There are a few earnings reports each quarter that give a view of what the overall economic landscape looks like. This week, we heard from Target, rounding out this earnings season's most important retail reports. I want to delve into what we learned below.

But first, it was another strong week on Wall Street, helped by Fed Chair Jerome Powell’s speech in Jackson Hole, WY that indicated short-term rate cuts are coming soon. And the market loves lower rates.

The Asymmetric Portfolio is again beating the market, led this week by some old names like General Motors and Crocs. If the economy is fine, why wouldn’t a profitable automaker trading for 5x earnings and a shoe retailer trading for 10x earnings continue to outperform the market? After all, multiple expansion is a key driver of asymmetric returns.

Asymmetric Investing is a freemium business model, which means the free version is made possible by ads like this one. Sign up for premium here to get 2x the content, access the Asymmetric Portfolio, and avoid ads.

Building trust and increasing sales has never been easier

As a business owner, you know how important PR is to your company's success.

But the challenge of maintaining a consistent media presence can be overwhelming.

Now imagine being able to publish unique content to your website newsroom, social media and top magazines with just A FEW CLICKS.

Without a bunch of expensive tools...

Without a PR agency...

Or even a lot of time (because AI automates 98% of your work 🤌)...

Pressmaster.ai makes it a reality:

In Case You Missed It

Here’s the content I put out this week. Back to a regular publishing schedule next week.

Uber Taps Cruise in Autonomous Driving Push: Uber is laying out its strategy to work with multiple autonomous driving companies and Cruise is now on the list with Waymo.

Is the Consumer All Right?

