What is risk in investing?

We talk about risk as a knowable thing we can measure and mythologize how some people can manage risk better than others.

But too often, we’re not talking about risk at all.

We’re talking about something else entirely.

Today, I’m going to blow up a lot of popular investing concepts that I frankly think are built on lies Wall Street and academia have told us about investing that have no basis in long-term investing.

Risk vs “Risk”

Here’s a dirty secret of Wall Street: When most investors use the word risk, they’re talking about volatility.

Hedge fund manager Edward Thorp says in the interview below that he beat the market while taking 1/50th the risk of the market. What the hell does that even mean?

When he says “risk,” what he means is volatility. His performance was less volatile than the market on a day-to-day basis.

He could have been trading Enron stock, and his view of “low risk” would have held.

This concept of risk comes from the Capital Assets Pricing Model (CAPM) that’s taught in every business school and is commonly used to value assets around the world. The formula below is trying to find the expected return (Er) of an asset to “properly” discount projected future cash flows to find an asset’s value. It uses beta as a stand-in for risk, which is correlated with higher required returns. Here’s the formula:

Er = Rf + beta * (Rm - Rf)

Er = Expected (required) rate of return of an investment

Also known as the cost of capital, cost of equity, or WACC (weighted average cost of capital)

Rf = Risk-free rate (treasury rate)

beta = “Risk” of an investment

Rm = Expected return of the market

(Rm - Rf) = Market risk premium

This is a premium put on investing in stocks rather than bonds or treasuries

A riskier stock will have a higher beta and therefore a higher expected rate of return (Er).

For example, Coca-Cola $KO ( ▲ 1.32% ) would have a lower beta than Hims & Hers $HIMS ( ▼ 6.92% ). If you project that Coca-Cola will generate $1 billion in free cash flow every year indefinitely and Hims & Hers will also generate $1 billion in free cash flow every year indefinitely, they would be valued differently because Hims & Hers has a much higher beta — and therefore a higher required rate of return — than Coca-Cola.

The result would be that Hims & Hers would have a lower valuation because of its higher beta and higher required rate of return.

Beta is a stand-in for risk in the CAPM formula, but it’s not risk. Beta measures volatility.

Beta is a measure that reflects how strongly a stock's price tends to move in relation to the broader market's movements. It helps investors estimate how much a stock might amplify or dampen the market's ups and downs when added to a portfolio.

Volatility may be a good proxy for risk for short-term traders, so it may make sense for someone like Thorp to use risk and volatility interchangeably.

But it is not a particularly relevant measure of risk for long-term investors.

Correlation of Risks and Perceived “Safety”

One of the reasons the idea of “low-risk” and “safety” in investing drives me crazy is when $#%@ hits the fan, everything falls.

In 2008, it wasn’t just stocks that collapsed. Bonds plunged, defaults on homes rose, and everyone took a bath. The only safety was…cash.

We can see this even in short-term panics.

