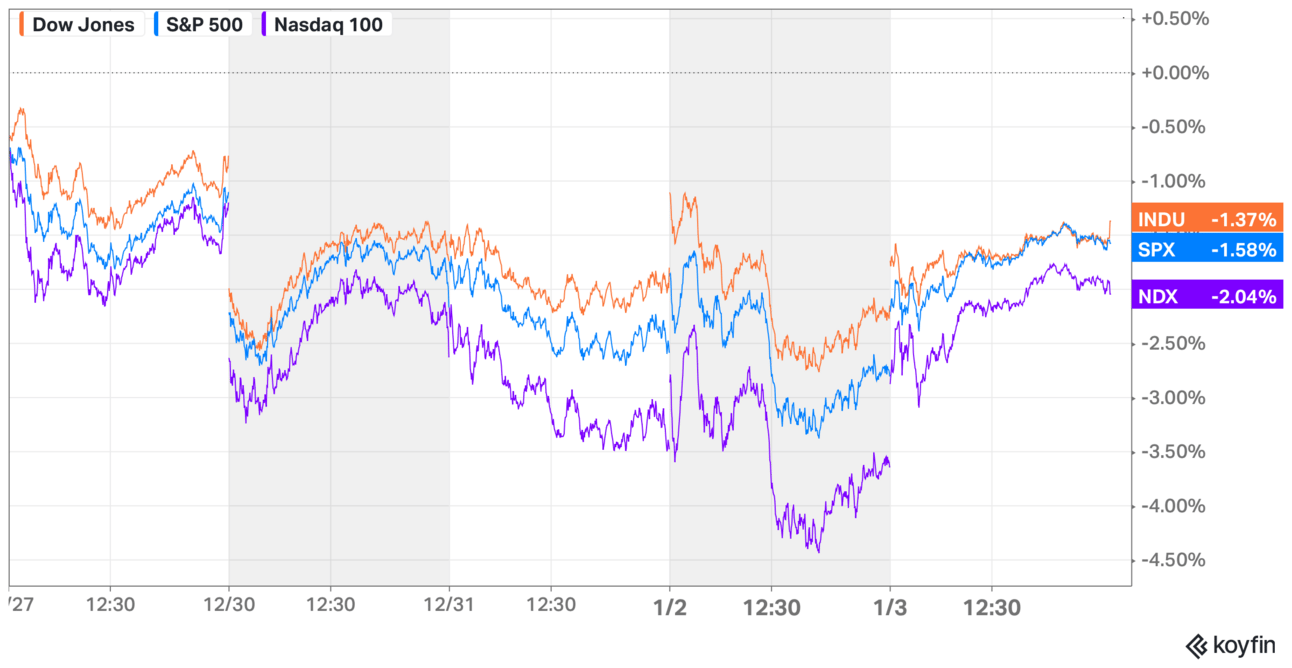

The stock market ended 2024 with a thud, dropping sharply in the final three days of trading. But started 2025 with a nice rally in the market. You can see the daily moves were volatile over the past week, and “normal” trading won’t begin until holiday vacations end tomorrow. Then, the focus turns to Q4 2024 quarterly reports, which start in a couple of weeks.

