I hope you had a wonderful week!

Publishing has been quiet here at Asymmetric Investing, but that will change with a free article about winner take all markets — a key to my investing philosophy — on Sunday and a stock spotlight on Monday. If you haven’t already, you can upgrade to premium to get the stock spotlight, real-money portfolio updates, and more below.

In case you missed it

Here’s some of the content I put out this week. Enjoy!

Facebook’s scorched earth strategy: I’m becoming increasingly convinced that most AI models we use in the future will be free and open source. A big driver of that opinion is that companies like Facebook can develop a model they use internally and then give it away to screw over competitors, aka “scorch the earth”. In Facebook’s case, open-sourcing an AI model doesn’t disrupt their social network or sever the tie between Facebook/Instagram and advertisers, but it may weaken Google’s ad business or Microsoft/OpenAI’s AI and advertising ambitions. It only takes one company choosing competitive violence to make AI essentially free for all of us and Facebook seems the most likely to cut competitors off at the knees if given the chance.

Tesla’s battery problem: 4680 batteries were going to revolutionize Tesla’s cost structure and vehicle range when they were announced by Tesla three years ago. This week, we found out Panasonic — Tesla’s main battery partner — would delay 4680 production by at least another year to mid-2024. Meanwhile, a dozen other companies are developing 4680 batteries. Competitive advantages are scarce in autos and I don’t see any evidence that the battery itself is a competitive advantage for anyone.

What’s going on with Disney?: Cable is dying, we know that. But streaming isn’t picking up the slack yet. So, investors are worried that Disney’s profitability will be permanently hampered by the move to streaming. A couple of things to point out.

Parks are insanely profitable with revenue jumping 17% to $7.8 billion and operating income increasing 23% to $2.2 billion for the quarter. There’s zero evidence this level of profitability won’t improve over time, so this is the foundation for Disney.

Streaming has barely had time to be optimized. Bob Iger spent a lot of the conference call talking about how the launch of Disney+ was constructed to get it into as many homes as possible, which meant low pricing and lots of marketing spend. It’s in 104.9 million homes, and Disney needs to start optimizing price, marketing, and content. That means largely abandoning some markets, like India where Disney+ Hotstart generates on average $0.59 per month in revenue, while investing more in markets like the U.S. and Canada where prices jumped 20% Y/Y to $7.14 per sub. Content is also an area of focus with Disney moving to make less of what people don’t watch and more of what they do. Duh, right? But the process of learning what people watch/value takes time.

Did you know Hulu with ads makes more money per subscriber than Hulu without ads? As a result, Disney is going to move to push more ads to all streaming services and ultimately “increase the delta” between the price of the ad-supported tier and the no-ads tier. In short, prices are going up for all services and the ad load is increasing.

Disney streaming is on the right track, but Rome wasn’t built in a day. Give it time.

Retail earnings

Earnings season is slowing down, but there were two notable reports this week:

Home Depot: Revenue fell 4.2% and same-store sales dropped 4.5% in the quarter ended April 30, 2023. That’s bad, right? Maybe if you think everything grows in a straight line, but Home Depot was one of the big beneficiaries of low interest rates and stimulus spending during the pandemic. In fact, revenue is up 43% since the start of 2020. So, revenue may be dropping as home updates get smaller and rising rates hit home equity liquidity. However, the company is still on a long-term growth trajectory and shows no sign of losing its market-leading position.

Target: We think of Amazon is a big beneficiary of the pandemic, but Target’s revenue is up 40% since the start of 2020 as shoppers found the convenience of same-day services Pickup, Drive Up, and same-day delivery. So, a 0.5% increase in sales on a 0.7% increase in same-store sales isn’t impressive but it’s off a much larger base than a few years ago. And same-day service revenue was up 5%, a sign that the same-day strategy is working. As competitors struggle (ahem, Bed, Bath & Beyond, and Kohls), Target will benefit from being a leader in consumer staples and more, which I call Grocery+.