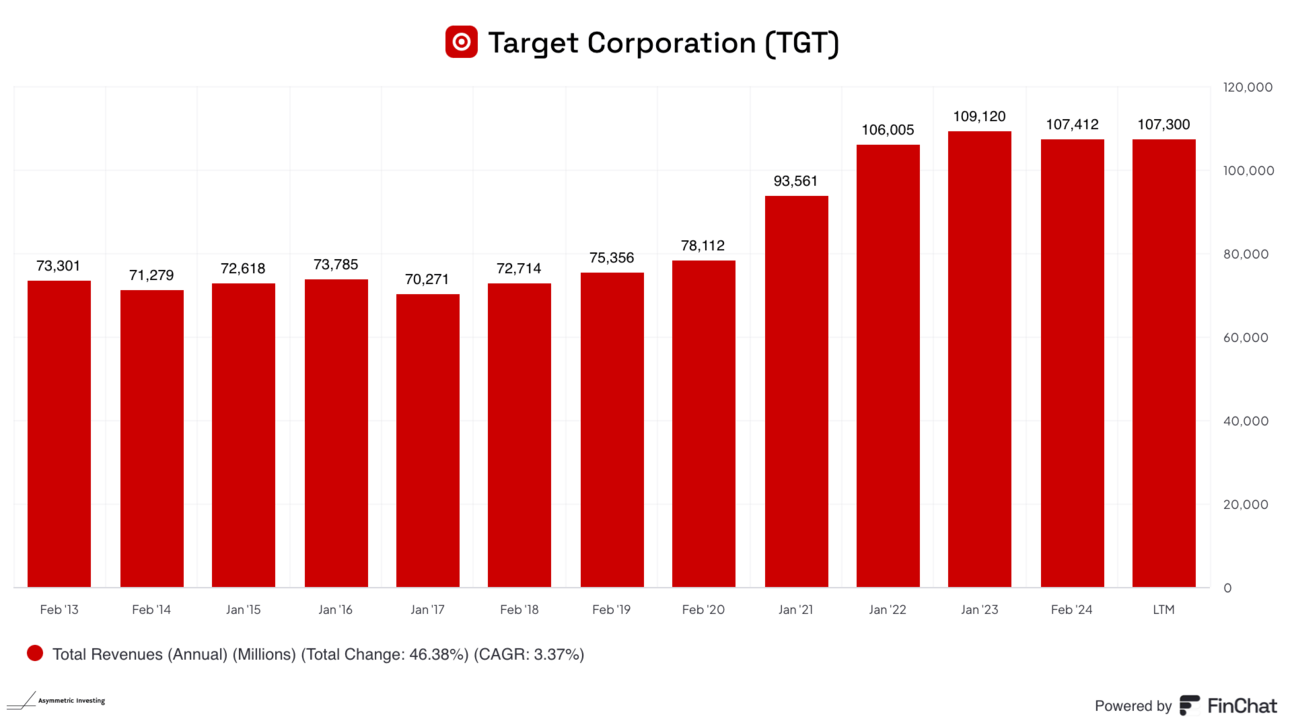

Target’s earnings report showed a 2.0% increase in same-store sales and a 3% increase in traffic (customer spending less per visit). The result was revenue rising 2.6% to $25.0 billion. These weren’t great numbers, but Target has seen sales fall after a pandemic boom, so they were welcome by the market.

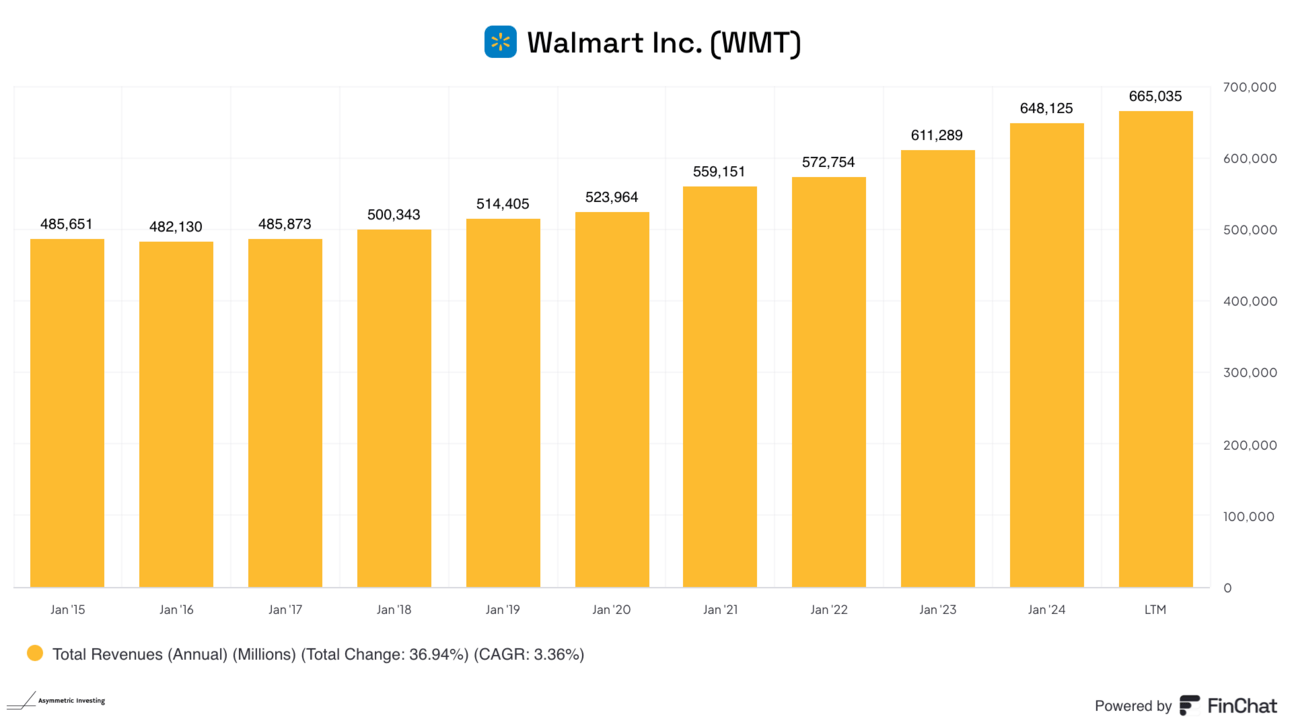

This follows a 4.2% increase in comparable sales at Walmart in the most recent fiscal quarter and a 4.8% increase in sales overall.

