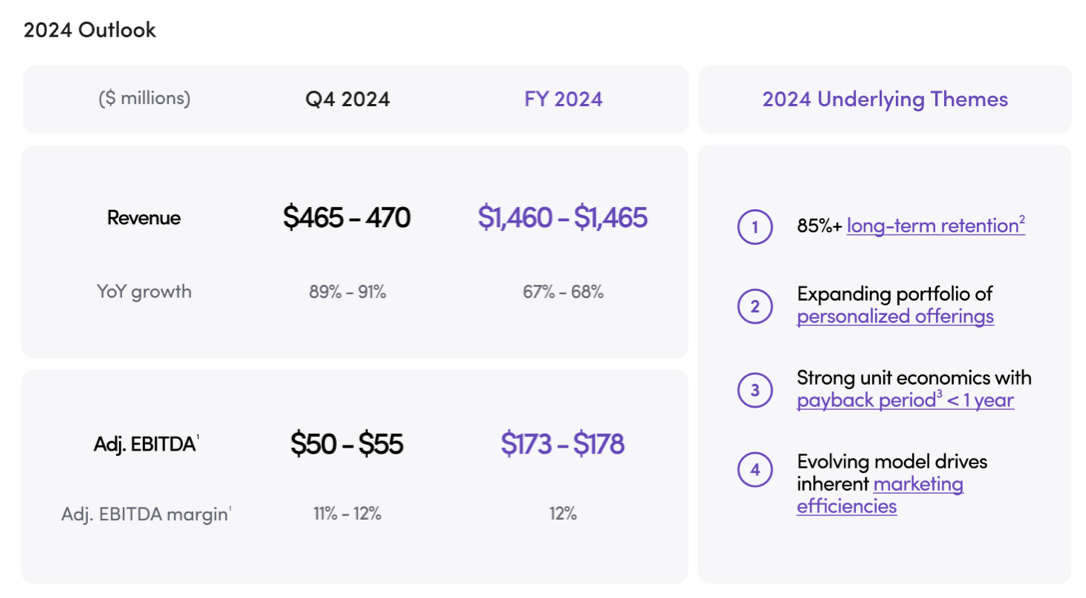

Management said fourth-quarter revenue will jump another 89% to 91% to over $465 million. This is an incredible growth company that keeps growing faster! This isn’t a normal trajectory for a public company, which typically sees slower growth as it scales.