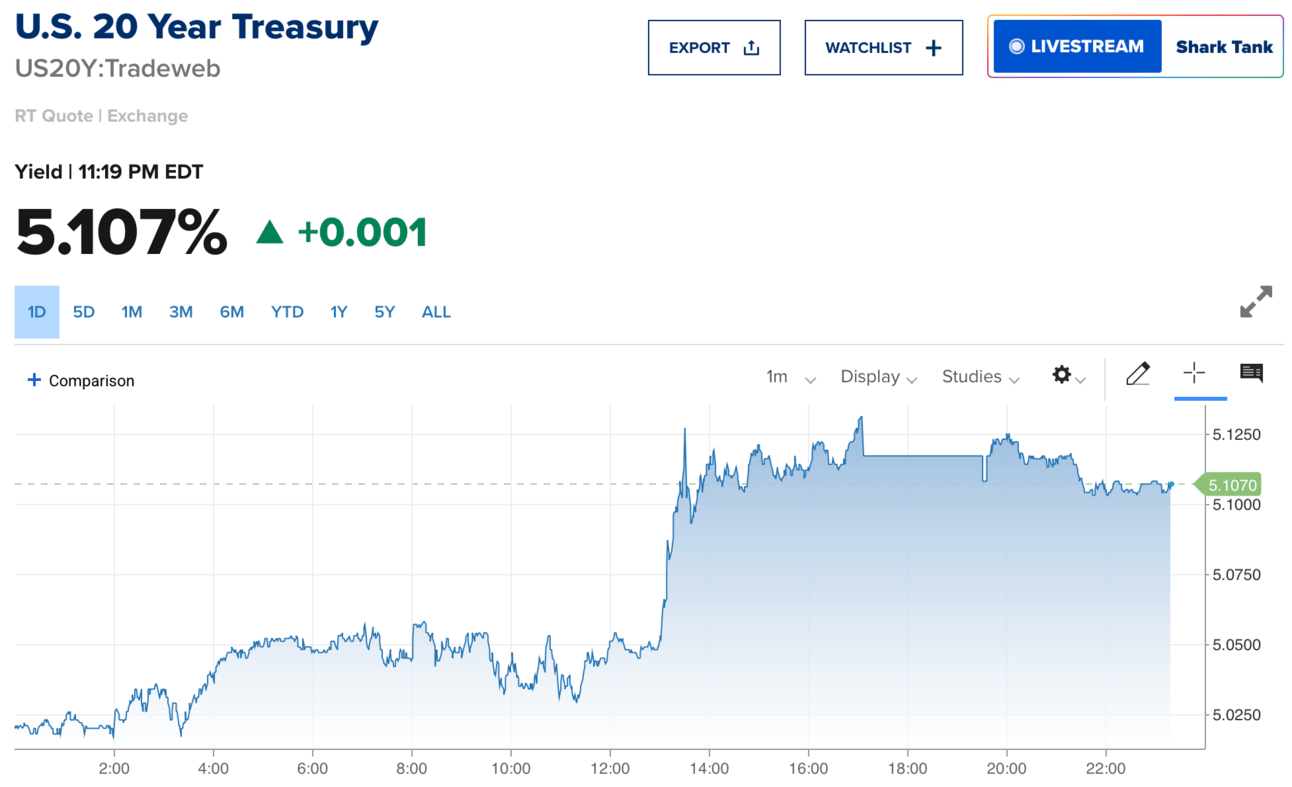

On Wednesday, 20-year treasury bond yields rose about 0.1% in a matter of minutes after a weak treasury auction. The resulting loss in value for bond investors was about 1.24% for a 20-year bond.

