Note: I wrote most of this before today’s Twitter meltdown by Musk and Donald Trump. I thought it was still relevant today, and maybe more so for investors. On with the story.

Next week, Tesla $TSLA ( ▼ 2.13% ) is expected to launch a fully autonomous robotaxi in the city of Austin, TX.

This comes more than a decade after Elon Musk said 90% of Tesla’s miles would be autonomous.

Will Tesla finally be fully autonomous? Sort of.

From what we know, the City of Austin is requiring Tesla to have remote operators available at a moment’s notice. And a safety driver may be in the front seat.

But if Robotaxis do indeed launch next week, it would be big news for all of autonomy. It impacts Tesla, and it impacts at least four of the biggest holdings in the Asymmetric Portfolio.

So, let’s get to why this is such a big risk and how the companies I own in the Asymmetric Portfolio are doing things differently.

Tesla’s Technology Risk

Tesla is the only autonomous driving technology company to use only cameras for sensing surroundings. We need to judge autonomy based on the inputs (sensors), processing (compute and ability to make decisions), and actions (safety/accidents).

Starting with the inputs, there are three main sensor types that companies are using:

Cameras: Senses visible light like a human. Low-cost and a lot of available data to train AI.

Downside: Struggles with glare, fog, and low-light conditions.

Radar: Senses radio waves, which makes radar ideal for low-light and low-visibility conditions like rain and snow, with a long-range capability of several hundred yards.

Downside: Lower fidelity than cameras, and can see “ghost targets” from reflections.

LiDAR: Light Detection and Ranging emits a laser pulse and measures the time for pulses to return after reflecting off an object. This creates an accurate 3D map of an area.

Downside: High cost of $1,000 or more (coming down rapidly) and limited range.

Most companies use multiple sensor types. Tesla uses only cameras.

This reliance on a single sensor type without redundancy leads to failure modes like the fatal accident in 2023 that was caused by glare in FSD cameras. Glare is a known failure mode for cameras that won’t improve with more data. No system is flawless, and this is the flaw of cameras.

Most companies understand the need for redundancy and multiple failure modes, using cameras as a base and then adding LiDAR or radar as a redundancy or assist to the system. LiDAR is the most common today, but Mobileye’s $MBLY ( ▼ 1.31% ) “imaging radar” is a new technology that was recently ordered for an autonomy system by an undisclosed OEM.

Waymo $GOOG ( ▼ 1.64% ) uses cameras, radar, and LiDAR.

Mobileye uses cameras and radar, or LiDAR.

GM $GM ( ▼ 1.97% ) uses cameras and LiDAR.

The theme here is that risks exist for any single sensor. And Tesla is taking a huge risk by using only cameras. That’s a risk no one else is taking.

The bet is that AI will solve the safety problem, assisted by driving data from Tesla vehicles. Elon Musk thinks low-cost cameras and a high-power GPU with an AI neural network will be more effective than higher-cost sensors and the redundancies most companies are using.

Simply put, the bet is on cameras + AI improving faster than cost reductions in radar/LiDAR sensors.

I think betting on the cost of sensors coming down is the right move. There are estimates that Waymo’s vehicles will soon be under $50,000, and that’s close to a Tesla that’s often over $40,000 today.

Camera-only autonomous technology is a massive risk, and we have no data today to support the idea that a camera-only system is safe enough for public roads. We may find out soon. But it’s not the only risk Tesla is taking.

Tesla’s Business Model Risk

One of the more puzzling pieces of the Tesla strategy is the business model. Tesla wants to sell people vehicles, charge them a monthly fee for FSD, and charge a fee per ride. It’s a low-capex concept with upside as the robotaxi fleet grows.

But does that make sense for a vehicle owner?

