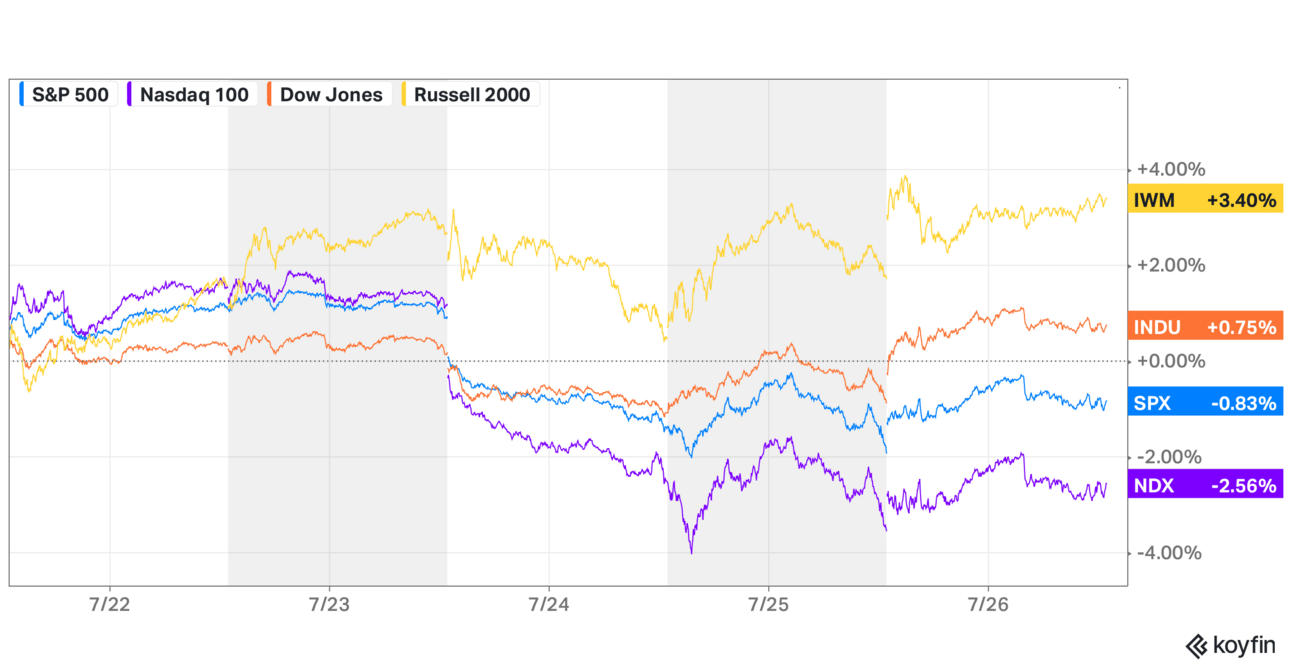

The story of the week was once again the resurgence of small-cap stocks while big tech took a major step back. Investors are questioning if the AI explosion that’s been priced in over the past year is overdone given the incredible amount of money spent to advance the technology with little financial impact to show for it. And it’s no surprise that Alphabet was caught up in the noise after reporting earnings, which I’ll get to below.

The Asymmetric Portfolio benefitted from underexposure to AI and saw great earnings reports from the top three holdings last week. This week, we will see another flurry of earnings reports that could determine the trajectory of the portfolio for the next 3 months.

Asymmetric Investing is a freemium business model, which means the free version is made possible by ads like this one. Sign up for premium here to get 2x the content, access the Asymmetric Portfolio, and avoid ads.

Take a demo, get a Blackstone Griddle

Automate expense reports so you can focus on strategy

Uncapped virtual corporate cards

Access scalable credit lines from $500 to $15M

In Case You Missed It

Here’s some of the content I put out this week. Enjoy!

Peacock, The Olympics, and Throwing Good Money After Bad: I highlighted how streaming winners and losers have shown themselves and which stock I’m betting on in streaming.

General Motors Earnings Conundrum: GM’s earnings were outstanding, but the stock dropped. Here’s why I’m not worried.

