The stock market pulled back a bit this week as investors digested some relatively weak earnings reports and the uncertainty around the election. The broad takeaway is that tech spending, particularly on AI, continues to be strong, but consumer spending isn’t very strong. That may mean sky-high valuations will need to come down.

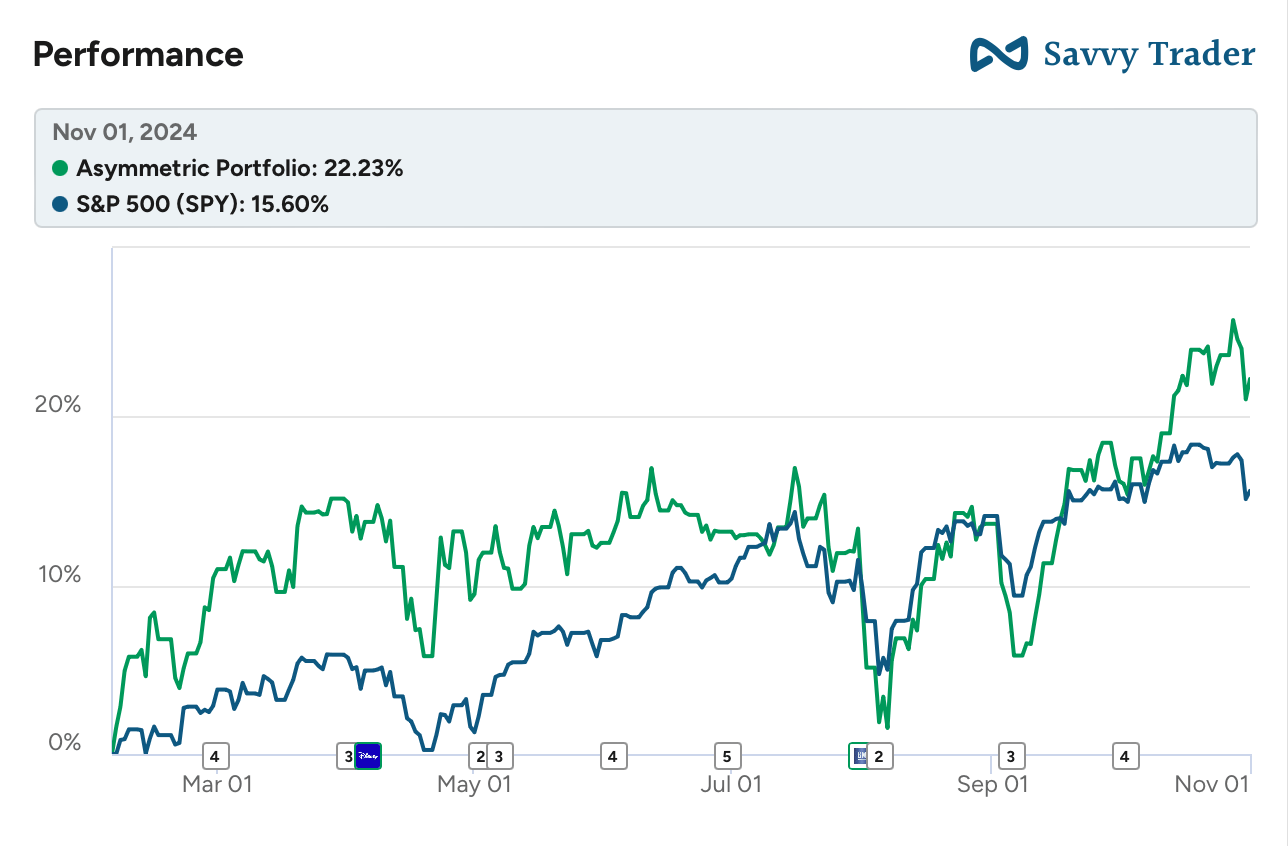

Earnings season was in full gear for the Asymmetric Portfolio, and it was a bit of a mixed bag. Stock that had run up over the past few months, like Robinhood, fell sharply after earnings. But that was offset by positive results from Mobileye and Peloton. This is why I’ve built a portfolio of asymmetric stocks. Some will win, and some will lose, but I think over time, the portfolio will beat the market.

