A lot of ink has been spilled over the last week discussing the demise of Disney and Iger’s already chaotic return as CEO. I even gave a few shots at Iger in my weekend article.

As challenging as business has been for Disney, the media industry is going through growing pains that are both healthy and necessary in the transition to streaming. This happened in the 1960s when TVs in homes threatened the economics of movie theaters. The next step is streaming disrupting the linear TV model that has been in place since the 1960s. Everyone is scratching for their place and Disney may be better positioned than you think.

The Disruption of Media

(I am going to focus this discussion on the disruption of cable TV, but the concepts are similar in movies today)

Today’s cable business and the economics behind it were built on the assumption of scarcity. The four major broadcast channels only had 24 hours a day to show content and only a few hours of prime-time attention. Cable brought on more channels with specialty content and to increase inventory more and more channels were added but the content available was still based on the number of channels available. There was scarcity and that drove the economics of companies like Disney.

Cable TV is really just a series of bundles. Cable is a bundle of channels, a channel is just a bundle of content, and content companies like Disney have created bundles of channels to gain negotiating leverage over cable companies for rights fees. The entire economic model is predicated on a bundle in a bundle in a bundle.

Streaming simply undoes the bundles. A piece of content can be sold directly to a consumer, so what value does a cable provider, TV channel, or bundle of TV channels (like Disney’s cable assets) have in the streaming world?

No wonder Iger said he would be open to selling ABC and cable networks. They hold very little value in a streaming world.

The un-bundling of cable TV appears clear. But I don’t think we are moving to a world where we’re paying for each piece of content individually makes any sense.

The logical end state is to re-bundle under the umbrella of streaming services as the point of distribution. Netflix is clearly a leader with 232.5 million global subscribers and Disney is trying to be one of the streaming companies left standing with 157.8 million Disney+ subscribers, 25.3 million ESPN+ subscribers, and 48.2 million Hulu subscribers.

What’s becoming clear is that Disney’s future in media is making content and owning streaming distribution. Everything else is a distraction.

TV and Internet Economics

As media moves to streaming, the physical constraints that drive cable’s distribution structure go away. Instead of Xfinity having geographic dominance because it’s the service that’s feeding content into my TV, Netflix and Disney can serve anyone, anywhere in the world with streaming.

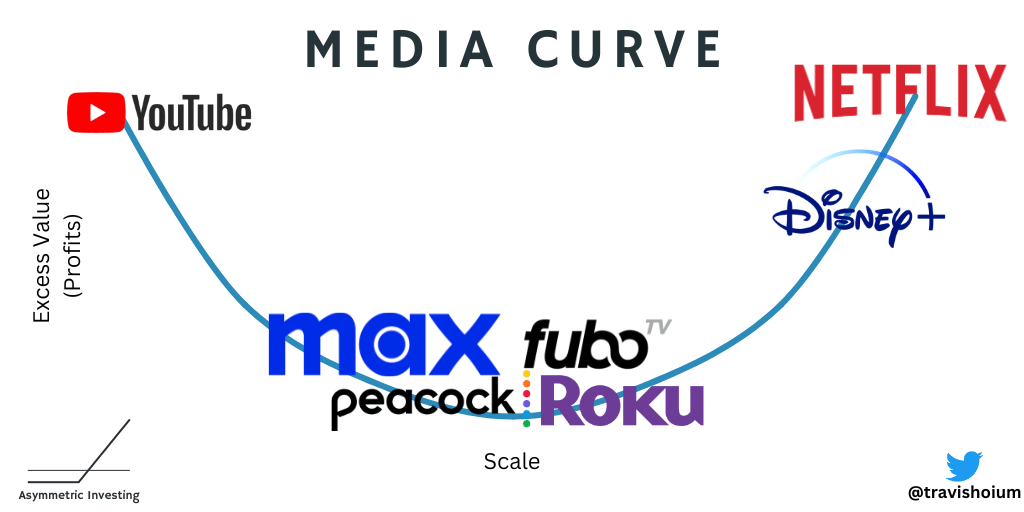

Based on the theories in Internet Economics and the Smiling Curve, it’s logical there will only be a small number of streaming companies that survive (the right side of the curve below), but those that do will be extremely valuable.

Netflix and Disney (Disney+/Hulu/ESPN) have a clear lead in being big and YouTube is the platform smaller creators can go to reach billions of viewers. Everyone in the middle is…in trouble!

Having a streaming business at scale will mean the power to pay for the best content and attract the most advertisers. I think Netflix will be a winner, but Disney is now doing everything it can to build a service that will be able to benefit from internet economics once it scales. Competitors will get tired of burning cash and will slowly give up on their streaming dreams.

Iger’s ESPN Pitch

The comment that stood out to me last week was Iger’s openness to “partners” at ESPN. He essentially took a sale of ESPN off the table because Disney wants to be in the sports business, so why would he want “partners”?

Ben Thompson suggested this morning that Apple (MLS and MLB deals), Amazon (NFL), and Google (NFL) would be good strategic partners because Disney could bring eyeballs to the content they’re spending billions on. I think the partner targets are more desperate than the tech giants.

Look at the media curve above and notice Peacock and Max. These are the streaming efforts of NBC Universal and Warner Bros. Discovery respectively. NBC has sports assets like the Olympics, NFL, Nascar, Premier League, and college football with billions of dollars locked up in rights fees and a streaming service burning $7 million PER DAY. Warner Bros Discovery’s biggest sports deal is TNT’s NBA coverage and that’s like a fish out of water in the streaming world. TNT was always an odd bundle of old movies and sports, but on a streaming app, those two make no sense together.

What does make sense? ESPN as the front door to the world of sports with leagues and other networks providing content to the service.

Iger needs to convince NBC and TNT that their own streaming aspirations are a pipe dream and their best chance at survival is helping ESPN become THE streaming sports app. The economics of these partnerships would be challenging, but it’s in everyone’s best interest to make streaming sports work.

Disney may be in a better negotiating position than it seems.

Sports leagues are losing young viewers to YouTube and TikTok, but the Disney and ESPN brands still hold sway.

The bankruptcy of Diamond Sports — which consists of the old Fox Sports regional networks — is the financial threat Iger needs. “Join me or go the way of Diamond Sports.”

It’s a compelling argument if you’re a sports league or competing network. ESPN doesn’t have a critical mass of sports subscribers yet, but Disney does and I don’t think it’s inconceivable that a standalone ESPN app with all of ESPN’s content would pull in at least 100 million subscribers around the world, especially if it’s bundled with Disney+ and Hulu.

Iger’s Final Achievement

If Iger can convince competitors to sell him sports content that makes ESPN the “winner take all” sports streaming service and simultaneously combine Disney+ with Hulu to create a real Netflix competitor, he would have Disney dancing on the right side of the smiling curve. It’s nearly impossible to see how any competitor would be able to knock off its position.

The irony is, it’s in everyone’s best interest to do just that. The economics of sports are getting worse as cable is dying and the channel model doesn’t work anymore. If NBC Universal, Warner Bros. Discovery, the NBA, and everyone else in sports realizes they’re chasing a losing strategy by fighting Disney and ESPN, they might as well join them. The only company standing in the way is Netflix, and they seem uninterested in sports.

If Iger pulls this off, this would be Iger’s greatest accomplishment. I, for one, think he has a good chance to get it done.

As an investor, if you’re disappointed by losses in streaming or don’t understand selling off iconic assets like ABC, zoom out. There’s a bigger game afoot in the future of media and the winner could be more profitable than all legacy media companies combined.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.