Spotify's Earnings Are Music To My Ears: Spotify is the top holding in the Asymmetric Portfolio and showed why with another great earnings report.

Tesla's Auto Business Has Become a Problem: Tesla is losing market share in the auto business, forcing investors to focus their attention on unproven AI and robotics markets.

Google’s Search Dominance

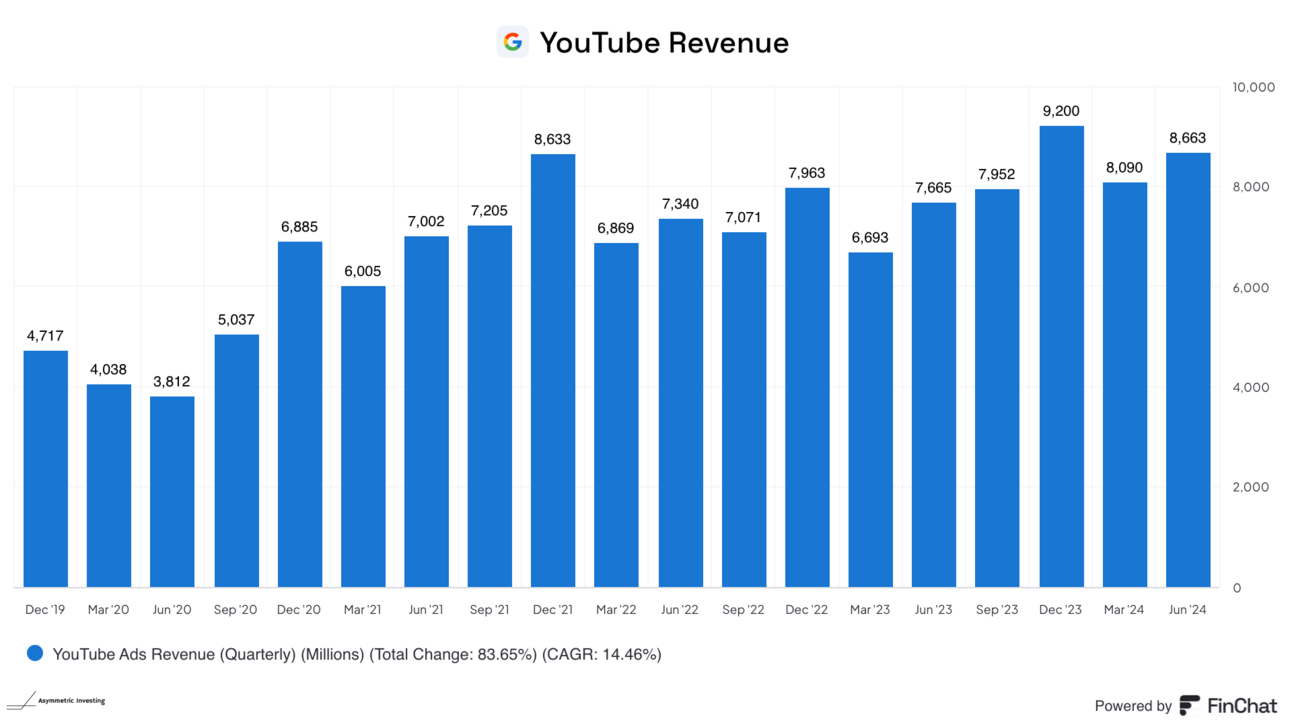

Shares of Alphabet dropped 8.1% last week after the company reported earnings. We can quibble about details like YouTube’s growth, but I think the bigger story is that search is doing extremely well and the stock now looks pretty cheap.

A year ago, investors were worried that AI would destroy Google’s search business and I don’t see evidence of that in the numbers.

There’s also strength in hardware and subscriptions, which includes Android. If there’s one place Alphabet will be able to extend its AI tools to competitive advantage to take market share in an existing market it’s in devices.