Asymmetric Investing is a freemium business model, which means the free version is made possible by ads. Sign up for premium here to avoid ads and get 2x the content and access to the Asymmetric Portfolio.

11.4% Cash Returns with Portfolios of Online Businesses.

WebStreet is a first-of-its-kind investment platform that allows accredited investors to own fractional shares in cash-flowing online businesses.

Our process is simple:

We buy online businesses cash-flowing from day one. 💸

We partner with world-class entrepreneurs to run and scale the businesses. 🚀

You invest, gaining fractional ownership and earning quarterly dividends. 📈

Additionally, you'll share in the profits when we exit these businesses within 2-3 years.

In Case You Missed It

Here’s some of the content I put out this week.

How to Read an Earnings Report: Analyst estimates aren’t the best gauge of an earnings report, so here’s how to read a report for yourself.

What I’m Buying in November 2024: My stock buys for this month are in.

Alphabet’s Inflection: Search and cloud are growing like crazy, and the market doesn’t appreciate Alphabet’s upside.

Down 12%, This Stock Is a Screaming Buy: MGM Resorts stock is cheap, and I explain why with some “in the weeds”

Warren Buffett’s Apple Sale and $325 Billion Cash Pile

One of the big revelations that came out yesterday was Warren Buffett continuing to stockpile cash. The “insurance and other” segment cash pile grew to $320.0 billion at the end of the third quarter of 2024, and “railroad, utility, and energy” has another $4.9 billion in cash.

