Looking at the market’s returns this week, it would seem there was some kind of major economic shift happening in the U.S. economy. No, it was simply an election.

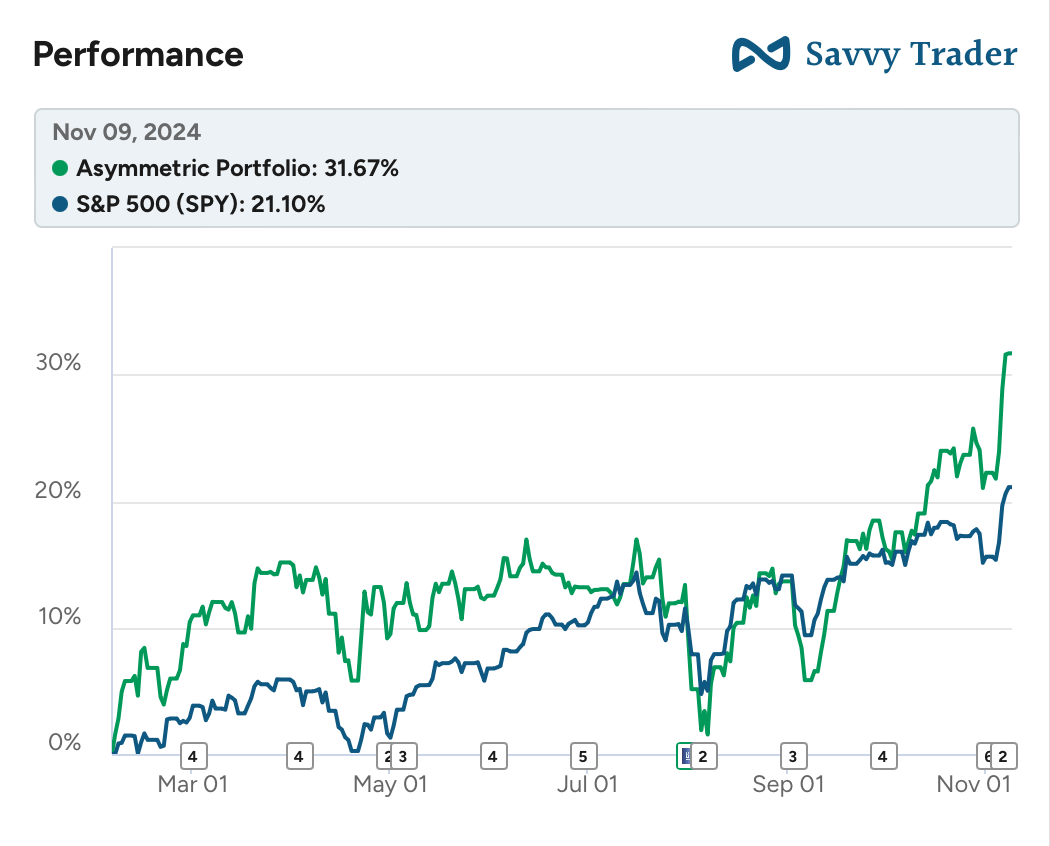

I’ve stayed intentionally apolitical here and that won’t change, but the market’s reaction and the pop in the Asymmetric Portfolio, which is up 7.73% this week, needs some context and temperament. As is often the case when politics and money meet, reality may not be what it appears.

As I mentioned, the Asymmetric Portfolio did have a great week and is now beating the market by over 10% since tracking started on Savvy Trader. Over the past year, the portfolio is up 54%!

What I’ll put into context below is where the recent moves are driven by a real change in the business and where it’s just speculation.

Asymmetric Investing is a freemium business model, meaning ads make the free version possible. Sign up for premium here to avoid ads and get 2x the content and access to the Asymmetric Portfolio.

This tech company grew 32,481%...

No, it's not Nvidia... It's Mode Mobile, 2023’s fastest-growing software company according to Deloitte.

Just as Uber turned vehicles into income-generating assets, Mode is turning smartphones into an easy passive income source, already helping 45M+ users earn $325M+ through simple, everyday use.

