On Friday, I highlighted the stock market’s freakout, which started Thursday when the Federal Reserve decided to keep short-term interest rates flat. Friday’s weaker-than-expected jobs report and downward revisions to the previous two jobs reports spanning May and June didn’t help the market’s confidence.

Revisions are normal, but the trajectory of jobs is what’s more concerning. While I pushed back on the response to the Fed, I want to provide some data about the state of the economy today and how I’m thinking about a potential recession.

The Asymmetric Portfolio had its worst week ever and that was despite some very strong earnings reports from some of the largest holdings. In time, earnings will drive the portfolio, but for now, it’s a “risk off” trade that’s pushing it lower.

Asymmetric Investing is a freemium business model, which means the free version is made possible by ads like this one. Sign up for premium here to get 2x the content, access the Asymmetric Portfolio, and avoid ads.

Track Company Earnings Like a Pro

Earnings Hub is designed for investors to give you everything you want to know about company earnings, including:

An Earnings Calendar

Expectations & Actuals

Listen to Earnings Calls Live (or replay)

Earnings Call Transcripts & AI Summaries

Realtime News on your favorite stocks

Alerts delivered via Text or Email

Most of the features are FREE! Premium features are 50% off right now at just $49 for an entire year.

In Case You Missed It

Here’s some of the content I put out this week. Enjoy!

What I’m Buying in August 2024: I bought 3 stocks this week.

Wall Street’s Temper Tantrum: The market’s reaction to a Fed move is a little overdone.

3 Portfolio Company Earnings Recaps: Finding the signal from the noise in these earnings reports.

The Most Innovative Company in Sports: Have you seen these new spray-on shoes?

Jobs and the “Modern Recession”

We’re about to enter a bizarre phase in the market.

Some stocks are extremely highly valued while other stocks are very lowly valued. What happens if we have a recession?

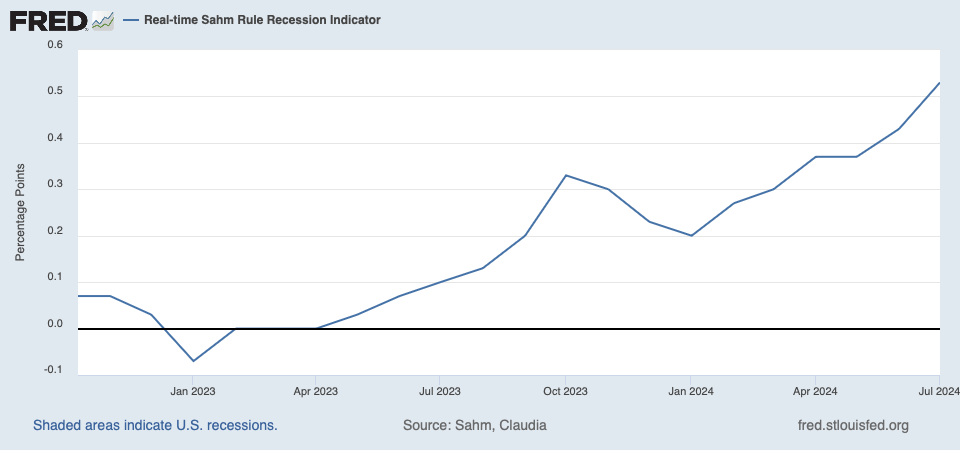

The Sahm Rule recession indicator was triggered in July, which has been a reliable predictor of a recession.

The rule states that if the 3-month average unemployment rate rises more than 0.5% above the lowest 3-month average in the last 12 months a recession has begun. In other words, unemployment is rising.

This is a good indicator because a normal recessionary feedback loop goes something like this:

Revenue/profits fall so a company cuts back by laying off some workers. See any retailer’s earnings report in 2024 for evidence this has been happening.

Workers lose — or fear they will lose — their jobs so they cut back.

Falling consumer spending leads to more layoffs.

and so on…

That’s how recessions have typically started. To end them, the economy must reach some kind of bottom, helped by lower interest rates, stimulus spending, innovation, and natural market forces.

I think this time is different and that makes the Fed particularly useless in fighting a recession. And that’s OK.

In the modern world, there’s a short circuit to the downward economic spiral.

Gig Work!

It used to be that a laid-off employee would see their family income fall 50% or 100%, depending on how many people worked in the house.

If new jobs were hard to find, that new lower-income phase could last for some time.

Unemployment helps, but it’s a fraction of what many white-collar workers make every week.

Consumer spending collapses and you can see why the economy would spiral.

In 2024, someone laid off may start driving for Uber or Doordash. They may start a newsletter (that’s me). They may do videos on YouTube.

The point isn’t that income is 100% replaced, but rather that it’s not 100% lost.

This may give the economy a little more elasticity to recover than we’ve ever seen.

The Manufacturing Tailwind

If you want another reason for optimism about the economy (not necessarily prices of goods), take a look at this chart.

There’s an absolute explosion in U.S. manufacturing investment. That will require new workers, more infrastructure, a new workforce, and decades of investment if the pace continues.

The Modern Recession

Put the gig economy and the manufacturing boom in the economic blender and I think we get a very new kind of recession in 2024/2025.

There will be a pullback on spending and companies will cut workers.

But there will be resilience in more flexible parts of the economy.

Add in the boom in manufacturing and this may be a short-lived recession that ends in more abundant jobs in the future.

Oh, and higher prices.

You didn’t think there weren’t going to be tradeoffs, did you?

You can get all Asymmetric Investing content, including deep dives, stock trades, and ongoing coverage of Asymmetric Universe stocks with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.