One of the best asymmetric opportunities on the market today is autonomous driving. Statista estimates the autonomous vehicle market will be $62 billion by 2026 and Markets and Markets thinks ride-sharing will be $185 billion by 2026. I’ve even seen addressable market estimates that range into trillions of dollars.

However you measure the market for autonomous vehicles and rides, it’s big.

From a technology perspective, we also know autonomy is here and expanding quickly. We just don’t know who is going to win in the marketplace.

Risk, Reward, and Asymmetric Opportunities

The easy answer to win in autonomy is Tesla. The company has built the most hype and CEO Elon Musk has been talking up Autopilot and Full Self Driving (FSD) since 2014. But Tesla isn’t the most asymmetric opportunity for investors.

Over the past 12 months, Tesla has generated $1.38 billion in free cash flow and has a $557 billion market cap. Success in autonomy is priced in and failure would cause the stock to collapse.

Compare that to General Motors — which happens to be a member of the Asymmetric Portfolio — which generated $9.67 billion in free cash flow over the past 12 months and has a market cap of $51.6 billion.

It’s General Motors that has an ~80% stake in Cruise, which hasn’t just talked about autonomy, it’s driven millions of miles without a driver in the car. The market doesn’t seem to be taking Cruise’s potential seriously, but my money is on the companies deploying autonomous vehicles with verified safety records, not rhetoric.

The good news for investors is Cruise is starting to scale…again.

Asymmetric Investing is possible because of the support from premium subscribers.

For just $100 per year, you get market-beating research and the frameworks behind Asymmetric Investing. A traditional financial advisor would charge over $100 per year to manage just $10,000.

If you’re investing $100,000 with an advisor or fund manager you’re paying $1,000 or more per year.

Invest $1 million and you’re paying $10,000 or more, whether you like it or not.

Is your advisor beating the market? You can with Asymmetric Investing Premium.

Cruise’s Roller Coaster

To give a little background, on October 2, 2023, Cruise was involved in an accident that would set off an 8-month shakeup at Cruise. Here’s the opening of a report from a third-party law firm that describes what happened.

On October 24, 2023, the California Department of Motor Vehicles (the “DMV”) issued an order suspending Cruise LLC’s (“Cruise” or the “Company”) permit to operate driverless vehicles in California (“Suspension Order”). The Suspension Order followed a widely publicized accident in San Francisco on October 2, 2023 in which a human-driven Nissan initially collided with a pedestrian and launched her into the pathway of a Cruise autonomous vehicle (“Cruise AV” or “AV”) traveling in autonomous mode in an adjacent lane. The AV then hit the pedestrian and ultimately dragged her for approximately 20 feet before coming to a final stop (the “October 2 Accident” or “Accident”). Although the Accident is considered the most severe in Cruise’s history, it is Cruise’s response to this Accident – and its subsequent disclosures to government regulators about the Accident – that is the subject of this Report.

The accident was caused by a human driver. That is not in dispute.

What’s being questioned is Cruise’s response, including the safety maneuver and disclosure to regulators.

Exactly how the Cruise vehicle completed a safety pullover can be debated. I like to ask if a teenager would have done better or worse. In this case, I’m not sure.

What was shocking about the report was why Cruise was ultimately suspended in California. Cruise didn’t exactly hide evidence, regulators had crappy internet!

Cruise leadership and those who communicated with regulators acknowledge that they did not affirmatively explain the pullover maneuver and pedestrian dragging in their initial meetings with regulators and government officials following the Accident. Many meeting participants, however, have said they played the full, 45-second, 9-pane video of the Accident that showed the pullover maneuver and pedestrian being dragged (the “Full Video”). But they concede that in all of the initial meetings on October 3 except one, the video transmissions were hampered by internet connectivity issues that prevented or may have prevented regulators from seeing the entire accident fully and clearly.

In addition, Cruise employees note that NHTSA received a copy of the Full Video within hours of their October 3 meeting, confirming Cruise’s intent to disclose the pullover maneuver and pedestrian dragging to government officials. Cruise employees also state that the CPUC declined Cruise’s offer to show the Full Video.