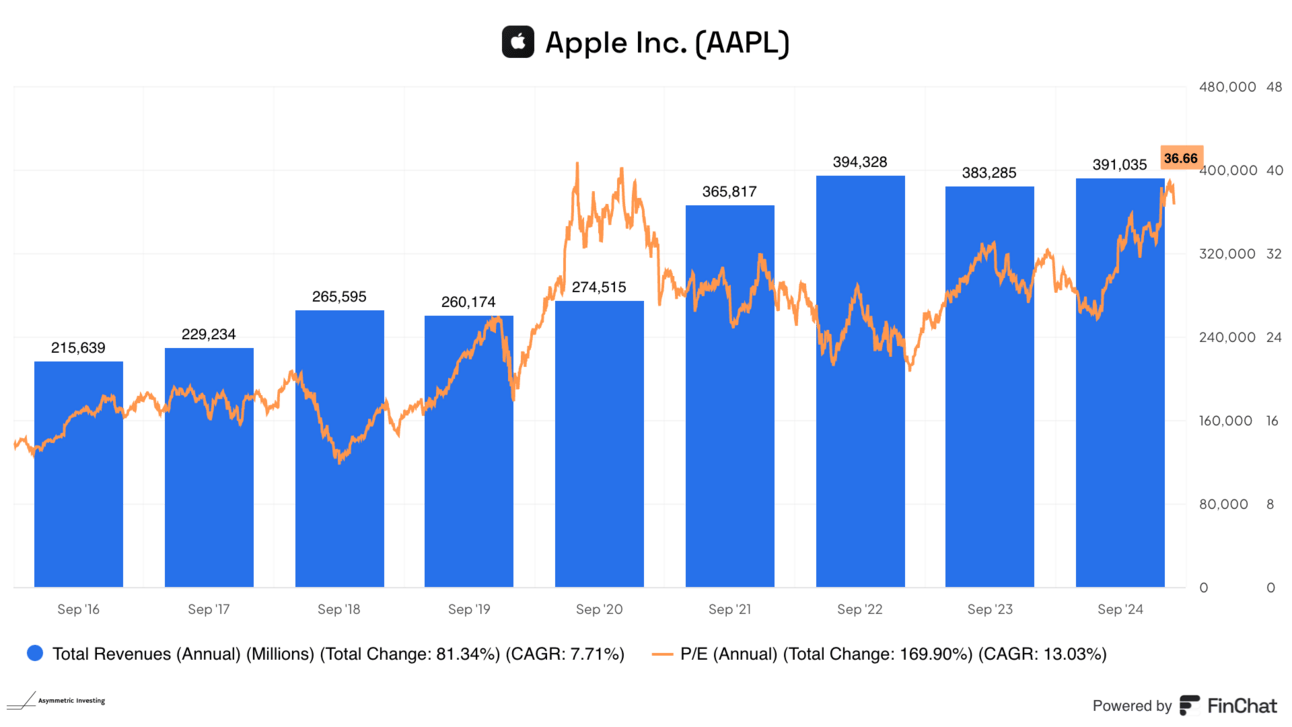

This is more cash than Berkshire Hathaway has ever had, and Buffett has been raising cash by selling stocks. The biggest sale this year is his massive stake in Apple, going from $174.3 billion at the start of 2024 to $69.9 billion at the end of the third quarter.

Why is Buffett selling? I think there are stock-specific reasons along with macro reasons.

A simple reason to sell Apple is he sees Apple as overvalued based on recent financial results. Apple’s stock has had an incredible run since he built the position in the mid-2010s when the company was still growing. Recent stock performance is driven by multiple expansion. Now that Apple is trading for 37x earnings and growth has begun to decline, it makes sense Buffett would sell.

Buy low. Sell high.

