The market had another outstanding week, helped by a solid earnings report from NVIDIA that indicates the AI investment boom will last at least another year or two. This week is a short week for traders. The market is closed on Thursday, and trading closes early on Friday, so expect a quiet week ahead of Black Friday data next weekend. That data may help clarify a mixed retail picture, which I’ll get below.

The Asymmetric Portfolio continued its momentum and is now doubling the market since tracking on Savvy Trader began. You can see that it’s been a volatile year, but as I would expect, the portfolio outperforms the market in an up year. What’s been especially impressive is how broad-based gains have been over the past month.

Asymmetric Investing is a freemium business model, meaning ads make the free version possible. Sign up for premium here to avoid ads, get 2x the content, and gain access to the Asymmetric Portfolio.

High-upside online businesses have investors lining up. 📈

WebStreet is a first-of-its-kind investment platform that allows accredited investors to own fractional shares in cash-flowing online businesses. So far WebsStreet has delivered 11.4% cash returns and is on track for 20%+ IRR.

In Case You Missed It

Here’s some of the content I put out this week.

Finding Value in a Frothy Market: There are still cheap stocks out there despite a market that’s trading at lofty valuations.

Buy Upside You Don’t Have to Pay For: A key to asymmetric returns is getting big upside from stocks…for free!

Up 51% in a Year, Here’s My Simple Strategy: Here’s a video on the core frameworks and strategies that are working in Asymmetric Investing.

What is the True Retail Story?

U.S. consumers drive 70% of the U.S. economy and are ultimately the economic engine of the world. So, when consumer spending is strong, it’s good for the market.

Depending on where you look, you could spin a story of an extremely strong consumer or a weakening consumer on the brink of collapse. The market has landed on the “consumer is strong” side, but I want to show a more complete — and confusing — picture.

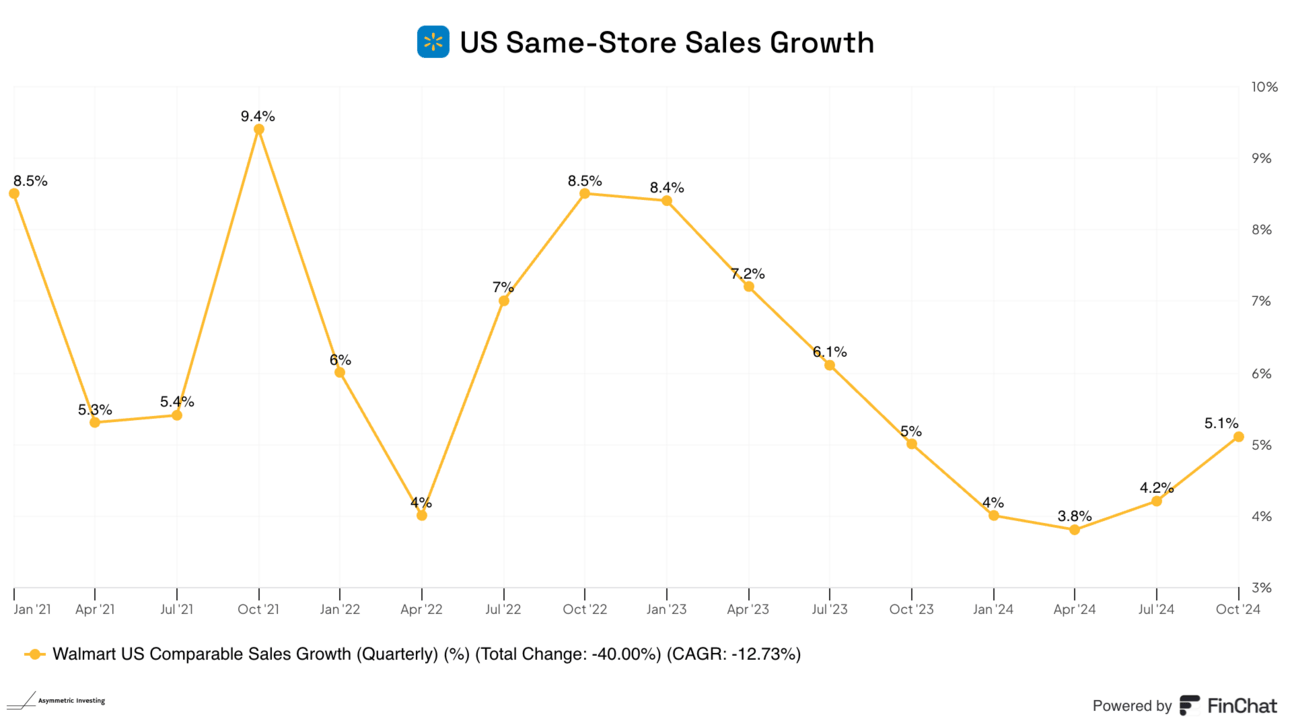

If you look at Walmart, all is well, and growth is picking up.

