Stupidity reigned supreme on Wall Street this week.

A Reddit personality named Roaring Kitty (Keith Gill) returned to social media and millions of people tuned in.

It was a reminder that most of what we see from financial media is noise. Asymmetric investments won’t be defined by a day or two. They’ll be built over years and decades.

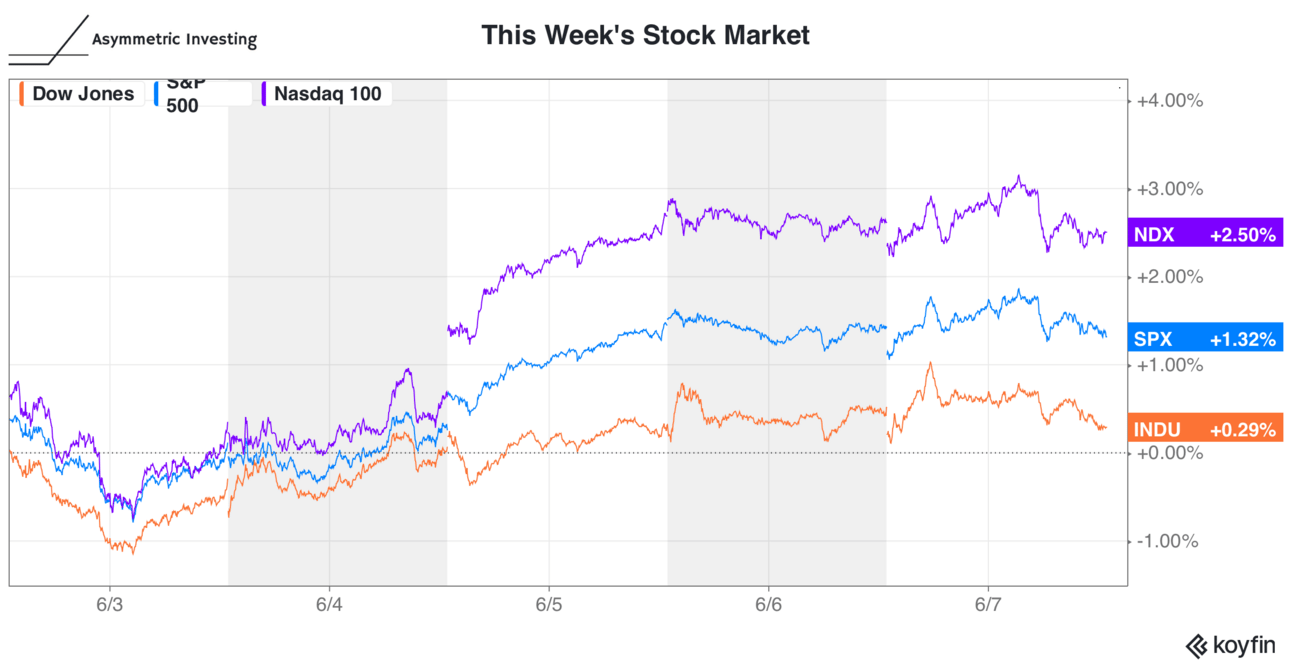

Before we get to the week’s craziness, here’s what the market did this week.

The Asymmetric Portfolio had four transactions this week and got a new position. Premium members can find the announcement here and the trade details here.

Asymmetric Investing has a freemium business model. Sign up for premium here to skip ads and get double the content, including all portfolio additions.

Make your money rise and grind while you sit and chill, with the automated investing and savings app that makes it easy to be invested.

In Case You Missed It

Here’s some of the content I put out this week. Enjoy!

The Asymmetric Opportunity in Autonomous Driving: It’s not Tesla with upside in autonomous driving.

Owlet’s 100x Opportunity: It’s easy to see how Owlet becomes a household name for new parents.

Zendaya + On Holding: On repeated a successful market strategy with a partnership with Zendaya.

