Zillow is one of those companies with massive potential that it’s sometimes hard to put your finger on.

It’s the first place I go to look at houses (and snoop on neighbors’ home values), and it was vital to finding the home we live in today. But I’ve never paid Zillow a dime directly, despite the value I’ve gotten from the platform, and the company itself has struggled to generate a consistent profit.

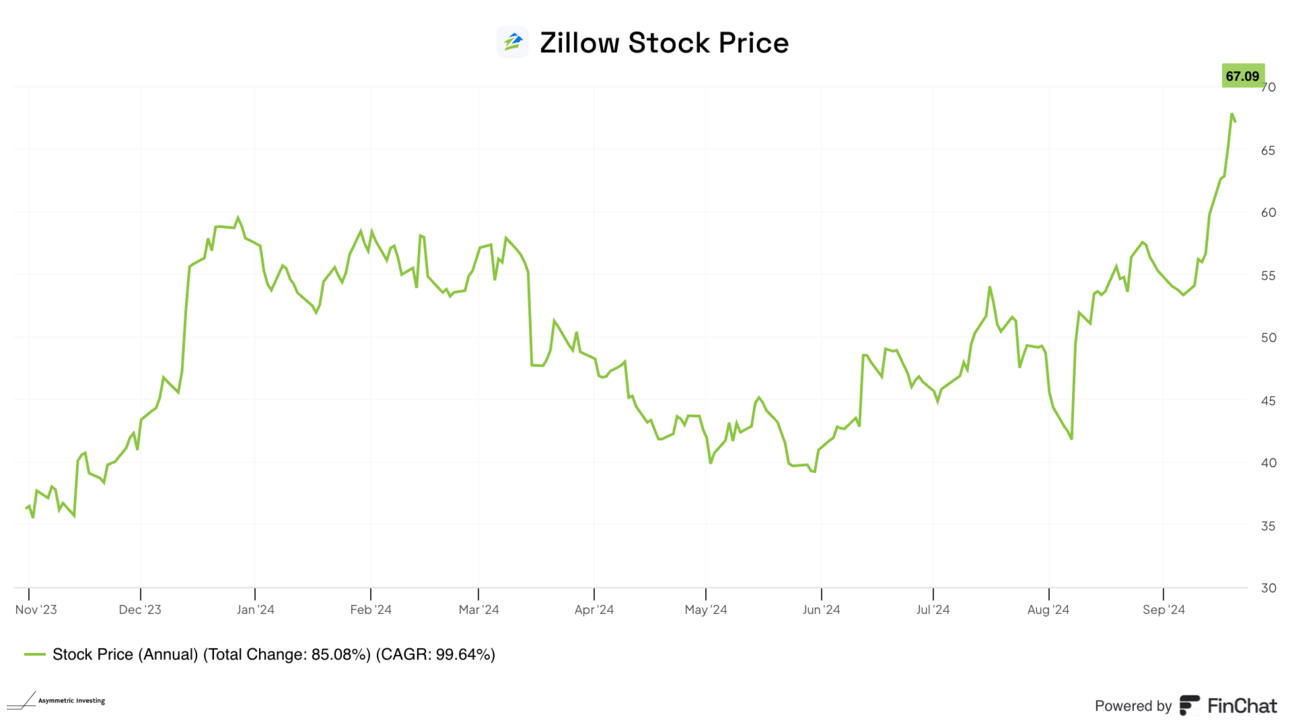

Where is Zillow going, and how will it get there? After hiring a new CEO earlier this year, I thought it was time to examine how he thinks about the company’s future. The stock has been doing well over the past few months and is up 82% since the October 2023 Spotlight article. Will that continue? Let’s take a look.

The Zillow Business Model

Today’s business model is to connect potential buyers with agents, collecting a finders fee if a real estate transaction is completed after the connection. But the vision for Zillow is much larger.

Zillow wants to be the central hub for home seekers, connecting them with agents and mortgages and holding their hands along the way. It’s part aggregator, part platform, and part marketplace, which could be a great place to be in the $50 trillion housing market.

If Zillow succeeds, the business could be worth 10x or 100x what it is today, but this won’t be an overnight home run. It will take decades to disrupt the status quo and potentially build something better.

Wacksman’s Vision

New CEO Jeremy Wacksman, who has been with Zillow since 2009, is now taking the company in a new direction after iBuying was shut down and Zillow went back to its roots. It’s now his show, and a recent interview with Ben Thompson shed some light on how he sees the company growing.

If you’ve followed Zillow for a while, you know it has had an up-and-down strategy path. So, what’s the guiding light?

The culture here is and has always been figure out what the customer needs or wants, figure out a way to help them get it, and then the rest will take care of itself.

You can see that in the way customers are given lots of data and not asked to pay for anything directly. But it also created conflicts in building a business that’s long danced between disrupting the status quo and working with it hand in hand.

Ben Thompson: And I think it’s fair to characterize a lot of your 2010s as a bit of casting around figuring out what direction, what worked, what was defensible, what wasn’t. You end up with this model of you can contact an agent, and that agent is generally on the buying side. Who is the customer in that transaction then? Is it the customer or the viewer or the buyer or is it the agents that are just looking for someone that’s looking for a house?

Jeremy Wacksman: It’s a great question because I think any two-sided marketplace has to know who their primary persona is and for us it’s the consumer. The customer is a consumer, and we’re explicit about that in our language internally. We have alliterative names for all of our personas, and we have personas on the demand side: the buyer, the seller, the renter, the homeowner. But we also have personas on the supplier side, on the professional side. We have agents, team leads, loan officers.

But for us, the sorting of the stack is really clear, we build for the consumer customer. The marketplace works when we can create win-win experiences and that was the great thing about our initial ads business model was a high-intent customer, buyer, or seller, raising their hand was what an advertiser really wanted, and the more we could do to help empower, educate that consumer, that buyer the higher intent that lead was for the advertiser who was buying them.

To clarify how the model works today (I’ll get to the future model below).

So just to make sure, the way it works is a customer, you have agents who bid on a geographic area and then you distribute the customer requests based on who bid the most and disperse it based on those lines. Is that a fair sort of summary of how it works at a high level?

JW: Yes. That’s a good summary of the ads business model which we are moving away from, which we can talk about as part of the Super App strategy.

We will for sure.

JW: But the historical ads-based or market-based advertising model is a set of advertisers, who they make their living in a set of neighborhoods or zip codes, and so they target their advertising, their visibility to buyers and sellers in those zip codes, and when buyers want to take a tour or want to ask a question about a listing they get connected with one of those advertisers who’s paying for that opportunity and wants to make that marriage between that buyer and that agent happen, and ultimately help that person buy a house, that’s how that works, you’re right.

What we found was there is a smaller set of professional agents, usually teams of agents, who had built technology and operations capabilities to actually handle Internet consumers who want an answer quickly. Or, who might want an answer over text message rather than over the phone, or have staff to help with questions in off hours, and all those things that we all — when we press buttons on our phone we expect instant response, but that was new to the real estate industry a decade ago.

So helping those teams build those capabilities, or find the teams that had done the building of those capabilities and can satisfy a modern Internet consumer was a big part of our focus. And you’re right, that led us to really honing in on a set of agents and agent partners that can provide good customer service to customers who ask.

The background is nice, but where is Zillow going? It’s all about the Super App!

The Super App Strategy

When it comes to the Super App, Zillow has an expansive vision to play a role in every part of the home search and buying process. They will then connect buyers with the software tools necessary to get financing, make an offer, and even close a purchase.