But remember, Walmart is the biggest discount retailer, and it does well when consumers are looking for value.

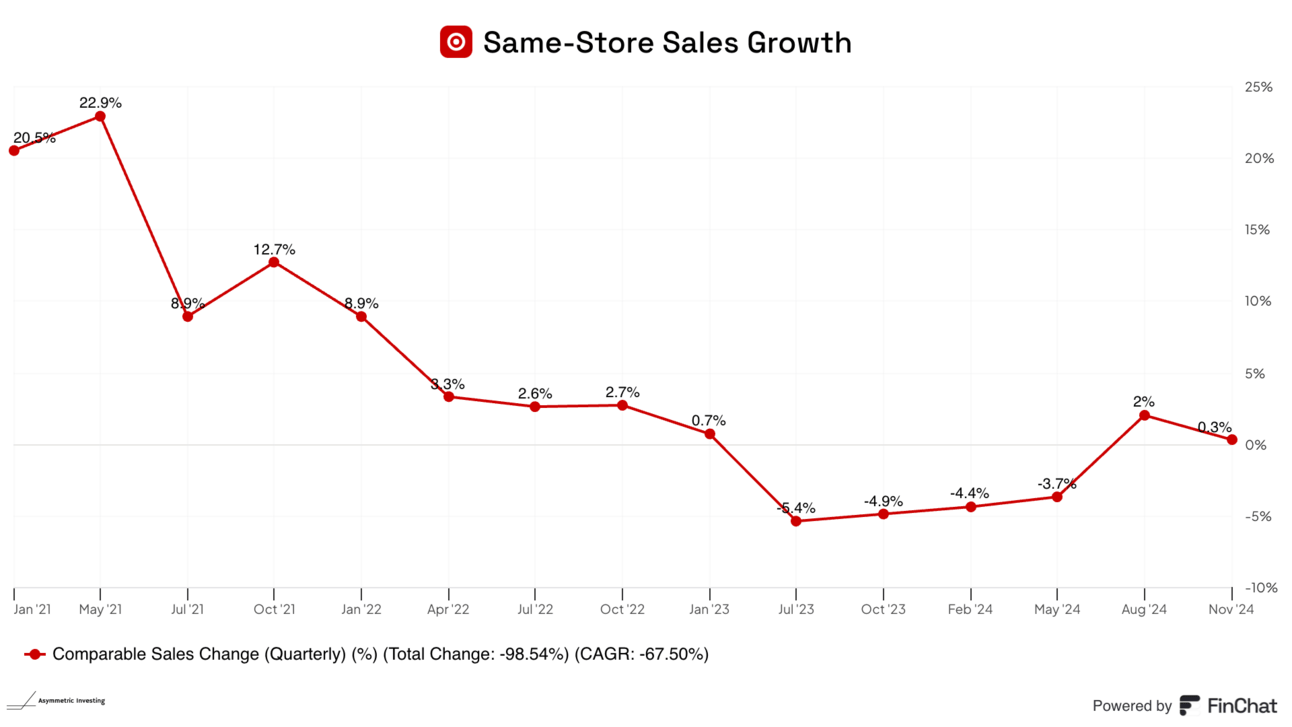

Maybe a better indication of consumer sentiment is Target? And they’re showing weakness, including a poor quarter announced last week.

Home Depot has also reported negative same-store sales comps for 7 straight quarters.

But Costco is crushing it!