4 Stocks to Sell Now: There are some red flags investors should look for in stocks.

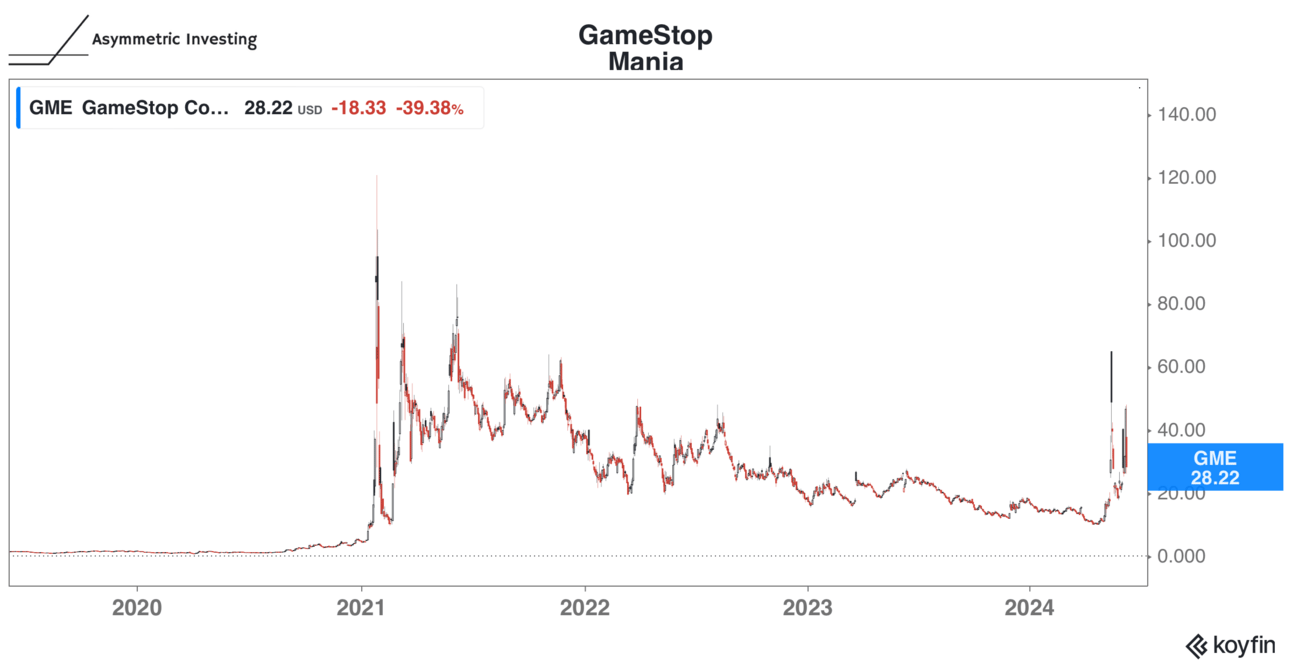

Gamestop Mania…Round 2

This week was a reminder investors need to understand and accept the game we’re playing.

In other words, are you a long-term investor or a day trader? Do you buy growth stocks or value? Are you seeking out amazing businesses or gamma squeezes?

If you weren’t aware (and I envy you if you aren’t), Keith Gill, aka Roaring Kitty, of Gamestop fame returned this week. On Friday, he did his first live stream in almost three years after causing the 100x increase in Gamestop in late 2020 and early 2021.

The pop in the stock during the pandemic was caused by a gamma squeeze, essentially a short squeeze on steroids.

Traders buy short-dated call options (going long the stock)

This means market makers selling the options are now short the stock

The stock price rises, forcing market makers to buy the stock to hedge out risk

Traders buy more call options

And repeat…

He had recently built a multi-hundred million dollar position in Gamestop (according to social media posts) and was trying to gamma squeeze again. For a while…it worked.

For a day or two this week, Gill was up $1 billion on his GameStop stock and options position. The gamma squeeze was working again.

How did he do it? Are there more opportunities like GameStop out there?

Unless your name is Roaring Kitty, it doesn’t matter. If your game is long-term investing, gamma squeezes are noise. Unless you pump and dump on CNBC, you can ignore trading this week.

Eventually, the squeeze cycle ends and as we saw in Gamestop, the stock loses 90% of its value in a matter of days (early February 2021).

What you’re left with is the business. And GameStop is a crappy business.

The difference this time around is GameStop was ready with a massive stock offering to take advantage of the higher stock price. Investors and traders didn’t like that and shares dropped as 2.3 million people watched live on YouTube.

I was happy to say, I had no position.

Know Your Game

This is one of the smartest things Morgan Housel has said:

Keith Gill and I are not on the same time horizon.

I’m not buying stocks or options hoping for a gamma squeeze.

There are frameworks behind Asymmetric Investing that outline the time horizons I will write about and buy stocks based on.

I’m a long-term buy-and-hold investor, not a day trader

I want to own stocks that can compound for decades

Business fundamentals will ultimately drive returns

I try to avoid hype.

I try to be contrarian when it makes sense.

I want to buy stocks at a value and error on the side of never selling a great business.

That’s the game I’m playing. You can play the same game or a different one. But don’t think missing out on the latest hotness in the market is a bad thing.

Sometimes, missing hot stocks is a good thing because stocks like GameStop eventually become duds.

You can get all Asymmetric Investing content, including deep dives, stock trades, and ongoing coverage of Asymmetric Universe stocks with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.