I hope you had a wonderful week!

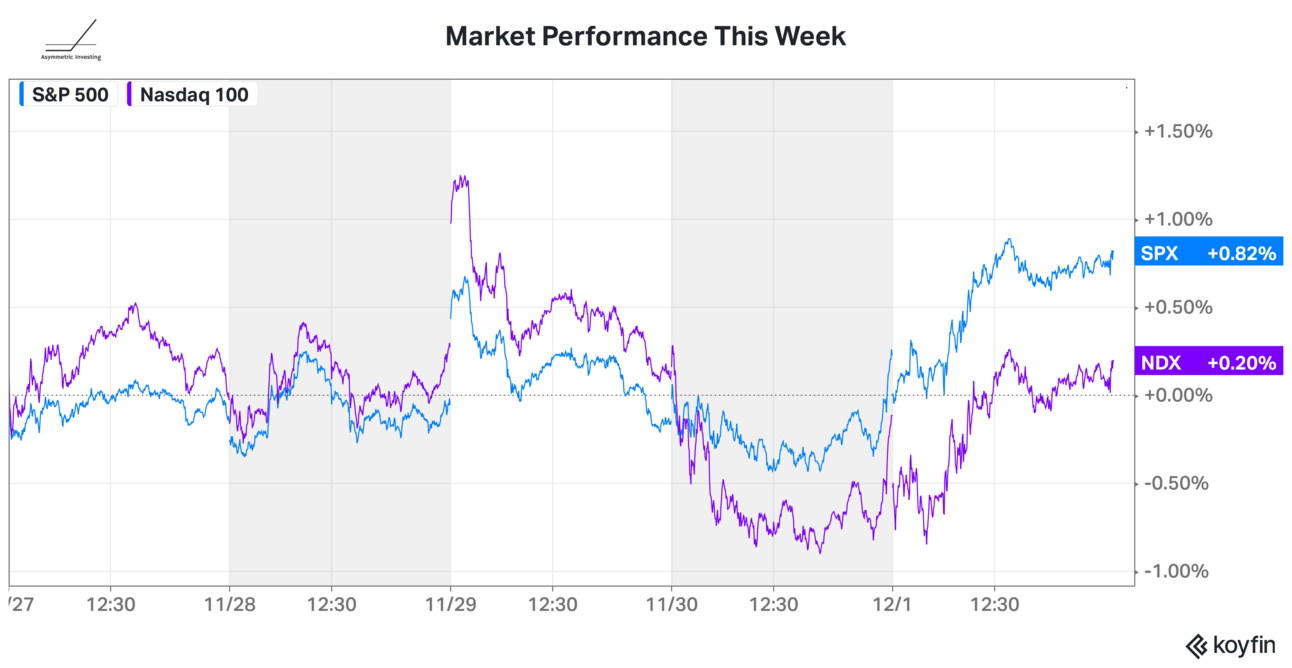

The market was choppy this week on relatively little economic news outside of some early holiday spending data. Online sales for Cyber Week were up 7.8% from a year ago and physical traffic at retailers was up 1.5% last weekend. Maybe the consumer is doing well after all?

Before we get to the week that was in investing, I want to share some of our partners!👇

The tools available for investors today are amazing and these are the sites I use every day while doing research:

The Motley Fool — I contribute to The Motley Fool in part because of their investing track record. The Motley Fool Stock Advisor returns are 492% as of 11/10/2023 and measured against the S&P 500 returns of 126% as of 11/10/2023. And they’re giving away the Top 10 Stocks to Buy Now right here.

Finchat — Pictures are worth 1,000 words and Finchat makes investing visuals easy. You’ll see Finchat’s platform in most articles on Asymmetric Investing.

Koyfin — Koyfin is like having a Bloomberg terminal without the price tag. Charts, data, transcripts, and more all in one place.

In case you missed it

Here’s some of the content I put out this week. Enjoy!

Dropbox Taps NVIDIA: Battle lines are being drawn in AI and Dropbox has chosen NVIDIA to provide models and cloud infrastructure. Not a bad choice if you ask me.

GM Announces a Massive Buyback: GM will buy back nearly 25% of the outstanding shares in the company by the end of 2024 and ~16% of shares were acquired just last week.