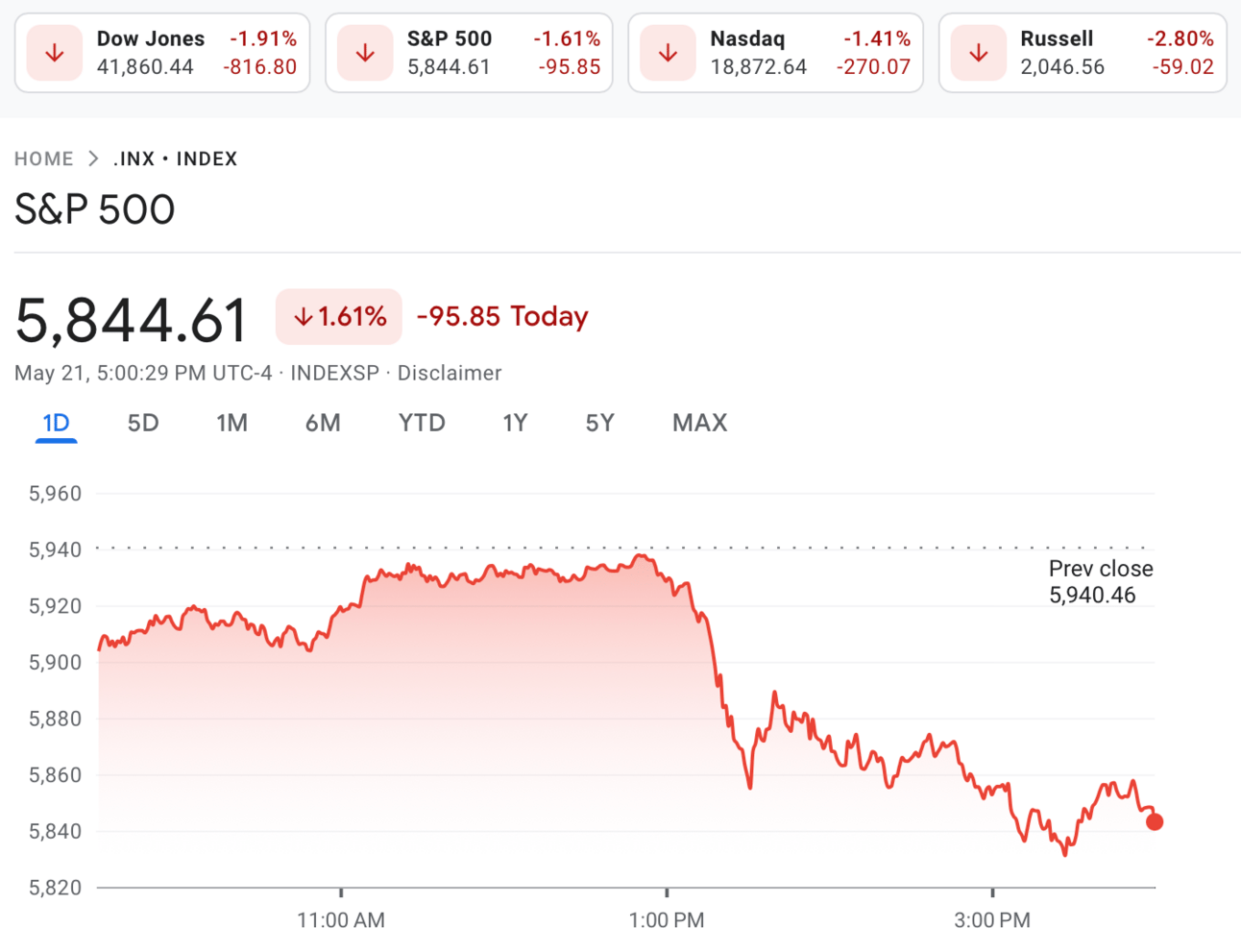

Ironically, that’s a similar decline to what we saw in the stock market.

Crypto had an even bigger drop, although that reversed after the market closed.

There was no “safe” place for investors yesterday. Everything lost value.

If there’s a crash later this year because a tariff-induced recession hits, everything will likely drop. Nothing will be “safe”. The perception of safety for most assets will fail.

Again, beta and risk are great concepts when markets are “normal” and trading in ranges. But asset values are generally correlated in a market crash. And that’s when most investors want safety.

Even Value Doesn’t Provide Safety

There must be some safety in the market, right?