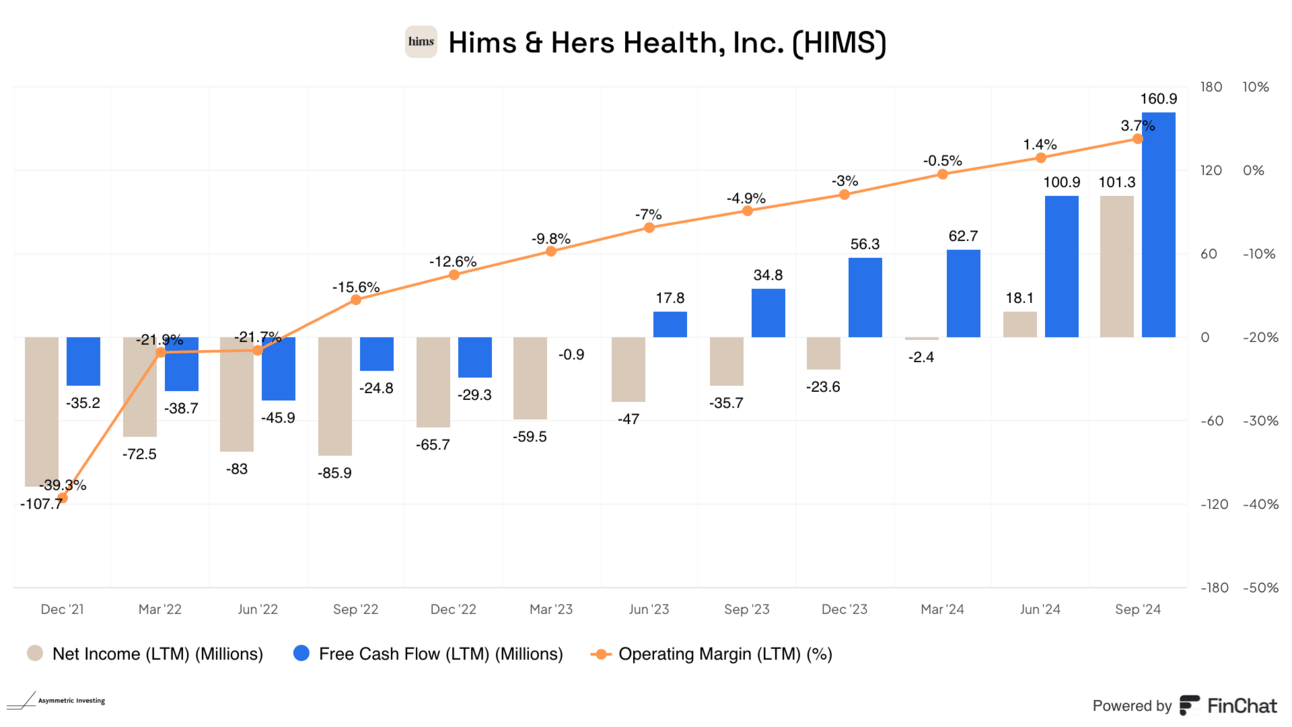

And it’s not just about top-line growth. Hims & Hers is generating better operating margins and is now generating both positive net income and free cash flow.

This is because operating leverage is starting to kick in.

Fixed costs associated with building the healthcare platform can be leveraged as the business grows, and we’re starting to see more return on marketing spend today.

Maybe the long-term value (LTV) of customers is bigger and more durable than we thought just a few quarters ago?

But What About GLP-1s?

For all of the good news, the stock market is still full of questions. And most of those questions are around GLP-1s, which were mentioned 50 times during the conference call.

I covered the shortage situation in GLP-1s here, but I think this is a case where investors are worrying about something that isn’t existential to the business. As far as GLP-1s specifically go:

Semaglutide will be offered as long as it’s on shortage in the market. This shortage could end soon, or it could last for years.

Liraglutide, the first generic GLP-1, will be sold by Hims & Hers starting in 2025, which should be a more durable product than the semaglutide being sold in a temporary shortage situation.

Branded products like Wegovy, Ozempic, Mounjaro, and Zepbound will be sold by Hims & Hers when they are off shortage.

We also need to keep in mind that GLP-1s are only a tiny fraction of Hims & Hers business, and it’s not driving the company’s growth.

Subscriber growth remains strong, with total subscribers in the third quarter growing 44% year-over-year. Equally exciting is that subscriber growth in offerings outside of GLP-1’s remains strong at approximately 40% year-over-year, as consumers increasingly associate Hims & Hers as a leading platform in personalized care.

Management didn’t give an exact number for GLP-1 sales in Q3, but at the end of Q2 2024, the pace of sales for the weight loss business was only $25 million per quarter. It’s safe to say GLP-1s are still less than 10% of the business today.

Risk vs Reward

I’ve laid out a pretty bullish case for Hims & Hers here, and it isn’t without risk.

GLP-1s may come off shortage, essentially eliminating the compounded GLP-1 business overnight.

Competitors in the direct-to-consumer space could take market share.

Suppliers could go directly to consumers like Hims & Hers does.

But there are also growth opportunities we can see ahead.

New products will be added, expanding the platform.

Brand awareness will improve for Hims & Hers as the company grows and increases brand vs direct marketing spend.

Operating leverage and benefits from vertical integration into pharmacies are just starting to take hold.

On the new product side, we don’t know exactly what’s coming, but there are many options.

Aaron Kessler, Analyst: A couple of questions. Just in terms of new sub-verticals with kind of Dr. Shepherd joining as CMO of Hers, can you just help us think through the potential kind of for new sub-verticals within the Hers category? And just within some of the -- maybe the traditional categories you've been and including sexual health, kind of hair dermatology, just provide us an update on maybe the performance of some of those within the quarter as well.