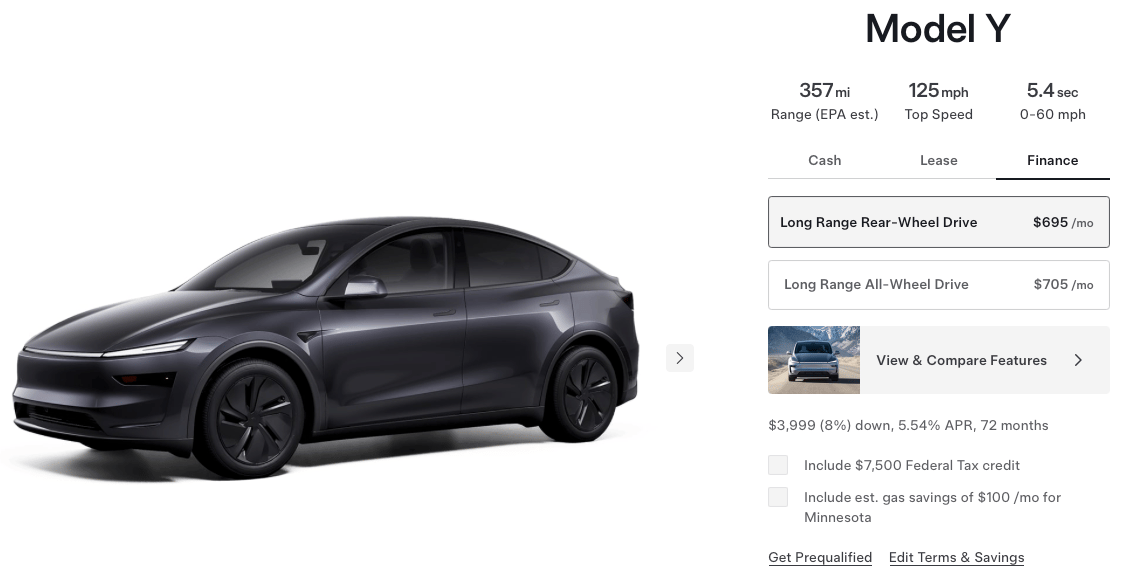

Let’s do some napkin math with this Model Y as our example.

Here’s what a month of expenses and revenue may look like. Let’s assume a Model Y owner sends their vehicle out twice a day and completes two rides on each outing of 5 miles each.

Revenue

$1.50 per mile net of Tesla fees

Total daily revenue is 4 rides x 5 miles x $1.50 per mile = $30 per day

Variable Costs

$0.05 in electricity per mile

Assume 40 miles of driving = $2 per day

Fixed Costs

Financing: $695/month

$23.17 per day

Insurance: $221/month

$7.36 per day

In total, the owner generates $30 in revenue per day and has $32.53 per day in expenses. That’s likely underestimating the expenses, but this is napkin math.

On top of that, they need to clean the car, deal with charging, get the car when it gets stranded, and on and on.

You’re now a taxi owner, and people are riding in your car when you aren’t in it. Is that worth still losing money on your vehicle?

Then there’s wear and tear and maintenance costs associated with the mileage. 40 miles per day is 14,600 miles per year on top of what you may drive personally. Do you want to put 100,000 on a vehicle in 4 years?

Would you get a brand new Model Y and send it out every day to save a few bucks?

Some owners would. But remember, Tesla would essentially launch a robotaxi fleet nationwide if this is successful. They wouldn’t need 100 vehicles on the road to serve a city. They would need hundreds of vehicles on the road every day in every city.

Maybe fleet owners like Hertz would see this as an opportunity and operate a fleet of Tesla robotaxis. And if we go from 4 rides per day to 15 or 20, the economics could be more attractive.

The point is, this is far from a slam dunk. And we haven’t even gotten to the hardest part of Tesla’s robotaxi model.

The Big Risk

Elon Musk’s risk isn’t just about hardware and software and convincing owners to let Tesla operate their vehicles in a robotaxi fleet. It’s about getting to market on the demand side.

In ride-sharing, there’s a reason Uber spent billions of dollars “winning the market” before it ever made a dime in profit. Ride-sharing is a network effect business, and that’s why it’s a winner-takes-most market.

