Silicon Valley is a remarkable idea. And, to be clear, it’s more of an idea than a physical location.

The culture of Silicon Valley is one of making big, audacious bets and lots of them. Only a few will pay off, but the ones that do can make the founders, employees, and VCs involved some of the richest people in the world.

Where this manifests most starkly is in how founders are treated.

Unlike the Midwest, where founding a business often involves signing away every asset you will ever own, venture capitalists walk around Silicon Valley willing to write checks to entrepreneurs (mostly young and inexperienced) to work on ideas written on a napkin.

Failure isn’t discouraged like it is in most places. It’s encouraged and rewarded.

A VC would rather a founder give up on a 2x idea early to go after their 100x idea. And that VC will fund the 100x idea to get it off the ground. Small wins are meaningless; they want 10x, 100x, or even 1,000x returns on their money.

The hit rate can be low as long as the outcomes are big. And second-time founders are more likely to be successful, so the system wants to support those with big ideas, not punish them.

In 2024, something seems to have changed. Gone are the days of lots of small bets on inexperienced founders. The money is HUGE and the names involved are well established. The Silicon Valley model is changing, and it seems like a paradigm shift for the tech industry.

Asymmetric Investing has a freemium business model. Sign up for premium here to skip ads and get double the content, including all portfolio additions.

Better PR with minimal effort: Let AI write your articles

Generate high-quality articles in seconds - SEO-optimized, plagiarism & fact-checked

Be featured for free by journalists looking for credible sources

Get your articles indexed and ranked directly in Google News

Distribute your content to top magazines with a single click

Forget ChatGPT: Manage, publish and track your PR efforts in one place

Get great PR fast:

Silicon Valley’s Big Return Formula

Traditionally, for venture capitalists funding companies, the idea is simple. Make a lot of bets and hope one or two pay off big.

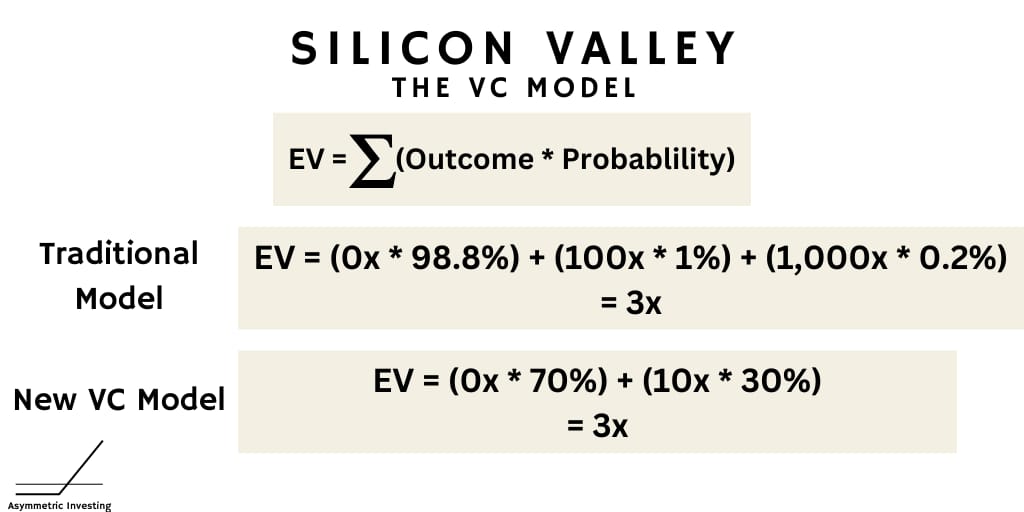

The expected value equation below is core to how VCs think. Any single investment may have a 98.8% chance of failure, but if it has a 1% chance to 100x their money and a 0.2% chance to 1,000x their money, the total expected value of the portfolio is positive. Not just positive, the expected return is 3x their money.

In simpler terms, the traditional model is making lots of bets on a penny slot machine, while the new model is making a few big bets in a game of poker.

In the first image, I tried to capture how the expected value calculation could be a similar outcome, but the risk profile of each investment is very different. A VC betting $1 billion on a single company can’t have a 98.8% chance of failure, the failure rate needs to be much lower.

There are always protections for VCs, like liquidation preference, but the calculus isn’t what it once was.

Silicon Valley’s Big Money Future

The risk profile has to change because the money involved is so big. Gone are the days of the $10,000 seed checks Uber used to get started. The money to build an AI company today is enormous.

This isn’t an exhaustive list, but the money going into the startups — particularly artificial intelligence startups — is staggering.

OpenAI: Raised $6.6 billion with a $157 billion valuation this week.

xAI: Barely a year old, xAI raised $6 billion on a $24 billion valuation.

Safe Superintelligence (SSI): In September, SSI raised $1 billion on a $5 billion valuation shortly after the company was launched.

Scale AI: Raised $1 billion at a $13.8 billion valuation.

Anthropic: Has raised $4.75 billion in the last year.

Poolside: Yesterday, Poolside announced a $500 million funding round at a $3 billion valuation.

The numbers are WILD for an industry that has yet to prove an economic model. Yes, AI may be a big part of the future and could create a lot of value and disruption, but if I’m investing $6.6 billion in OpenAI, I want to know how/when they’re going to make a profit.

OpenAI’s Big Money Raise

Reporting around OpenAI’s round revealed that OpenAI expects to lose $5 billion this year on $3.7 billion in revenue. But, they expect to raise the price of ChatGPT to $44 per month over the next few years, and revenue will be $100 billion by 2029.

Sorry if I’m skeptical.

I’ve inadvertently used AI multiple times while writing this article simply because Google includes AI answers when I’m looking up facts, like what fundraising rounds were. No need to pay for ChatGPT, Google is free!

Speaking of Google, Brad Gerstner from Altimeter Capital — which participated in OpenAI’s round — justified the valuation with Google as an example.

I like the idea, and I don’t blame Gerstner for investing in or supporting OpenAI. His job is to make big bets…because that’s how he makes the most money (management fee + carry).

But OpenAI is no Google. At IPO, Google had a $23 billion market cap and was trading for 7x sales and 57x earnings. Based on Gerstner’s numbers, weekly active users were already 15.3% of all people with internet access in 2004. OpenAI isn’t close to any of those metrics.

OpenAI | ||

|---|---|---|

Year | 2024 | 2004 |

Market Cap | $157 billion | $23 billion |

Revenue | $3.7 billion (estimate) | $3.2 million |

Profit | ($5 billion) (estimate) | $399 million |

Weekly Active Users as % of Global Internet Users | 4.6% | 15.3% |

Valuation as % of U.S. GDP | 0.54% | 0.18% |

Even in those early days, Google had an incredibly profitable business model.

OpenAI is losing $1.35 for every dollar in revenue it generates.

And the funding round is so big that OpenAI needs to get to a $1 trillion+ valuation for it to make sense for VCs. Even that wouldn’t be a 10x outcome, much less 100x or 1,000x.

OpenAI seems like something of a paradigm shift for Silicon Valley and the VC community. We’ve been moving to a world of bigger VC funds and bigger private companies. But the numbers and valuations have gotten crazy.

The last time Silicon Valley money flowed this freely to companies with little more than an idea and a dream; it didn’t end well. Time will tell if this time is any different, but I already miss the old Silicon Valley’s small bets, big outcome strategy.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your own research before acquiring stocks.