Cruise employees note that they shared the Full Video without any internet connectivity issues with the San Francisco Municipal Transportation Authority (“SF MTA”), the San Francisco Police Department (“SFPD”), and the San Francisco Fire Department (“SFFD”) on October 3, and that they had a full discussion with those agencies about the pullover maneuver and pedestrian dragging—again showing their good faith intent to disclose all facts about the Accident to regulators and government officials.

It’s a little surreal. A random accident that no one could anticipate or know how to handle led to Cruise being suspended in California and pulling all of its vehicles from roads ultimately for…internet issues.

This time did allow Cruise to rethink itself and its strategy. And that’s where the opportunity lies today.

Road to Recovery

Over the past few months, Cruise has announced a plan to get back on roads that include:

Cruise changed management and implemented safety reviews intended to improve the product and improve communication with regulators and residents

Launching autonomous driving entirely with modified Chevy Volts

The Cruise Origin is on hold indefinitely

Operations will begin in fewer cities to expand to larger fleets in fewer markets

The first city Cruise began mapping was Phoenix in April.

In May, supervised driving began in Phoenix.

This week, Cruise announced it would begin mapping in Dallas.

Cruise looks like it is retaking its steps in 2022 and 2023, verifying its technology and scaling to new markets.

If successful, Cruise could be an enormous business that investors.

The Upside in Transportation as a Service

Shares of GM are trading for 5.7x trailing earnings and 4.8x forward earnings estimates. Any way you look at it, the stock is cheap.

We are getting any upside from Cruise for FREE!

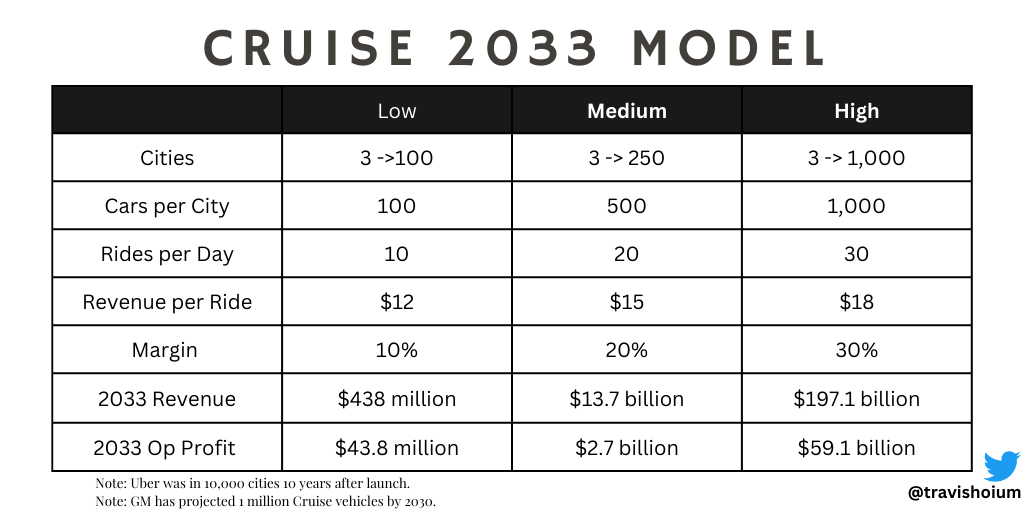

Below, I’ve outlined some potential upside scenarios I published in the April 2023 GM spotlight article. At the time, Cruise was in 3 cities and I gave a range of cities, vehicles per city, revenue, and margins.

These numbers are a ballpark guess at what the opportunity in autonomous ride-sharing looks like, and you can see it’s potentially huge.

The business also scales more quickly than you might think. By October 2023, Cruise had plans to launch in about a dozen cities. Standing up a new city takes a few months, but would only be constrained by available vehicles, which GM has ample capacity to make.

Remember, Uber was founded in 2009 and by 2019 it completed 6.9 billion rides in a year, generating $65.0 billion in bookings.

Don’t underestimate how disruptive a business model this could be in a decade.

Despite all of the turmoil, GM stock is up 32.6% — beating the market — since I covered it in a spotlight article. If Cruise ever gets off the ground in a meaningful way the asymmetric potential is still there.

GM may not lead in hype, but GM and Cruise are leaders in autonomous driving technology. And now Cruise’s vehicles are back on the road and scaling again.

The market doesn’t seem to realize the opportunity quite yet.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.