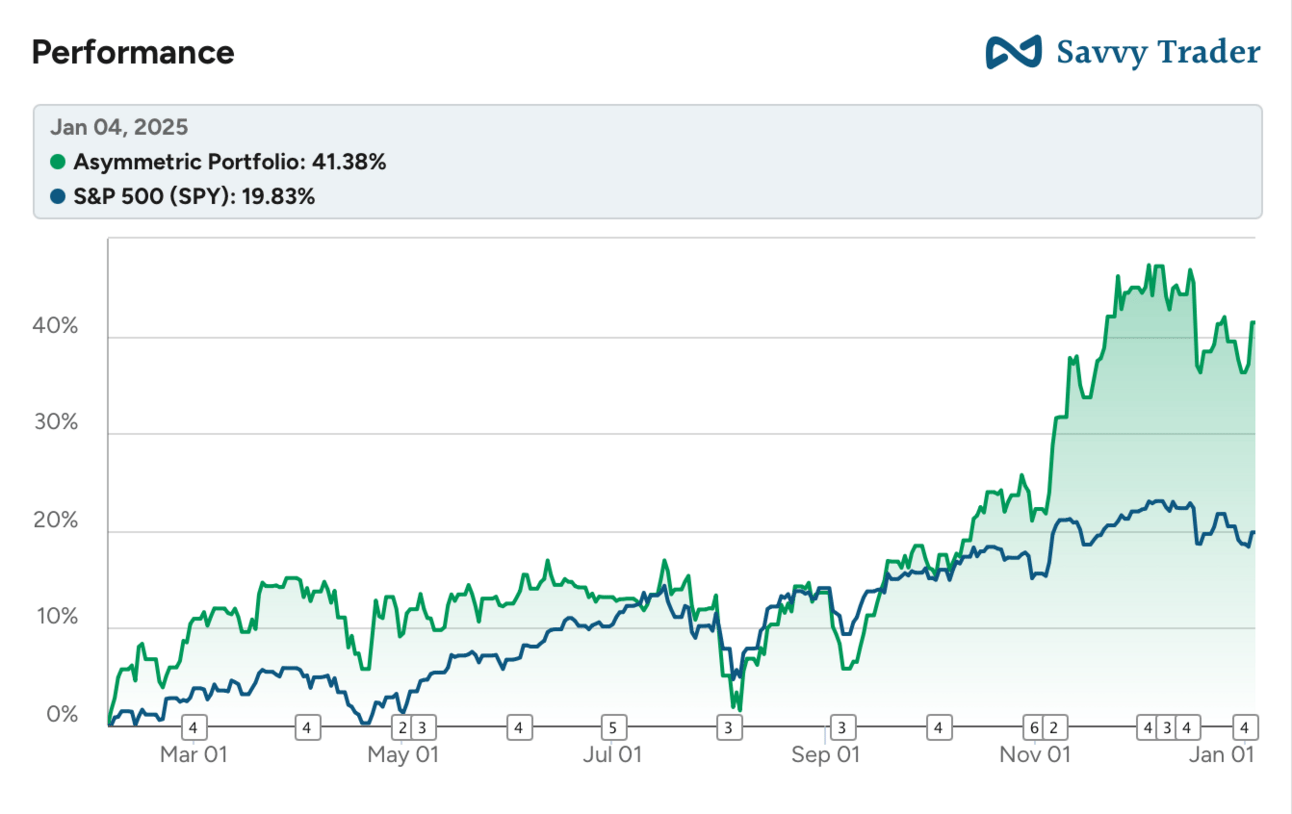

We’re only two trading days into 2025, but the Asymmetric Portfolio is off to a great start, up 3.76% compared to a 1.0% gain for the S&P 500. Most of the short-term gains were just a reversal of losses at the end of 2024, so there’s no real news of note, which, of course, will change in the next few weeks.

Asymmetric Investing is a freemium business model, meaning ads like the one below make the free version possible. Sign up for premium here to avoid ads, get 2x the content, and gain access to the market beating Asymmetric Portfolio.

Stay up-to-date with AI

The Rundown is the most trusted AI newsletter in the world, with 1,000,000+ readers and exclusive interviews with AI leaders like Mark Zuckerberg, Demis Hassibis, Mustafa Suleyman, and more.

Their expert research team spends all day learning what’s new in AI and talking with industry experts, then distills the most important developments into one free email every morning.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses – tailored to your needs.

In Case You Missed It

Here’s some of the content I put out this week.

What I’m Buying — January 2025: Here are the monthly acquisitions for the Asymmetric Portfolio.

Expect the Unexpected in 2025: Projections for 2025 seem eerily similar and I think we should expect the unexpected.

Lyft’s Optionality Just Got Even More Interesting: Will Amazon acquire Lyft? Probably not, but it adds to the company’s optionality.

Top 20 Stocks For 2025: Here’s a video version of some top stocks for the year.

Why a Little Is Always Enough

In my younger days, I investing in a very concentrated portfolio. It wasn’t uncommon for me to have three or four stocks and at one time a single company made up about 90% of my portfolio.

Luckily, that didn’t lead to ruin, but it certainly wasn’t a smart way to run a portfolio.

As I enter my 30th year of investing 👴 , I’ve come to appreciate the stability of diversification and the acknowledgment that I may be wrong with any given investment idea. This willingness to be wrong is core to asymmetric investing and it also needs to be balanced with an appropriate level of diversification.

I don’t know who said it (if you do, please let me know), but this quote sums up how I think about diversification.

If I’m wrong, I only want a little and if I’m right, a little is enough.

Let’s put some numbers to this simple comment.

Say there are only two outcomes for a stock over a 10 year period and you have to hold for the full 10 years.

Outcome 1: 10x in value, 20% probability

Outcome 2: 0x in value, 80% probability

The expected value of this portfolio will be a double over the course of a decade (EV = 10 × 0.2 + 0 × 0.8). But the range of outcomes is extremely wide depending on how diversified the portfolio is.

1 Stock Portfolio: 80% chance the portfolio goes to 0.

2 Stock Portfolio: 64% chance the portfolio goes to 0.

5 Stock Portfolio: 33% chance the portfolio goes to 0.

10 Stock Portfolio: 11% chance the portfolio goes to 0.

20 Stock Portfolio: 1% chance the portfolio goes to 0.

As an asymmetric investor, I’m looking for stocks with 10x to 100x outcomes in a decade. It would be great if I knew which stock was going to 10x, but the reality is this style of investing is inherently risky and there’s the possibility of a 0x return.

If I’m wrong, I don’t want to be all-in on a stock.

And if I’m right, a small position is big enough to have a big impact.

We saw this in 2024. Since I started tracking the Asymmetric Portfolio on Savvy Trader, there are 6 stocks that are up around 100%. 9 stocks had negative returns, including the ones I closed, out of 25 total positions in 2024.

The result has been doubling the performance of the market with a low batting average and high slugging percentage.

Building a Concentrated Portfolio

As much as I’m arguing against investing too much in a single stock, I’m not saying a single stock shouldn’t become a large percentage of a portfolio.

But that concentration should come naturally from value appreciation.

Today, 2 stocks each account for over 10% of the Asymmetric Portfolio. But most of those gains have come from their value appreciating over time. I haven’t bought shares of Spotify, which makes up 11.4% of the portfolio, since January 2024. Most of its growth is simply appreciation in value.

If gains continue, I would be comfortable letting a position grow to 20%, 30%, or even more of the portfolio.

But I’m not going to invest 20% of the portfolio into a single stock to build a position. If I’m right, a little is enough.

For me, that means a 3% to 5% position normally as a starting point. I may go higher in certain circumstances, but I want to have 20+ positions that will make a meaningful impact if they 10x in value. That’s the point of Asymmetric Investing, I just don’t know which stock is the one that will 10x over the next decade.

You can get all Asymmetric Investing content, including deep dives, stock trades, and ongoing coverage of Asymmetric Universe stocks with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your own research before acquiring stocks.