Earnings season begins this week, with major banks such as Citi, Bank of America, and U.S. Bancorp reporting, along with Netflix, 3M, and ASML. By the end of the week, we should have a feel for how the season will trend from a macro perspective.

Over the past three months, the market hasn’t seemed worried about a potentially weakening economy or rising tariffs on U.S. imports. But during earnings season, the rubber meets the road, so the narrative may change.

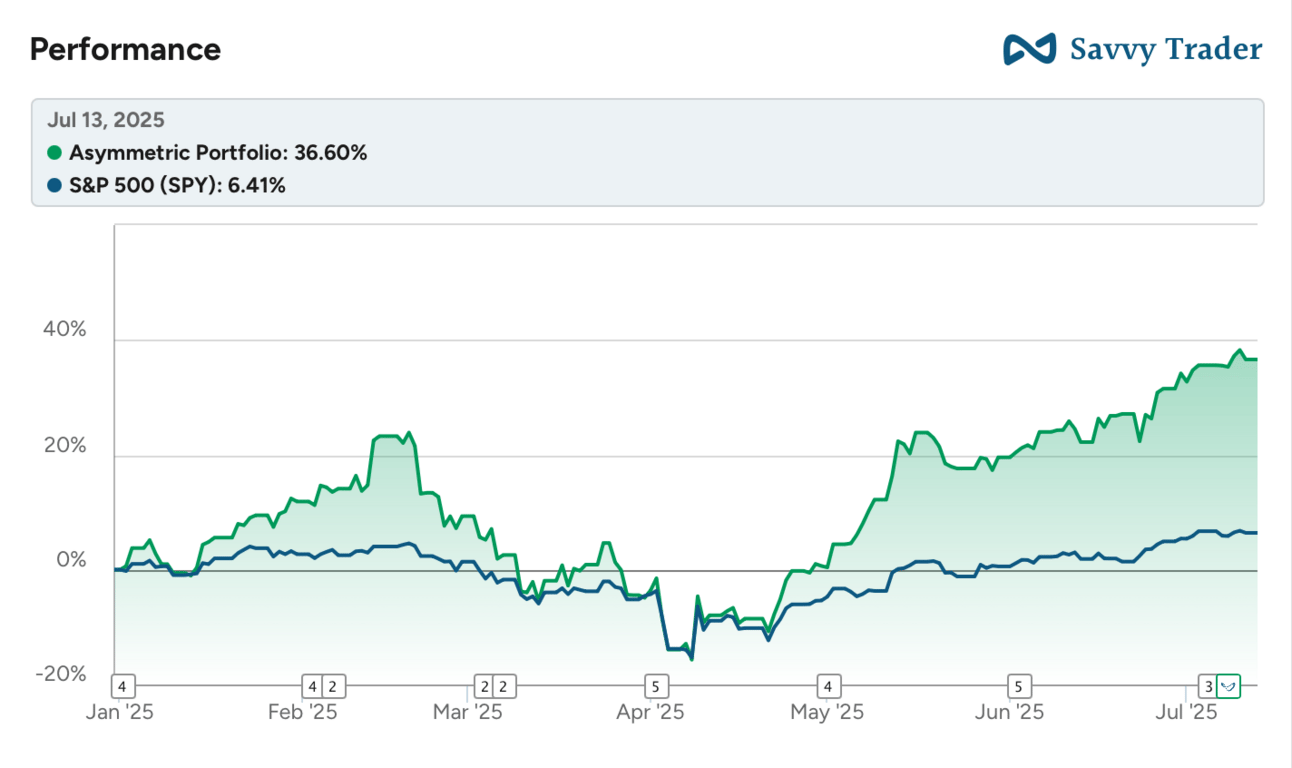

The Asymmetric Portfolio is in something of a holding pattern until we get earnings. To be frank, I don’t know whether earnings season will be another good one, like Q1 was, or if some highly valued stocks in the portfolio will prove to have gotten ahead of themselves. I’ll be covering each report for premium subscribers over the next month.

All of the charts you see here are easy to make with Fiscal.ai, the first place to go for all of my research. I can’t say enough how much easier it’s made my research, and you can start with 2 weeks free. 👇

In Case You Missed It

Here’s some of the content I put out this week.

The Most Important Investing Trend of the Decade: Supply was the dominant part of the supply chain for decades, but demand is where we want to invest now.

Zillow’s Aggregation and Real Estate Lawsuits: Zillow is being sued and it shows how desperate real estate companies are getting.

“I’m the Captain Now“: Sundar Pichai is running the AI world now.

What to Watch During Earnings Season

As we go into earnings season, here are the trends I’m looking for across the board.

Guidance

In Q1 2025, the trend was guidance uncertainty. Tariffs had just been announced, and no one knew what was next. We’ve had three months to digest potential tariffs and the up and down policies at play, so what do companies see for the rest of 2025?

I’m expecting many companies to reinstate guidance, potentially at lower levels than we came into the year. And if that’s the case, is it because they’re conservative or because they see lower earnings because of tariffs or weakening consumer spending?

The guidance numbers will be important, but so will reading between the lines.

Lending Trends

Are banks lending more aggressively because they see a bright economy ahead?

Or are they worried about riding default rates?

What’s the latest on auto defaults and credit scores?

Big banks will have a feel for how the overall lending environment is performing, and I’ll be listening closely to that this week.

Consumer Spending

Let’s be honest, we’ve been hearing about a weak consumer for over a year now, but the market keeps ripping higher. Who is right?

I keep seeing some weak signs, but not enough to force a recession or companies to pull back. But I’ll be listening to results from companies like Target and Walmart closely because they give us a broad look at whether consumers are spending freely or looking for deals.

Any AI Pullback?

AI companies have been tripping over themselves to increase capex in recent years, but the trend will slow down eventually. Is now the time?

Big tech starts to report results next week, and we will find out if anyone is increasing or reducing capex guidance.

AI is going to be fascinating because we have both seen startups be gobbled up, indicating less disruption to big tech, and massive pay packages for top talent, indicating high competition among incumbents. So, we will learn a lot about the lay of the land starting next week.

Tariffs…

Are we worried or over it?

I honestly don’t know what to think about tariffs because the market seems to have forgotten…but not a lot has changed since April 2.

We had a few companies project the tariff impact in Q1, and I’ll be looking for updates and hard numbers about tariffs and inventory levels this quarter.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor, or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your research before acquiring stocks.