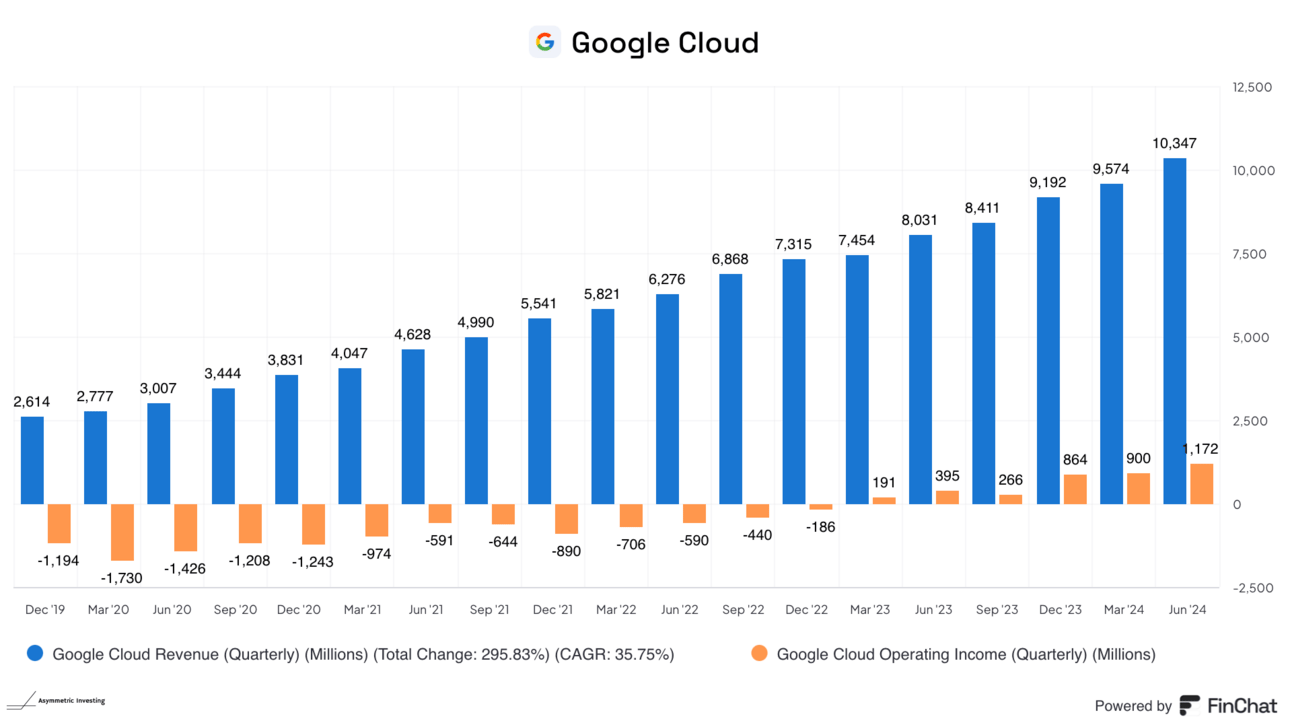

The cloud is also a growth machine that has turned solidly profitable. If artificial intelligence is indeed a disruptive business in tech, this could be the future of Alphabet and it’s barely registering on the company’s financials given the size of search.

YouTube was the one segment that “underperformed” but is anyone threatening YouTube’s place in streaming? This is a business that will be volatile depending on advertising spending, but it’s hard not to be bullish on YouTube long-term.

Finally, let’s talk about the bigger picture at Alphabet. You can see that operating cash flow has surged to $105 billion over the past year. However, management is spending over $10 billion per quarter building out infrastructure for artificial intelligence. That capex spending will either pay off or slow down in the future, which is why I think the operating cash flow growth is the key for long-term investors.

If search is going to maintain dominance, subscriptions and hardware grow, and the cloud business is a rocket ship then I think Alphabet stock is entering “no-brainer” territory. Shares trade for 24x trailing earnings and you can see above that management is buying back stock and even paying a modest 0.5% dividend yield.

It’s hard to find companies with big moats trading for a reasonable price and this one is staring us in the face.

You can get all Asymmetric Investing content, including deep dives, stock trades, and ongoing coverage of Asymmetric Universe stocks with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.