Disney hasn’t been the most popular stock over the past year and that’s understandable for a lot of reasons. Films have been disappointing, cable TV is dying, and the streaming business is losing money like crazy.

But in the August 2023 spotlight of Disney, I laid out how the company could be a leader in streaming everything from proprietary IP to sports with an experiences business attached.

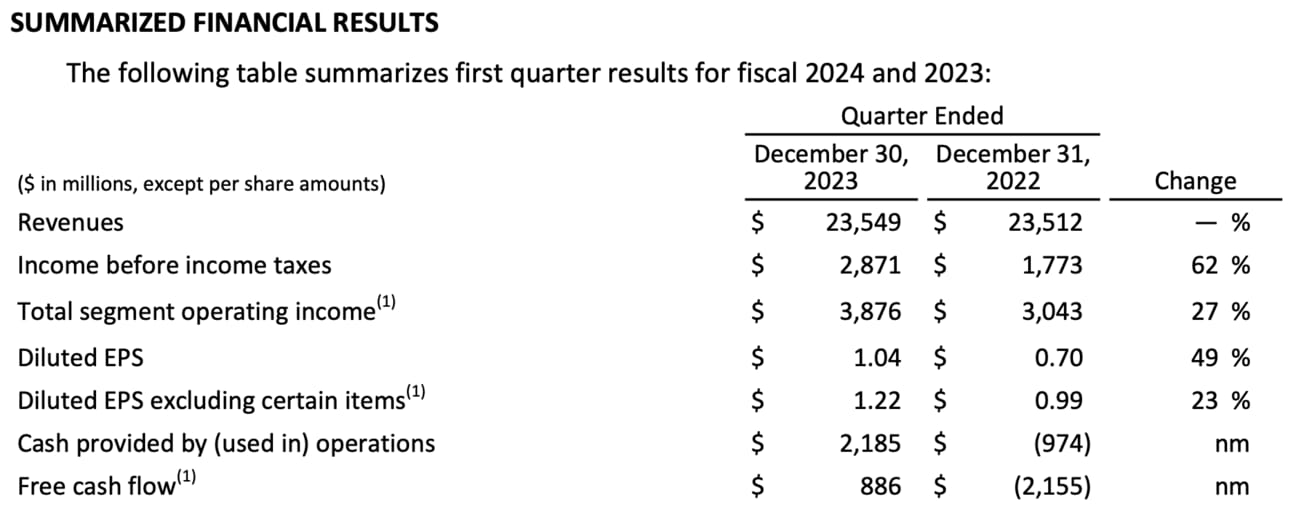

Q1 2024 financial results showed Bob Iger is not only taking Disney in that direction, but he may be burning some bridges along the way.

First Things First

At a high level, the quarter was about treading water on the top line and cost cuts on the bottom line. The cuts were deeper than expected and that’s why the market reacted positively to the quarter.

Disney also said they expect earnings of around $4.60 per share in fiscal 2024 with free cash flow generation of about $8 billion. At Friday’s closing price, shares now trade for 24× 2024 earnings and 25× 2024 free cash flow.

While the valuation is reasonable, I’m more worried about the future of Disney’s streaming business and Iger is now laying out a clear path forward. And that path may involve burning bridges in the cable industry.

Disney’s Sports Vision and the Future of Cable

Sports are the lynchpin for Disney’s media business. ESPN has given Disney negotiating power over cable companies for decades and sports is the missing piece in Disney’s current streaming bundle.

When Disney announced a new streaming sports venture earlier this week I thought this was the play. ESPN would be available this fall in a streaming bundle with TNT, Fox, and other assets. And it could be bundled with Disney+ and Hulu. There’s your Disney IP/general entertainment/sports bundle.

What made less sense was why this new service was equally owned by ESPN, Warner Brothers Discovery, and Fox. ESPN has the best sports assets and biggest distribution of those three and I questioned why Disney needed to give up 2/3 of the ownership of the venture.

The conference call cleared up a lot of my questions. Now, I don’t think the sports JV is a big deal at all. It’ll be a small bundle of cable assets focused on sports. But there’s nothing revolutionary or new and Iger didn’t seem all that interested in making it a meaningful business.

My interpretation is the JV is a weigh station on the way to the true vision, which is a Disney+/Hulu/ESPN bundle. And ESPN won’t just be a few sports, it’ll include so much more.

From the conference call:

This is really not a first step. It's a second step. The first step was launching ESPN+ some years ago, which has actually been quite successful. The second step is finding these partners to distribute basically the equivalent of a multichannel, sports-centric tier via app. So one, we're serving sports fans well. Two, we're doing it with partners. Three, we're doing it in a more modern way. Rather than cable and satellite in this case, it's app based. And that's a big step for us because we know that there are a number of people who have never signed up for multichannel television. This gives them a chance to do so at a price point that will be obviously more attractive than the big fat bundle. Two, there are people who have left that ecosystem because they didn't want all those channels or that cost. And this is a way of basically preserving a relationship or creating one with those that are no longer part of the multichannel ecosystem. The next step after this, and we announced today that we'll launch it in probably August of '25, is to bring out ESPN flagship.

I say on its own, but it will be bundled ultimately with Hulu and Disney+. And that will be a very, very immersive, very obviously sports-centric app, which will have features that this combination with FOX and with Turner -- Time -- Warner Discovery will not have such as integrated betting, integrated fantasy, likely to have some sales arm or merchandise capabilities, obviously, deep dive into stats and high degree of customization and personalization. Again, another kind of feature that we'll bring out to engage with sports fans.

There’s a lot to unpack from that quote, but I took away 2 things:

Disney sees the end of the “big fat [cable] bundle” and is creating an over-the-top mini competitor to traditional cable. Comcast and Charter better watch out.

The JV with Fox and Warner Bros. Discovery is a weigh station on the path to a bundled ESPN with fantasy sports, betting, stats, merch, and more.