5 Stocks I’m Buying In December: Here are the stocks I bought for the Asymmetric Portfolio in December.

2 Hypergrowth Stocks You Don’t Want to Miss: Hint, they’re already in the Asymmetric Portfolio.

Cybertrucks and Non-Cyber Trucks

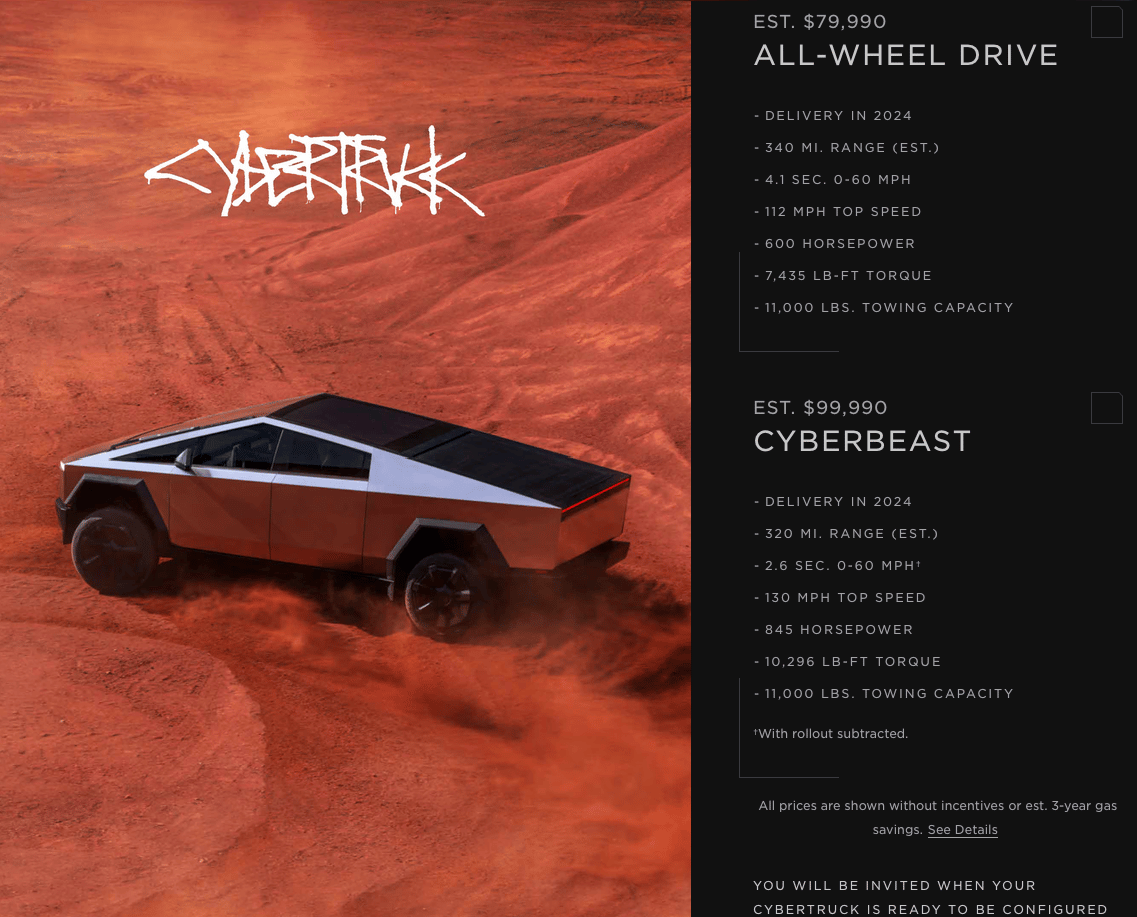

Twitter was abuzz with the launch of the Cybertruck this week.

It’s definitely a departure from standard truck designs and could open up interesting uses with the tent in the trunk and a theater inside. As a traditional truck…we will see.

But the price point is double what was promised in 2019 and Tesla delivered far short of the promised 500-mile range, leaving lots of questions about how many of the 2 million+ reservations would be completed.

Still, I like that Tesla is trying something new and this will be a good test of Tesla’s demand and design skill.

Comparing the Cybertruck with the Silverado is interesting as well. The Silverado is about half the cost and is bigger in almost every way except width. On that front, the Cybertruck may have a hard time fitting in a standard single-stall garage that’s 96” wide…

Cybertruck

Starting Price: $79,990

223.7” length

70.5” height

95” width

6,603 lbs

Chevy Silverado 1500 Double Cab

Starting Price: $41,495

231.9” length

75.6” height

81.2” width

4,940 lbs

But this isn’t why I bring up the Cybertruck. What’s more interesting is how Tesla is launching high-risk new products while General Motors (and others) is cutting back on EV plans and just announced a $10 billion buyback plan.

EVs may be the future and ICE vehicles may be a dying business. But this is an investing newsletter and the question is would you rather buy Tesla or GM stock today?

Let me ask another question. In 2000, would you rather have owned the best tech companies in the world — Microsoft, Cisco, and Intel — or buy Philip Morris, now Altria, the cigarette maker?

In hindsight, the correct answer was Philip Morris and it’s not even close.

A business in decline doesn’t always mean a stock will decline and a growth business doesn’t always translate to a rising stock.

The auto business is facing fierce competition in EVs and Tesla is cutting prices in reaction, cutting margins to industry-average levels in 2023.

Meanwhile, the traditional truck and SUV market (where the money is made) is still dominated by GM and Ford and they’re reporting strong demand in 2023 and flat-ish vehicle prices.

Businesses and investors look to the future and the future is EVs, so that’s where investment is going. On the flip side, that means very little new investment is going into the ICE market, despite ICE vehicles being ~90% of auto sales.

Like cigarettes in 2000, maybe ICE auto manufacturers are in a dying business and they focus on cash flow rather than growth over the next two decades, paying dividends and buying back 10-20% of their stock every year.

And maybe that’s a recipe for market-beating returns while Tesla needs to grow into its valuation in a highly competitive market the same way Microsoft, Cisco, and Intel did following the dot com bubble.

Growth is great. I seek out growth as an Asymmetric Investor. But price matters and history shows that paying a high premium for growth is a great way to underperform the market.

I own shares of GM and the company reminds me a lot of Philip Morris in the 2000s. Maybe you don’t like the future of ICE trucks and SUVs, but GM sells a lot of them and they’re extremely profitable.

On Jan 1. 2000, the average P/E multiple of Microsoft, Cisco, and Intel was 104 and Philip Morris had a P/E of 1.7.

On December 3. 2023, Tesla has a P/E ratio of 77 and GM has a P/E ratio of 4.5.

Something to think about.

Thank you for being an Asymmetric Investing subscriber. If you want all of my stock deep dives, stock updates, and access to Asymmetric Portfolio trades before I make them you can subscribe below. The premium subscription is what makes this newsletter possible. I appreciate the support.

What do you want more of?

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.