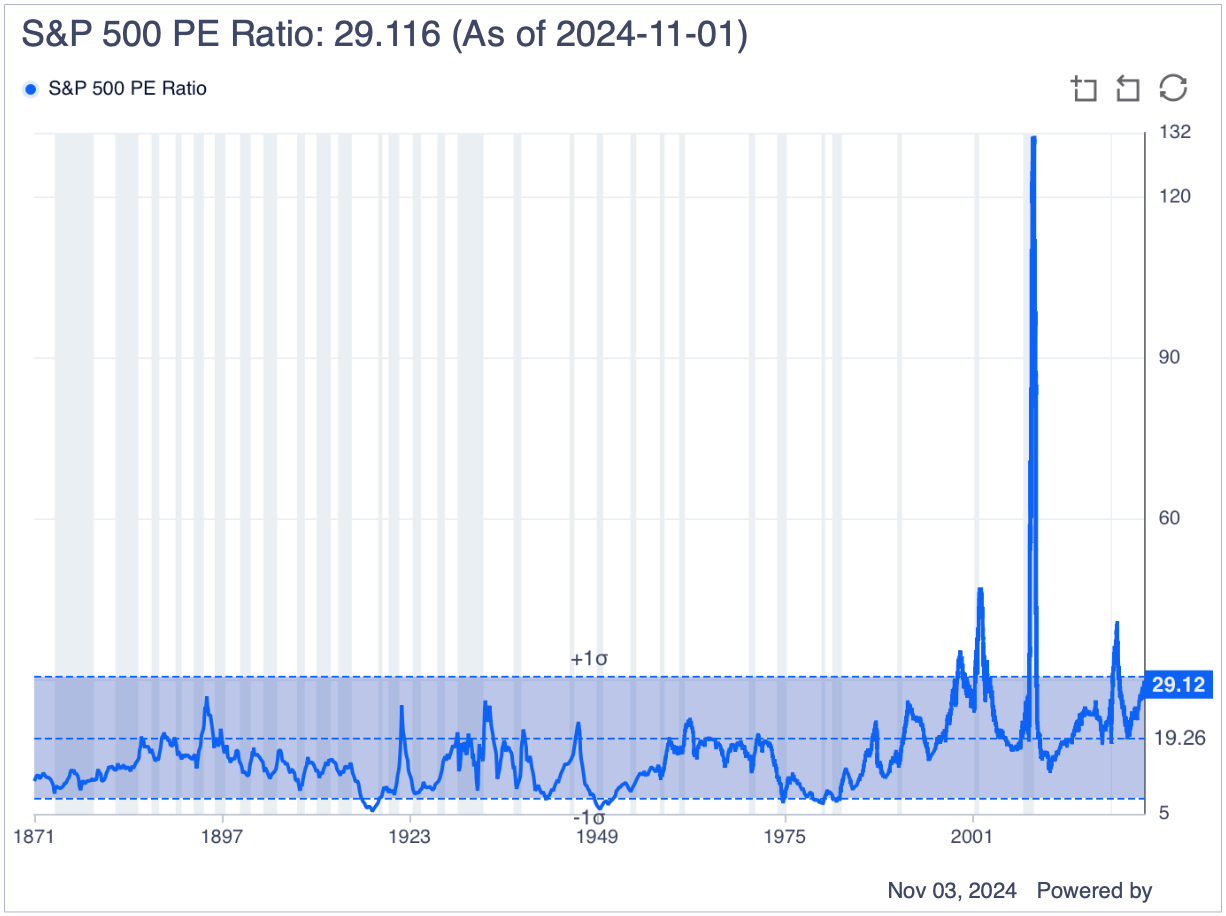

The market overall also seems extremely highly valued. You can see in the chart below the S&P 500’s P/E ratio is 29, a level we have only seen in 2001, 2009, and 2020 — all recessions when the “E” in P/E declined. Now, we just have a high “P”.

Even the smallest hiccup could send shares sharply lower. Why not build up cash to buy opportunistically when the opportunity arises?

Price Matters

This is a reminder that price matters.

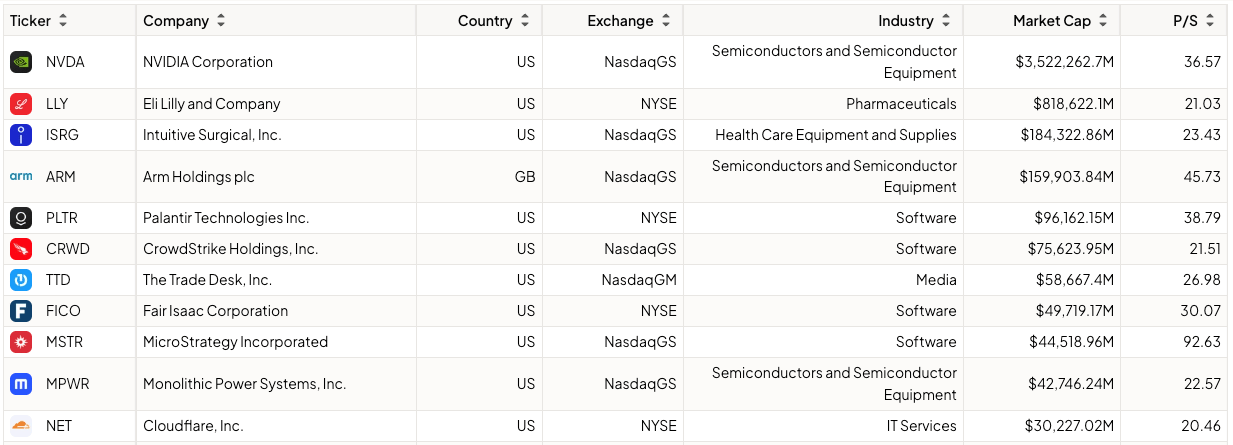

High prices indicate the market is already pricing in growth and/or margin expansion that hasn’t happened yet. What’s crazy is the market looks a lot like it did in 2021 from a valuation perspective. There are 11 companies with a market cap of over $30 billion that trade for over 20x sales!

That’s probably not sustainable.

Buy and Verify

Selling stocks is my weakness as an investor — which is why I over-index to not selling — but Buffett’s sales show that even the world’s best buy-and-hold investor reaches a point where selling is the right answer.

Having cash on hand isn’t a bad idea, and right now is a great time to raise cash by selling highly valued companies that aren’t operating up to their valuation.

“Buy and hold” should be “buy and constantly verify” that your investment thesis is intact.

For Buffett, the Apple thesis changed, and he’s not seeing many opportunities in the market. He’ll be ready when an opportunity arises.

You can get all Asymmetric Investing content, including deep dives, stock trades, and ongoing coverage of Asymmetric Universe stocks with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your own research before acquiring stocks.