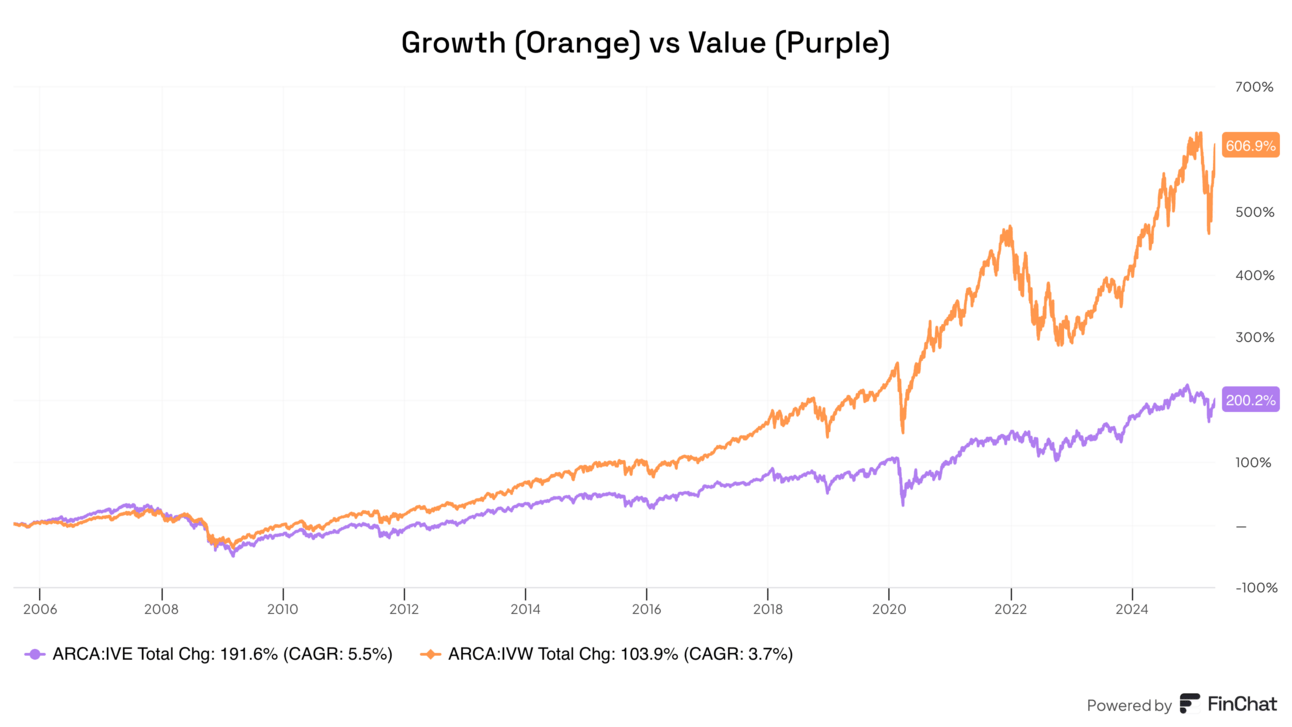

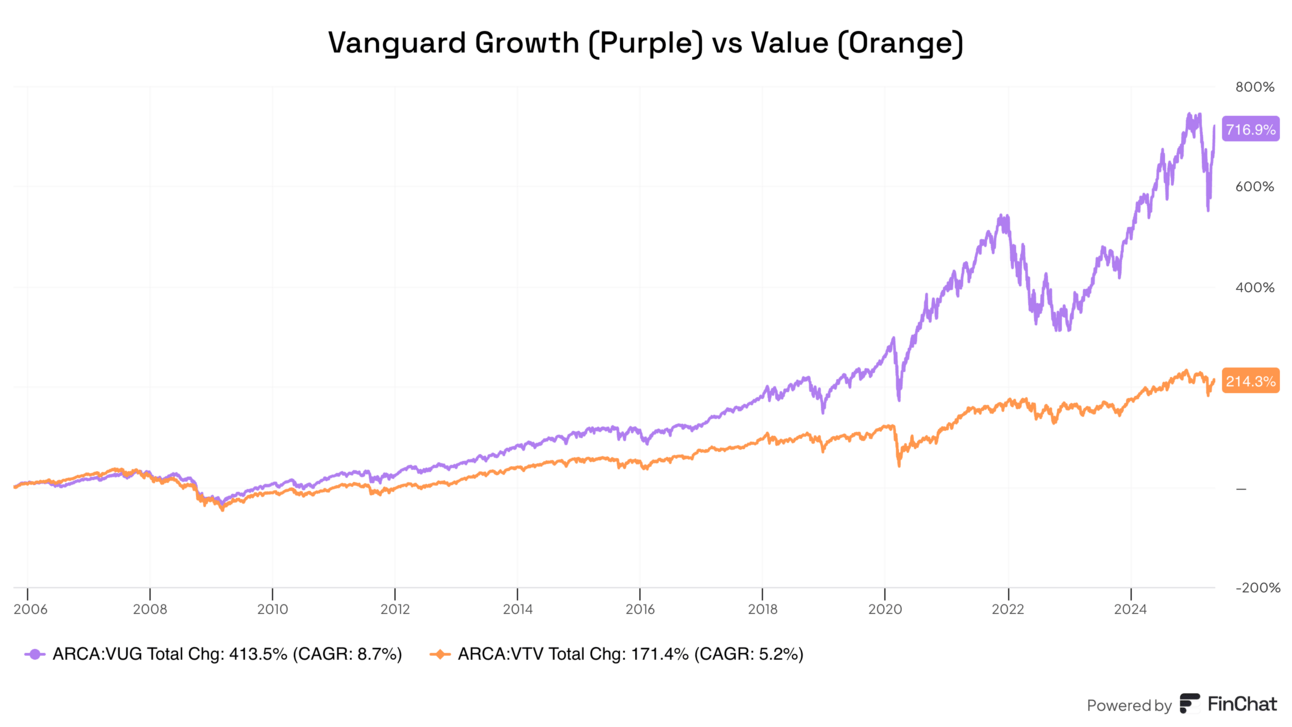

It would seem logical that value stocks provide more safety for investors. Value stocks have low P/E multiples and pay nice dividends. But is that the case?

Maybe short-term. But over time, value vastly underperforms growth, so the perception of safety results in lower returns.

We can see this across growth and value indexes and ETFs.

Want to beat the market? Over-index to growth versus value!