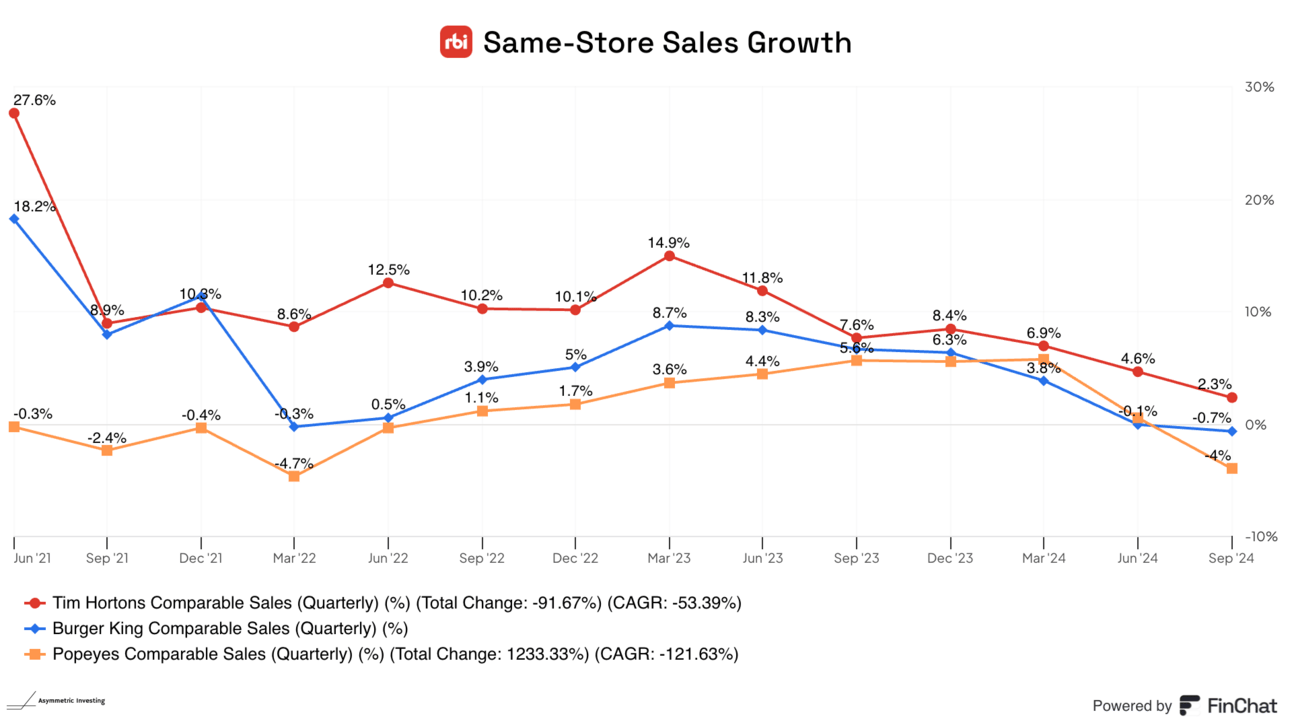

If we move over to the food business, Restaurant Brands International is telling us people are eating out less at Tim Horton’s, Burger King, and Popeyes.

And coffee is in freefall, according to Starbucks.