They’ve just been granted their stock ticker by the Nasdaq, and you can still invest in their pre-IPO offering at just $0.26/share.

*Mode Mobile recently received their ticker reservation with Nasdaq ($MODE), indicating an intent to IPO in the next 24 months. An intent to IPO is no guarantee that an actual IPO will occur.

*The Deloitte rankings are based on submitted applications and public company database research, with winners selected based on their fiscal-year revenue growth percentage over a three-year period.

*Please read the offering circular and related risks at invest.modemobile.com.

In Case You Missed It

Here’s some of the content I put out this week.

When 90% Growth Isn’t Enough: Hims & Hers expects to grow 90% this quarter, so why isn’t the stock on fire?

Airbnb’s Past, Present, and Future: Airbnb has an amazing core, but it’s the future growth prospects that provide an asymmetric upside.

Zillow’s Massive Opportunity: We are seeing signs that Zillow is winning the housing platform war.

The Stock Market and Elections

I spend a lot of time on Asymmetric Investing hammering on the point that our biggest advantage over the market is thinking long-term. It’s the first topic in Asymmetric Investing Frameworks, which is the second link on the home page after the portfolio.

The reason long-term thinking is important is we have no advantage over the hedge funds and day traders who think in hours, days, and weeks. Even Wall Street analysts and mutual fund managers have a hard time thinking further out than a quarter or two because that’s where their financial incentives lie.

Thinking in decades allows us to tune out the noise. And elections are noise!

This graphic from Schwab and Morningstar shows just how much $10,000 invested in 1948 would have returned under only Republican presidents, Democrat presidents, or staying invested 100% of the time.

Staying invested rather than speculating on the market’s moves is almost always the right answer. It is simple but effective.

The Obvious Answer Is Often Wrong

What’s wild is how often the obvious election narrative is wrong.

This is my fourth election cycle writing about investing publicly and I could tell story after story about how often this is true. Remember the coal baron, Robert Murray, who was in the White House regularly in 2017? His company went bankrupt in 2019.

I’ll focus on the one story I know well, which is solar energy.

After the election in 2016, the obvious answer was that solar would be a terrible investment because the incoming administration was actively hostile to renewable energy, favoring coal and natural gas. That obvious thesis was wrong!

The “obvious” time to invest in solar energy was in 2020 when the power in Washington D.C. shifted parties. In reality, 2020 was a terrible time to buy solar stocks. This chart doesn’t include SunPower (a company I owned) because…it went bankrupt earlier this year!

What’s the equivalent this time around? We don’t know. But the obvious moves in the market this week may be completely wrong.

Elon Musk is seen as an obvious winner and Tesla stock was up 31% this week on speculation he can do whatever he wants now.

Crypto values soared this week on speculation a more friendly policy environment is on the horizon.

Big banks soared because…lower rates?

The obvious answer after any election is often wrong. Stay focused on the business strategy and performance. Everything else is noise.

I’ll Take the Wins But Remain Focused on What Matters

I don’t write this to pour cold water on stocks that were hot this week or predict what will happen. The point is, that we often can’t predict exactly how politics, the economy, and markets will mix.

This week, three of the Asymmetric Universe stocks had great weeks primarily because of speculation. I continue to be bullish on them, but I’m bullish because of what I see over the next decade, or more, not what I see in the next 4 years.

What matters more to me is the stocks moving higher because they had great earnings reports. That’s a signal.

I’ll continue to cover and invest in companies with long-term growth and buy stocks I think are trading at reasonable values.

History has shown that buying or selling based on who is in the White House is a bad idea and can cloud judgments about how businesses will perform.

I’ll take the short-term wins, but there’s a lot of work to unlock the long-term thesis of any of the stocks I cover. A period of time that will span multiple administrations and policy environments.

Don’t forget that long-term view or get caught up in the hype this week. Hype will fade.

You can get all Asymmetric Investing content, including deep dives, stock trades, and ongoing coverage of Asymmetric Universe stocks with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your own research before acquiring stocks.