“Margin of Safety” vs Asymmetric Value

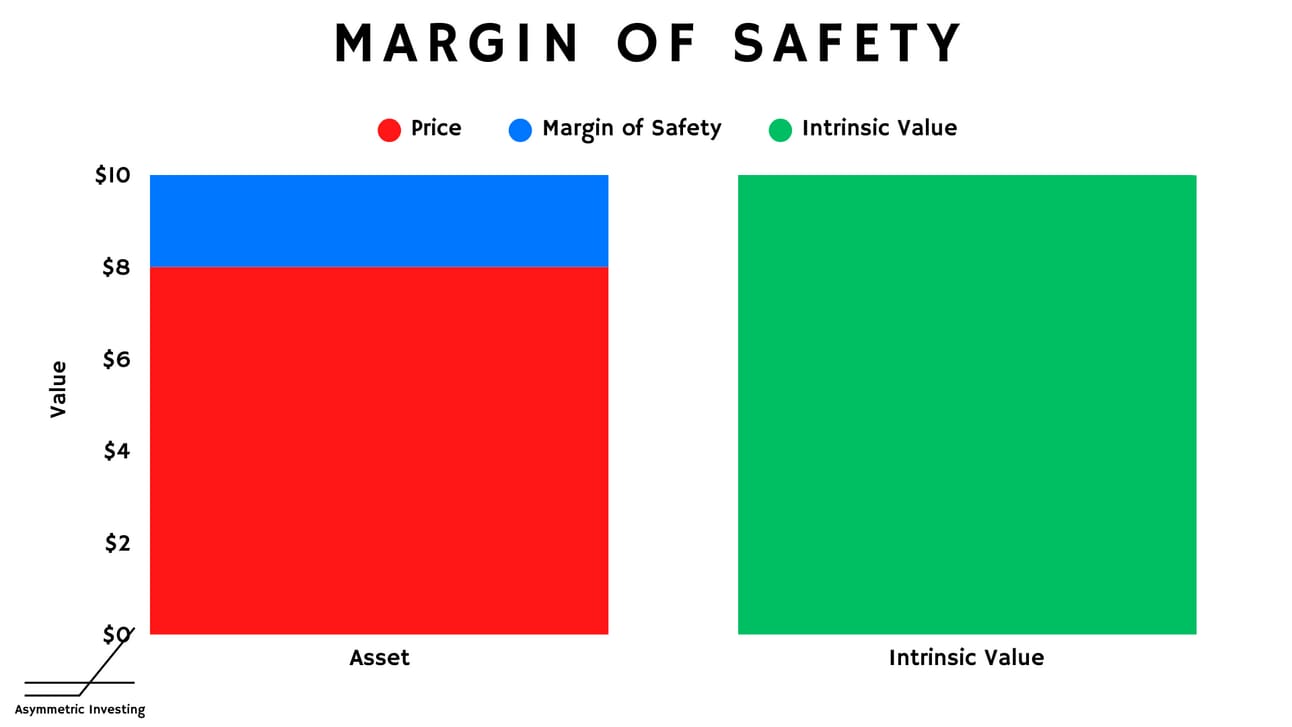

I’ll end my safety rant with the idea of a “margin of safety” as it’s normally theorized.

This is something I hear about a lot.

A lot of investors want a perceived margin of safety in their investment. Let’s say you do a deep analysis of a stock that you think is valued at $10 per share, but it’s trading for $8 per share. You get a $2 per share “margin of safety”. Yay!

Where could this go wrong?

Maybe your intrinsic value calculation is off because the market changed or earnings missed expectations, or the company you bought has simply entered structural decline (see the last two decades in former stalwarts like General Mills, 3M, GE, P&G, etc).

At the end of the day, intrinsic value is a calculation based on a guess about future earnings, and it can be wrong.

