Not all stocks with asymmetric opportunities have to be high risk. Some can be value stocks that simply have a lot of optionalities. That’s what I see in today’s spotlight stock—Dropbox (Nasdaq: DBX).

Why stock Dropbox?

Dropbox was the first mass-market cloud storage company, and it is used by over 700 million users worldwide. In a world of high-growth, unprofitable software-as-a-service (SaaS) companies, Dropbox sticks out like a sore thumb because of its focus on *GASP* free cash flow.

On the surface, Dropbox seems like a boring, mature company that’s getting eaten alive by bigger competitors; however, the numbers tell a very different story.

Key Stats

Dropbox by the numbers:

Company: Dropbox

Ticker: DBX

Market Cap: $7.7 billion

Revenue (ttm): $2.37 billion

Gross Margin (ttm): 81.1%

Operating Margin (mrq): 13.8%

Net Income: $542.5 million

Shares Outstanding and Y/Y Growth: 348.8 million down 6.5% Y/Y

Earnings per share: $1.52

FCF (ttm): $770.8 million

Date Founded: 2007

Founder: Drew Houston and Arash Ferdowsi

Dropbox’s Leadership:

Drew Houston, Co-Founder and CEO: Founded the company and continues to lead the strategic direction and products at the company.

Tim Regan, CFO: Experience prior to Dropbox includes Pandora, Dolby Labs, and Ernst & Young.

The Strategy

Dropbox was one of the original cloud software-as-a-service companies. It made it easy to have a folder of files in the cloud, which was revolutionary at the time.

From there, the company made it easier to sync files across devices, across multiple users, send documents to third parties, and more. This is a horizontal or modular business model, which means it’s important for Dropbox to be accessible on any device at any time. This can be an advantage over companies like Apple or Microsoft, who are more interested in building their own vertically integrated business (Apple) or platform (Microsoft).

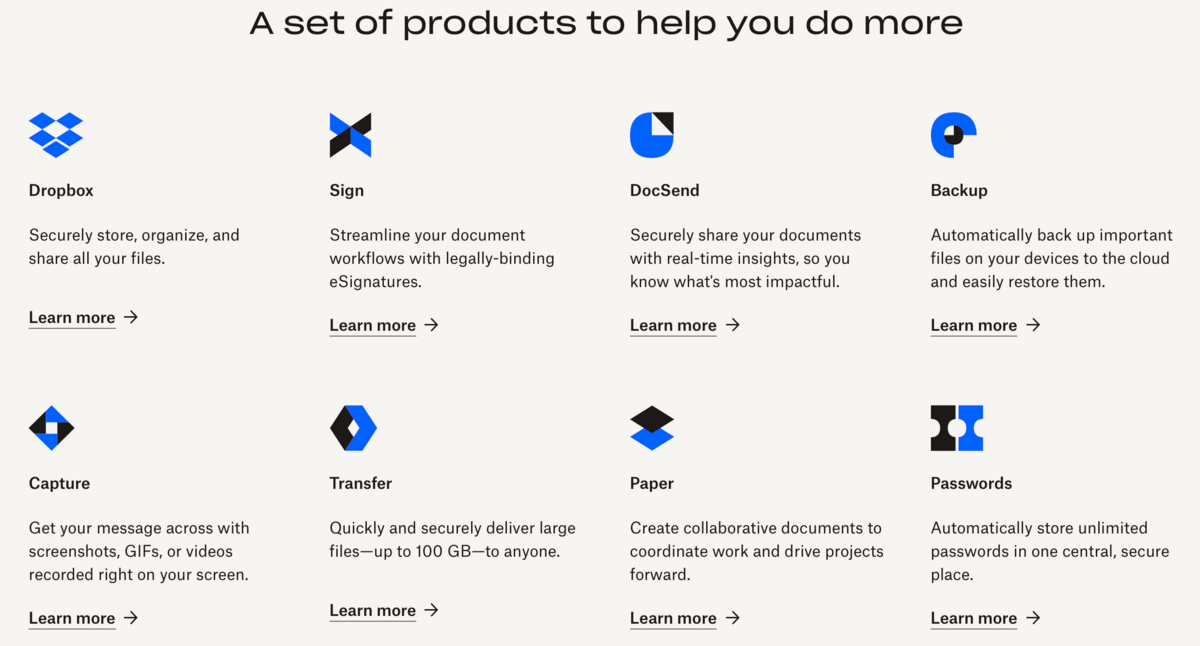

Dropbox is known as a file storage company, but it’s become much more than that. You can see the product lineup below.

Dropbox isn’t a platform like Microsoft, but for businesses who use these products, it’s a critical product for operations. In file storage in particular, there are only a few choices for reliably sharing files and Dropbox is at the top of the list with Google’s G-Suite and Microsoft’s OneDrive.

It may be difficult to fight against tech titans, but Dropbox isn’t playing the same game as big tech. In fact, most new customers seek the company out and then Dropbox can “land and expand”, moving up an organization rather than trying to sell in at the top like competitors would.

90% of our revenue is still through our self-serve channels