Based on Target and Walmart, it seems the consumer is all right. But they don’t tell the whole story.

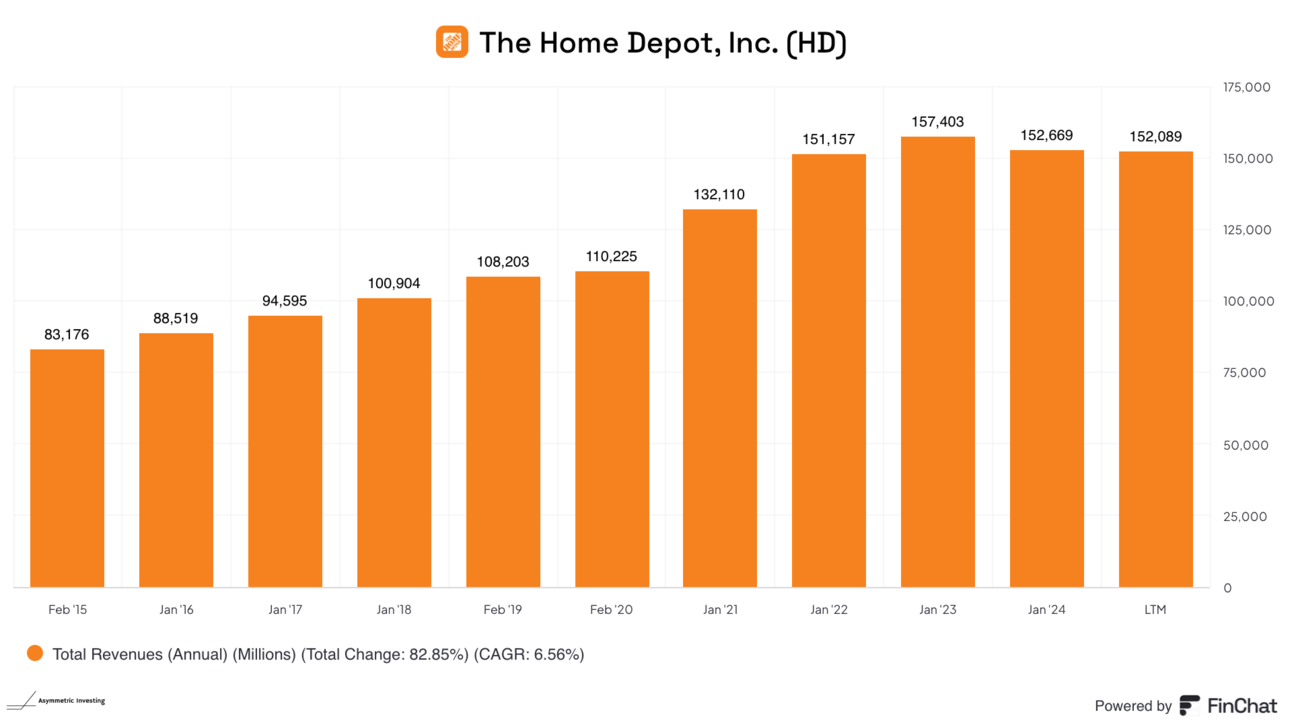

Home Depot reported a 3.3% drop in same-store sales in the most recent quarter and sales have been dropping since the end of 2022. Management has blamed fewer large home improvement projects on the drop in sales.