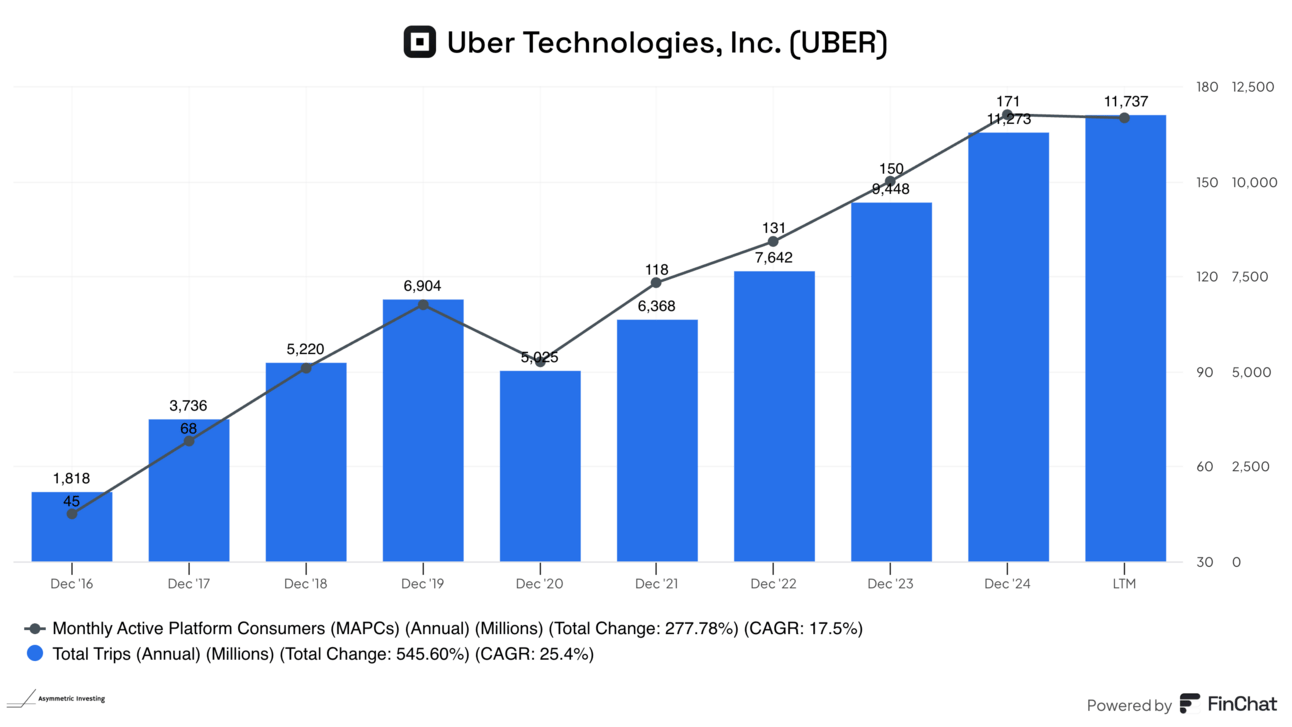

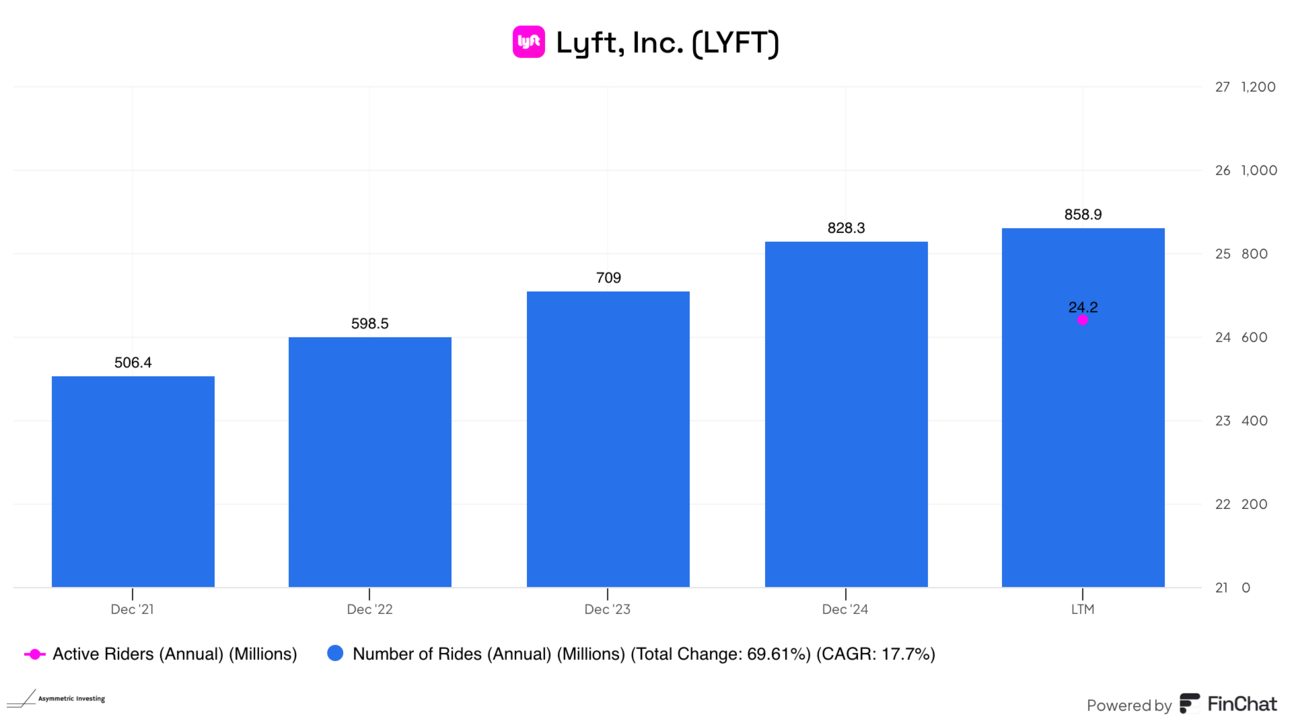

Tesla needs to build a network effect that can overcome 7 million Uber drivers, 170 million active riders, and 11.7 BILLION rides per year. Plus, there are competitors like Waymo, Mobileye/VW, BYD, May Mobility, and others who are ahead of Tesla in testing full autonomy and proving safety, and they’re supplying Uber and Lyft.

Even topping Lyft’s 24.2 million riders and 858.9 million rides per year would be a tall task. For context, it’s taken Waymo years to get to a 13 million ride runway.

If Waymo, Uber, and Lyft all have autonomous vehicles on the road by the time Tesla can operate robotaxis in your city, why would you switch?

The network effect is set.

And to layer on top of this, there are millions of people all around the country who today wouldn’t set foot in a Tesla autonomous vehicle for one reason or another.

I think Tesla’s vertical integration is a hindrance in autonomy, and the only “winner-take-all” part of the market is likely to be the companies aggregating demand for rides (ie, Uber and Lyft).

Elon Musk’s $1 Trillion Gamble

One of the themes of Asymmetric Investing is that business models matter.

Great technology fails with the wrong business model.

Great valuations don’t matter if the business model is wrong.

I like the start with the business model and work out from there.

In the case of autonomy, business models matter more than ever, and I think the winners are already clear.

Uber and Lyft will aggregate demand for rides.

Autonomous vehicles themselves will be a commodity provided by dozens of suppliers.

This is a continuation of the auto business being a commodity business that earns its low valuations on the stock market.

Fleet owners and operators will have opportunities to build steady ROI, REIT-like business models on top of autonomous vehicles and serving ride-share marketplaces.

The opportunity for suppliers is to be a horizontal or modular niche supplier

This is where Mobileye fits as a chip, sensor, and software supplier to most OEMs.

Waymo is also testing this model by working with Toyota.

Tesla is trying to go it alone, developing the vehicles, proving the AI technology, and building the ride-sharing network. And investors are still paying nearly $1 trillion for the company, despite not proving it can do any of the above.

I’m an asymmetric investor, and I want companies with upside. But paying for upside that may never materialize is a path to financial ruin. And I think that’s where Tesla lands today.

And that’s all before the last 24 hours, which were something else entirely.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor, or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.