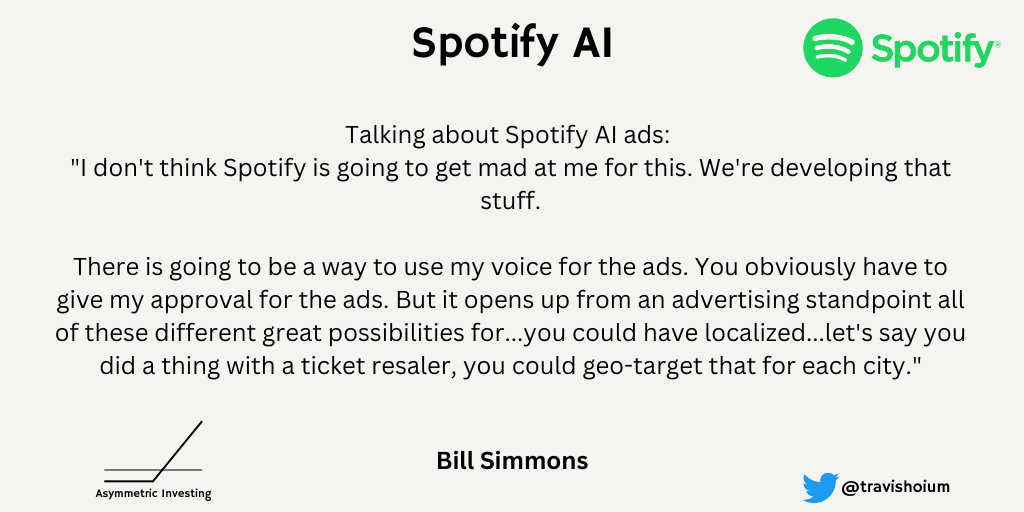

Bill Simmons lets Spotify’s AI plans slip

I was listening to Bill Simmons's podcast on Friday, which isn’t usually a momentous occasion for investors. But he had a long conversation with Derek Thompson about possibilities for artificial intelligence ad reads and this slipped out:

He went on to say:

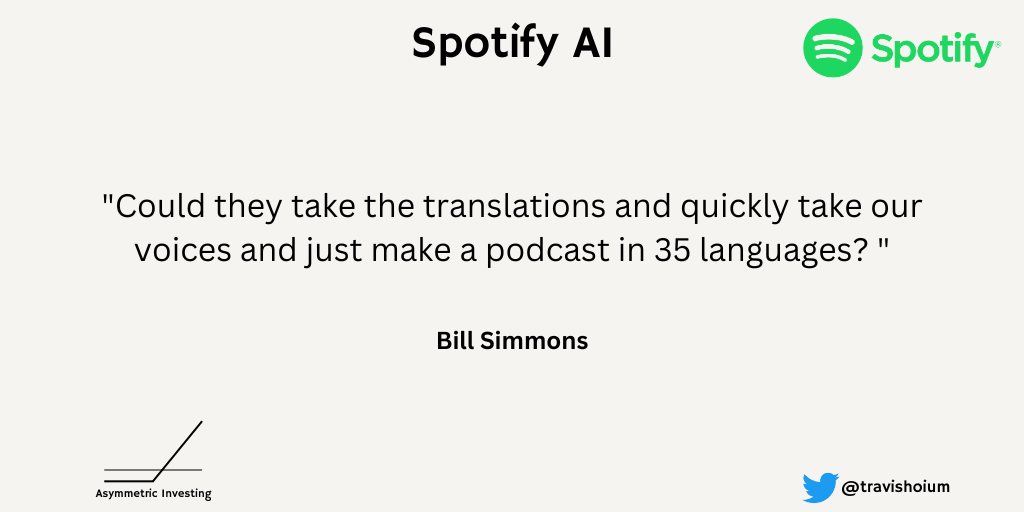

This comment was in the context of turning a single podcast recording into dozens of other languages using only AI.

We know Spotify has been developing AI technology, but like a lot of companies, it’s not entirely clear how AI would add value. The idea of targetted ad reads and multi-lingual podcasts put the AI focus into perspective and if Spotify can indeed “own your ears”, the potential to monetize with ads just got a lot more compelling.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.