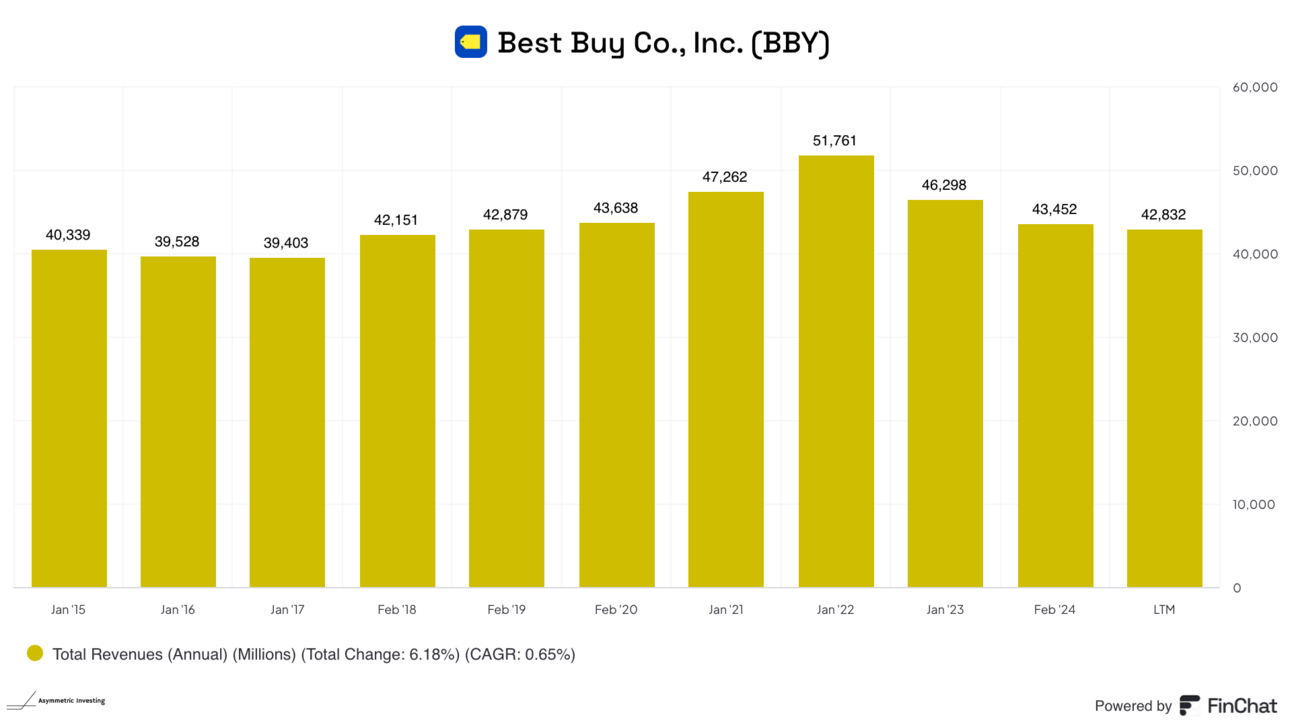

At Best Buy, same-store sales were down 6.1% last quarter and management expects sales to be flat to down 3% for the fiscal year.

If you look at consumer spending based on Target and Walmart’s reports you may think the consumer is all right.

But if you look at Home Depot and Best Buy, which are much more discretionary spend locations, the consumer is clearly pulling back.

Here’s what I think is happening right now:

Inflation has led to essentials eating up more of consumers’ budgets.

Consumers are trading down where possible.

The pandemic stimulus has run out!

The Fed is likely to respond by lowering interest rates. Will that cause consumers to spend more on home improvement projects? Will companies hire more if rates are lower? Will new businesses form?

It’s possible, but I think this is likely to be more of a mild recession as consumers and businesses continue to normalize spending coming out of the pandemic.

From an investment perspective, I think the slow growth in consumer spending means we need to look for values in the market rather than paying up for growth. Even a shallow recession will lead to lower growth projections, which will hit high growth stocks hardest.

You can get all Asymmetric Investing content, including deep dives, stock trades, and ongoing coverage of Asymmetric Universe stocks with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.