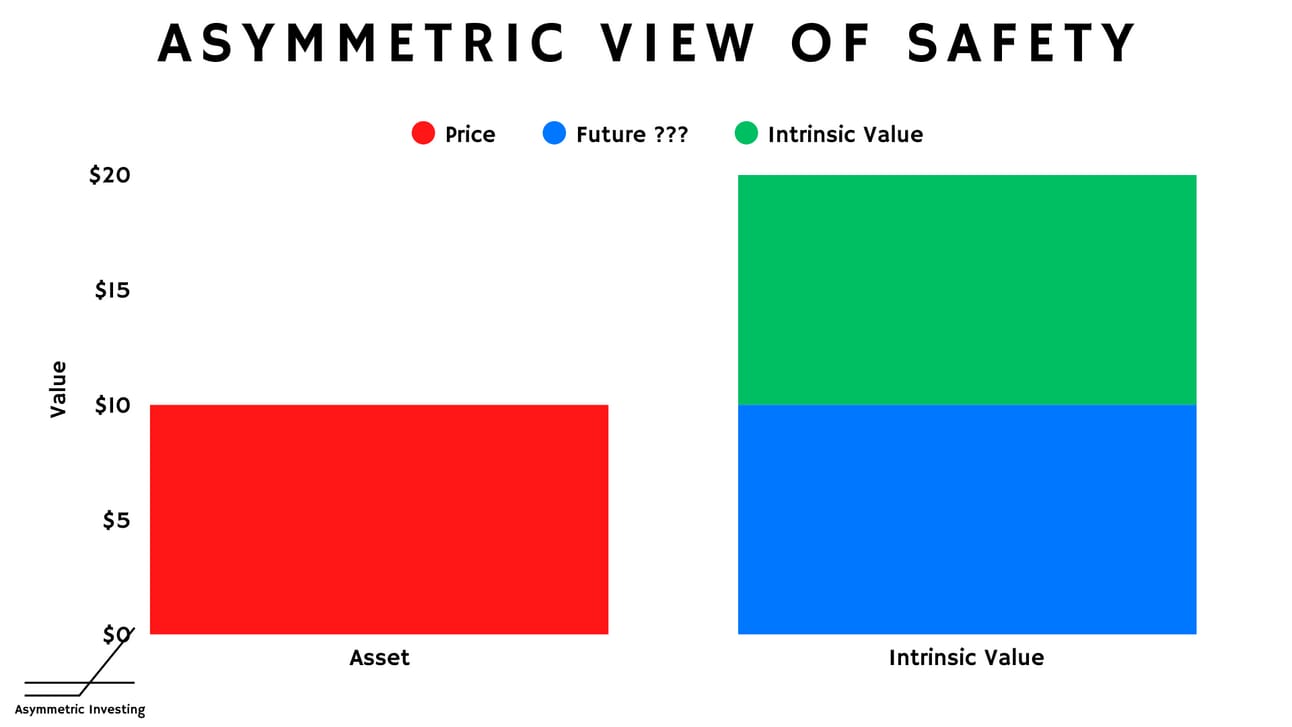

I start by assuming my valuation calculation will be wrong, so instead, I want to pay a “reasonable” price for an asset and get upside risk for free.

With MGM Resorts $MGM ( ▼ 2.02% ) that means being comfortable paying 14.7x earnings because the future upside is in resorts in Japan and New York, and an unknown payoff from online gaming. I could guess at the value of those projects, but I don’t have to because I’m getting a “fair” price for the existing business, and the future upside is “free”. Sprinkle in some buybacks, and this is a great Asymmetric Value Stock.

With Lyft $LYFT ( ▼ 1.84% ), I think we’re getting a solid business for just 14x forward earnings estimates, and management is buying back over 10% of the shares outstanding in the next year or two. The upside is from the ride-sharing market growing as autonomy is introduced and Lyft potentially taking market share. But neither of those things is priced in today. So, I get a “fair” price for the existing business and free upside.

That’s how I think about safety and risk.

I’m not substituting volatility for safety.

I’m not calculating unknowable future results and calling it a “margin of safety.”

I’m paying a price I think is fair for a stock today, and the risk in a stock to be as close to pure upside as possible for my investments.

Risk and Safety Are More Than a Number

One of the reasons I focus so much on strategic positions and business models is that I think that’s where we find an edge over the market.

I’m not going to out-quant the quants.

I’m not going to out-intrinsic value Wall Street.

I think the edge is in thinking further out than most investors can because they’re trying to quantify everything.

But the world is full of uncertainty, and future results are unknowable until they become history.

Once we accept that reality, it’s easier to view risk for what it is.

1: possibility of loss or injury: PERIL

2: someone or something that creates or suggests a hazard

3a: the chance of loss or the perils to the subject matter of an insurance contract

also: the degree of probability of such loss

b: a person or thing that is a specified hazard to an insurer

c: an insurance hazard from a specified cause or source

war risk

4: the chance that an investment (such as a stock or commodity) will lose value

Risk isn’t a bad thing.

It’s why we can make money investing.

Volatility is the price of admission—the prize inside is superior long-term returns.

But let’s not tell lies about risk and safety to convince ourselves we’re taking less risk than we are.

Risk and uncertainty are OK. And they’re a feature, not a bug, of Asymmetric Investing.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.