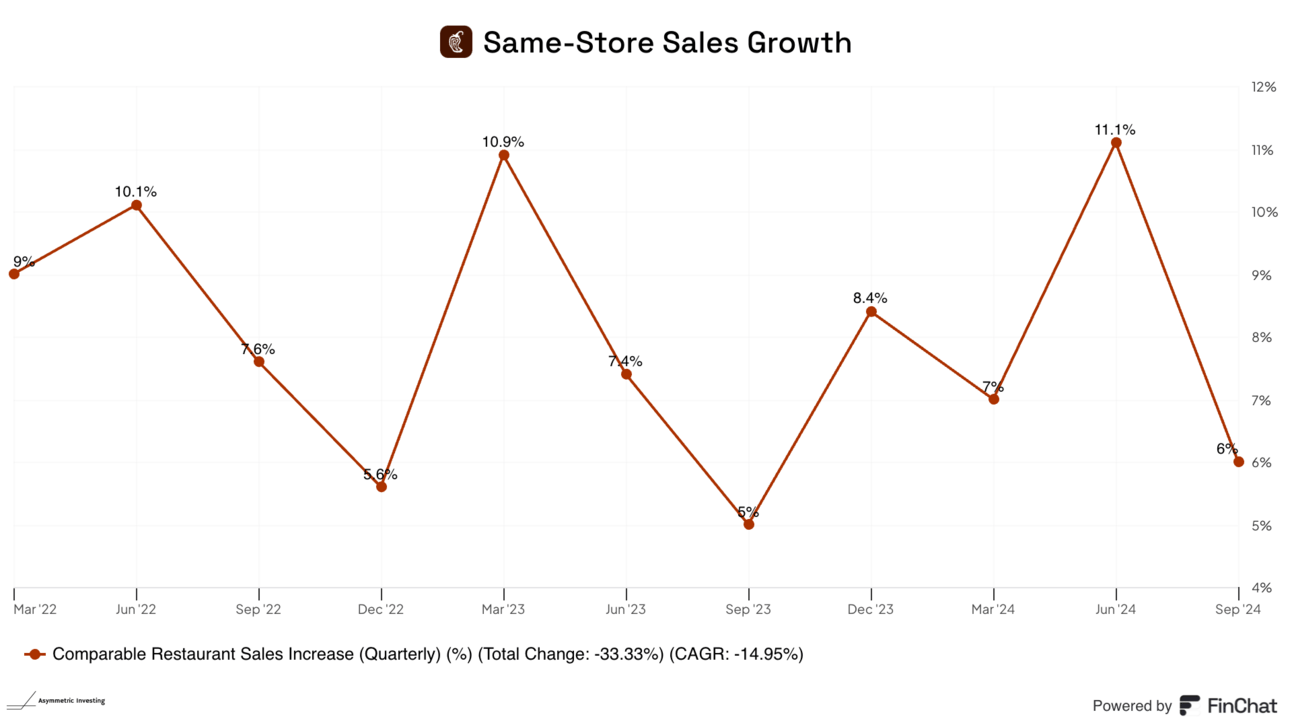

But Chipotle is crushing it, growing same-store sales by 6% last quarter and expecting continued momentum.

Is this “normalizing” shopping patterns with big spending days moving to the holidays?

Is the COVID hangover affecting comps?

Is this company-specific performance?

It’s not clear.

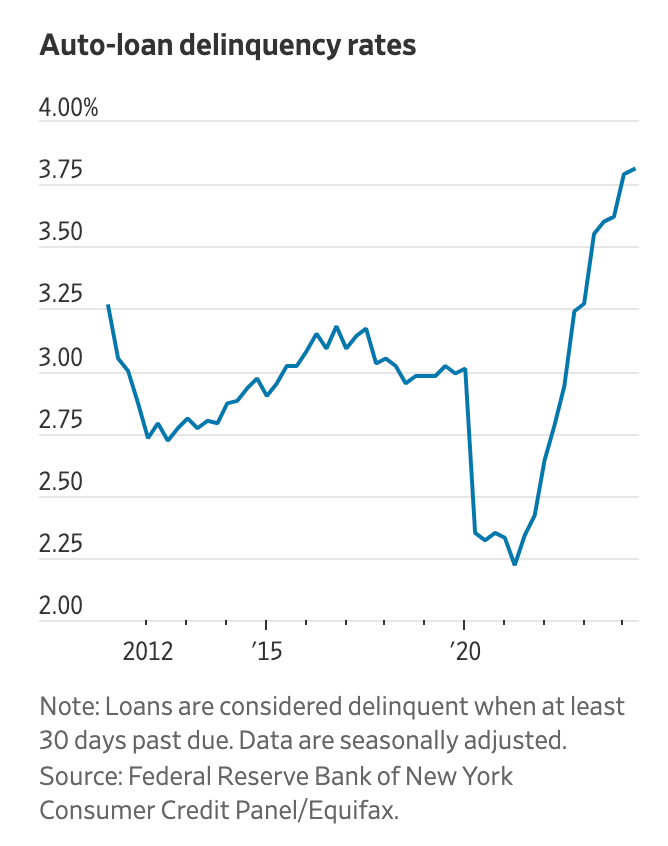

And to add another data point, auto loan delinquencies are rising. This one is worrying.

Is the consumer OK, as the market thinks?

Or is there trouble ahead?

The picture isn’t clear. But I’m watching the trends closely.

You can get all Asymmetric Investing content, including deep dives, stock trades, and ongoing coverage of Asymmetric Universe stocks with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your own research before acquiring stocks.