Andrew Dudum, CEO: Yes. Thanks, Aaron. So, on the new side of the house, we're really excited by Dr. Shepherd joining. The Hers business, as we mentioned, is the fastest part of the aggregate business growing, right? It's an incredible business, and it's diversified quite dramatically across mental health, dermatology, as you shared, metabolic health, and obesity. So, an incredible amount of diversity taking place that's actually driving that. I think the combination of moves that we've made, such as bringing Dr. Shepherd onto the team as well as the 503(b) Medisource in California, which allows for sterile injectables, kind of leads towards categories that we've spoken about in the past that Dr. Shepherd is an expert on and these are categories such as perimenopause, menopause, hormonal therapy and all of the related impacts that, that might have for women as they age. Same thing on the men's side of the business. We expect that business to be something that is rolling out in the next couple of years and something that our customers really have been wanting for some time.

The platform is growing, expanding, and getting more profitable. What’s crazy is the price is still right for the stock.

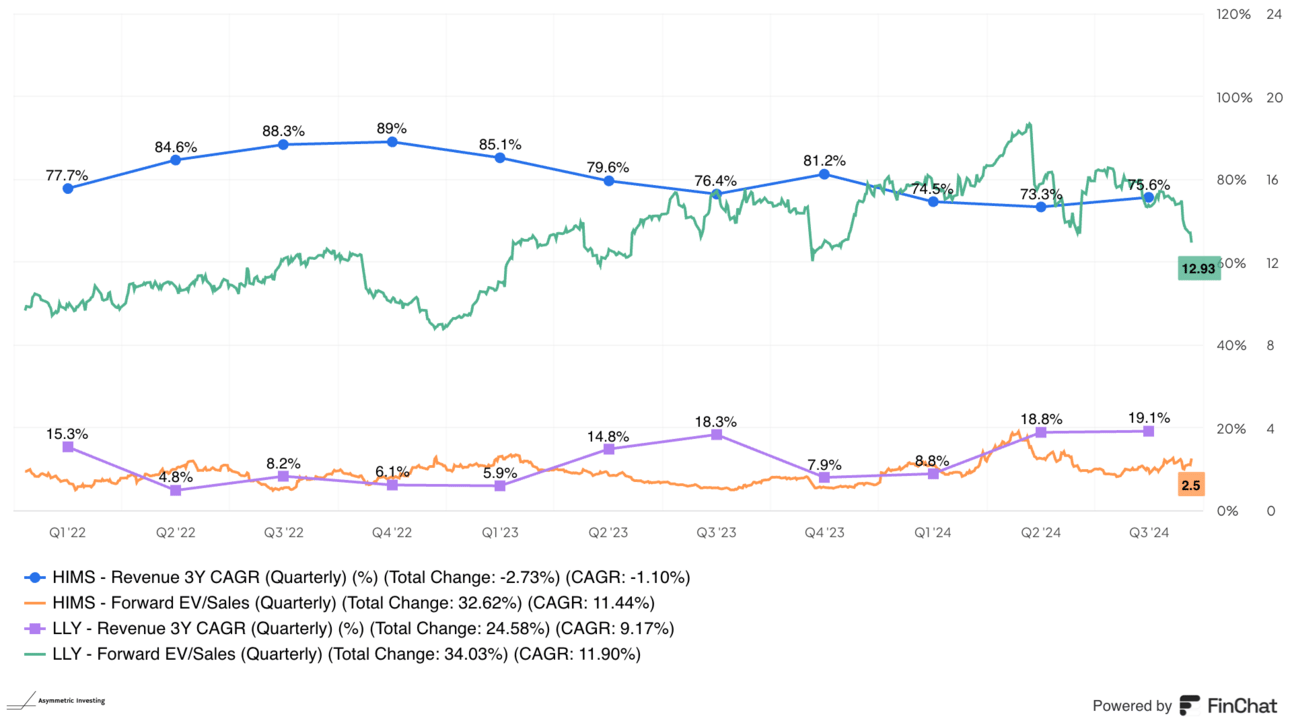

Shares of Hims & Hers trade for just 2.5x forward sales estimates compared to 12.9x for Eli Lilly. And this is despite Hims & Hers growing four times faster than the big pharma company.

Valuation metrics aren’t perfect, but a company growing revenue at a 90% pace trading for 2.5x forward sales is cheap. I bought more recently, and I’ll keep adding to the Asymmetric Portfolio.

90% growth stocks don’t come along often, and I’m not going to miss this opportunity to ride the wave while it’s here.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your own research before acquiring stocks.